How to communicate credible impact with carbon ratings

Sustainability leaders need robust guidance on how to confidently communicate climate impact and encourage others to take action.

Carbon ratings and complementary frameworks such as the VCMI Claims Code of Practice and the Oxford Offsetting Principles are well suited for this purpose.

Credit buyers can use independent ratings to demonstrate the quality of their carbon portfolio, defend associated climate claims, and mitigate reputational risk.

Contents

- Walking the walk, but not talking the talk

- Demonstrating impact with carbon ratings

- The VCMI and the Claims Code explained

- Preparing for the future with the Oxford Offsetting Principles

- Credible and defensible claims

Over 8,000 companies are taking climate action through science-based targets and net-zero commitments.¹ Only about a third use carbon credits to enhance their climate strategy.²

As one of the most effective ways of delivering immediate climate action, more sustainability leaders need to embrace carbon markets if we are realistically going to achieve net zero. As Maria Mendiluce, CEO of the We Mean Business Coalition puts it: ‘without the voluntary carbon market, we will not reach the goals of the Paris Agreement’.

So what’s holding them back? One likely theory is the fear of repercussions should things go wrong - for instance, if credits don’t deliver on their promises, or when project activities have unintended negative social or environmental impacts.

Understandably, no sustainability leader wants to see their climate strategy undermined or their company’s reputation tarnished. Against a backdrop of increased scrutiny around climate claims, communicating credible impact to your investors, customers, and employees is paramount.

Fortunately, companies have many tools and resources at hand to help them be as good as their word, including carbon ratings and frameworks such as the VCMI Claims Code of Conduct, the ICVCM Core Carbon Principles (CCPs), and the Oxford Offsetting Principles.

Walking the walk, but not talking the talk

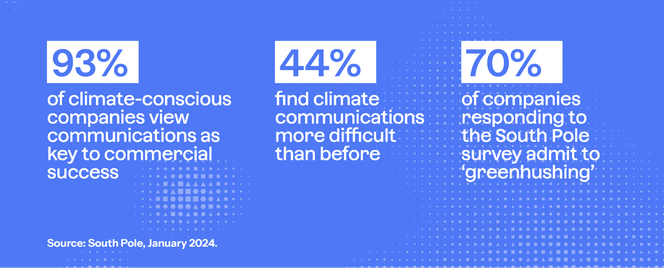

A recent survey of 1,400 businesses ³ revealed a worrying disconnect around climate communications. On the one hand, 93% of climate-conscious companies view communications as key to commercial success. On the other, close to half find climate messaging more difficult than before, with most decreasing their external communications as a result. 70% admitted to ‘greenhushing’, the practice of not reporting climate-related information in order to avoid scrutiny.

These figures are troubling because being a climate leader goes hand in hand with communicating impact. Companies should be empowered to communicate with confidence, as it encourages disclosure and accountability around climate commitments, and sets an example for peers.

Demonstrating impact with carbon ratings

‘Carbon neutral’ is a poorly defined concept, and a loaded term. Proving carbon neutrality not only requires that every tonne of emissions is accounted for across a company’s full value chain, it also assumes an equivalent amount is offset (or inset) via climate projects that are credibly delivering on their carbon claims. While emissions measurements are getting more precise, a carbon neutral claim can backfire if the calculations or assumptions behind them are even slightly off.

Instead, companies can make credible claims around their use of carbon credits using carbon ratings, which represent an informed view on the carbon impact of a climate project.

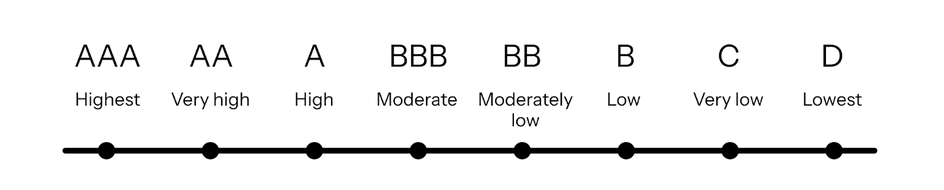

The BeZero Carbon Rating represents BeZero’s current opinion on the likelihood a given credit achieves a tonne of CO₂e avoided or removed, with ‘AAA’ representing the highest likelihood, and ‘D’ representing the lowest. BeZero’s listings page hosts all of its headline ratings and ratings summaries.

The BeZero Carbon Rating scale. Each letter rating represents the likelihood a carbon credit delivers on its promise of 1 tonne of CO2e avoided or removed.

Buyers using the above definitions and rating scale to communicate the quality of their retired credits on their website or annual sustainability report can thus:

Evidence their claims based on a deep assessment of key drivers of carbon efficacy such as additionality, carbon accounting, and permanence.

Defend their claims by highlighting the scientific, carbon, and markets expertise that goes into third-party ratings.

Qualify their claims as a likelihood rather than a guarantee.

Mitigate reputational risk by demonstrating the role of independent ratings in their due diligence.

Avoid claims around carbon neutrality which are often treated with scepticism.

The VCMI and the Claims Code explained

Carbon ratings complement buyers’ guidance such as the Claims Code of Practice created by the Voluntary Carbon Markets Integrity Initiative (VCMI), a multi-stakeholder platform aiming to drive credible, net-zero aligned participation in the market.

The Claims Code offers practical guidance to help sustainability leaders ensure their claims are accurate, evidence-backed, and do not overstate environmental benefits. The Code has been supported by governments, environmental NGOs, corporates, and investors.

Some companies are already making use of the Claims Code to signal their commitment to high-quality carbon credits - a leading strategy consultancy was the first to make a ‘Platinum’ claim, the VCMI’s highest Carbon Integrity Claim.

To make a VCMI claim, companies must follow a four-step process:

Step 1: comply with the Foundational Criteria

These criteria are designed to ensure corporate alignment with Paris Agreement goals. As the backbone of a credible climate strategy, they include disclosing annual greenhouse gas emissions, setting reduction targets and committing to net zero by no later than 2050, reporting on progress towards emissions reductions, and demonstrating support and advocacy of the Paris Agreement’s objectives.

Step 2: select a claim

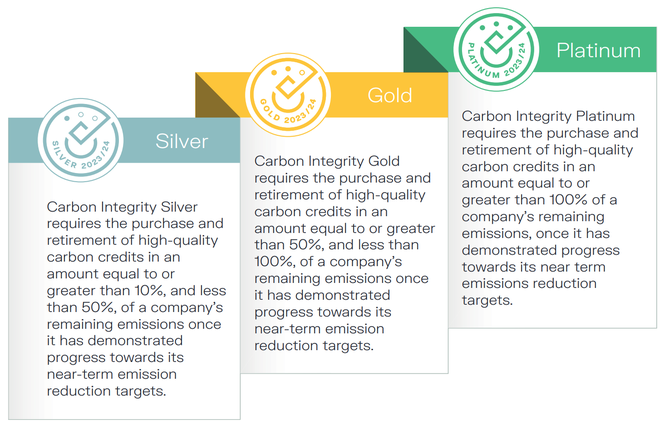

Companies can choose from three types of Carbon Integrity Claims, each relating to the proportion of carbon credits retired relative to their annual emissions footprint:

VCMI carbon integrity claims. Image source: VCMI Claims Code of Practice.

Worth noting, the percentage of total remaining emissions covered by credits must increase every year following a claim. The VCMI’s tiered approach is designed to simplify what companies can claim while also providing an incentive for accelerating internal decarbonisation.

Step 3: Meet the quality thresholds

Companies have to demonstrate that the credits used to make the claim are high-quality, which the VCMI defines as those meeting the Core Carbon Principles of the Integrity Council for the Voluntary Carbon Market (ICVCM), an independent governance body.

In essence, Core Carbon Principles-labelled credits have proven their worth by passing the ICVCM’s assessment of their associated methodology (a protocol designed by a standards body such as Gold Standard or Verra). The role of the Core Carbon Principles is entirely complementary with the project-level analysis offered by carbon ratings.

For those categories of credits that have not yet undergone the ICVCM assessment, companies have two options. The first is to retire credits approved under the pilot phase or first phase of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA), a Paris Agreement-aligned initiative developed by the International Civil Aviation Organization.

The second option acknowledges that existing carbon credit procurement agreements were likely established prior to Core Carbon Principles-approved credits becoming available in the market. In this case, companies can publicly disclose how their due diligence for identifying high-quality credits aligns with all 10 Core Carbon Principles.

Step 4: obtain third-party assurance

Finally, companies have to substantiate their claims by providing information relating to the Foundational Criteria and to the retirement of high-quality credits, as outlined in the VCMI’s Monitoring, Reporting & Assurance (MRA) Framework.

Preparing for the future with the Oxford Offsetting Principles

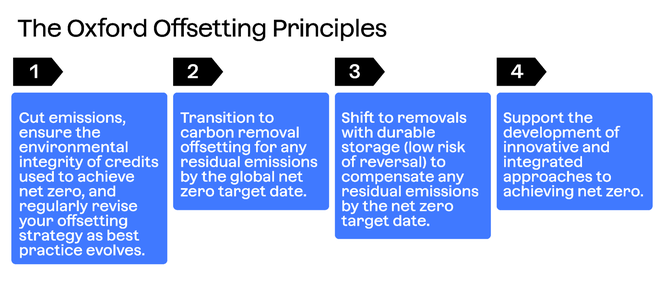

While the VCMI Claims Code offers guidance on making credible claims today, the Oxford Principles for Net Zero Aligned Carbon Offsetting helps companies plan for the future.

First published in 2020 and updated in 2024, the Oxford Offsetting Principles provide best-practice guidance for aligning use of carbon credits with a net zero society. As a framework grounded in science, companies aligned with these Principles can communicate the climate impact of their offsetting strategy with confidence.

The Oxford Principles laid the groundwork for integrity initiatives such as the VCMI, and have spurred sustainability leaders to build net zero-aligned carbon credit strategies.

The updated Principles flag carbon ratings as an innovation in carbon quality assessment.

“Certain novel tools, including carbon credit rating systems and integrity assessments, can assist with quality assessments.”

- Oxford Principles for Net Zero Aligned Carbon Offsetting (revised 2024)

BeZero supports the updated Oxford Principles, and urges companies to integrate them into their decarbonisation plans. The principles underscore the importance of ensuring credit quality, requiring them to yield demonstrably additional results, pose a low risk of reversal, and avoid negative impacts on people and the environment.

Ensuring the avoidance of negative impacts is paramount to credit quality. The BeZero Carbon Rating evaluates the potential risk of adverse ‘beyond carbon’ impacts by including an assessment of safeguards, which are mechanisms aimed at reducing such risks.

The fourth Principle, which addresses the early-stage funding of high-quality projects, is another example of where ratings can play a role. Buyers turning to the pre-issuance market to invest in early-stage projects can use pre-issuance ratings to mitigate the risks of early-stage financing and long-term offtake agreements, and help strengthen associated communications.

Credible and defensible claims

Climate communications can be nerve-wracking, but with the window of opportunity to materially reverse the negative impacts of climate change shrinking every year, now is not the time to delay action and risk missing your net zero goals.

Making claims about unrated credits means you’re effectively flying blind and taking on unnecessary risk. Claims backed by the analysis of independent carbon ratings agencies not only make them credible from a quality standpoint, they also make them defensible - in the unfortunate and often unpredictable event that your chosen credits don’t live up to their promises, demonstrating to your stakeholders that you took precautions by opting for highly-rated credits can help alleviate greenwashing accusations.

Ratings are fully complementary with well-regarded frameworks such as the Core Carbon Principles, the VCMI Claims Code, and the Oxford Offsetting Principles, and provide a demonstrable way to communicate the impact of your carbon portfolio. The Science Based Targets initiative (SBTi) has also supported the use of ratings to help identify high-quality credits, and has shown supportive signs for the potential role of carbon credits to accelerate Scope 3 emissions abatement.

Taken together, all these tools make it easy to not only build a robust climate strategy with defensible net zero claims, but also to talk about it with pride and confidence. Signalling this kind of ‘above and beyond’ climate leadership can be a powerful win for you and your stakeholders, and more importantly, in the fight against climate change.

Learn more in our guide to making claims using the BeZero Carbon Rating.

In the next article in our carbon credit explainer series, you’ll learn how climate leaders around the world make use of ratings as part of their carbon credit procurement. Read more here.

References

Allied Offsets, November 2023: 2023 VCM Forecast Report

South Pole, January 2024: Destination Zero: the state of corporate climate action