Welcoming the first announcements on CCPs

Here are some key takeaways

As a member of the Categories Working Group, BeZero welcomes the list of first approvals being announced for internal review.

Close to 40% of the Integrity Council for Voluntary Carbon Markets (ICVCM) first approvals list received a high BeZero rating with projects being rated ‘A’ or ‘BBB’.

Only 20% of projects within categories marked for deeper assessment received a high BeZero rating.

The ratings distribution for the multi-stakeholder working groups aligns with the overall ratings distribution.

Project-level ratings provide a comprehensive picture of risk distribution within CCP approved methodologies and complement the ICVCM assessment.

Introduction

Yesterday, the ICVCM released its first updates on which categories within the voluntary carbon market have been identified for its internal review process of Core Carbon Principle (CCP) eligibility. According to the ICVCM, credits from these categories represent 8% of the voluntary carbon market.

The ICVCM has further identified other project categories making up 47% of the market that will require deeper analyses through external experts involved in multi-stakeholder working groups.

Here, we discuss how these categories align with BeZero ratings, and the collaborative approach by which ratings and market entities operate as we expect the first assigned labels in March.

What is in the internal assessments list?

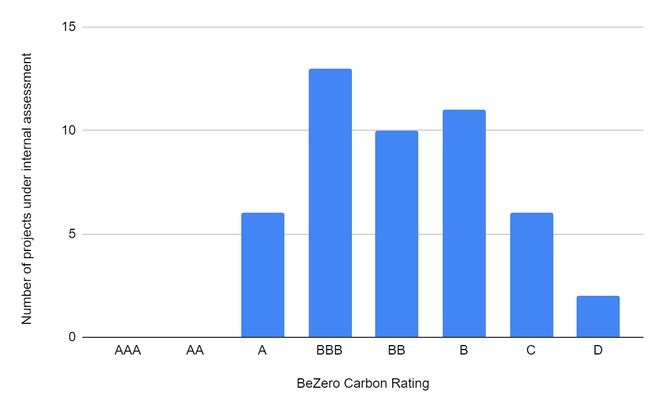

The categories identified for internal review by the ICVCM map onto seven sub-sectors within the BeZero Carbon Sector Classification system, which have 48 projects currently rated (Chart 1). Close to 40% of projects rated within the ICVCM internal assessments list received high BeZero ratings. More than 12% are ‘A’ rated and 27% received a ‘BBB’ rating.

Chart 1. Ratings distribution for the internal assessments list. Ratings represent BeZero’s assessment of the likelihood of a carbon credit achieving a tonne of CO₂e avoided or removed, with AAA highest and D lowest.

What requires more detailed analysis?

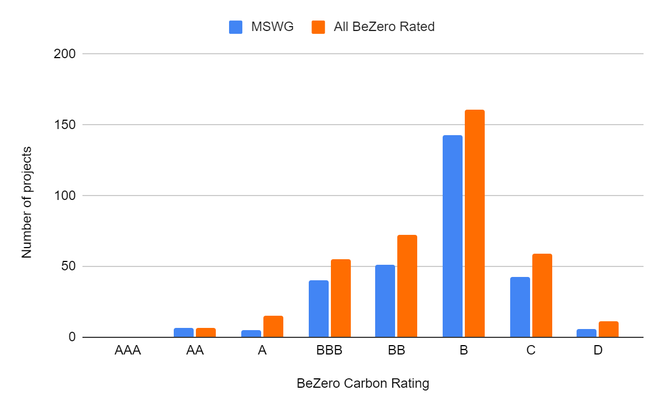

The ICVCM has also identified 19 categories that will require a panel of external experts to review whether these can be assigned CCP labels. Together, these categories represent 47% of credits in the market, according to the ICVCM. These categories map directly onto 12 sub-sectors within the BeZero Carbon Sector Classification system, and represent 282 rated projects. This number could increase to 295 rated projects with the inclusion of mangrove, peatland and grassland projects that can involve Afforestation, Reforestation & Restoration and/or Avoided Deforestation activities (Chart 2).

The categories planned for multi-stakeholder working groups encompass a spectrum of ratings and credit qualities. Ratings for projects that have been marked for deeper assessment are concentrated in the middle section of the ratings scale. Close to 80% of BeZero ratings for MSWG projects are rated between a ‘B’ and a ‘BBB’ showing that deeper analysis by the ICVCM is merited.

Chart 2. Ratings distribution for the deeper assessment working group compared to overall ratings distribution.

The rating distribution for categories planned for multi-stakeholder working groups are well aligned with the ICVCM assessment on the complexities of credit quality within these categories. We also note that the rating distribution for these categories closely matches the distribution of all BeZero rated projects (in orange, above) and highlight an overarching requirement for project-level analysis (Chart 2).

Conclusions

Project-level ratings provide a comprehensive picture of risk distribution within CCP approved methodologies and complement the ICVCM assessment.

BeZero welcomes efforts to establish clear and transparent guidelines for market participants and believes greater disclosure will support market growth. BeZero ratings incorporate all material considerations relevant to carbon credit quality. Highly rated projects have been shown to deliver a price premium in the carbon market.

It is essential to recognize that both groups of categories, either tagged for internal or external review by the ICVCM, have a diverse range of credit qualities, evident by the dispersion of ratings within these classifications. Notably, BeZero's ratings tend to be more conservative than other ratings and quality assessments, providing a meticulous and cautious evaluation of project-specific risks.

Through consultations and working groups, BeZero works together with market entities such as the ICVCM, as well as with standards bodies who also use our markets platform, to facilitate methodology development and continually evolving frameworks for assessing the integrity and quality of carbon offset projects.

Note: BeZero contributed insights from its ratings database to the assessment process and was represented on the ICVCM’s Categories Working Group.