Carbon Credit Quality Assessors: A CCQI Comparison

Here are some key takeaways

The CCQI Tool is a valuable insight into broad carbon credit quality, but covers just 35% of the market and lacks project specific insight.

Project-specific ratings provide value to the market by highlighting project-specific variations in carbon credit quality.

Top-down versus holistic ratings can produce mismatched views on quality, a potential impediment to market transparency and scalability.

Contents

Background

The Carbon Credit Quality Initiative (CCQI) launched its carbon credit scoring tool in May 2022 1, joining ratings agencies in the effort to assess the quality of credits on the voluntary carbon market (VCM). Earlier this year, the CCQI updated its scoring tool to include more sub-sectors.

This article will explore the similarities and differences between the CCQI Tool and the BeZero Carbon Rating, to help market participants understand the best uses of each tool.

There are clear differences between frameworks

The BeZero Carbon Rating (BCR) is an eight-point scale and reflects our current opinion on the likelihood that a carbon credit achieves the avoidance or removal of a tonne of carbon dioxide equivalent (CO2e). In comparison, the CCQI examines seven quality objectives across five score categories, and assigns a likelihood that a credit will meet each of the objectives.

There are two immediate distinctions between the two assessments. Firstly, the BCR produces a headline rating that incorporates our assessments of six risk factors for each project, whereas the CCQI produces seven individual scores. Secondly, the BCR assigns ratings on a project-specific basis whilst the CCQI broadly assigns scores based on different components of a carbon credit, e.g. the choice of project activity and Standards Body. We find that the choice of Standards Body is usually not directly related to credit quality. This is because projects can be transferred among Standards Bodies and may retain the original methodologies, or apply a methodology different from the Standards Body in the first instance. For example, a project registered with the Verified Carbon Standard (VCS) may apply a Clean Development Mechanism (CDM) methodology.

Comparing frameworks

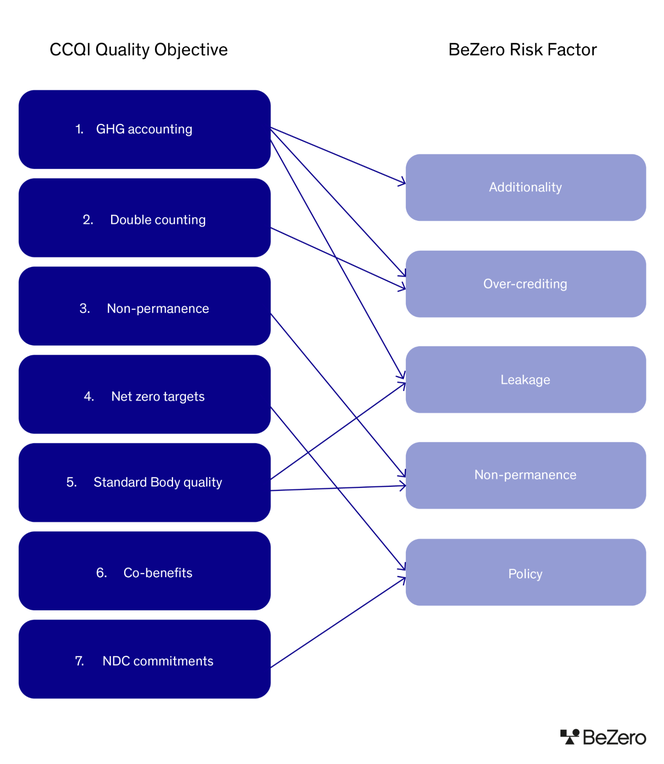

The visual representation of the BeZero and CCQI methodologies (Figure 1) demonstrates areas of overlap and divergences. For example, the CCQI’s greenhouse gas (GHG) accounting objective contains elements that BeZero Carbon assesses in our Additionality, Over-crediting and Leakage risk factors. As the BCR solely reflects a project's carbon efficacy, co-benefits such as positive biodiversity impacts and job creation are not considered in BeZero’s framework.

Figure 1: A visual representation of the CCQI and BCR frameworks, demonstrating overlap and divergences²

Currently, the CCQI framework only scores 35% of the sub-sectors covered by BeZero’s ratings. Comparable sub-sectors are:

Afforestation, Reforestation and Restoration (ARR)

Cookstoves

Domestic Fuel Efficiency - Biodigesters

Landfill Gas (LFG)

Renewables

Agricultural Methane Recovery (AMR)

Fugitive Emissions

Using data for the above sub-sectors from the CCQI Scoring Tool and the BeZero Carbon Markets (BCM) platform, we compare opinions on credit quality across sub-sectors, methodologies and Standards Bodies. To compare the seven scores produced by the CCQI Tool to the headline BCR, we averaged the CCQI Tools scores for each sub-sector to create a single overall score. An average rating was taken across all BeZero-rated projects within each sub-sector.

Framework analysis reveals opinions on quality differ

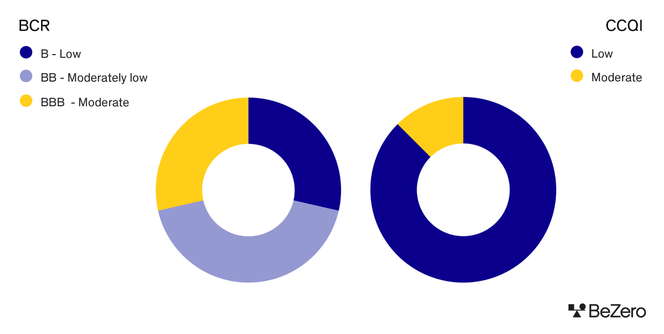

Our investigation into credit quality across sub-sectors reveals that the BCR identifies a greater range in credit quality compared to the CCQI (Figure 2).

Figure 2: Six out of seven sub-sectors are deemed as ‘low likelihood’ under the CCQI framework. Under the BCR, two are deemed as ‘low likelihood’, three as ‘moderately low likelihood’ and two as ‘moderate likelihood’

On average across the comparable sub-sectors, credits rated by BeZero range from low to moderate quality. The majority of sub-sectors included in this review have an average rating of ‘BB’, which denotes a moderately low likelihood of achieving 1 tonne of CO2e avoided or removed. Under the CCQI framework, the same sub-sectors are evaluated as providing low or moderate likelihood, on average, with only one sub-sector achieving moderate status.

The CCQI acknowledges drawbacks across all credit types. For example, the tool highlights significant additionality risks in renewable credits and non-permanence risks in ARR and cookstove credits. AMR projects are the only sub-sector viewed as moderate quality due to having little non-permanence risks.

However, the generalist framework means that intricacies of project specifics are omitted. An example of this is in the non-permanence risk associated with cookstove projects. The CCQI identifies significant risk, due to a combination of natural and anthropogenic disturbance risk and a lack of robustness in the Standards Bodies’ approach to accounting and compensating for reversals and avoiding non-permanence risks. Therefore, the CCQI Tool does not reflect the permanence of the carbon avoided by any individual project, but only evaluates the general risks that apply to the broader sub-sector.

The greater range in credit quality assigned by the BCR speaks to the increased granularity of our framework. Whilst broad trends across sub-sectors are still visible, the inclusion of project-specific data serves an important purpose in differentiating between projects within sub-sectors and highlighting a project's strengths and weaknesses. This perspective is valuable to all VCM stakeholders to ensure that project weaknesses are addressed, and to encourage credits to pursue the highest level of quality.

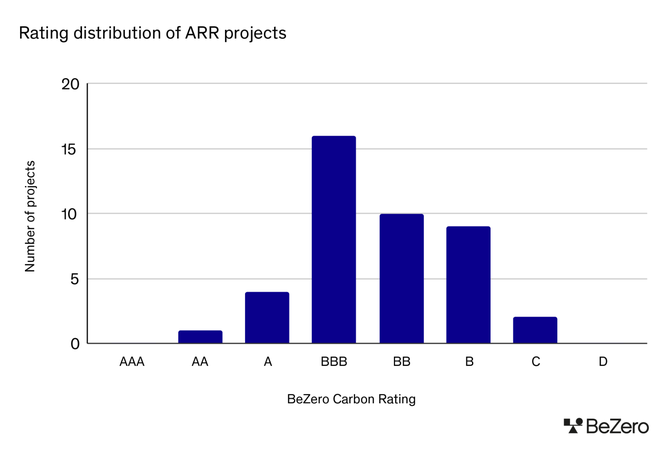

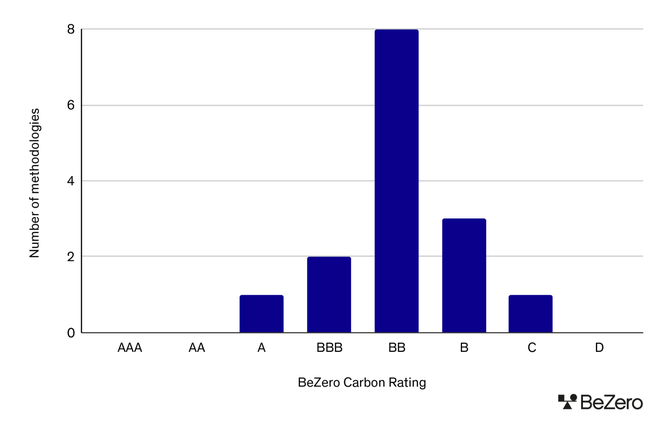

An example of this is clear on the BCM where ARR projects display a large range, from ‘AA’ (very high likelihood) to ‘C’ (very low likelihood) (Figure 3). The spread in ratings means we cannot say that all ARR projects perform well in one area and poorly in another. The differences in the ratings of ARR projects are often driven by the type of activities the project is conducting - either commercial plantation, community-based tree planting initiatives, or natural forest restoration. These project activity types play a key role in our assessment of additionality. This subdivision of the ARR sector is not accounted for by the CCQI.

Figure 3: BCR rating distribution of ARR projects (as of 25th May 2023)

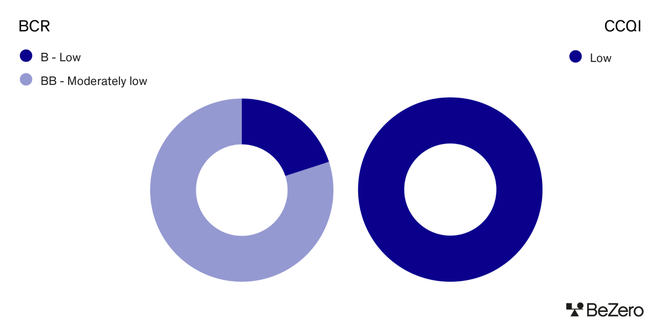

Differing frameworks produce mismatched views on quality

A similar situation is observed across Standards Bodies (Figure 4). Of the five main Standards Bodies - the American Carbon Registry (ACR), CDM, Climate Action Reserve (CAR), Gold Standard (GS), and VCS, for which sub-sectors overlap with the CCQI, the BeZero Carbon rating shows dispersion. This is because credit quality is independent to a Standards Body and ultimately dependent on how a project applies its methodology. Under the CCQI, quality is considered consistent among Standard Bodies (low); or at least, divergences are not large enough to warrant different categories.

Figure 4: All five Standards Bodies are categorised as ‘low likelihood’ under the CCQI framework. Under the BCR, four are classified as ‘moderately low’ and one as ‘low likelihood’.

In contrast to the BeZero view, the CCQI views projects registered with the CDM to have significant double counting risks. Double counting issues in CCQI scores are identified where there is a risk that a project might be registered with more than one Standard Body. However, due to the robust measures to prevent double issuance provided by other Standards Bodies during project transfer, in most cases, it is unlikely that credits will be double counted. The CCQI Tool does not appear to interrogate whether a given project has double counted its credits. It instead looks at whether provisions exist to prevent double counting under the Standard Body, assuming that a project is registered with two bodies. This highlights the lack of data standardisation for projects registered across multiple Standards Bodies and presents a need for credit ratings which can interrogate double counting risks at the level of an individual project.

The CCQI deems that VCS projects overall may have significant over-crediting and additionality risks compared to projects registered with the other Standards Bodies. This is slightly contradictory to the characteristics demonstrated by BeZero-rated VCS projects, where over-crediting risks are considered lower (BCR risk level: 15% significant, 18% notable, 40% some, 25% little), but additionality risks can be present on a case-by-case basis.

In our opinion, the level of over-crediting risk in VCS projects - and all projects - can be influenced by how a project applies a methodology as well as any deviations from the methodology. For example, the use of project-specific data over methodology defaults reduces over-crediting risks. We also consider whether legal requirements and carbon finance incentives impact additionality. However, we find that these are variable across projects, particularly tied to project type and location, and thus not all VCS projects exhibit the same level of additionality or over-crediting risk. For example, under the BCR, VCS projects range from a AA to a D rating.

In certain cases, trends within Standards Bodies may be observed, For example, many credits issued under the American Carbon Registry (ACR) are viewed as low quality under the BCR. This is predominantly because the projects tend to present lower additionality. This is normally reflective of the methodology application, project location or project type, rather than any characteristics of the Standards Body itself. The CCQI, on the other hand, tends to assess higher levels of additionality for projects registered under the ACR, particularly for financial and regulatory additionality.

Differences in opinion on how credit quality may fluctuate across Standards Bodies again suggests that, despite variation in institutional arrangements and methodologies between bodies, credit quality is driven by unique project considerations. This is highlighted in discussing that ratings can vary independently of Standard Bodies principles and typical sub-sector characteristics, as demonstrated by the spread in ARR ratings under the BCR. It is important to consider that factors such as additionality and non-permanence can fluctuate project-to-project, driving differences in ratings.

Unique project conditions also drive differences in methodology quality

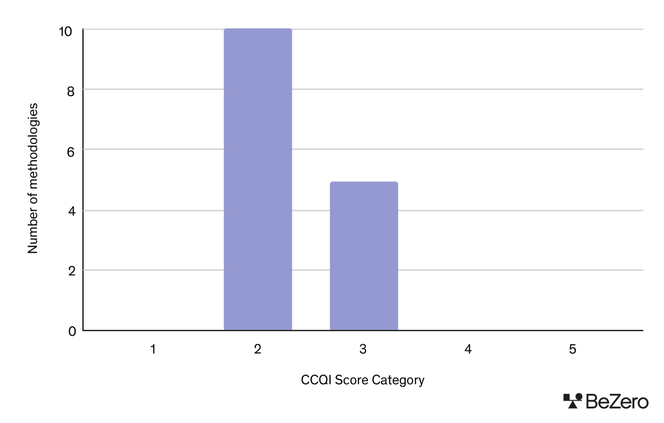

Of the 15 methodologies used by projects that both the CCQI and BeZero have rated, 11 of these fall into the CCQI’s Category 2 (low likelihood), with the remaining four falling in Category 3 (moderate likelihood) (Figures 5 & 6). This is similar to the BCR methodology rating distribution, with 13 falling in the ‘B - low likelihood’ to ‘BBB-moderate likelihood’ bracket. It is expected to see a wider distribution of methodologies under the BCR as the scale itself is wider, consisting of eight points, compared to the CCQI’s five-point scale.

Figure 5: The BeZero Carbon rating distribution for methodologies rated by both the CCQI and BeZero indicates that the majority of methodologies lie within the ‘BB’ bracket (as of June 2023).

Figure 6: The CCQI score distribution for methodologies indicates that the majority of methodologies fall within Category 2: ‘Low confidence or likelihood that the assessment subject meets the criterion or quality objective’.

It is important to note that within sub-sectors, discrepancies are minimal between methodologies and often yield the same score under the CCQI. This suggests that, under the CCQI framework, differences between methodologies are strongly tied to differences in sub-sector or Standard Body.

Under the BCR framework, methodologies are considered in our comprehensive assessments of projects. This means that methodology deviations are inherently related to the unique conditions demonstrated by the projects, rather than Standard Body quality. Projects may differ in how they apply a given methodology, which could incur deviances between two projects using the same methodology.

The CCQI Tool and carbon ratings should be used hand-in-hand

The nature of the CCQI framework serves as an important basic indicator of credit quality across different sub-sectors, Standards Bodies, and methodologies. However, our analysis demonstrates that there are important, project-specific variations in carbon credit quality that cannot be captured by the CCQI Tool. Bespoke ratings of individual projects are important to identify specific areas where projects could improve, and can act as a template for project developers to implement projects which generate high-quality carbon credits.

The CCQI Tool is a valuable asset to VCM actors seeking to improve market integrity; however, this tool is only part of the picture, project-specific ratings are necessary for a complete assessment of carbon credit quality.

References:

1 CCQI, 2023

2 CCQI quality objectives have been briefed for the purpose of the figure, for full objective titles please see here