Implementing the Oxford Offsetting Principles with ratings

Here are some key takeaways

BeZero Carbon welcomes the updated Oxford Offsetting Principles, and urges organisations to integrate them into their decarbonisation strategies.

Key changes to the Principles emphasise the importance of reducing value chain emissions alongside offsetting, investing more in high-quality carbon removals projects, and recognising durability risks on a spectrum.

Ratings are vital for implementation of the Principles: they de-risk project financing, aid in building diversified credit portfolios, and support green claims.

Contents

- Introduction

- Carbon credits have a role to play alongside value chain emissions reductions

- Ratings should be used to bolster credible claims

- Removals will grow in importance, but quality can be found in all segments of the market

- Investors and project developers should prioritise ex ante ratings to support early-stage financing

- Regulation should promote transparency in claims made using carbon credits

- Conclusion

Introduction

The Oxford Principles for Net Zero Aligned Carbon Offsetting (herein referred to as ‘the Oxford Principles’ or ‘the Principles’) were first published in 2020 to provide best-practice guidance for aligning use of carbon credits with achieving a net zero society. The influential document has spurred organisations to develop net zero-aligned carbon credit purchasing strategies and has laid the groundwork for integrity initiatives within carbon markets. Yesterday, a revised set of principles was published, updating the previous document to reflect developments in the intervening period and clarify key aspects.

The four Principles, while remaining aligned with the previous document, now include additional nuances:

Cut emissions, ensure the environmental integrity of credits used to achieve net zero, and regularly revise your offsetting strategy as best practice evolves.

Transition to carbon removal offsetting for any residual emissions by the global net zero target date.

Shift to removals with durable storage (low risk of reversal) to compensate any residual emissions by the net zero target date.

Support the development of innovative and integrated approaches to achieving net zero.

Overall, BeZero supports the Oxford Principles and would encourage organisations to consider them when building their carbon credit portfolio or financing carbon projects. This article highlights alignment between the Oxford Principles and carbon ratings, demonstrating how BeZero ratings can be used to implement the Principles effectively, leading to better alignment with net zero targets.

Carbon credits have a role to play alongside value chain emissions reductions

BeZero agrees with the Oxford Principles that companies should prioritise delivering emissions reductions within their own value chains, viewing carbon credits as a complement rather than a substitute for this activity. Recent research by Ecosystem Marketplace’s Forest Trends indicates that companies engaged in the voluntary carbon market are actually reducing their emissions more rapidly than their peers: for example, they are investing three times more in emissions reductions within their own value chains. However, scrutiny on companies purchasing carbon credits has increased, making it essential to identify high-quality credits. BeZero Carbon Ratings serve this purpose, providing an easily understandable assessment of risk which supports decision-making and assists in conveying credit quality to external audiences.

Ratings should be used to bolster credible claims

The Oxford Principles underscore the importance of ensuring credit integrity, requiring them to yield demonstrably additional results, pose a low risk of reversal, and avoid negative impacts on people and the environment.

The updated Principles rightly flag carbon credit ratings as a new market development which provide a means of assessing quality. BeZero Carbon Ratings provide an assessment of the likelihood that a carbon credit truly represents 1 tonne of emissions removed/avoided, summarising all relevant risk factors (including additionality and non-permanence) within a single 8-point scale.

In our White Paper, ‘Making Credible Claims’, we advocate for organisations purchasing carbon credits to leverage ratings in constructing a diversified credit portfolio which balances risk across a range of factors. Recognising that no project is devoid of risk, utilising BeZero ratings aids in mitigating overexposure in any one direction across a portfolio of credits.

Ensuring the avoidance of negative impacts is paramount to credit integrity. BeZero evaluates the potential risk of adverse “beyond carbon” impacts through safeguards, mechanisms aimed at reducing such risks. Safeguards related to carbon efficacy are integrated into our carbon ratings assessments, and we are actively exploring avenues to highlight the safeguards implemented by projects.

Removals will grow in importance, but quality can be found in all segments of the market

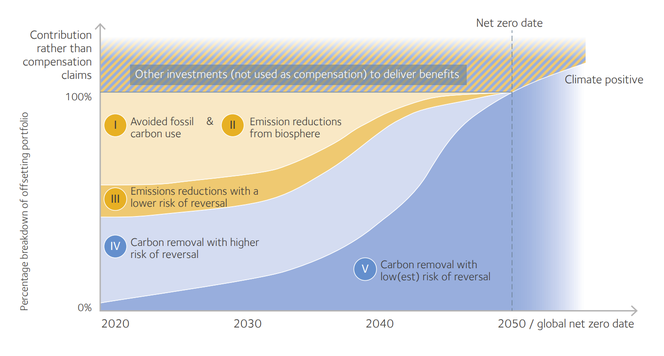

Figure 1. Evolution of an idealised carbon credit offsetting portfolio over time. Source: Revised Oxford Offsetting Principles.

The revised Oxford Principles emphasise the urgency to expedite the development of high-quality carbon removals projects and address the ‘carbon removals gap’. We concur that, in the long-term, credits generated by technologies such as direct air capture may dominate carbon markets. Figure 1 depicts the potential evolution of an offsetting portfolio over time, indicating that even in an idealised scenario, avoided emissions, emissions reductions and shorter-lived carbon removal credits are expected to remain significant components of purchased credits, up to a 20-year time horizon.

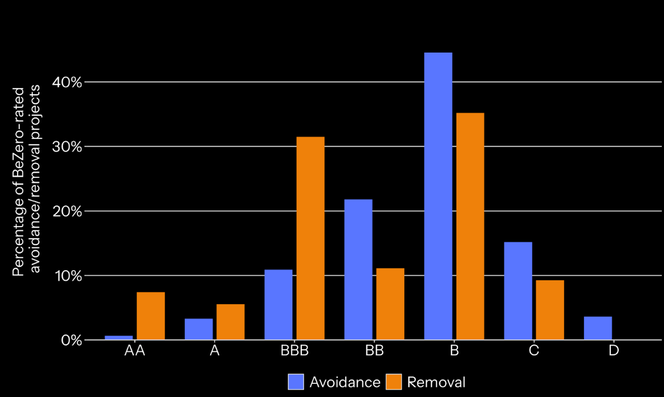

Figure 2. Distribution of BeZero ratings for avoidance and removal projects

To effectively mitigate global warming and strive to limit it to 1.5°C, halving emissions by 2030 is imperative. Incentivising high quality carbon projects across both avoidance and removals through carbon markets offers a scalable solution to boosting financing for climate and nature this decade. BeZero ratings highlight that the relative scarcity of longer-lived carbon removal credits in the medium term does not necessarily imply a lack of high-quality credits.

Figure 2 above illustrates the BeZero rating distribution for avoidance and removal projects, revealing two crucial points. First, around 15% of avoidance projects have been rated BBB or above, indicating a moderate likelihood or better of each credit representing one tonne of carbon avoided. It is therefore clear that there are, and will continue to be, high quality credits available within the avoidance category. Secondly, while the ratings for removal credits are more skewed towards the higher end of the BeZero scale than avoidance, they are distributed across a range of ratings levels and the most common rating is ‘B’ - indicating a low likelihood that each credit represents one tonne of carbon removed. Hence, even as carbon markets move towards removals in the long term, project-level ratings will continue to play a critical role in supporting market participants to identify quality and price risk effectively.

We also appreciate the nuanced approach adopted in the updated Oxford Principles, which refrains from segmenting carbon removals into distinct ‘short-lived’ and ‘long-lived’ categories. Our analysis of carbon markets underscores the misleading nature of such binaries, which can steer market participants towards suboptimal decision-making. Instead, they adopt the language of durability with Principle 3 calling for a ‘shift to removals with durable storage’. We explored durability across nature-based and engineered methods in our BeZero Carbon Durability Assessment. In general, this Principle suggests a shift towards Engineered Carbon Removals given their higher durability. However, there are nuances and variations at the project-level due to site specific conditions and choices, impacting reversal risks. This calls for project specific ratings to ensure the integrity of these credits in the shift towards more durable removals. For more on our project-level assessments for this sector of the market see our Engineered Carbon Removals ratings methodology.

Investors and project developers should prioritise ex ante ratings to support early-stage financing

Oxford Principles 4A and 4B address the early-stage financing of high-quality carbon projects. While market activity is shifting upstream, with roughly USD 4 invested in pre-issuance credits for every USD 1 spent in the ex post market, the updated Principles correctly address the issue of perverse price incentives favouring cheaper but lower quality projects rather over more expensive but higher quality projects.

BeZero’s ex ante ratings offer a solution to mitigate risks associated with early stage financing. Our recent report ‘Towards efficiency’ demonstrates that credits with higher BeZero ratings command a significant price premium. By obtaining an independent ex ante rating before issuance, developers can differentiate their projects based on quality, attracting investment due to the higher returns generated when selling credits. For investors considering long-term offtake agreements, ex ante ratings provide a risk assessment of projects, facilitating investment decisions.

Regulation should promote transparency in claims made using carbon credits

The updated Principles advocate for transparency in green claims made using carbon credits and call for regulation of the voluntary carbon market to address integrity issues. In line with our recent blog, ‘Demand-side regulation: understanding disclosures and green claims’, we support increasing regulatory efforts worldwide to ensure that green claims supported by carbon credits are well-evidenced and transparent. Regulators should consider mandating organisations to disclose carbon credit ratings as part of transparency duties to uphold the integrity of purchased credits.

Conclusion

The Oxford Offsetting Principles offer a robust strategic framework for organisations incorporating or planning to include carbon credit purchasing in their decarbonisation plans. The updated Principles, published yesterday, introduce nuances in key areas, and explicitly acknowledge the role of carbon ratings agencies for the first time. When implementing these Principles, organisations should consider BeZero Carbon Ratings as a tool to mitigate early-stage financing risks, build a diversified credit portfolio and make credible claims using carbon credits.