How Additionality limits the BeZero Carbon Rating

Here are some key takeaways from the blog

Additionality is a limiting factor for the BeZero Carbon Rating and the primary indicator of risk to credit quality.

BeZero takes a thorough and holistic approach to assessing all aspects of additionality, beyond that required by Standards Bodies.

Our vintage-based ratings ensure that the BeZero Carbon Rating provides a true representation of additionality (and overall credit quality) throughout a project’s lifetime.

Contents

- Additionality is the primary criteria for BCR eligibility

- Additionality risk inherently linked to overall rating

- A holistic assessment of additionality

- A vintage-based approach to additionality

- Conclusions

Additionality is the primary criteria for BCR eligibility

Projects must meet our qualifying criteria to qualify for a BeZero Carbon Rating (BCR). The primary test is whether the project has applied an additionality test, or has otherwise provided sufficient information on how it is deemed additional. The other criteria centre on third party auditing and public disclosure of sufficient information to assess the project’s claims.

All three act as limiting factors for whether BeZero accepts a project to be rated at all.

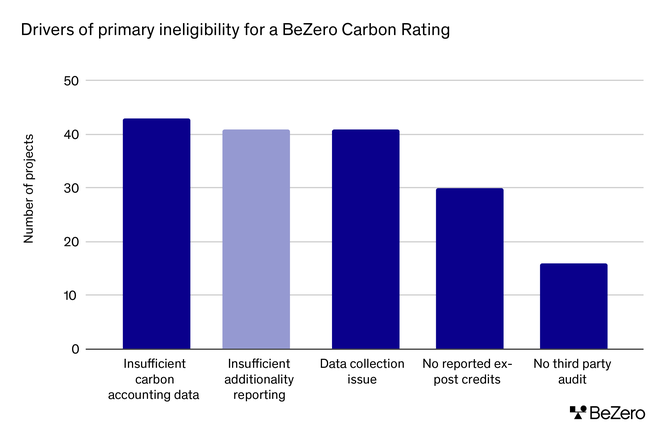

In practice, we find that close to 30% (129 of 444) of projects we have examined to date are currently ineligible for a BCR. Of these, 31% (41) were disqualified from being rated because of poor additionality disclosure and or reporting - see figure below.

Figure 1: 129 projects are deemed ineligible for a BeZero Carbon Ratings and of these, 31% are ineligible because of insufficient additionality reporting.

Additionality risk inherently linked to overall rating

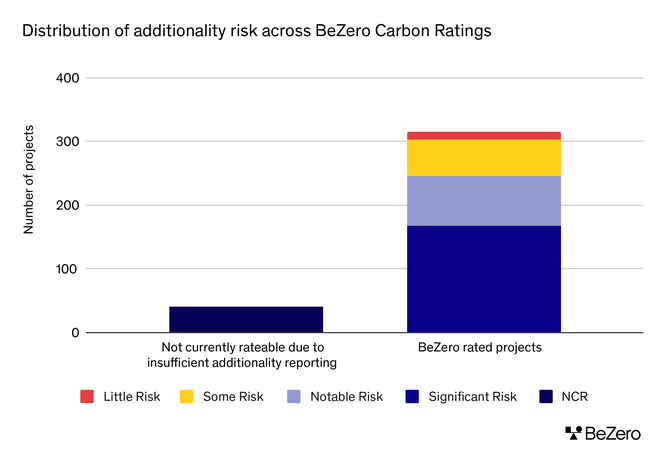

For projects that are deemed rateable, additionality is the dominant risk factor (out of six) in our assessment of credit quality. All rated projects are individually assessed on a five-point scale of risk from very low, little, some, notable, to significant for each risk factor. An indicative 50% weighting is applied to the additionality analysis.

Figure 2: Additionality forms a key limiting factor for both a project’s eligibility for rating and the overall assigned BeZero Carbon Rating. Of projects assessed to date, 41 (9%) do not meet primary eligibility criteria on account of insufficient additionality reporting. Among rateable projects, a majority (53%) have significant additionality risk in our view, severely limiting the rating that we assign.

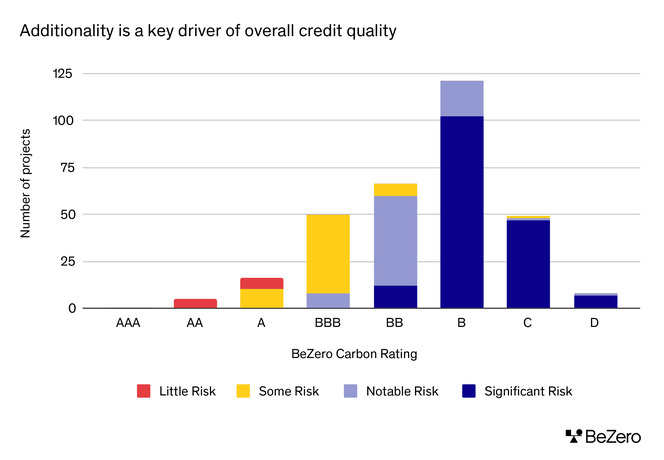

Projects assessed to have the highest level of additionality risk - significant risk - are limited to a moderately low (‘BB’) BeZero Carbon Rating. Further, in cases where we consider additionality risk to be especially severe, the rating is analytically constrained. In fact, seven out of eight of our lowest rated projects (D ratings) are driven by overarching additionality risk.

Figure 3: Additionality is a key determinant of overall credit quality. The majority of projects with significant additionality risk are assigned ratings of ‘B’ or ‘C’ in the overall assessment.

Our analytical model means that we are not constrained by our indicative risk factor weighting (it’s not a cut-and-dried formula) and no one risk factor is limiting, any can be.

If the Rating Committee considers any given risk factor (not just additionality) to have an overbearing impact on a project’s overall risk, the assigned rating can be driven by or constrained by said risk factor, i.e. limit the rating or even lead to a rating being withdrawn.

In 97% of cases where this analytical judgement has been applied, the result has been to lower the overall rating, reflecting our view of a lower likelihood of achieving 1 tonne of CO2e avoided or removed, and indicating the stringent application of expert judgement.

A holistic assessment of additionality

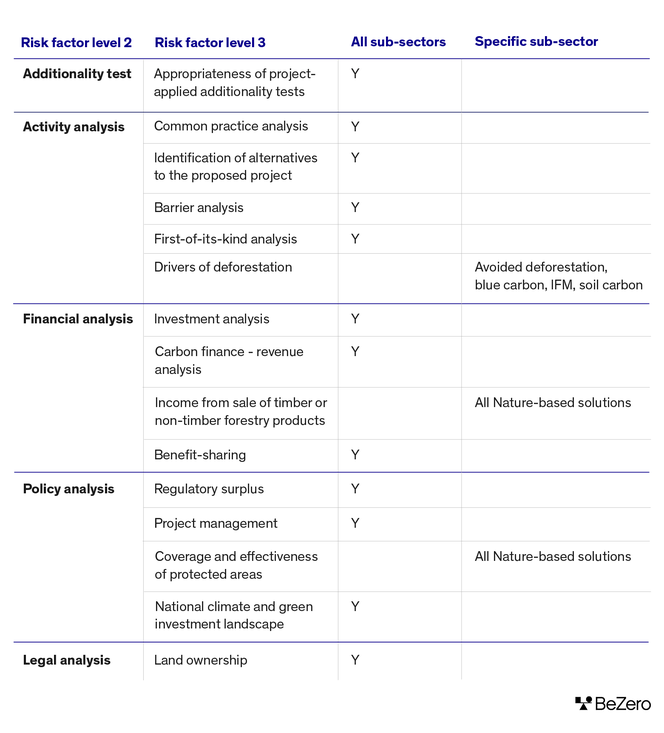

To assess additionality risk, we take a comprehensive approach that integrates various components of additionality including, but not limited to, common practice, carbon finance, regulatory and technology based barriers, and the plausibility of alternative scenarios. This holistic approach is in contrast to the approach used in the accreditation process, which may often be more narrow in focus.

For every rated project, in every sub-sector of the VCM, we assess thirteen sub-components of additionality, and further components are considered for certain individual sub-sectors. At a more granular level, to take one sub-sector as an example, our analysis of additionality for Avoided Deforestation projects evaluates over 100 parameters related to project activities, legal backdrop, finances, and policy.

Table 1. Thirteen sub-components of additionality assessed for every BeZero Carbon rated Project.

We take account of myriad drivers of additionality - and how they may change over a project’s lifetime based on vintage splits - to go beyond the binary approach taken by Standards Bodies and deliver a more robust conclusion via a probability-based risk assessment. In our view, this is a more appropriate approach because whether a project is additional is ultimately an opinion - one that relies on a mix of objective and subjective analysis that changes through time.

A vintage-based approach to additionality

All BeZero Carbon Ratings and their underlying risk factor assessments are vintage-specific. For additionality, this includes analysis of the effectiveness of policies, development and penetration of technologies and changes in common practice.

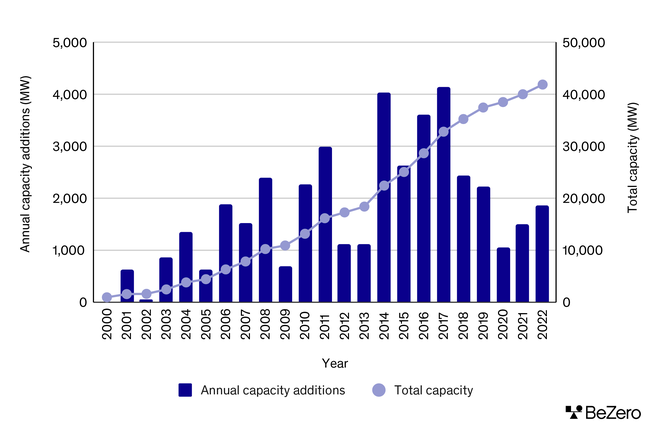

One example is the effect of regulations on wind energy projects in India, where fiscal schemes, such as the ‘Generation Based Incentive’ or ‘Accelerated Depreciation’, are interwoven with technology uptake and additionality.

Here, we observe the broad effectiveness of policies at deploying wind power in India where capacity additions can be used as a proxy for policy implementation. Yet, on a granular scale, annual capacity additions in 2012 and 2013 dropped significantly when both of these policy schemes were removed. In fact, the key role of policy in driving additionality can be noted when capacity additions increase again in 2014 on reintroduction of both regulatory schemes. Such data can be used to infer the variable effectiveness of policy over the crediting period of a project.

Figure 4: A vintage based approach to examining additionality of wind power projects in India highlights the role of regulatory financial schemes in the deployment of wind energy over time

Conclusions

Additionality - i.e. whether, in the absence of carbon revenues, the avoidance or removal activity would be viable - is the founding principle of a carbon credit project. To reflect this, additionality is a limiting factor for the BeZero Carbon Rating in two main ways:

As a mandatory qualifying criteria for the BeZero Carbon Rating, with 41 of the 129 ineligible projects assessed to date deemed not rateable due to poor additionality disclosure and/or reporting.

Seven out of eight of our lowest rated projects (‘D’ ratings) are driven by overarching additionality risks.

To assess additionality, BeZero takes an analyst-driven, model-informed approach relying on a series of additionality tests and a broad range of data inputs and financial, environmental and policy analysis techniques. Our final assessment reflects the team’s balanced view of the many aspects of additionality risk that a given project faces.

Finally, it is important to remember that additionality is just one of six risk factors that make up the BeZero Carbon Rating. All six risk factors have the potential to limit carbon efficacy, restrict the final rating, or even cause a rating’s withdrawal. For example, where projects can be evidenced as additional but face overarching over-crediting, non-permanence, or leakage risks.