How to make credible claims using the BeZero Carbon Rating

Contents

- Introducing risk-adjusted tonnes

- A portfolio theory approach

- What drives risk?

- Complementing the industry

Today, we are pleased to publish a new landmark white paper - Making Credible Claims. It lays out how to use the BeZero Carbon Ratings to build robust portfolios of carbon credits and make effective net zero claims. We call it risk-adjusted tonnes.

BeZero Carbon now provides an end-to-end risk-based toolkit for market participants, a framework for scaling the voluntary carbon market (VCM), and a pathway to accelerating net zero transition.

Introducing risk-adjusted tonnes

A risk-adjusted tonne of CO2e is a new unit of account that can be used to make credible claims when buying and retiring carbon credits.

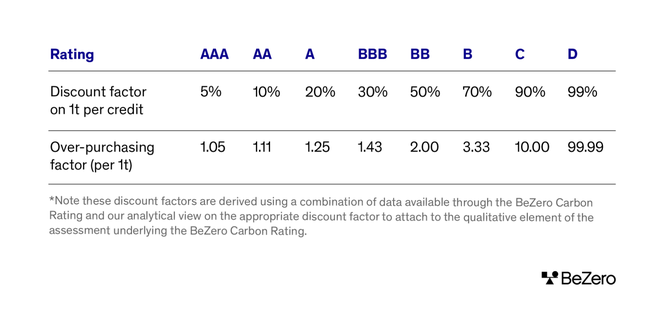

It is based on a discount rate, similar to bond markets, which provides a quantitative indication of how many credits a buyer should purchase and retire in order to make a given tonne-based claim - see Figure 1.

Figure 1: BeZero Carbon Rating discount factor and implied over-purchasing factor (2023)

A portfolio theory approach

In simple terms, the discount factors shown in Figure 1 imply that an organisation seeking to make a net zero claim by purchasing and retiring credits with a AAA-rated credit should over-purchase by a factor of 1.05; 1.43 for BBB-rated credits; 10 for C-rated credits and so on.

However, over-purchasing single credit types is only one part of the equation for calculating risk-adjusted tonnes. Risk is a dynamic concept for carbon projects. New information can change either current or previous assumptions about a credit’s carbon quality.

In order to ensure that a given claim is not overly exposed to changes in a single credit’s risk profile, it is prudent to diversify.

What drives risk?

The risks any given carbon credit can be exposed to range from the micro to the macro. The BeZero Carbon Rating incorporates both, assessing the project-specific risks along with the top down risk factors.

Key macro risk factors include: country, sector, and methodology risks. Simply diversifying within each of these categories when constructing a carbon credit portfolio will alone help reduce the chances of a user being overly exposed to a change in risk.

More sophisticated approaches would include project-specific risks as well.

Complementing the industry

The BeZero Carbon Ratings and our approach to discounting complements the existing carbon market structure. It explicitly provides a risk-based solution for assessing and making retirements based on project-level quality. More specifically:

All projects require accreditation and third party verification to be rated.

Accreditation as a process must lead to the issuance of a whole unit - a market cannot be built on ranges or confidence intervals.

The role of Standards Bodies is to set and continuously improve accrediting methodologies.

Ongoing market initiatives, such as the IC-VCM, are seeking to improve threshold standards at a methodology level via the Core Carbon Principles (CCPs) rather than assess project-level risks.

Demand-side initiatives, such as the VCMI, set out how to make claims based on methodology level frameworks and do not include discounting.

However, variations in project level quality will always exist and require a risk-based approach to account for effectively.

Introducing discount rates to the BeZero Carbon Rating scale enables organisations to calculate how many credits they should purchase in order to make a certain tonne-based claim.

It gives the BeZero Carbon Rating a practical application so that buyers, or intermediaries assisting buyers, now have the ability to make risk-adjusted claims when retiring credits.

For more details on our approach to discounting, email commercial@bezerocarbon.com or watch our webinar replay where our Chief Innovation Officer & Co-Founder Sebastien Cross and guest speaker David Stead from Vertree explained why this new discounting tool is essential for building credible, net zero aligned portfolios.