Why carbon ratings complement labels in the search for quality

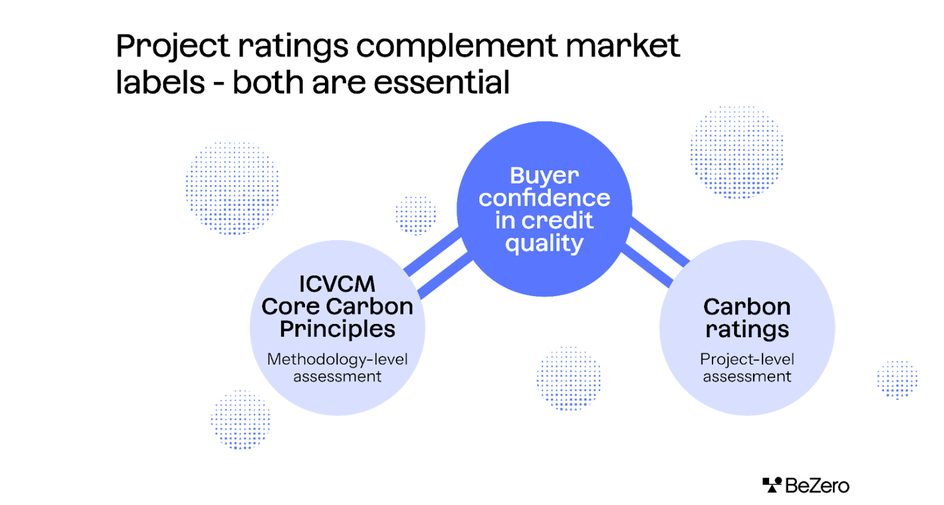

The Core Carbon Principles (CCPs) established by the Integrity Council for the Voluntary Carbon Market (ICVCM) assess standards bodies’ methodologies, while carbon ratings assess individual projects from the bottom up.

CCPs complement ratings: the ICVCM helps standards increase ambition on methodologies, while third-party carbon ratings help developers build better projects.

Both empower credit buyers with a holistic view on quality: CCP labels through assurance that credits meet a minimum threshold standard, and ratings via project-level analysis.

Contents

- A snapshot of carbon quality initiatives

- The ICVCM and the Core Carbon Principles explained

- Project ratings and market labels are complementary

- What this means for companies using carbon credits

- Lifting the minimum quality threshold is essential for climate action

What can carbon markets learn from Super Mario?

Nascent markets rarely grow in a linear path, and inevitably experience setbacks. Take the burgeoning market for video games in the early 1980s: powered by hits such as Pac-Man and Donkey Kong, a race to own the home gaming market ensued. But a surge in lower quality games almost brought the industry to a standstill. Only when Nintendo - focused on creating quality games - set a new standard with the release of Super Mario Bros did the industry recover, eventually growing into a $184 billion market today.

The carbon market is no different. Since its inception in the 1990s, it has seen countless examples of projects delivering tangible climate outcomes and life-changing benefits to local communities. It has also seen its fair share of controversy, from questionable carbon efficacy to human rights issues. Far from being swept under the rug, these failings should be seen as an opportunity to learn and do better.

And that’s exactly what’s happening. Innovations such as climate regulation, market-led quality initiatives, and carbon ratings are restoring faith in carbon credits, one of the most effective tools for delivering immediate climate action.

A snapshot of carbon quality initiatives

There are a number of initiatives making positive contributions, all with a mission to improve market quality. These include:

The International Carbon Reduction and Offset Alliance (ICROA)

The first body focused on carbon market integrity and credit quality. Part of the International Emissions Trading Association (IETA), this body accredits projects developers and endorses standards bodies.

The Integrity Council for the Voluntary Carbon Market (ICVCM)

An independent governance body with the aims of setting global benchmarks for carbon credits and offsets.

The Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA)

A Paris Agreement-aligned initiative developed by the International Civil Aviation Organization with the goal of curbing the climate impact of international aviation through emissions reductions offsets.

The Carbon Credit Quality Initiative (CCQI)

Which provides transparent information on the quality of carbon credits. It was founded by Environmental Defence Fund, World Wildlife Fund (WWF-US) and Oeko - Institut.

BeZero supports the hard work undertaken by these coalitions, and welcomes any effort to drive transparency and quality at every stage of the carbon credit lifecycle.

One recent innovation that has caught the attention of buyers active in the market is the rollout of the Core Carbon Principles (CCPs) established by the ICVCM. Here’s what you need to know.

The ICVCM and the Core Carbon Principles explained

The ICVCM was set up in 2021 to address market criticism, inspire confidence in carbon credits, and maximise climate impact through quality.

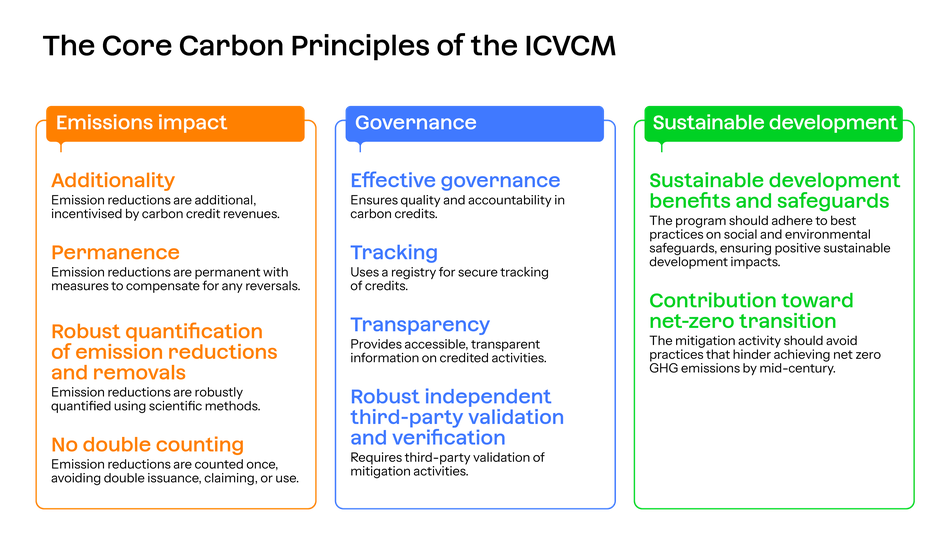

To achieve this, the ICVCM established the CCPs which act as a minimum quality threshold for eligible credits. The 10 principles are grouped under the three broad pillars of emissions impact, governance, and sustainable development, and are summarised in the table below:

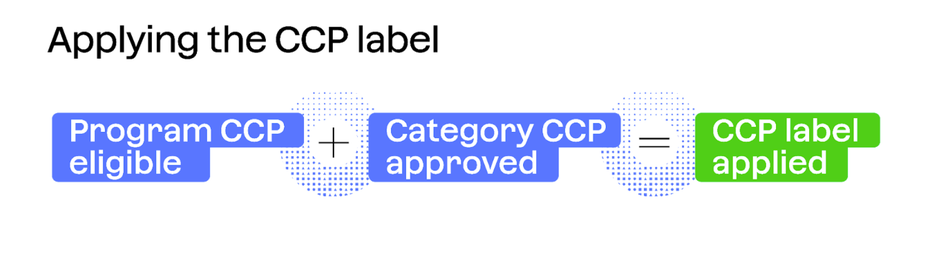

For a carbon credit to be eligible for a CCP label, two things have to happen.

First, the carbon-crediting ‘program’ that develops and maintains the standard used to register or approve carbon reduction activities - otherwise known as the standards body - is assessed for eligibility.

Second, a ‘category’ - which refers to a group of carbon credits registered under the program and quantified using a given methodology - is assessed.

After this ‘two-tick’ assessment process is complete, meaning both a credit’s program and category meet the ICVCM’s requirements, the crediting program can then apply the label directly on its registry.

Project ratings and market labels are complementary

BeZero sees the role of CCPs and carbon ratings as entirely complementary. With the CCPs providing guidance on good methodologies, and carbon ratings offering detailed project-level assessments, credit buyers are empowered with a holistic view on carbon quality from the top down and the bottom up.

The ICVCM helps programs increase their ambition on methodologies by creating a minimum threshold standard for the market, while third-party ratings help developers build better projects.

What this means for companies using carbon credits

Quality indicators such as those underpinning the CCPs make it easier for buyers to find high-quality credits. They’re also often complementary, helping remove market fragmentation. The application criteria of CCPs, for example, are aligned with CORSIA, often viewed as a proxy for credit quality.

All of these ‘carbon KPIs’ are instrumental in driving up the minimum quality threshold for credits in the market. Standards bodies are incentivised to tighten and iterate their methodologies to deliver higher quality frameworks, and developers have to take heed to run better projects.

Alongside these quality initiatives, carbon ratings play a role by offering project-specific assessments independent of standards bodies. Analysis from ratings agencies such as BeZero and Calyx show that a spectrum of quality still exists within credits under the categories undergoing initial internal review by the ICVCM.

Carbon projects are dynamic and carbon ratings should be too. Continuous monitoring is therefore paramount. Any new information on a project’s performance - be it the release of new documents on the registry, publication of new sector-specific academic research, or a natural hazard putting carbon stores at risk - could impact the rating.

In other words, because risk is dynamic, buyers looking for quality should use all reference points available before committing to their purchase.

Lifting the minimum quality threshold is essential for climate action

The ultimate goal of improving quality is to make sure that any claims about delivering a climate benefit, whether they are made by a developer, an investor or a buyer, translate to genuine climate action.

Going back to the promise of a carbon credit - one tonne of carbon dioxide equivalent avoided or removed - a high-quality credit shouldn’t be delivering half a tonne or even three quarters of a tonne, but a full tonne.

Alongside the CCPs and other initiatives increasing the minimum quality threshold for credits in the market, carbon ratings play a critical role in maximising the climate impact per dollar spent globally. They’re becoming an essential part of decision-making for serious credit buyers. With their climate strategy’s credibility at stake, ratings not only help buyers minimise reputational risk, they also help deliver better climate action.

In the next article in our carbon credit explainer series, you’ll learn how carbon ratings can help companies communicate credible impact. Read more here.