What does climate action look like?

Carbon finance gives a boost to climate projects that may not have otherwise been financially viable so that they can begin or continue operations.

This revenue can help to establish climate action in a new location, develop new ways of avoiding or removing carbon, and encourage local communities to engage in positive environmental practices.

These projects can also deliver ‘beyond carbon’ benefits, offering a holistic approach to climate and social action that positively impacts everyone involved.

Contents

- Money talks in the fight against climate change

- Case studies - carbon projects in action

- Going ‘beyond carbon’

- Avoiding harm through Safeguards

- Contributing to environmental and social change has never been so urgent or as accessible

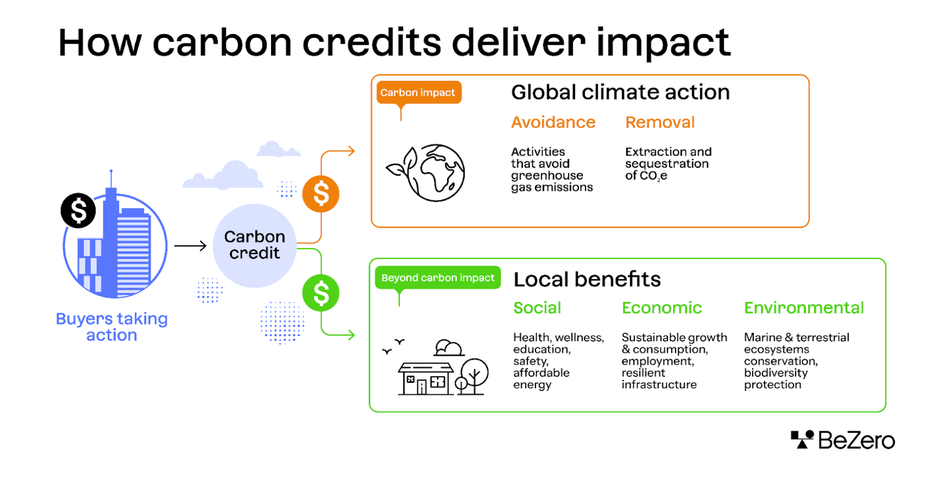

What do we mean when we talk about climate action? It looks something like this:

Any form of climate action is a substantial endeavour. Emissions avoidance and removal activities require significant planning, expertise, commitment and funding before any carbon benefits can be realised. Given the scale of these undertakings, many climate projects wouldn’t be feasible without financial intervention. This is where carbon credits come in.

Money talks in the fight against climate change

Carbon finance facilitates the set-up and continued operation of climate-positive projects. Such projects can sell carbon credits (1 tonne of carbon dioxide or the equivalent amount of another greenhouse gas depending on the project activity) to generate essential funding for project activities whilst also contributing towards the buyer’s climate commitments.

Carbon credit sales may be a project’s sole source of revenue, or carbon finance may supplement other revenue streams to expand activities or coverage. In either case, additionality - the extent to which a project’s activities depended specifically on carbon finance - is a key marker of a high-quality credit.

The impacts of greenhouse gas emissions are felt everywhere, and particularly in developing countries. Avoiding or removing one tonne of carbon dioxide equivalent in any location therefore contributes to the global fight against climate change.

But most of these projects also have on-the-ground benefits for local communities, such as the conservation of natural resources and the establishment of more sustainable livelihoods. When done right, carbon projects can directly improve the lives of people living locally, allowing carbon credit buyers to contribute to social and environmental change on the local and global scales.

Case studies - carbon projects in action

Let’s take a look at some examples of ‘additional’ climate action, meaning the kind that truly depended on the money generated from carbon credit sales.

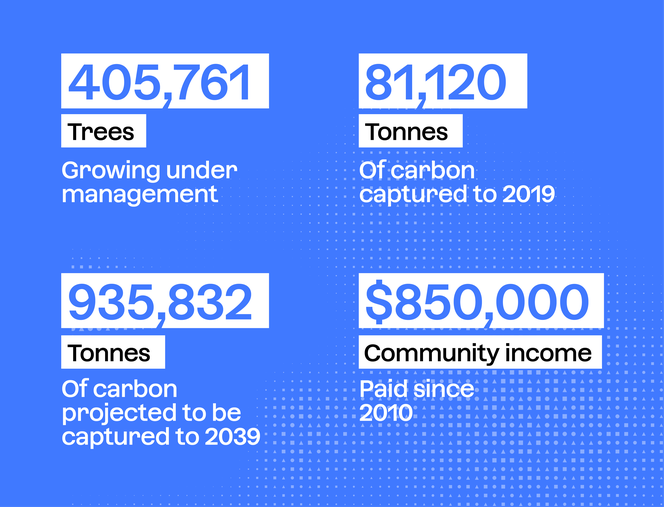

Carbon finance can help to establish activities that have otherwise been prevented by financial, operational, or technical barriers. Take for example the ‘WithOneSeed Timor Leste Community Forestry Program’ project, which has a BeZero Carbon Rating of ‘AA’ (as of 29/04/2024). It’s the only tree-planting programme in this region of Timor-Leste and, with a goal of planting one million trees, is on track to become the largest such project in the country.

Other projects of this nature in Timor-Leste are dependent on external financial backing from the government, foreign aid organisations, and NGOs. In contrast, this project plans to become fully self-sufficient through the continuous generation of carbon revenue, providing a long-term source of income.

Impact of the WithOneSeed project. Source: WithOneSeed website, as of November 2023

Carbon finance can also provide essential funding for innovative engineered carbon removal activities, such as the Novocarbo Rhine biochar project (BeZero Carbon Rating of ‘A’, as of 29/04/2024), which produces a stable char substance from waste wood chips that is applied as either a fertiliser in soil applications or a feedstock in concrete production, durably storing carbon in the biochar itself.

Biochar technology is currently in the demonstration phase, according to the Intergovernmental Panel on Climate Change (IPCC), and this particular project served as a proof of concept for the project developer to demonstrate the feasibility of industrial biochar production. Given the nascent nature of this technology, there are high costs associated with biochar production and financing; Novocarbo documentation indicates a total project cost of over USD 1,000 per tonne of biochar produced. The operating cost is so high that carbon finance could account for a material portion of the project’s overall revenue, even with biochar sales as an alternative revenue stream. This suggests that carbon finance greatly enhances the financial viability of the project.

Concrete enhanced with biochar, an example of a commercial application. Image source: Novo Carbo website.

Going ‘beyond carbon’

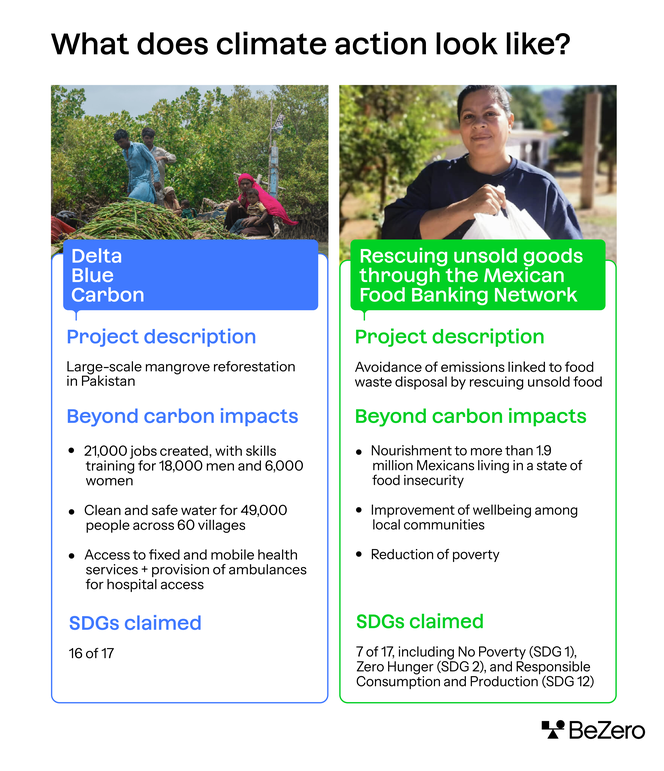

Carbon credits can also have ‘beyond carbon’ benefits. These positive impacts include environmental outcomes such as increasing biodiversity and socio-economic benefits, including improving employment opportunities and developing infrastructure for local communities.

The ‘beyond carbon’ impacts of carbon projects are often communicated via the UN Sustainable Development Goals (SDGs). The SDGs are 17 global sustainability objectives agreed upon by UN member states in 2015. The goals cover the pillars of sustainable development, environment, society, and economy, and are also very closely related to decarbonisation and net-zero activities.

Although they were originally designed for country-level use, they have since been used on other scales, including in the voluntary carbon market. ‘SDG claims’ are used to communicate to buyers what further impacts a carbon project may have had.

Image and data sources: Delta Blue Carbon and CoreZero websites.

One of the SDG claims directly related to climate action is SDG 13, unsurprisingly called the ‘Climate Action’ SDG. In theory, all carbon projects should be able to make SDG 13 claims as this goal includes a sub-goal on reducing carbon emissions. But other SDG 13 sub-goals relate to improvements in and the sharing of climate change knowledge and expertise.

The integrity of SDG claims can vary. Some projects publicly report little to no evidence behind their SDG claims, while others report validated and verified evidence for every monitoring period. In addition, some projects may impact only a small percentage of people in the project area, whereas others impact the majority over decades.

Avoiding harm through Safeguards

While SDGs are about promoting positive benefits, it is also critical to avoid inadvertent harms from carbon projects. Safeguards are measures projects can take to avoid negative social, economic, and environmental impacts. For example, environmental safeguards can protect ecosystem health and resilience such as the use of native species for planting activities. Social and economic safeguards can reduce the risk of human rights abuses, such as through obtaining ‘free, prior, and informed consent’ or by sharing project revenues with the local communities in a benefit-sharing scheme.

These measures mean buyers can be confident that carbon projects engage with and benefit on-the-ground stakeholders too. They can also have a material effect on carbon quality, as some social safeguards are even linked to the additionality and permanence of a carbon project.

Contributing to environmental and social change has never been so urgent or as accessible

Climate change must be tackled in every corner of the world, but climate action is most successful when it’s tailored to the specific circumstances of a community, region or country. For instance, BeZero’s analysis finds that clean cooking stove programmes tend to have the biggest impact when they specifically target rural areas with the lowest penetration of improved cookstoves.

Another example is improved forest management projects focused on managed forest regions. At their best, these projects help enhance natural carbon stores while substituting timber income with climate-focused investments in the local community.

The boost provided by carbon finance effectively accelerates environmental and social change at a scale, in a location, or through a means of emissions reduction that would not have otherwise happened. With the added input of safeguards, carbon ratings, and innovations in Earth observation and monitoring technology, credit buyers can be more confident than ever that their investments are delivering tangible climate action.

In the next article in our carbon credit explainer series, we highlight six ways that companies benefit from carbon credits. Read more here.

You can also read our thought piece on what a $100bn carbon market looks like, including the immense benefits for planet and people.

Note that the use of case studies in this article is for informational purposes only and does not constitute an endorsement. For examples where BeZero Carbon has assigned a rating, note that the rating is accurate as of April 29, 2024 and is liable to change.