Understanding the SEC’s climate disclosure rules

Here are some key takeaways

The SEC’s climate disclosure rules, finalised last week, require SEC-registered companies to disclose climate-related information in financial statements for the first time, including disclosure of Scope 1 and Scope 2 emissions, any climate targets, and any carbon credit use that is material to achieving targets.

This regulation should encourage more corporates to include climate-related assets & liabilities ‘on balance sheet’ and hence incentivise more concerted effort to deliver decarbonisation and tackle residual emissions through carbon credits.

Governments should seek to align disclosure regulation across jurisdictions as far as possible, supported by the work of the International Sustainability Standards Board (ISSB).

Ratings should be used as part of disclosure requirements under the SEC, to substantiate the quality of claims and produce risk-adjusted estimates of the emissions impact of carbon credits.

Contents

- The SEC’s rules require information about carbon credits used to meet climate targets to be disclosed

- Disclosure will incentivise more companies to put a price on their emissions and go further on climate action

- Regulatory alignment is needed to ease the burden on businesses and aid international comparisons

- Ratings should be used as a tool in disclosure to substantiate the quality of offsets

- Concluding remarks

The SEC’s rules require information about carbon credits used to meet climate targets to be disclosed

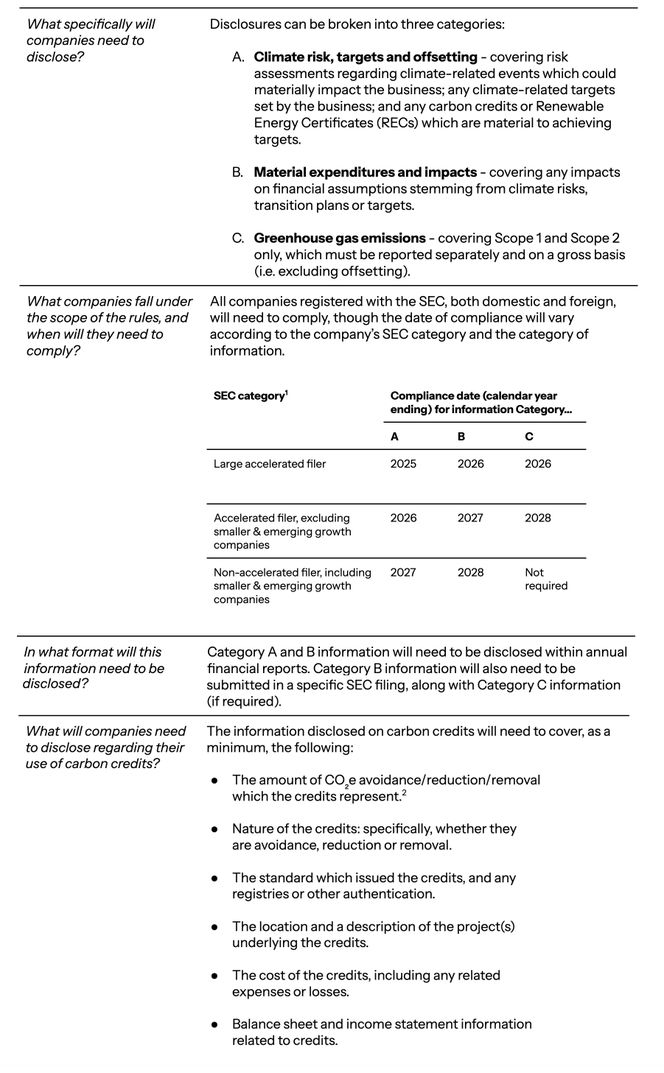

Last week, the US Securities and Exchange Commission (SEC) issued final rules that will require companies to include climate-related disclosures, including the use of carbon credits, in annual financial reports and other filings. Although it represents a scaled-back version of the initial proposal, most notably in excluding Scope 3 emissions, this remains a landmark ruling which will for the first time mandate many of the world’s largest businesses to disclose their emissions and use of carbon credits. Table 1 below sets out answers to FAQs regarding the rules.

Table 1. SEC climate disclosure rules FAQs

One key element of the rules that remains open to interpretation is the definition of ‘materiality’. With regard to carbon credits specifically, companies may choose a ‘maximum transparency’ approach of disclosing all carbon credits retired within a given reporting period or may take the more nuanced approach of only disclosing credits which they deem to be material to a specific climate-related goal. This will remain unclear until we see the first wave of disclosures under the rules.

Disclosure will incentivise more companies to put a price on their emissions and go further on climate action

The SEC rules mark a step-change in requiring climate risk assessments, climate-related targets, and the use of offsets to be integrated into standard financial reporting for the first time in the US. This means that climate-related considerations will receive more attention from boardrooms and investors, and be held to a higher standard of auditing.

Ultimately, the nudge provided by these rules could encourage more companies to go a step further and include climate-related assets and liabilities ‘on balance sheet’, putting an internal price on the negative external impact of their emissions. This in turn will help incentivise companies to go further and faster on climate action, delivering decarbonisation within their value chains and tackling residual emissions through carbon credits. Recent research by Ecosystem Marketplace’s Forest Trends indicates that companies which purchase carbon credits are reducing their emissions more rapidly than their peers: for example, they are investing three times more in emissions reductions within their own value chains.

Regulatory alignment is needed to ease the burden on businesses and aid international comparisons

In recent months, we have seen a slew of climate disclosure regulations being announced. This includes the EU’s Corporate Sustainability Reporting Directive (CSRD) and Green Claims Directive, and California’s Voluntary Carbon Market Disclosure Act (VCMDA) AB1305, all of which featured in our recent blog ‘Demand-side regulation: understanding disclosures and green claims’. In parallel, several organisations have published voluntary guidance related to corporate climate disclosure, including the SBTi’s Beyond Value Chain Mitigation guidance and the Oxford Offsetting Principles.

Many of the recently announced pieces of climate disclosure regulation have been influenced by International Sustainability Standards Board (ISSB) standards 1 & 2, released in June 2023. As various jurisdictions move into implementation of their climate disclosure regulations, we would encourage regulators to adopt guidance based on the ISSB to ensure reporting and accounting standards are aligned as far as possible. This will ease the administrative burden on businesses and ensure that valid comparisons can be made between disclosures in different jurisdictions, aiding transparency.

Ratings should be used as a tool in disclosure to substantiate the quality of offsets

The SEC rules rightly require that, where carbon credits are material to achieving a climate target, project-level information regarding the nature and source of credits should be disclosed. Disclosing credit use will provide an incentive for companies to scrutinise the quality of the credits they purchase. BeZero analysis consistently shows that there is a wide spectrum of quality within projects from specific countries, sectors and methodologies. Ratings thus provide a means of substantiating offsetting claims made using credits, providing a measure of quality and credibility.

Furthermore, the SEC rules require that companies report on the amount of CO2e that credits used as part of their climate strategies represent. BeZero’s White Paper ‘Making Credible Claims’ provides a framework for calculating the CO2e equivalent of a given portfolio of credits by using risk-adjustment factors related to BeZero’s 8-point rating scale. We would encourage companies to consider this approach in their disclosure reporting, rather than taking the simplistic approach of assuming that one credit is equivalent to one tonne which does not account for the project-level risk inherent in carbon credits.

Concluding remarks

We welcome the growing wave of climate-related disclosure regulation being implemented across the world. As the world’s largest economy, and home to many of the world’s largest and most influential companies, the US has a truly vital role to play in setting standards for corporate disclosure and demonstrating how this translates into effective climate action. For carbon credits specifically, greater transparency is necessary to drive up quality and unlock market growth, and the SEC rules represent a step in the right direction in this regard.

References:

Large accelerated filers typically have a public float of $700m or more, Accelerated filers typically have a public float of $75 - $700m and non-accelerated filers typically have a public float <$75m.

The SEC defines avoidance, reduction and removal as follows: ‘A carbon avoidance occurs, e.g., when a company protects a forest from deforestation. A carbon reduction occurs when emissions are reduced, e.g., when a company switches from the use of fossil-fuel based energy to the use of wind or solar power. A carbon removal occurs when CO2 is drawn out of the atmosphere and sequestered, e.g., by carbon capture and storage technology.’