How do you know if carbon credits are living up to their promises?

Sustainability leaders need tools to identify the carbon credits most likely to deliver on their promised climate benefits.

Key drivers of carbon quality to consider include additionality, accurate carbon accounting, and permanence.

Carbon ratings help buyers accelerate their due diligence and maximise ‘climate bang for buck’ invested, globally.

Contents

- A promise is a promise

- Let ratings be your guide

- Why ratings drive carbon quality

- What you need to remember

Carbon credits, often seen as catalysts for climate action, hold a simple promise: one tonne of carbon dioxide equivalent (CO2e) avoided or removed from the atmosphere per credit issued. However, not all credits are created equal. So how can you tell if credits are living up to their core promise?

A recent Boston Consulting Group study revealed that carbon efficacy is the most important attribute of credit quality valued by buyers, and a strong indicator of their willingness to pay. 1

Business leaders and sustainability officers are seeing their climate credibility scrutinised more than ever, so choosing the right carbon credits as part of a broader climate strategy is paramount. Fortunately, carbon ratings offer a simple and robust way to deliver effective climate action.

A promise is a promise

Similar to a coffee seller promising the delivery of 1kg of coffee beans without specifying a particular grade of coffee , a carbon credit promises the delivery of one tonne of CO2e. Just like getting a potentially disappointing cup of coffee, the risk you take as a carbon credit buyer is that your investment may not translate to effective climate action. That’s where ratings come in.

Buyers can dig into three key factors driving credit quality: additionality, carbon accounting and permanence. While the science can be overwhelming, independent expert analysis can enhance and accelerate your due diligence.

1. Additionality

In the simplest terms, examining additionality helps to answer the question ‘Would this project have happened anyway without carbon finance?’. If the answer is no, then the project is considered additional. Understanding a project’s level of additionality is crucial because if you’re trying to offset your residual emissions by buying credits from projects that are unlikely to be additional, it can put into question your company’s net impact on the environment.

Take the example of a hypothetical avoided deforestation project. The project developer claims that without carbon finance, the forest would be at risk of deforestation from illegal logging or some other form of forest degradation. But it can be hard to prove whether that forest was ever under any real threat - we are dealing with counterfactual scenarios. Does it really need money from the sale of carbon credits to survive, or is the forest already protected by local communities, or the effective implementation of the government’s environmental policy, for instance?

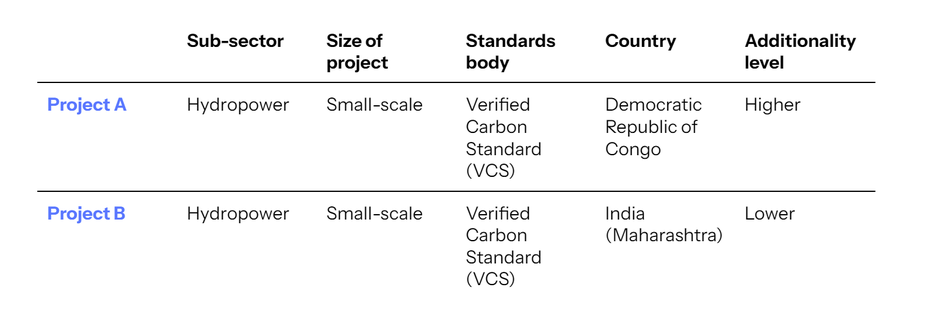

While being additional is binary in theory – it’s either additional or it’s not – in practice it’s more complicated. Some projects are inherently more additional than others. For instance, BeZero’s ratings scientists found this in their assessments of two small-scale hydropower projects in India and the Democratic Republic of Congo (DRC). On the surface, the projects are very similar and are even accredited by the same standards body. But in the Indian state of Maharashtra, hydropower is a relatively common practice and benefits from government subsidies, whereas access to external finance in the DRC is more limited. In other words, in the DRC, the project likely would not have been developed without carbon finance, making it comparatively more additional.

Table 1: digging deep into similar projects can reveal important differences

BeZero’s project-level analysis for two similar projects from the same sub-sector, accredited by the same standards body, but located in different countries, reveals significantly different likelihoods of additionality. Table is for illustrative purposes only - other differences between the two projects may also influence additionality.

2. Carbon accounting

The purpose of accurate carbon accounting is to ensure the right amount of emission reductions are being claimed by a project. If for example, you want to offset 1,000 tonnes of your emissions, you want to be confident that your carbon credits are having the same amount of climate benefit.

To work out how many credits a project can issue, the project developer has to first provide an estimate of likely emissions in the project area in the absence of project activities. This is known as the baseline scenario and forms the backbone of accurate carbon accounting. Then, a project is issued credits for the difference between project scenario emissions and the baseline. If a baseline is overstated - by exaggerating the rate of expected forest loss in and around a forestry project area for example - the project runs the risk of over-issuing credits.

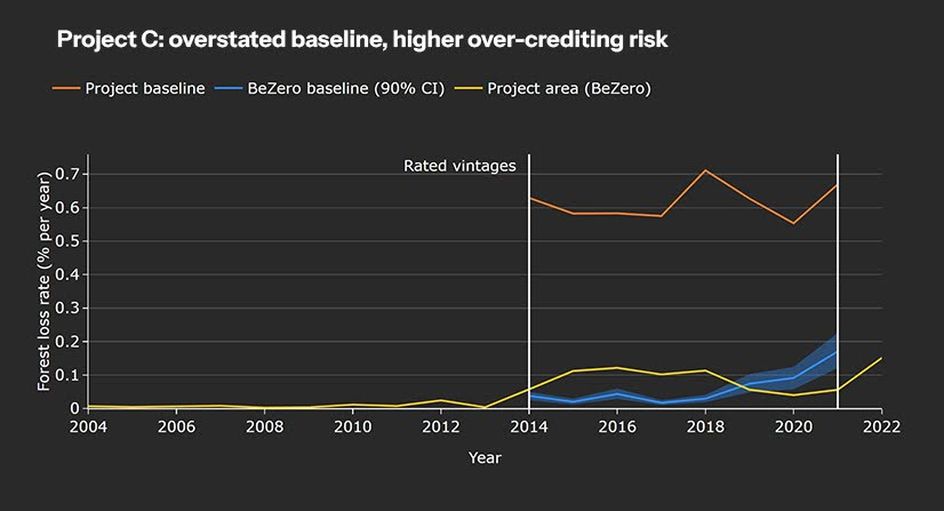

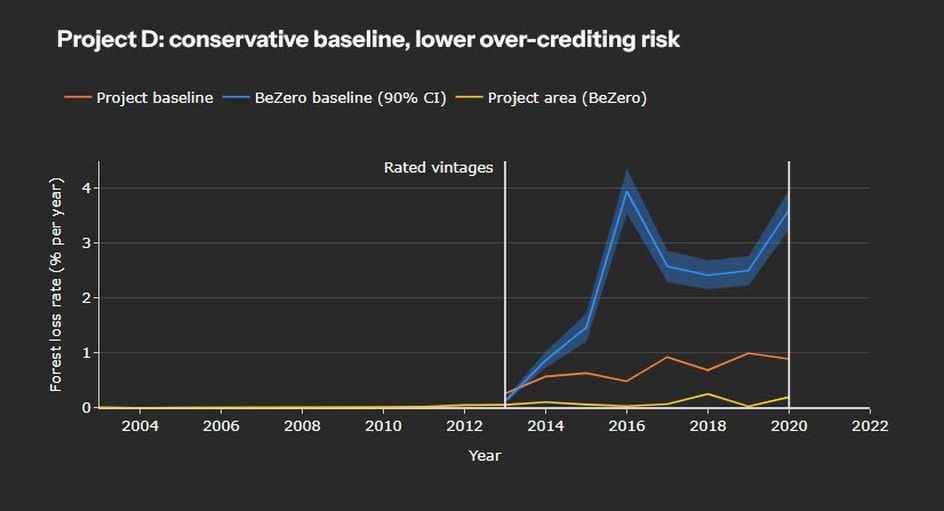

While the performance of individual projects varies, avoided deforestation projects may take a relatively conservative approach to baseline setting by using representative historical forest loss data. Instances of inflated baselines, which translate to a higher risk of over-crediting, have been observed by BeZero’s analysts when baseline estimates are overly reliant on probabilistic models that ignore historical rates. The charts below illustrate what this looks like in practice.

Baseline comparison charts for two avoided deforestation projects. See below for details on how the charts show estimated and observed forest loss rates within the respective project areas.

Orange line: baseline deforestation rate estimated by the project developer, as stated in the project design document or the latest monitoring report.

Blue line: baseline deforestation rate independently built by BeZero using satellite imagery and machine learning techniques.

Yellow line: deforestation independently observed by BeZero using Earth observation methods.

For project C, the notable difference between the project's model-driven baseline (orange line) and BeZero’s independent, dynamic baseline (blue line) indicates significant over-crediting risk for this project. Furthermore, the observed deforestation (yellow line) shows some additionality risk given the project’s inability to prevent forest loss, compared to independent controls, especially early in the project.

For project D, the project developer used historical deforestation data to set the baseline (orange line) which lies well below BeZero’s independently constructed baseline (blue line), leading to lower risk of over-crediting compared to project C.

Another factor to consider is leakage. Essentially, you want to be sure that the deforestation that you prevented in the project area doesn’t just happen somewhere else. To assess that, BeZero uses advanced geospatial and Earth observation technology and analysis to detect changes in forest cover not only in the project area, but also in nearby areas. Micro and macro-economic factors that could drive leakage risk are also taken into account.

Worth noting, leakage can sometimes be positive, meaning that the project’s activities reduce emissions outside its boundaries. BeZero’s analysts have seen examples of this in afforestation projects in Uganda that employ agroforestry practices, when farmers in lands neighbouring the project sites replicate the project’s greening efforts after seeing their benefits, such as increased tree shade and improved soil fertility, first-hand. The net effect can be an increase in soil carbon stores.

Whether negative or positive, accounting for leakage in credit issuance calculations is essential for dependable carbon accounting.

3. Permanence

Part of a carbon credit’s promise is a commitment to achieving its carbon benefits over a specified period. Permanence refers to the project’s ability to mitigate potential carbon reversals throughout that timeframe. This can be dozens, hundreds, or even thousands of years in the case of some engineered carbon removal methods such as biochar. You may also hear the term durability, which is closely related to permanence and refers to the duration of time that the benefits of the carbon project last.

Reversal events take many forms. Natural hazards like wildfires, droughts and floods for instance can all negatively impact carbon levels in nature-based projects. Even slower-moving phenomena such as sea level rise can put projects at risk, such as in mangrove forests. Modelling future sea level rise and assessing a mangrove ecosystem’s ability to adapt gives ratings analysts an indication of how permanence may be affected.

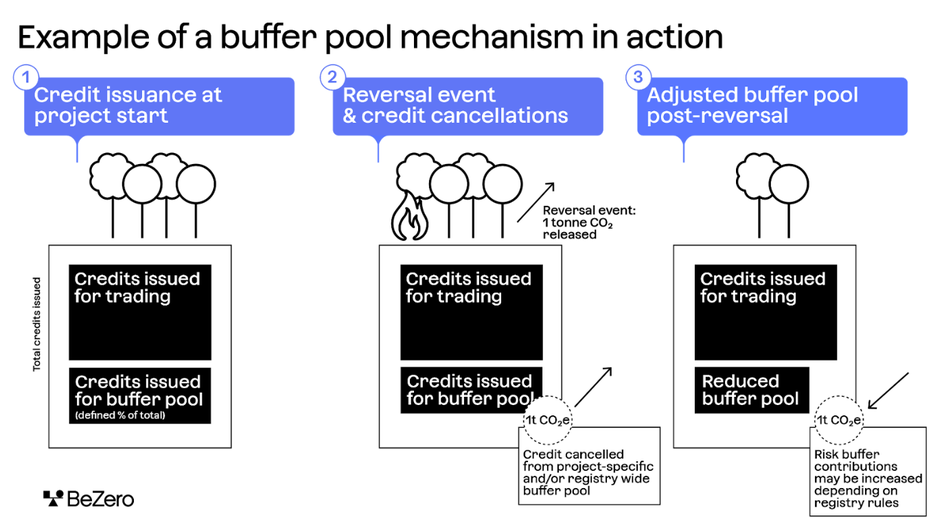

The most common way to account for reversals is through a dedicated ‘buffer pool’ of credits which acts as an insurance mechanism. Say a carbon loss event happens from unauthorised tree felling or a drought impairing a peatland’s ability to absorb carbon. The standards body that issued the impacted credits would then dip into the buffer pool and cancel credits accordingly to make up for the shortfall. The capacity and integrity of the buffer pool, and how it is used, can have a material impact on carbon credit efficacy, so credit buyers should have this in mind when looking at permanence.

Let ratings be your guide

By now you may be thinking ‘This sounds complicated and time-consuming’. And you’d be right - evaluating the quality of a carbon credit is a difficult exercise requiring dedicated expertise and a tremendous amount of data. From dealing with counterfactual scenarios to understanding the nuanced interplay between climate science, finance and environmental policy, assessing project efficacy is very, very hard.

Thankfully, carbon ratings play a pivotal role in distilling the quality indicators mentioned above into a single, easy-to-understand metric.

Ratings represent an informed assessment of whether a carbon credit is likely to deliver on its carbon promise. In other words, independent ratings empower credit buyers with a simple reference point for confident and informed decision-making.

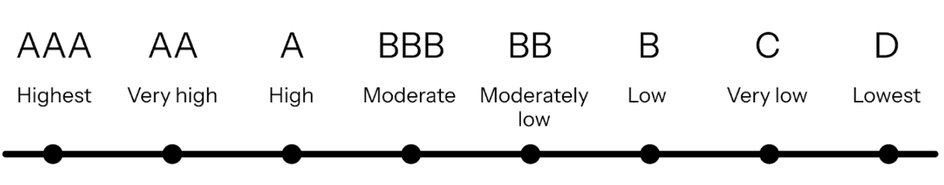

The BeZero Carbon Rating represents BeZero’s opinion on the likelihood that a given credit achieves a tonne of CO₂e avoided or removed from the atmosphere. With ‘AAA’ representing the highest likelihood, and ‘D’ representing the lowest, the rating scale is fully aligned with financial market standards, making it easy to interpret. BeZero’s listing page hosts all of its headline ratings and ratings summaries.

The BeZero Carbon Rating scale. Each letter rating represents the likelihood a carbon credit delivers on its promise of 1 tonne of CO2e avoided or removed.

The factors driving carbon quality - additionality, carbon accounting and permanence - are all represented in the BeZero Carbon Rating.

In addition to what a carbon rating reveals, companies often want to know about ‘beyond carbon’ features not explicitly expressed in this rating such as the social, economic and environmental benefits often claimed by projects, commonly expressed as UN Sustainable Development Goals.

Sustainability leaders want a compelling story to tell, whether it’s the health benefits of clean cookstoves, biodiversity conservation linked to many nature-based solutions, or the jobs created by large-scale mangrove restoration projects. Understanding how a project delivers on these ‘beyond carbon’ claims, and how it ensures appropriate safeguards are in place to protect its social and environmental integrity, are essential for peace of mind.

Why ratings drive carbon quality

Carbon ratings play a crucial role in maximising the climate impact per dollar spent globally. By directing investment towards projects with the highest environmental integrity, ratings ensure that every dollar spent on carbon credits translates into genuine emissions reductions or removals.

Moreover, publicly available and widely adopted ratings help lift the carbon market’s quality floor. Empowering buyers with an informed opinion on the efficacy of carbon credits removes doubt and unlocks finance for effective projects. This fuels more demand for highly rated projects, ultimately driving more high-quality climate action. Everyone wins - developers get more funding, buyers derisk their investments, and the planet benefits from meaningful climate action.

What you need to remember

As the most effective tools to deliver climate action today, carbon credits hold immense potential in the fight against climate change. But their effectiveness hinges on quality and transparency.

By providing a better understanding of the drivers of quality, carbon ratings take the guesswork out of carbon risks and ultimately drive better climate action. They empower buyers with a simple way to accelerate their due diligence, whether at the early investment stage or when retiring credits for reduction claims. And with ratings being adopted by developers, investors, intermediaries and buyers alike, the whole market benefits from better transparency around climate efficacy.

The great news for climate action is that collaboration among climate groups is encouragingly on the rise, helping to remove doubt for companies on the sidelines. The Science Based Targets initiative (SBTi), often seen as the global authority in corporate decarbonisation, has not only shown signs of support towards the potential role of carbon credits to help accelerate Scope 3 emissions abatement, but it has also recognised the value of carbon ratings agencies to help identify high-quality credits.

Want to be a climate leader? Three quick wins for climate action today would be to:

Add BeZero’s listings page to your bookmarks as your go-to reference for hundreds of project ratings across sectors,

Ask your climate advisors and credit brokers if they use carbon ratings (and probe them if they don’t)

Share this article on LinkedIn or X with your fellow climate leaders to encourage wider use of carbon ratings for better climate action.

In the next article in our carbon credit explainer series, you’ll learn how carbon ratings can help you find and compare quality projects that meet your needs. Read more here.

References

BCG, September 2023: In the Voluntary Carbon Market, Buyers Will Pay for Quality