Carbon credits and climate regulation: what you need to know

With the rise in new climate regulations, standardised approaches between regulators in different jurisdictions are crucial to avoid fragmentation.

Consistent reporting and disclosure will build greater confidence in carbon credits by accurately demonstrating their promised environmental and social impacts.

As companies are required to disclose information around climate claims, demand for demonstrably high-quality carbon credits will increase. Disclosing carbon ratings can help substantiate those claims.

Contents

- A wave of new regulations for carbon credit users

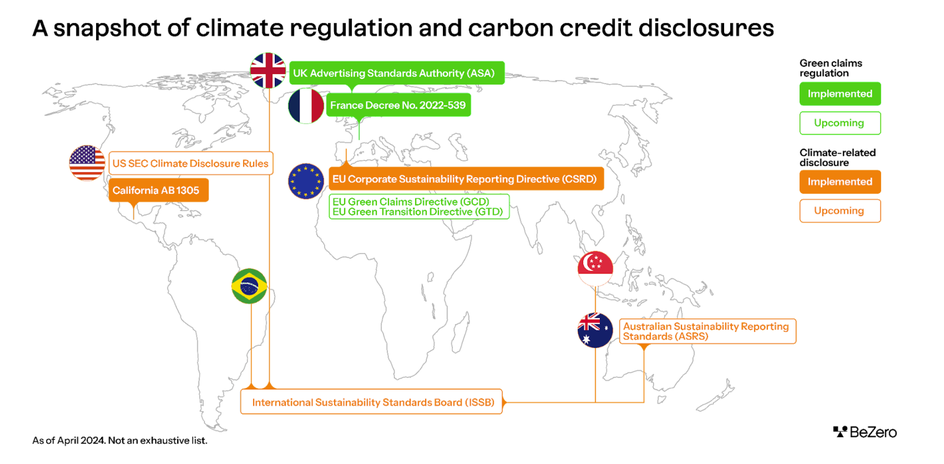

- Where has climate regulation been introduced?

- Understanding disclosure requirements is crucial for companies

Whether viewed as a necessary step forward for effective climate action or an exercise in box-ticking, Chief Sustainability and Risk Officers around the world can’t escape green regulation.

This brief explainer outlines what you need to know about carbon credit disclosures in the face of evolving climate regulations. While not an exhaustive list, the article focuses on key regulations to be aware of, and will be periodically updated on an ongoing basis.

A wave of new regulations for carbon credit users

Since 2022, a wave of climate-related regulation has brought requirements that companies disclose information about their use of carbon credits. Purchasing high-quality credits is the most effective way to deliver immediate climate action. The increase in mandated climate-related disclosures will bring greater transparency to carbon markets and accelerate the flow of money to quality climate projects.

Why do companies need to understand these regulations now?

The influx of regulations requiring that companies disclose their carbon credit holdings or substantiate their green claims means demand for high-quality credits is expected to increase. Companies wishing to use carbon credits to fund climate action and contribute to emissions reductions have an opportunity to secure a high-quality credit supply now in anticipation of more competition - and potentially rising credit prices - later.

What types of regulation are most impactful for companies retiring carbon credits?

The types of regulation most likely to impact credit buyers - the demand side of the voluntary carbon market (VCM) - are climate-related disclosure and green claims regulation. Table 1 shows the differences between these two complementary types of regulation.

Table 1. Definitions of climate-related disclosure and green claims regulation.

| Type | What does it include? | What does this mean for carbon credits? |

|---|---|---|

| Climate-related disclosure | Regulation requiring that companies publicly disclose specific information related to their environmental impact. | Companies must disclose relevant information on the carbon credits they retire. |

| Green claims regulation | Regulations that set standards to ensure environmental claims made by a business, brand, product, or service are accurate and reliable. | Clear parameters for what constitutes a green claim, in some instances only allowing for a proportion of the green claims to be based on carbon credits |

Where has climate regulation been introduced?

The first regulations to be implemented are likely to influence the creation of future regulations. Paying attention to the specific requirements for carbon credits can help companies prepare to comply with future disclosure or green claims rules.

The European Union

The EU has already introduced a suite of climate-related information disclosure and green claims regulations:

Corporate Sustainability Reporting Directive (CSRD): requires companies to report on both environmental and social aspects of their business, including the use of carbon credits with metrics including the share of projects which are removals or reductions and share of projects in the EU.

Green Claims Directive (GCD): requires companies to substantiate the claims they make about environmental impact and labelling of products to consumers. Any claim must be publicly evidenced and verified by a third party before it can be used.

Green Transition Directive (GTD): protects consumers by prohibiting companies from making claims that a product has a neutral, reduced, or positive impact on the environment based solely on the use of carbon credits.

Non-compliance with these regulations once in force could result in financial penalties as well as reputational damage. CSRD is already operational; reporting is mandated in phases starting with companies required to disclose by the previous legislation, the Non-financial Reporting Directive.

Once the Green Directives are passed by the European Parliament and in force (assumed for 2026), member states have 24 months to adopt them into domestic law. Companies operating within the EU should consider if and when they will be required to disclose and prepare accordingly.

The supranational design of the European Union may mean that companies are required to comply with additional regulations at the national level, for example:

France: Decree No. 2022-539 which establishes parameters for carbon credit use and associated carbon neutrality claims.

The United States

Efforts to regulate elements of the voluntary carbon market in the US have come from various regulators, such as the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) at the federal level. Regulations proposed by the CFTC and SEC have not yet been implemented. California’s government has introduced the first state-level disclosure rule, AB 1305.

On the 28th of May, the US Government released a Joint Statement of Policy and new Principles for Responsible Participation in Voluntary Carbon Markets (VCMs). This statement sets out the government's approach to advance high-integrity VCMs and contains principles relating to the quality of carbon credits, safeguarding and co-benefits and the use and disclosure of high-integrity carbon credits. At the launch of the Principles, Secretary Yellen provided an unambiguous statement of the US Government’s support for VCMs: "Let me be clear - we applaud companies that finance decarbonisation through purchasing high quality carbon credits."

The US Government also recognises the development of innovative solutions such as carbon credit ratings to increase credit transparency and quality.

The CFTC has already issued guidance on reporting carbon market fraud, and has consulted on the listing of Voluntary Carbon Credit Derivative Contracts. Based on its Second Voluntary Carbon Markets Convening held in 2023 and informed by BeZero’s Chief Research Officer, final advisory guidance on the VCM is expected in the first half of 2024.

SEC Disclosure Rules mandate disclosure of climate-related information within financial statements, including Scope 1 and 2 emissions1 for SEC-registered companies, any climate targets and any carbon credit use which is material to achieving targets. Standardised reporting will include the type of credit, the crediting standard, and the cost of the credits.

AB 1305 in California requires ‘companies operating in California’ to publicly disclose information about their use of carbon credits on their websites. This is coupled with additional climate-related disclosures mandated by SB 253 and SB 261. These rules are likely to be interpreted broadly, meaning that even companies registered outside of the state will need to comply if they operate there. Hear more about AB 1305 from BeZero’s Policy Manager in Watershed’s webinar.

The United Kingdom

In the UK, green claims are covered by the Advertising Standards Authority (ASA). The UK is in the process of developing climate-related disclosure rules which are expected to align with the International Sustainability Standards Board (ISSB), an independent standard-setting body for sustainability reporting formed by the International Financial Reporting Standards (IFRS) Foundation.

ASA rules prevent misleading advertising. Their extended guidance covering environmental claims was released in June 2023. Green claims should be substantiated by meeting ASA standards for evidence and should include details of the carbon credit scheme used.

Australia

In Australia, the Clean Energy Regulator oversees the regulation of Australian Carbon Credit Units (ACCUs). These can be used voluntarily and are also eligible for the safeguard mechanism, Australia’s compliance emissions trading scheme. The introduction of climate-related disclosures is expected this year, and a draft bill was released in January 2024. To support this, the Australian Accounting Standards Board (AASB) is currently adapting ISSB standards to fit the domestic context.

AASB has drafted the Australian Sustainability Reporting Standards which will adopt the ISSB’s international standards, adapting the definition of a carbon credit to ensure it captures ACCUs too.

International reporting standards

In addition to the bespoke regulation introduced by various governments, international efforts to standardise climate-related reporting, such as the ISSB, are beginning to be adopted into domestic law. The ISSB’s IFRS S2 Climate-related disclosure includes requirements that companies disclose their planned use of carbon credits, the scheme that certifies the credits, and the credit types.

The following are examples of countries that have adopted or announced their intention to adopt the ISSB standards into their domestic reporting requirements:

Brazil: the Ministry of Finance and Comissão de Valores Mobiliários announced that the standards can be used voluntarily from 2024 with mandatory disclosure phased in later, from 1 January 2026.

Singapore: the Accounting and Corporate Regulatory Authority (ACRA) and Singapore Exchange Regulation (SGX RegCo) recently announced that the phase-in for mandatory reporting would result in the first reports for listed companies in 2025.

Understanding disclosure requirements is crucial for companies

Carbon credit buyers should expect the introduction of more regulation modelled on these initial developments; standardisation is essential to avoid excessive fragmentation.

By understanding the likely disclosure requirements for carbon credits commonly cited in these initial regulations, and monitoring upcoming developments in the jurisdictions where a company operates, sustainability leaders will be best prepared to meet new requirements as they are introduced.

BeZero Carbon monitors the introduction of demand-side regulation, helping buyers better anticipate developments in the carbon market. To stay one step ahead of climate regulation and its potential impact on carbon credit disclosures, follow BeZero on LinkedIn or X, or sign up for newsletter updates.

You can also read BeZero’s deep dive on green claims and climate-related information disclosure.

In the next article in our carbon credit explainer series, we explain how buyers can use carbon ratings to assess credit quality. Read more here.

References

Scope 1 emissions refer to a company’s direct emissions from owned or controlled sources. Scope 2 emissions are indirect emissions from the generation of purchased energy. Scope 3 emissions are all indirect emissions (not included in scope 2) that occur in the value chain of the reporting company, including both upstream and downstream emissions. Source: GHG Protocol.