How ratings help unpack risk in carbon portfolios

From nature-based to tech-based solutions, carbon projects are wildly diverse; companies need simple tools to find and compare their climate impacts.

Carbon ratings put projects of all types on a level playing field by distilling quality into a simple and comparable metric.

Unpacking project-level risk empowers sustainability leaders to invest in diversified carbon portfolios that match their corporate values and mitigate risks accordingly

Contents

- Setting a level playing field

- Quality is not uniform

- Life-changing investments

- How ratings can supercharge your carbon portfolio

Which of the two carbon projects below is most likely to deliver on its promises?

When you compare a thriving forest and a massive landfill side by side, it may be tempting to turn to the trees for their well-known climate benefits. But project quality is in the eye of the beholder, and unpacking the drivers of carbon quality, as well as the ‘beyond carbon’ benefits of each, is the only way to get a holistic view. Whether the environmental impact of flaring harmful methane in the landfill or the conservation of a biodiverse forest ecosystem, different companies may value some outcomes over others.

Greenhouse gas emissions are the same everywhere in the world, but no two projects are the same. The simple comparison above shows that knowing where to focus climate efforts isn’t always obvious. With thousands of projects out there, how can companies know which ones to invest in?

That’s where carbon ratings come in. Not only do they help sustainability leaders home in on high-quality projects, but they also help uncover risk. Understanding both macro and project-specific risks gives invaluable insight into how best to spread these risks at the portfolio level.

Setting a level playing field

It is crucial to have robust tools to assess and compare carbon projects. The landscape of projects is wildly diverse; how do you go about comparing a reforestation project in Kenya with an improved cookstove programme in Mongolia?

By distilling carbon efficacy into a single quality metric, carbon ratings put projects of all types on a level playing field. Whether you’re interested in nature-based or tech-based solutions, avoidance or removal projects, mangroves or biochar, ratings make carbon projects directly comparable and lift the veil on what you’re buying when you invest in the carbon market.

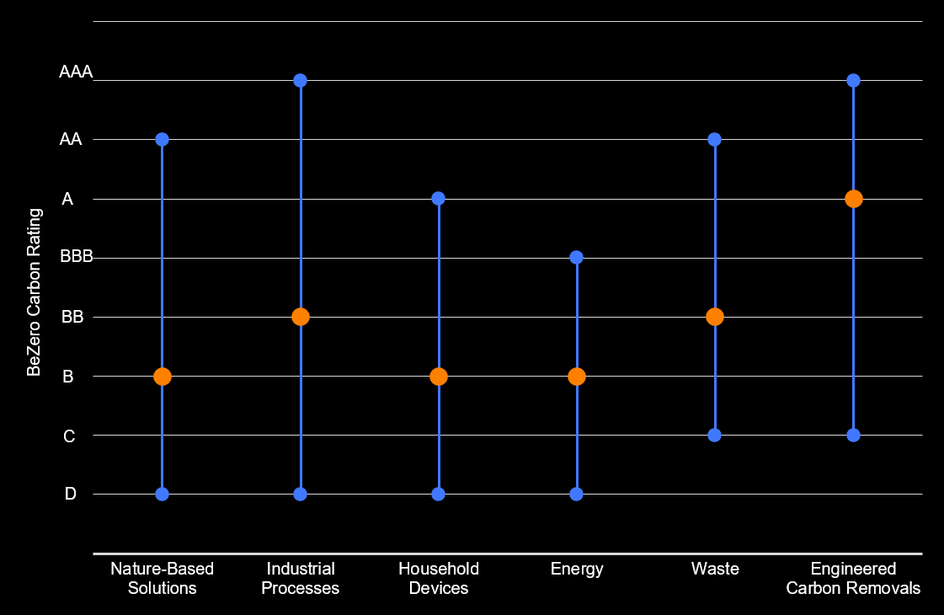

As the chart below shows, carbon quality varies not only between sectors but also within them. Nature-based solutions projects, for instance, show wide dispersion, with BeZero Carbon Ratings ranging from ‘AA’ – representing a very high likelihood of achieving the promised climate benefits – down to ‘D’, the lowest likelihood.

Overview of BeZero Carbon Ratings across the six sector groups in BeZero’s sector classification system. Risk analysis data for 603 project listings as of 04 September 2025.

A deeper dive into the data behind this chart unveils the unique considerations inherent to different sectors.

Take projects in the Forestry sector, for instance. BeZero’s analysis finds high over-crediting risk in more than 70% of rated Forestry projects, meaning the large majority may be overstating the amount of emission reductions claimed. This is partly driven by the difficulty of estimating future deforestation rates, which are counterfactual baseline scenarios that cannot be directly measured. Knowing where these risks are at the project level helps you make better decisions about your investments.

In the Waste sector on the other hand, BeZero’s analysis finds that over 80% of rated projects have low over-crediting risk.1 Waste projects benefit from more accurate carbon accounting, meaning baseline estimates are generally more dependable.

The list goes on. Forestry projects tend to face greater permanence risk than landfill gas projects – loggers and wildfires can damage trees, but there’s no way to reverse a methane flare. Renewable energy projects see variations not only in technology but also in policy and market context – a wind project in Vietnam may present different risks compared to a hydro project in the same region.

The details matter. By understanding these nuances, credit buyers can tailor their carbon portfolios to align with their corporate values and balance sources of risk.

Quality is not uniform

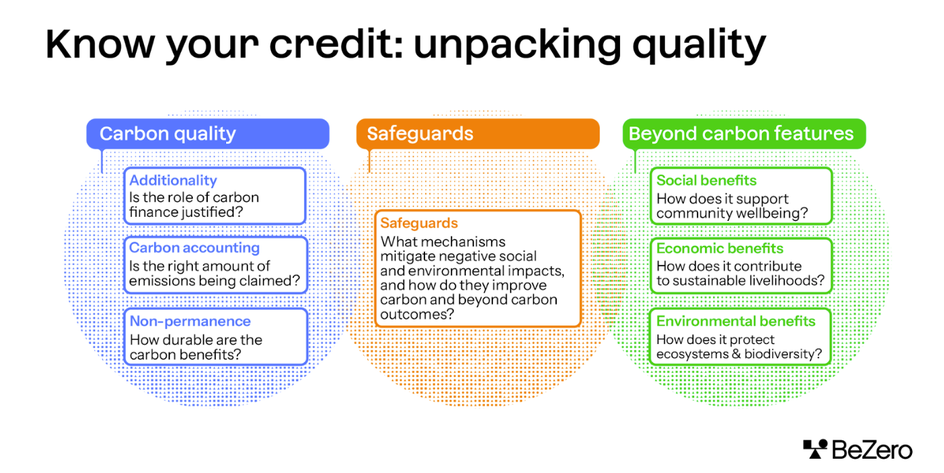

Quality is not uniform - different companies may prioritise different aspects of a carbon credit, whether it’s the social impact of an afforestation project or the permanence of an engineered carbon removal technology. When trying to effectively channel finance into various impact areas, it helps to unpack all the benefits of the individual climate projects in your portfolio.

These can be split into three broad categories:

Carbon quality, which looks into carbon risk factors such as additionality and carbon accounting.

Beyond carbon features, which include social, economic, and environmental benefits.

Safeguards, or mechanisms to mitigate negative social and environmental impacts. These may impact carbon quality and beyond carbon benefits.

Life-changing investments

Carbon ratings focus primarily on carbon efficacy because a tonne of carbon benefit should remain a tonne regardless of location, sector, or the method used to achieve it. As the sole common metric that can be compared across all project types, evaluating credits’ carbon efficacy makes it easier to distinguish between high- and low-quality credits. Easier decision-making means more confidence that your money is flowing into impactful projects that deliver real climate action.

This does not however make carbon efficacy the be-all and end-all of credit quality. Social and economic benefits linked to carbon projects matter, too. Take improved cookstove projects for instance - while many face risks due to assumptions used in credit issuance calculations, these projects typically come with numerous ‘beyond carbon’ benefits.

Worldwide, 2.3 billion people (many of them in Africa) rely on open fires or basic stoves for cooking, exposing themselves to harmful pollution. This pollution claims the lives of 3.2 million people annually 2 and contributes significantly to climate emissions, comparable to those from the aviation industry. Carbon markets offer a solution by providing incentives for projects that replace harmful stoves with cleaner alternatives, awarding carbon credits based on the CO2e emissions avoided.

Distribution of improved cookstoves, particularly in rural populations, has benefits linked to:

Climate, by decreasing harmful pollution from burning coal, charcoal, firewood, crop waste, and animal dung.

Health, via improved indoor air quality and reduced respiratory diseases, with the potential to 463,000 lives and $66 billion in health costs annually in sub-Saharan Africa alone.3

Economic empowerment, through employment opportunities and safety for vulnerable populations.

Gender equality, by reducing time collecting cooking fuel for women and girls, and consequently increasing access to tuition, employment and leisure.

Nature, through prevention of deforestation for firewood collection.

While improved cookstoves often come with concerns on their carbon efficacy, many credit buyers in the past chose to overlook these risks given their potential to address pressing social, economic and environmental challenges. With the advent of ratings, we now have pragmatic, proven solutions to find projects that offer these beyond carbon benefits while also delivering on their carbon promise. And these solutions need investment so they can be scaled rapidly while acknowledging and addressing imperfections. With 2.3 billion lives at stake, it’s essential to prioritise action over perfection.

How ratings can supercharge your carbon portfolio

Companies face competing forces when building robust carbon portfolios. A sustainability leader usually has to:

Find high-quality credits that are likely to deliver on their carbon promises

Choose credits with a charismatic story driven by impactful ‘beyond carbon’ benefits

Minimise costs without compromising on the above

Carbon ratings are well suited to respond to these challenges. They make projects comparable through a single carbon efficacy metric, facilitating the search for quality. They also offer an independent way to verify that credits are fairly priced. And by unpacking the drivers of quality, be they carbon or beyond, ratings empower credit buyers with all the information they need to effectively spread risks across a well-balanced portfolio.

Using ratings to help diversify risks linked to the location, sector, methodology, developer, or even a credit’s individual risk factors such as additionality or over-crediting, means your company’s credit retirements can align with its sustainability preferences without compromising on the quality of the credits’ climate benefits. This also makes the claims linked to your carbon credit strategy credible and defensible, given the independent nature of carbon ratings.

Ultimately, carbon ratings facilitate better climate action. Knowing your approach to credit selection and carbon portfolio construction has been informed by third-party ratings is a great way to defend and take pride in your net zero strategy.

If you haven’t been considering carbon ratings until now, it’s not too late to get started. Your journey starts on BeZero’s listings page, where you can find public ratings for more than 600 carbon projects across all sectors of the market and across the globe. And if your climate advisors and credit brokers aren’t already making use of carbon ratings, now would be a great time to ask them why!

In the next article in our carbon credit explainer series, discover why project-level carbon ratings complement market labels such as the ICVCM Core Carbon Principles. Read more here.

References

The BeZero Carbon Market risk report, January 2024.

World Health Organization, December 2023: Household air pollution

Duke Global Health Institute, February 2023: Study: Most Households in Africa Would Benefit By Upgrading Their Stoves