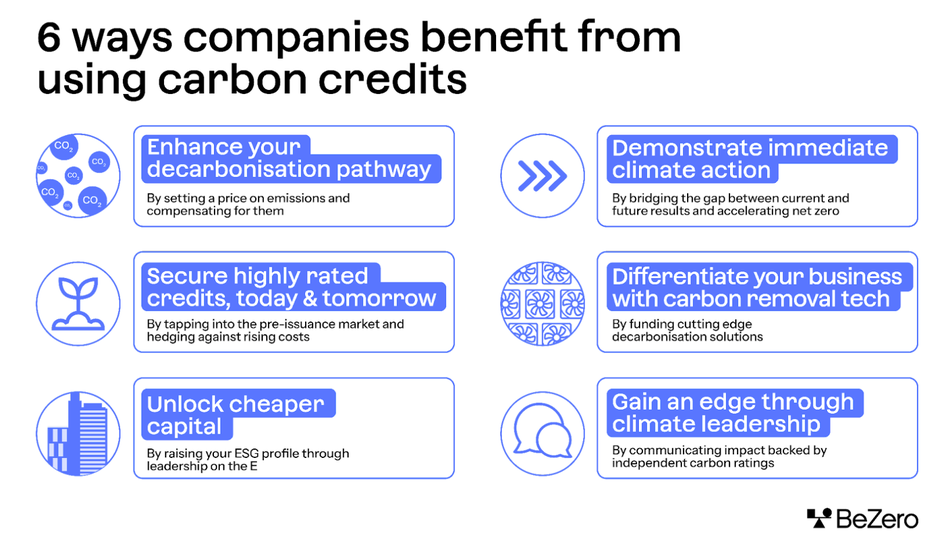

6 ways companies benefit from using carbon credits

Contents

- 1. Enhance your decarbonisation pathway by setting a price on emissions

- 2. Demonstrate immediate climate action and accelerate net zero

- 3. Secure highly rated credits, today and tomorrow

- 4. Differentiate your business with carbon removal tech

- 5. Unlock cheaper capital

- 6. Gain an edge through climate leadership and impact

- Change catalysts

Chief Sustainability and Financial Officers around the world are constantly getting asked about the big ‘E’ in ESG.

‘What’s your decarbonisation strategy?’

‘Are you on track for net zero by 2050?’

‘Are you using carbon offsets?’

Investors, regulators, customers, and colleagues want answers.

Regardless of where companies are in their decarbonisation journey, high-quality carbon credits should be treated as a cornerstone of a robust climate strategy. But while more than 7,800 businesses are taking climate action through science-based targets and net-zero commitments1, only about a third are making use of carbon credits.2

As one of the most effective tools to deliver climate action, this needs to change. The UN Intergovernmental Panel on Climate Change - the global authority on climate science - makes the case for carbon removals in particular: ‘The deployment of carbon dioxide removals to counterbalance hard-to-abate residual emissions is unavoidable if net zero greenhouse gases emissions are to be achieved’.

Here are six reasons sustainability heads should include carbon credits in their decarbonisation plans.

1. Enhance your decarbonisation pathway by setting a price on emissions

Figuring out how to lower emissions across your operations tends to be the first order of business. Given how entrenched we still are in a fossil fuel economy, this is easier said than done, particularly for carbon-intensive industries where low-emission technologies aren't yet available or affordable. Residual emissions are almost always inevitable, so how do you address them?

And even if you operate in a ‘cleaner’ sector like software or communications, and you do manage to eliminate your owned emissions and those associated with purchased energy (Scope 1 and 2), how do you deal with the mammoth task of reducing the indirect emissions linked to your suppliers and customers (Scope 3)?

With Scope 3 accounting for over 70% of most companies’ emissions,3 the case for compensating for them with carbon credits becomes compelling.

Contrary to the belief that they are merely a ‘licence to pollute’, carbon credits are a complement to a broader decarbonisation strategy. One study of 4,000 businesses showed that companies buying carbon credits are decarbonising twice as fast as those that don’t. 4

The best thing a company can do to accelerate decarbonisation is to set an internal carbon price. By making carbon a bottom-line issue, you not only have a financial incentive to operate more efficiently, but you can also use the proceeds both to fund internal decarbonisation activities and finance climate action outside your value chain through the purchase of carbon credits.

Scope 3 emissions account for over 70% of most companies' greenhouse gas emissions

2. Demonstrate immediate climate action and accelerate net zero

By buying and retiring carbon credits, you deliver immediate climate action and accelerate the global net-zero ambition.

From protecting forests to extracting methane from landfill sites, projects all over the world are creating tangible environmental and often socio-economic outcomes. Purchasing high-quality carbon credits means you’re complementing efforts to avoid or sequester carbon in your company’s reduction pathway.

In other words, for those hard-to-abate emissions which require investment in new technologies that still need time to scale, you can effectively bridge the gap between immediate action and future results.

3. Secure highly rated credits, today and tomorrow

Carbon markets provide access to thousands of projects globally, across dozens of sectors. Third-party carbon ratings are a great way to help buyers home in on today’s supply of high-quality credits.

But the number of outstanding credits with high ratings is limited. By the end of 2023, just 11% of available credits in the market (about 94 million) had a BeZero Carbon Rating of BBB or above.5 A scramble for remaining high-quality credits could push up prices, meaning now is the time to lock them in.

Just 11% of outstanding credits had a BeZero Carbon Rating of BBB or higher as of year-end 2023

For companies in hard-to-abate sectors such as energy and aviation, carbon removal credits offer a way to stick to their reduction targets. To secure the next generation of quality, many are turning to credits in the pre-issuance market.

Pre-issuance or ‘ex ante’ credits are underpinned by early-stage projects that haven’t yet delivered on their carbon promises. The opportunity in the pre-issuance space for engineered removal credits is particularly exciting - innovative methods such as biochar or enhanced weathering can help future-proof net-zero roadmaps.

By securing a long-term supply of removals via forward purchase agreements, you can lock in prices and protect your investment against credit price volatility. You can also choose credits with pre-issuance ratings for the peace of mind that your investments are likely to deliver on their carbon benefits.

4. Differentiate your business with carbon removal tech

Just because some of the more nascent carbon removal solutions aren’t readily available today doesn’t mean you can’t benefit from what their future holds.

Some forward-thinking companies are tapping into carbon markets to finance cutting-edge decarbonisation tech. This sometimes forms part of a carbon insetting approach, whereby companies compensate for their emissions through activities within their value chains.

Insetting is particularly relevant for businesses with multinational footprints or large and complex supply chains. Some food and drink conglomerates, for instance, have integrated regenerative agriculture into their supply chains to reduce emissions.

The same model could be used for technology-based carbon removals. For example, companies could fix direct air capture units to their cooling towers or use biochar in the soil used for crops. Financing models abound, from taking an equity stake in a project developer, to securing future shares of carbon credits at a discounted price (known as carbon streaming deals). Furthermore, ratings can help de-risk investments in early-stage projects. BeZero has assigned pre-issuance ratings to projects across forestry, soil carbon and tech-based solutions to name a few. As early-stage investors in nascent carbon removal tech, companies stand to benefit from these new business opportunities, long-term financial returns, and unique competitive advantages.

5. Unlock cheaper capital

PwC estimates that global ESG-related assets under management will reach USD 34 trillion by 2026, or roughly one in every five dollars under management. The growing prevalence of ESG in financial markets means a company’s ESG score can affect its access to capital.

While the scoring criteria for ESG vary somewhat across rating providers, your carbon footprint and decarbonisation trajectory tend to feature in the ‘E’. As mentioned earlier, companies that buy carbon credits tend to be decarbonising quicker than their peers. This does not mean that purchasing credits magically brings about faster decarbonisation. Rather, on average, companies using credits are doing so as part of a comprehensive and effective climate strategy. In other words, using carbon credits can show broader leadership on the ‘E’.

The financial case for raising your ESG profile is hard to ignore. Investors, asset managers and index providers want a credible ESG story. This can not only facilitate access to capital but can also lower the cost of that capital. A study by MSCI found that the difference in the cost of financing between the highest ESG bucket of the MSCI World Index and the lowest was almost 0.5%. 6

6. Gain an edge through climate leadership and impact

Climate commitments come with responsibility. Against a backdrop of increased scrutiny around climate claims, communicating credible impact to your stakeholders is essential.

By offering an impartial view on whether your chosen credits are truly delivering on their promises, carbon ratings provide a demonstrable way to communicate impact. Choosing credits that fit your needs and values on the one hand, and have independent ratings on the other, makes that communication all the more easy.

Furthermore, by evidencing the high quality of your credits, and in many cases the beyond carbon benefits linked to local communities, ecosystems and biodiversity, you signal to your employees and broader stakeholders that your climate strategy is legitimate. This can encourage buy-in, cementing your positioning as a climate leader.

Change catalysts

Carbon market champions are advocating for better transparency and higher-quality projects. With increased cohesion between climate groups to help companies on their journey, a real sense of optimism is in the air. The Science Based Targets initiative (SBTi) has also made encouraging recommendations on building and reporting a credible ‘beyond value chain mitigation’ strategy, showing signs of support for both the use of carbon credits to accelerate Scope 3 emissions abatement and the use of carbon rating agencies to help identify high-quality credits.

Both decarbonisation and carbon credits have a role in a robust net zero roadmap. A thoughtful approach to carbon offsetting or insetting, backed by independent ratings, can go a long way to appease your stakeholders and deliver credible climate action.

Whether you’re currently impacted by climate regulation or not, buying and retiring high-quality carbon credits sends a powerful signal that you’re serious about taking climate action today.

In the next article in our carbon credit explainer series, we introduce what you need to know in the climate regulation landscape around the world. Read more here.

References

Allied Offsets, November 2023: 2023 VCM Forecast Report

Trove Research, June 2023: Corporate emission performance and the use of carbon credits

BeZero proprietary database, as of end of December 2023.

MSCI Research, 2020: ESG and the cost of capital