Breaking ground: the future of soil carbon

Here are some key takeaways from the report

The Soil Carbon & Agriculture sector offers a globally significant opportunity for carbon sequestration and storage. However, until now, there has been a relatively limited number of registered projects (less than 30) from this sector within the voluntary carbon market (VCM).

Nevertheless, this sector is currently undergoing significant expansion, with over 350 projects currently under validation or in development in the Grasslands, Peatlands, and Soil-Related Agricultural Practices sub-sectors.

The BeZero Carbon toolkit allows users to assess the risk that a project faces at any point in its lifecycle; an important capability for this sector in light of its rapid development.

Contents

- Introduction

- The voluntary carbon market

- Grasslands

- Peatlands

- Soil-Related Agricultural Practices

- Other Agricultural Practices

- The BeZero Carbon Toolkit

- Conclusion

Introduction

Soils represent a significant risk or opportunity for global efforts to mitigate atmospheric carbon loads, depending on how they are managed. The potential annual flux is approximately 23.8 Gt CO2e, 25% of the total for all nature-based solutions, of which 40% could be achieved through protecting existing soil carbon and 60% through rebuilding depleted stocks.1 Soil carbon comprises 9% of the total mitigation potential for forests, 72% for wetlands, and 47% for agriculture and grasslands.¹

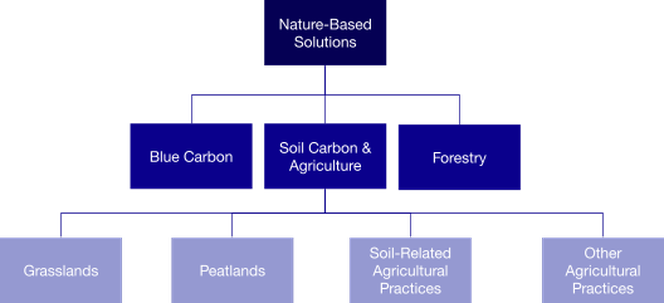

Under the BeZero Carbon Rating framework, projects with primary credit issuance via soil-related activities are encapsulated by the Soil & Agriculture sector, which includes peatlands, grasslands, and agricultural projects (Chart 1). However, soil carbon can also play an integral role in forest ecosystems.

Chart 1. In the BeZero Carbon Rating framework, soil carbon falls within our Soil Carbon & Agriculture sector and consists of four sub-sectors: Grasslands, Peatlands, Soil-Related Agricultural Practices, and Other Agricultural Practices.

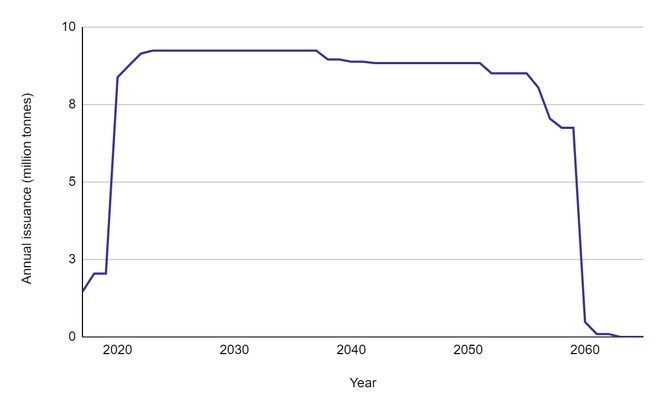

Despite their enormous carbon storage and sequestration potential, soil carbon projects have been relatively slow to establish themselves in the voluntary carbon market. However, there are now clear signs of change, with over 350 projects in development or validation, such as those under Verra's VM0042 and VM0026 methodologies, and the IUCN Peatland Carbon Code. The scale and number of projects currently in development suggests that the Soil Carbon & Agriculture sector has the potential to be one of the largest sectors in the VCM by land area and issuance (Chart 2).

In this article, we explore the state of soil carbon and agriculture projects within the VCM at a sub-sector level. We present some of BeZero’s aggregated datasets on the spatial distribution and status of projects that are registering under the major standards bodies of the VCM, and provide commentary on trends and their likely causes. We also provide a perspective on future developments in this sector.

The voluntary carbon market

While there are still relatively few active soil carbon and agriculture projects in the VCM, with activity concentrated in the Peatlands sub-sector, the sector as a whole is quickly gaining traction. Until recently soil carbon credits have only accounted for a relatively small portion of issuances. However, future credit issuances under the projects that are currently being developed under VM0042 alone could amount to approximately 65 million credits per year, with a planned cumulative issuance of around 2 billion credits between 2017 and 2121.

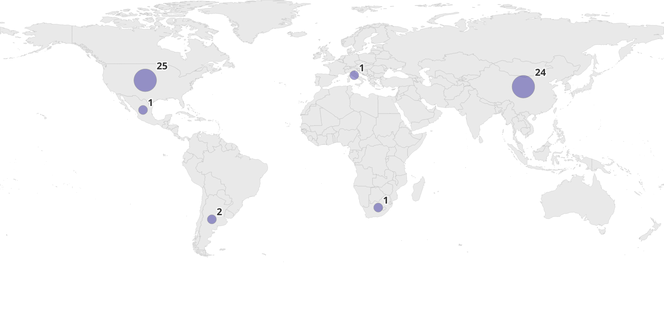

Chart 2. (a) The distribution of projects in the Soil Carbon & Agriculture sector that are currently issuing ex post credits. (b) The potential future distribution of projects in the Soil Carbon & Agriculture sector based on projects that are currently under validation or development. 2,3,4,6,7,8

There are several reasons for the growing interest in the Soil Carbon and Agriculture sector from both the supply and demand sides. Soil carbon sequestration can provide long-term carbon storage solutions; over millennial timescales under favourable conditions. Many of the credits issued by the new projects are highly likely to be eligible for compliance schemes (e.g. CORSIA). Investor interest in projects in this sector is also likely to be stoked by the multiple co-benefits derived, such as improving crop yields, soil health, water quality and biodiversity.

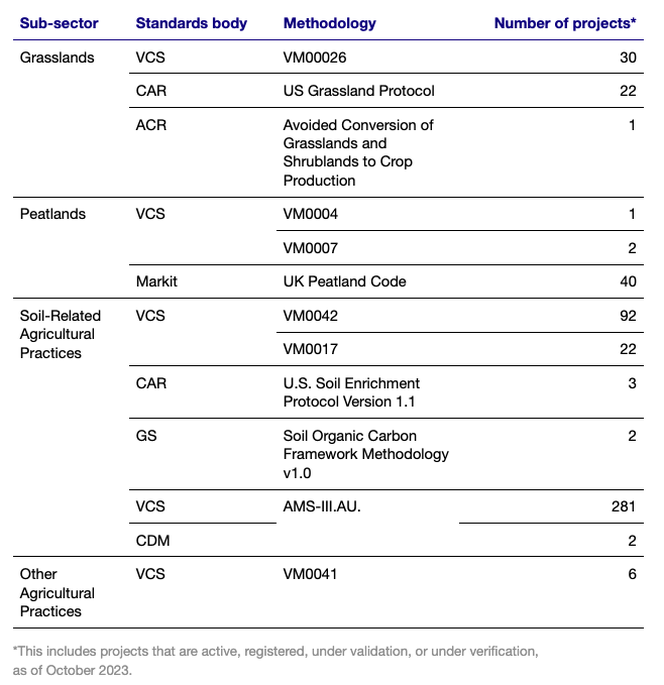

Numerous soil carbon methodologies have been developed in recent years. These methodologies define the methods that can be used to measure and verify soil carbon sequestration. Some of the most common soil carbon protocols are listed in Table 1.

Table 1. A non-exhaustive list of the frequently used methodologies in the Soil Carbon & Agriculture sector

Grasslands

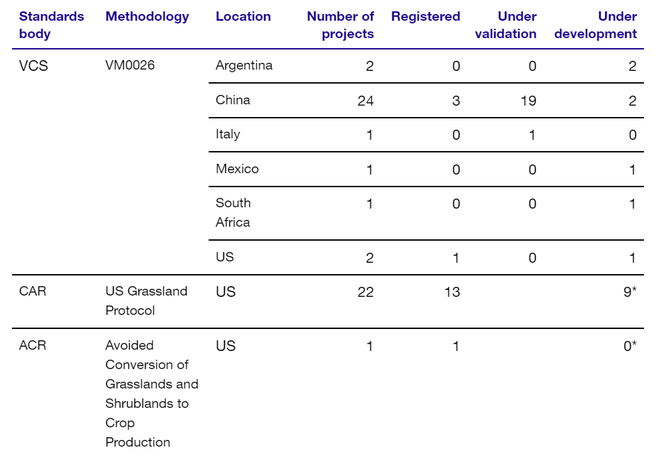

Grassland projects most commonly fall under one of three methodologies: Verra’s VM0026: Methodology for Sustainable Grassland Management, the Climate Action Reserve’s US Grassland Protocol, and the American Carbon Registry’s Avoided Conversion of Grasslands and Shrublands to Crop production (Table 2).

Currently, the Climate Action Reserve’s US Grassland Protocol hosts the most registered projects at 72% of the market’s current active grassland projects, resulting in 278,365 credits being issued (as of 10/2023). Under this protocol, the main aim of these projects is to avoid the conversion of grassland ecosystems to cropland, overcoming barriers typically related to the high opportunity costs.

With the Climate Action Reserve only operating in the US, the development of projects under it has probably contributed to the US being the primary country with active grassland projects in the VCM. However, ongoing project developments outside the US suggest that this could change in the future.

Table 2. The total number of grassland projects that are registered, under validation, under development, or listed within the Grasslands sub-sector.2,3,4 Under CAR and ACR, non-registered projects are listed, however, we are unable to determine the status of these projects. This is highlighted by an (*).

Verra’s VM0026: Methodology for Sustainable Grassland Management has more grassland projects in development or under validation than any other soil carbon methodology (chart 3). Notably, many of these are in China, with 21 projects under development or validation, placing China at the forefront of project development in the Grasslands sub-sector (chart 4). Grasslands cover over 40% of China's land area and have historically been subject to degradation, with overgrazing being the foremost cause. Grasslands are strategically important in China, supporting a population of over 20 million people and playing a critical role in food security for the whole country.5 Some grassland projects in China could therefore be driven by motives other than carbon benefits, raising additionality risk. Indeed, grassland policy in China is strongly supportive of anti-desertification practices, grassland protection, and grassland restoration, raising further additionality and policy risk in the context of project ratings.

Chart 3. Total annual issuance for all projects currently planned under VM0026.2

If all 35 projects that are currently under validation and development gain certification, 45% would be within China, an increase from the current 17% market share. These China-based projects have the potential to generate a total of 283,387,520 credits. For comparison, 47% will be in the US compared to 72% currently. This highlights the significance of China in the emerging Grasslands sub-sector of the VCM, together with the importance of the risk factor rating in assessing project outcomes.

Chart 4. The number of grassland projects that are currently registered, under validation, or under development.2,3,4

Peatlands

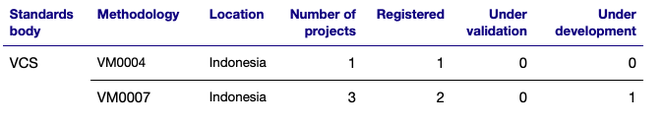

Although currently small in number, peatland projects are among the largest projects in the VCM by credit issuance. Until recently, the focus has been on avoided peatland conversion projects under Verra’s VM0004 and VM0007 methodologies in Indonesia, with only three projects currently issuing credits (table 3). Nevertheless, these three projects have contributed over 74 million credits to the VCM (2009 to 2020) and over their lifetime are expected to contribute over 639 million credits, based on estimated credit issuance. Moreover, in our opinion all of these projects provide a high or very high likelihood of achieving their carbon promises. However, with these projects starting in 2008, 2010, and 2016 respectively, and given that there is currently only one other peatland project of this type in the registration process, these highly rated, high-issuing projects are entering the market relatively infrequently.

Table 3. The total number of tropical peatland projects that are registered, under validation, or under development in the VCM.3

With the VCM currently focusing on Indonesia-based peatlands and avoided planned deforestation projects, peatland projects have remained relatively limited in scope within the VCM despite other relevant methodologies existing, such as Verra’s VM0036: Rewetting Drained Temperate Peatlands. However, peatlands are globally distributed and many areas of non-tropical peatlands are in a degraded state. This offers a potential avenue for VCM expansion into both non-tropical peatlands and peatland restoration projects. With the development of new standards bodies in this space, a major expansion in non-tropical peatlands projects is a distinct possibility.

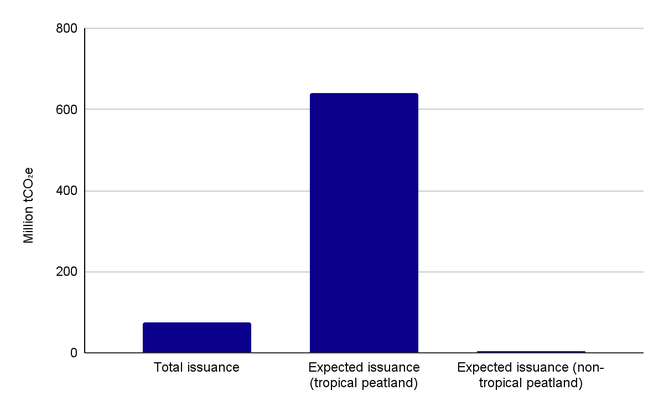

The VCM is starting to expand into these areas through the development of new standards bodies such as the IUCN Peatland Carbon Code and the Peatland Protocol, both of which are currently focused on peatland restoration in non-tropical regions, notably in the UK. For example, currently the IUCN Peatland Carbon Code has 215 registered projects (50 validated, and 165 under development as of 10/2023). However, the code focuses on selling credits ex ante and with no projects currently verified, no ex post credits are available on the market. Nevertheless, with the verification of the first project expected soon, non-tropical peatland credits will soon enter the VCM (chart 5).

Chart 5. Total issuance and the expected cumulative issuance of tropical and non-tropical peats.2, 6 Whilst the non-tropical peats are set for expansion in the number of projects, projected issuance suggests that the four tropical peatlands are likely to persist as the primary source of issued credits within this sub-sector.

Soil-Related Agricultural Practices

Several types of projects fall within this sub-sector, including regenerative agriculture projects and irrigation projects such as adjusted water management in rice cultivation. Regenerative agriculture is arguably experiencing the greatest development currently in the VCM, based on the number of projects in development relative to those registered. These projects protect and increase soil organic carbon through changes in land management practices. Despite a limited number of registered projects with ex post credits, a large number of projects are in development or under validation around the world, suggesting significant future growth in this sub-sector.

In general, the development of these projects is clustered around a single methodology: Verras’s VM0042. In addition, there are several other projects that are being set up under new standards bodies, which do not currently disclose methodologies publicly.

There are currently only six registered regenerative agriculture projects, but a further 113 projects are under development, validation, verification, or listed status, demonstrating the scale of expansion expected to occur in this sub-sector (chart 6).2,3,7

Chart 6. A map of the number of regenerative agriculture projects that are registered, under development, or under validation.2,3,7

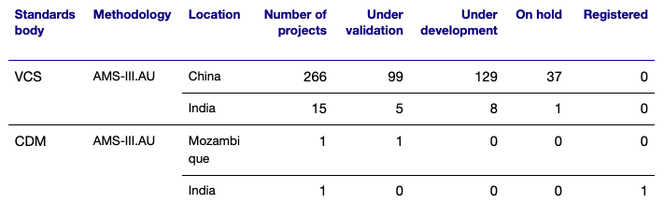

In addition to regenerative agriculture projects, other irrigation-based projects, such as adjusted water management in rice cultivation, also fall within this sub-sector. Extensive recent development of rice irrigation projects has taken place (table 4). Concerns over additionality, over-crediting, and policy risk are widespread, with one adjusted water management in rice cultivation project being assigned BeZero’s lowest rating. The majority of these projects use the methodology AMS-III.AU: Methane emission reduction by adjusted water management practice in rice cultivation operated in China.

Table 4. The total number of projects that are registered, on hold, under validation, under development, or that use the methodology AMS-III.AU: Methane emission reduction by adjusted water management practice in rice cultivation.2, 8

Other Agricultural Practices

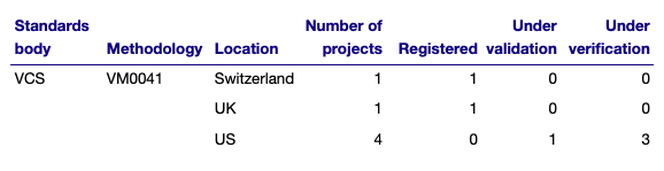

The Other Agricultural Practices sub-sector encompasses projects that instigate changes in agricultural practices where the primary source of avoided emissions are not related to soil carbon (excluding agricultural methane recovery and animal waste management). Thus far this sub-sector consists primarily of projects seeking to reduce methane from enteric fermentation. However, projects that are registered under more general regenerative agriculture methodologies such as VM0042 may also produce credits in this sector through improved management of inputs such as fertilisers, and the introduction of nitrogen-fixing crop species. A limited number of projects exist within this sub-sector, with the majority registered under VM0041: Methodology for the Reduction of Enteric Methane Emissions from Ruminants through the Use of Feed Ingredients. All of the projects within this sub-sector are located in Europe and the US (table 5).

Table 5. The total number of projects that are registered, under validation, or under development operating under VM0041.3

The BeZero Carbon Toolkit

With the Soil Carbon & Agriculture sector likely to expand rapidly over the coming years, currently much of the development is occurring in the pre-issuance space. BeZero Carbon recently released a suite of tools to assess risk in pre-issuance credits. These tools include the ex ante ratings and our recently launched self-serve scorecard tool. These innovations provide the VCM with a fungible assessment of the risk associated with projects in any sector, and at any stage of their lifecycle.

With the Soil Carbon & Agriculture sector likely to expand rapidly over the coming years, the combination of multiple tools to help VCM stakeholders to understand project risk, especially in the pre-issuance space, is essential for increasing market transparency.

Conclusion

The Soil Carbon & Agriculture sector looks set to break new ground, with three of its four sub-sectors poised for a large expansion in the coming years. China-based projects appear to be one of the key new regions of development in the sector as the country hosts 68 projects in development within the Grasslands and Soil-Related Agricultural Practices sub-sectors. Meanwhile, the Peatlands sub-sector looks to be dominated by projects in the non-tropics, with over 200 projects in development in the UK alone. Overall, the large number of projects currently under validation or development looks set to change the status quo of the Soil Carbon & Agriculture sector and shift from the current dominance by large-scale peatland projects that avoid land conversion to a more diverse market offering.

Credit quality is central to the transparency and effectiveness of the voluntary carbon market. BeZero’s combination of ex ante and ex post ratings, together with innovative toolkits such as the Scorecard risk assessment tool, enable the veracity of carbon claims to be assessed at any stage of the process, from project development through to credit issuance. With the anticipated shift in the market towards ex ante credit transactions via large-scale projects, the ability to assess early signs of quality is increasingly important.

References:

¹ Bossio, D.A., Cook-Patton, S.C., Ellis, P.W. et al. The role of soil carbon in natural climate solutions. Nat Sustain 3, 391–398 (2020).

² Verra (VCS)

³ Climate Action Reserve (CAR)

⁴ American Carbon Registry (ACR)

⁵ Linghao, L., Xiaoping, X., Huajun, T. et al. China’s meadow grasslands: challenges and opportunities. Plant Soil 473, 1–8 (2022).

⁶ IUCN peatland Carbon Code

⁷ Gold Standard

⁸ UNFCCC Clean development mechanism (CDM)