SBTi’s Beyond Value Chain Mitigation guidance

Here are some key takeaways

SBTi’s updated guidance on beyond value chain mitigation is a positive step towards aligning the demand-side of the market.

It provides corporates with a number of sensible recommendations on developing, maintaining and reporting a credible BVCM strategy, including leveraging ratings.

Ratings have a key role to play in enabling buyers to leverage diverse, multi-year portfolios to develop credible BVCM strategies. They can also be used to substantiate claims in disclosures.

Contents

- SBTi: comprehensive BVCM guidance now available

- Ratings are a vital tool for organisations implementing BVCM

- Concluding remarks

- Annex: BeZero’s recommendations at consultation and how they are addressed by SBTI’s guidance

SBTi: comprehensive BVCM guidance now available

SBTi has seen widespread adoption of its framework for internal decarbonisation in recent years, validating the emission reduction targets of over 4000 companies as of 2023.¹ However meaningful guidance on what a credible strategy for mitigation of emissions beyond a corporate’s own value chain looks like has been lacking to date.

Last week, the SBTi published two reports following a public consultation on Beyond Value Chain Mitigation (BVCM)². BVCM is defined as ‘mitigation action or investments that fall outside a company’s value chain, including activities that avoid or reduce GHG emissions, or remove and store GHGs from the atmosphere.’ ³

The reports provide guidance on the design and implementation of BVCM and look to accelerate corporate adoption of BVCM. However within the Corporate Net-Zero Standard, BVCM is framed as a best practice recommendation, rather than a requirement for validation of net-zero plans. The SBTi does not currently have plans to validate BVCM claims, which remain voluntary.

While this is a much needed step in the right direction, there is further to go in driving net zero alignment of the private sector by ensuring every corporate undertakes mitigation measures beyond their own value chain. The results of the SBTi survey highlighted the role policy, such as tax incentives, could play in unlocking demand for carbon credits. Furthermore it showed the key role both investors and customers can play in motivating corporates to engage in BVCM.

Important progress for the carbon market

The SBTi’s updated guidance should boost confidence in carbon markets by acknowledging the role that high integrity carbon credits can play in driving climate action. The absence of clear criteria for corporates to act beyond their own value chain combined with media attention on those perceived to be purchasing low quality carbon credits has led many corporates to remain wary of engaging in the market recently.

The report, ‘Above and Beyond: An SBTi report on the design and implementation of BVCM’ establishes two goals that the corporate adoption of BVCM should achieve:

Deliver additional near-term mitigation outcomes to achieve the peaking of global emissions in the mid-2020s and the halving of global emissions by 2030.

Drive additional finance into the scale-up of nascent climate solutions and enabling activities to unlock the systemic transformation needed to achieve net-zero by mid-century globally.

Below we highlight some of the key factors for corporates developing a BVCM strategy in line with SBTi recommendations:

Commitment period: the guidance recommends BCVM strategies commit to action over at least five years. This is a better time horizon for corporates to build a strategy over, rather than focusing on year to year changes. Offtake agreements can be a useful tool to both secure future supply and give greater clarity on pricing.

Pledge format: historically buyers have looked to make tonne-based claims using carbon credits. The guidance has broadened the potential format pledges could take to include money-for-ton and money-for-money approaches. While the additional flexibility should broaden the appeal of BVCM to corporates, it is important that the risk inherent in all credits be reflected in how buyers make claims regardless of the metric attached.

Credit vintage: only mitigation outcomes generated from activities from 2021 onwards are recommended for use. This will undoubtedly increase demand for newer vintages and aligns with vintage requirements for emissions reductions units eligible under CORSIA’s first phase. Our research shows that vintage is not necessarily an indicator of quality though so buyers should still be diligent in how they choose credits for their portfolio.⁴

Carbon removals: committing finance to scale carbon dioxide removals technologies is recommended in order for them to fulfil a greater role in neutralising residual emissions over time. This is reinforced by the recently updated Oxford Offsetting Principles which provides corporates with an indicative portfolio and how it can transition over time to be net zero aligned. Providing a long term demand signal for some of these technologies is an important mechanism to enable them to raise the capital required to scale.

Ratings are a vital tool for organisations implementing BVCM

We welcome that the SBTi has recognised the role of carbon credit ratings in their ‘Above and Beyond’ report. Organisations using carbon credits to deliver BVCM can use ratings in two key ways:

Building a diversified portfolio of high quality credits: We have undertaken research which demonstrates how ratings should be used to develop a diverse portfolio of carbon credits. Recognising that no project is devoid of risk, utilising carbon credit ratings aids in mitigating overexposure in any one direction across a portfolio of credits. The BeZero Carbon Markets platform provides our users with the tools to build diversified carbon credit portfolios.

Including ratings in disclosure of credits used to make claims: Project-level ratings should be used to support and substantiate the climate action taken, providing a measure of quality and credibility to claims. This is especially relevant for those seeking to make ton-for-ton pledges where ratings can help users risk-adjust such claims. .

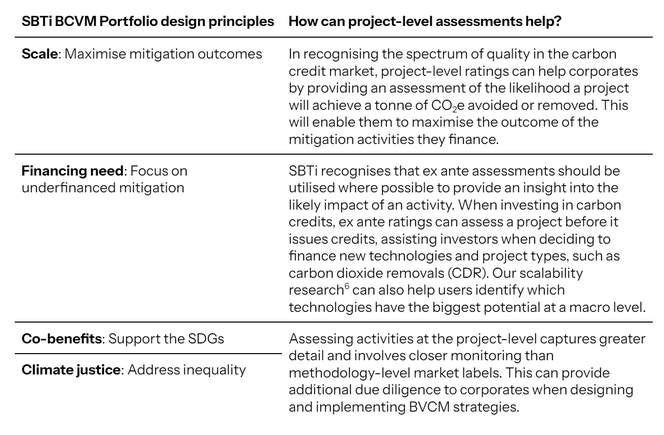

The SBTi encourages companies developing their BVCM portfolio to follow four principles.⁵ Table 1 below demonstrates how project-level ratings can support each of these principles.

Table 1. The SBTi BVCM Portfolio design principles can be implemented using project-level assessment.

Concluding remarks

The SBTi’s Corporate Net-Zero Standard is one of the most widely accepted and used reporting frameworks for corporate climate action plans. The clarity provided by the supplementary reports provides a much needed boost to carbon markets by acknowledging the role carbon credits play in driving corporate climate leadership.

This updated guidance gives corporates the confidence they need to act now in building credible, long term BVCM strategies. Alignment between demand-side integrity initiatives and reporting efforts fosters harmony in the market and improves ease of access for corporates. This has the potential to send a meaningful demand signal to the market and help to unlock the capital needed to scale climate solutions.

Developing a diversified portfolio of high-quality carbon credits using project-level ratings can enable corporates to meet emissions reductions targets while also financing broader co-benefits. While this is a much needed step in the right direction, there is further to go in driving net zero alignment of the private sector by ensuring every corporate undertakes mitigation measures beyond their own value chain.

Annex: BeZero’s recommendations at consultation and how they are addressed by SBTI’s guidance

BeZero Carbon previously responded to the SBTi’s BVCM consultation and wrote an article following the publication of the consultation results, titled ‘How should companies reach Net Zero?’. This included the following recommendations (in bold) and how they were addressed:

Updated guidance for companies should address both short- and long-term emissions targets and treat ongoing emissions as a liability: SBTI’s first BVCM goal addresses near-term climate mitigation, emphasising the need to halve global emissions by 2030. Their view is that companies have a responsibility to undertake BVCM, but it remains voluntary.

SBTi needs to introduce interim targets for carbon removal to support development of the sector and ensure a viable pathway to address residual emissions before 2050: SBTI’s second BVCM goal recognises the need to scale nascent technologies and strongly encourages corporate investment in the sector, but does not set specific interim targets.

SBTi should simplify their guidance and align with other initiatives like VCMI and ICVCM: SBTI’s BVCM guidance aligns with VCMI Claims Code of Practice, corporates can seek to have their claims validated by VCMI as SBTi currently has no plans to validate BVCM.

SBTi should provide more clarity for corporates to develop effective sustainability strategies now: SBTI’s BVCM guidance clarifies their own position and provides broad recommended actions for corporates in how to develop an effective and impactful BVCM strategy.

References:

SBTi (2024) ‘SBTi doubles corporate climate validations in one year as scale up gathers pace’. Available online: https://sciencebasedtargets.org/news/sbti-scale-up-gathers-pace

‘Above and Beyond: An SBTi report on the design and implementation of BVCM’ and ‘Raising the Bar: An SBTi report on accelerating corporate adoption of BVCM’

SBTi (2024), p.22

For example, our research demonstrates that older vintages of avoidance credits received higher ratings than newer credits. Platform users can read more here.

SBTi (2024), p.28

BeZero's Carbon Removal Scalability Assessment: Summary Report