Market-building research

Pioneering research into what’s needed for effective markets in environmental assets.

Big views, bigger insights

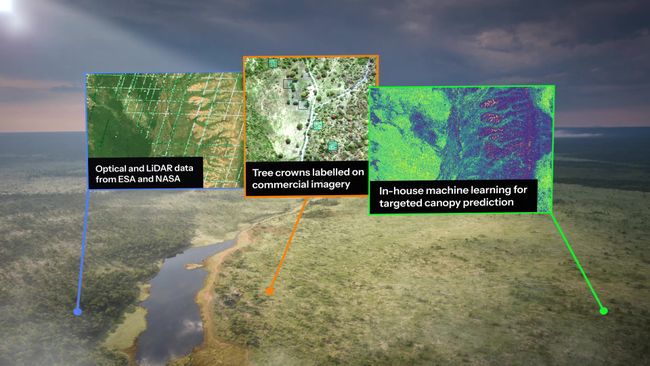

To keep a constant eye on project performance, we partner with leaders in Earth imaging, including the operator of the world’s largest constellation of satellites, Planet. No other ratings agency leverages data at this scale.

Our views from space are complemented by extensive ground truth data from local research partners, giving us unparalleled forest carbon data.

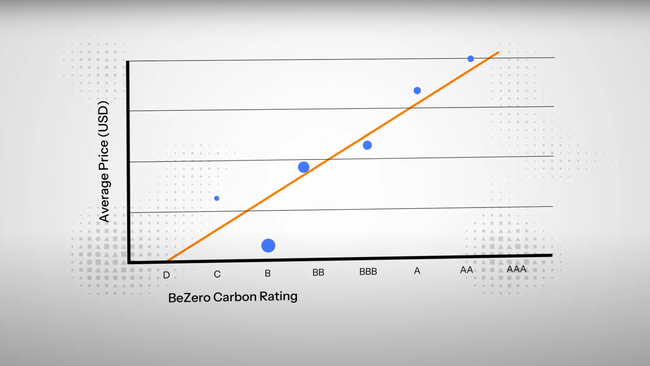

Higher ratings, higher prices

Since its launch in 2022, a meaningful relationship has emerged between a credit's BeZero Carbon Rating and the price it commands.

Credits rated 'A' or higher are resulting in greater price premiums and greater demand across the voluntary carbon market compared to those rated lower on the scale. This relationship also holds up at sectoral level.

Research partnerships

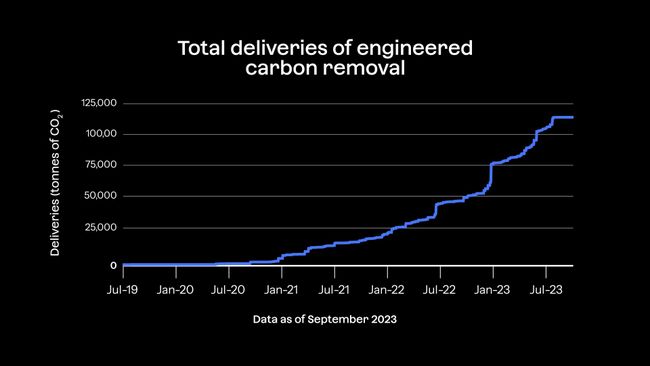

Removing barriers, removing carbon

Scaling engineered carbon dioxide removal (CDR) technologies is crucial to the net zero transition, but the sector remains expensive and opaque.

Our research focuses on disclosure, scalability and durability, to remove barriers to investment in this frontier sector.

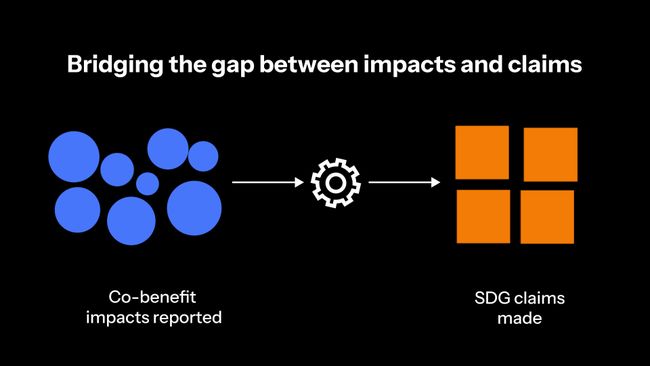

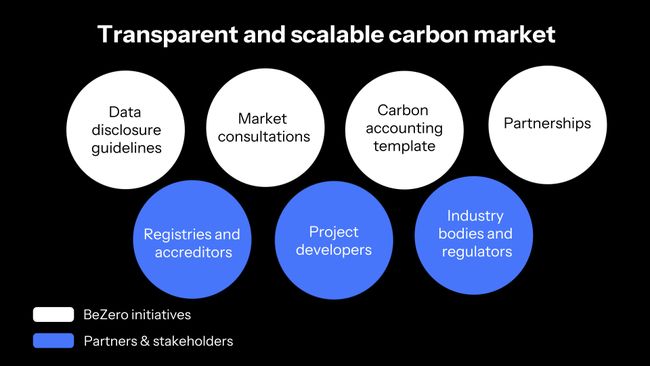

Better disclosure, better markets

Working with carbon credit project developers and registries, including community-based projects and those supporting rural organisations, to produce guidance and improve disclosure standards in the voluntary carbon market.

Artificial intelligence, market intelligence

AI has a role to play in the fight against climate change. BeZero's ratings analysts, geospatial experts and data scientists harness cutting edge techniques such as generative AI and machine learning to drive standardisation in carbon markets, and complement project-level analysis.

New measurements, new assets

Biodiversity credits could help protect and restore nature. Our in-house team are pioneering eDNA trials with global partners to find new ways to measure and assess biodiversity.

Explore Insights

Read about the latest insights, analysis and trends in global carbon markets.

Explore InsightsA first look at VM0048: winners, losers, and the price to pay

Analysing Verra's consolidated REDD methodology, VM0048, and the impact it will have on credit issuance

2024: Carbon credit markets in review

A review of carbon markets in 2024, including an overview of major policy developments followed by analysis of key market statistics