Demand-side regulation: understanding disclosures and green claims

Here are some key takeaways

Governments around the world have responded to greenwashing scandals by implementing regulations for green claims and climate-related information disclosure, aiming to require environmental claims to be substantiated.

The International Sustainability Standards Board, European Union, and California have been key first movers in developing this demand-side regulation.

Disclosure requirements for carbon credits generally include but are not limited to, the type of carbon credit, the third party which verifies it, and how credits are used in a company’s decarbonisation strategy.

By including independent carbon ratings as part of their disclosure requirements, and building credit portfolios that responsibly manage risk, companies can improve the integrity of green claims.

Contents

- Demand-side regulation can increase market transparency

- What has happened so far?

- What are the implications of demand-side regulation?

Demand-side regulation can increase market transparency

In February 2024, the European Union took another step towards implementing the Green Claims Directive. The joint committees voted to adopt its position on the directive, and the first plenary vote on the directive is expected by mid-March.¹ This is part of a wider trend of governments introducing demand-side regulation covering the claims that can be made using carbon credits and increasing the climate-related disclosure requirements for companies. Governments are driven by an ambition to protect consumers from greenwashing and to ensure that companies deliver real emissions reductions.

The climate disclosure movement originally started gaining momentum in the 1990s with a call by corporates and environmental groups for standardised measurement and reporting of greenhouse gas emissions. In the early 2000s, voluntary guidance appeared with the establishment of the Carbon Disclosure Project (CPD) and the Corporate Standard under the GHG Protocol. This was followed by a flurry of activity in 2015 with the creation of the Taskforce for Climate Related Disclosures (TFCD) by the G20 which signalled the spill over of voluntary guidance into compliance schemes. This was cemented by the creation of the International Sustainability Standards Board in 2021 which aimed to consolidate and standardise guidance for companies and governments.

In 2022, detailed net zero guidance was developed by the Science Based Targets initiative (SBTi) and the ISO Net Zero Guidelines. Accounting standards like the GHG Protocol, TCFD and ISO Net Zero determine the use of carbon credits for GHG inventories. With the recognition of the use of carbon credits for net zero pathways, there have been increasing calls for guidance and standards on these claims to be developed. This is where the Voluntary Carbon Market Integrity Initiative (VCMI) comes into play with the introduction of guidelines for companies on how they can use voluntary carbon credits as part of their net zero pathways. We are now seeing governments begin to regulate the carbon market space with the introduction of demand-side regulation on claims and disclosures. This follows a similar pattern to what we witnessed in the early 2000s with the creation of voluntary standards first before the implementation of regulations and or recognition of standards by governments.

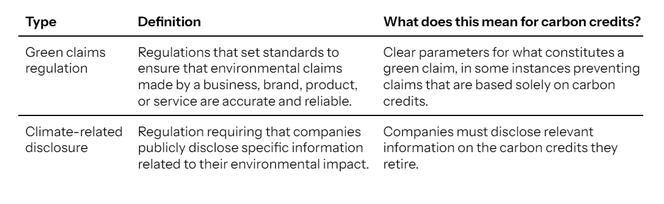

Regulations governing claims and disclosure often go hand in hand, but while they are complementary, they do have differences. The table below defines these regulations and sets out what they mean for companies.

Table 1. Definitions of green claims regulation and climate-related disclosures.

What has happened so far?

While voluntary disclosure schemes have been in development for decades, regulatory efforts to mandate disclosure and combat greenwashing are relatively new and are ongoing. Some governments that seek standardisation have chosen to adopt domestic regulation based on internationally developed standards under the ISSB, such as Brazil and South Korea. Other regulatory efforts are more singularly focused on the circumstances of that government’s jurisdiction, such as the European Union and California. We explore each of these approaches in the following section, before considering the implications of regulatory fragmentation.

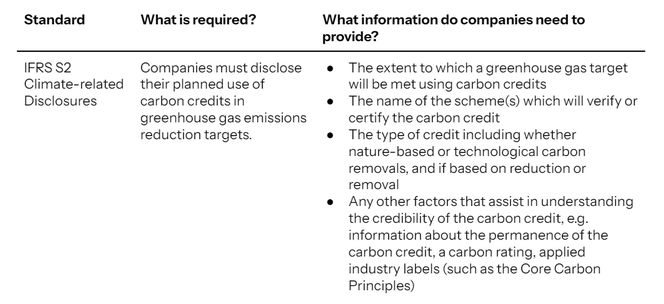

Climate-related disclosure standards are being adopted based on the work of the ISSB

There have been efforts to standardise climate-related disclosure rules through the creation of the ISSB, established as part of the International Financial Reporting Standards (IFRS) at COP26 in Glasgow in 2021. The IFRS is an organisation which develops global accounting standards with the aim that governments will adopt them into domestic regulation. In June 2023, the ISSB released its sustainability standards, IFRS S1 and IFRS S2. The standards require that companies provide useful and comparable data. Through governments’ adoption of the standards into domestic regulation, more consistent rules will be applied across jurisdictions. IFRS S2 is of particular interest, as it requires the disclosure of the use of carbon credits. The table below sets out those requirements.

Table 2. Requirements of IFRS S2.

A number of governments have adopted the standards and will require companies to comply. Brazil and South Korea will both require mandatory reporting from 1 January 2026. Other governments have announced their intention to develop standards based on the ISSB domestically. This will increase transparency while also providing a clearer picture of future demand, as companies must disclose their future intentions for using credits to meet emissions reduction targets.

The approach to green claims regulation has been unique to each government

So far, there have not been similar standardisation efforts for green claims regulation. First-movers are likely to set the tone for other regulators. Examining the efforts in the EU and California can provide insight into the potential future landscape of green claims regulations. These examples demonstrate the close links between climate-related disclosures and green claims regulation, and how they can be developed in parallel.

The European Union is cracking down on greenwashing

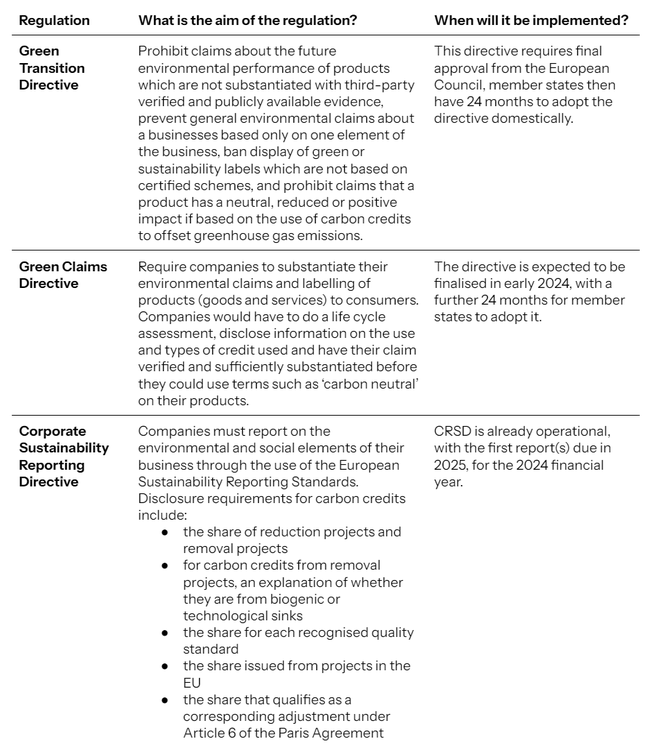

The EU has pioneered the development of demand-side disclosure and claims regulation for carbon credit use. It has introduced a suite of complementary measures to protect consumers from greenwashing and require that companies make transparent climate-related disclosures. These include the Directive Empowering Consumers for the Green Transition (the Green Transition Directive), the Green Claims Directive, and the Corporate Sustainability Reporting Directive. Table 3 below sets out the aim of each of these regulations.

Table 3. Requirements of European regulations.

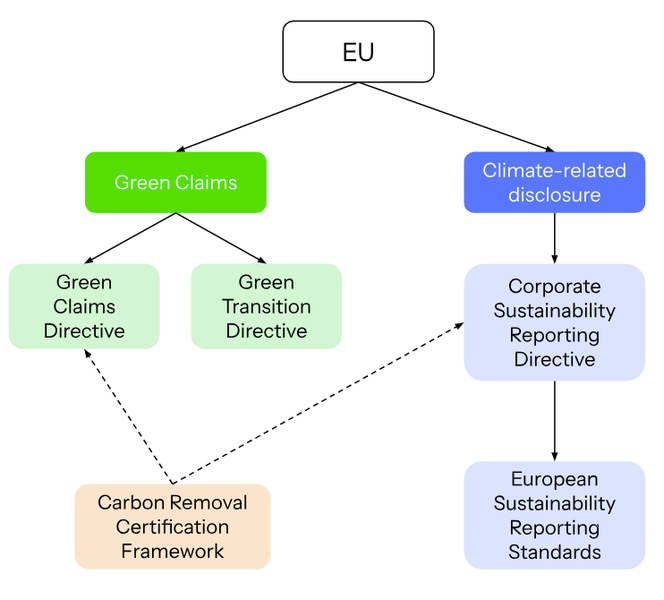

These regulations are supported by efforts on the supply side of the market. This week, the Carbon Removal Certification Framework (CRCF) passed the final trialogue stage, meaning that the final text has been agreed and is likely to pass in April.² The CRCF aims to establish a consolidated certification process for carbon removals in the EU, including nature-based solutions, technological solutions such as direct air capture and storage, and storage in long-lasting materials. The CRCF is expected to directly link to the Green Claims Directive and Corporate Sustainability Reporting Directive, providing even clearer parameters for the use of carbon credits in the EU.

The diagram below categorises the various pieces of legislation mentioned here and demonstrates how they are expected to relate to each other.

Figure 1. Relationship between green claims and climate-related disclosure regulation in the European Union.

California is the first US state to introduce disclosure rules for voluntary carbon credits

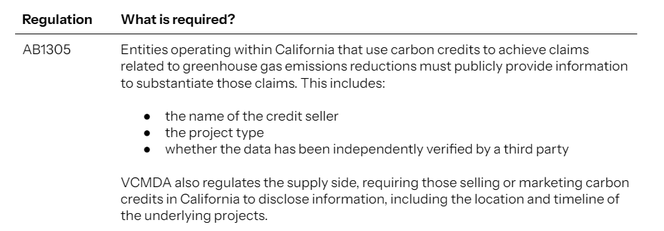

In California, the Voluntary Carbon Market Disclosure Act (VCMDA) AB1305, which came into effect on 1 January 2024, requires that companies operating in the state publicly disclose carbon credit information related to their environmental claims. California is the largest sub-national economy in the world, larger than most countries, meaning the requirements introduced by this legislation could have influence beyond the state’s borders.

Table 4. Requirements of AB1305.

Some critics have challenged that the implementation instructions for the VCMDA are too vague, leading to confusion. In response to this critique, another piece of legislation was introduced to the California legislature last week, intended to further clarify the VCMDA and improve its implementation. Regulators in the climate space often argue that perfectionism can hamper progress - particularly in reference to Article 6 development - thus the swift response from California to remedy any confusion should be welcomed.

What are the implications of demand-side regulation?

The voluntary carbon market (VCM) has long relied on its own initiatives to guide its development. The recent growth in government regulation is a sign of a maturing market. With the expectation that more demand-side regulation will emerge soon, regulators can take lessons from established practices for financial information disclosures. This could include the requirement for companies to disclose carbon credit ratings as part of their duty to demonstrate the integrity of purchased credits. Although not yet mandatory, companies should consider providing this information voluntarily, as part of climate-related disclosures and in defence of green claims, where appropriate.

Climate-related disclosures will bring transparency

Companies covered by climate-related disclosure regulation will be required to publicly disclose crucial information about their use of carbon credits, including their planned use of carbon credits in decarbonisation strategies. This can bring transparency to the market and legitimacy to the climate action it is funding. Project-level ratings can make it easier for companies to understand the integrity of the credits they buy. Globally, governments must work together to ensure that multinational corporations do not face undue complexity and costs in complying with a multitude of varying national claims and disclosure regulations. Fragmentation can cause unnecessary confusion.

Green claims rules require environmental claims to be substantiated

Clear parameters for what constitutes a valid green claim should be welcomed - requiring companies to substantiate environmental claims protects consumers and places a responsibility on buyers to deliver climate action. However, some stakeholders in the VCM note that this may narrow the ways carbon credits can be used, potentially impacting demand. Companies should consider using carbon credit ratings to build credit portfolios that responsibly manage risk, as set out in BeZero’s white paper on making credible claims.

References:

¹ Joint committee on Environment, Public Health and Food Safety (ENVI) and committee on Internal Market and Consumer Protection (IMCO).

² Carbon Future. 2024. The Carbon Removal Certification Framework: The EU Blueprint for Net-Zero. Available online: https://www.carbonfuture.earth/magazine/the-carbon-removal-certification-framework-europes-blueprint-for-net-zero