Afforestation, Reforestation and Restoration - the root of carbon removals

Here are some key takeaways

Afforestation, Reforestation and Restoration (ARR) projects are the original carbon removals method within the VCM. They aim to store carbon by increasing biomass and associated carbon pools within a project area, usually through tree planting.

These projects fall into primarily two categories: commercial plantations and community-based tree planting.

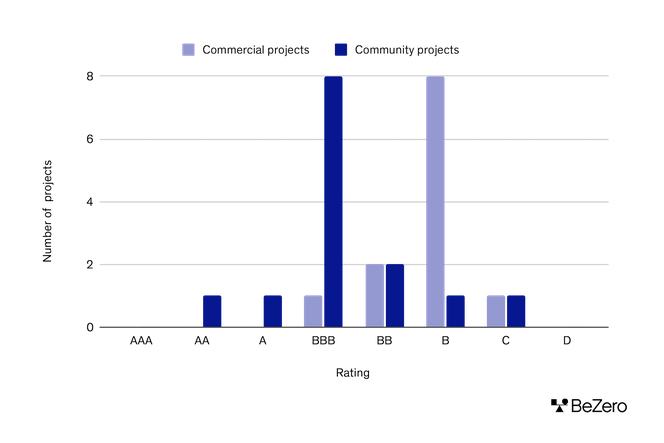

Community projects generally achieve a higher overall rating than commercial projects due to their exceedance of common practice.

Contents

ARR projects account for 43 of BeZero’s 315 rated projects, and ~4% of BeZero rated credits. These projects extend over 19 countries and five continents. Over the six months prior to March 2023, growth in credit issuance within the ARR sub-sector more than quadrupled, with an increase of 320%.¹ This makes it the fastest growing sub-sector amongst nature based solutions.

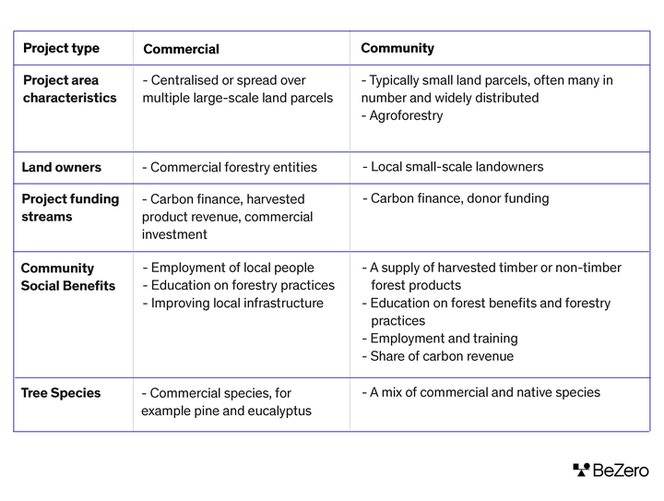

ARR projects are highly diverse in their methods, operations and incentives. An instructive way to distinguish ARR project types is splitting them out into two categories: commercial plantations versus community-based tree planting.

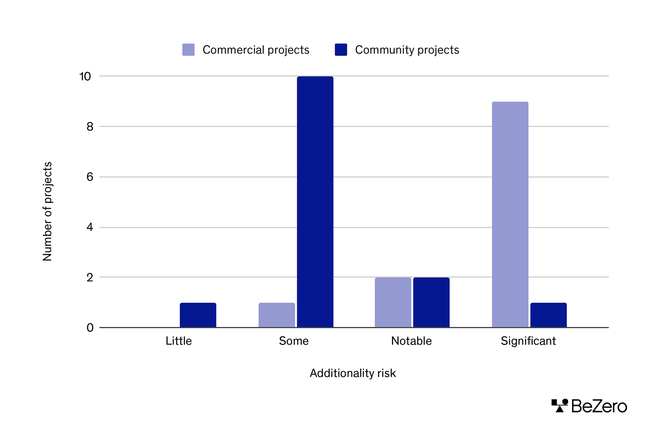

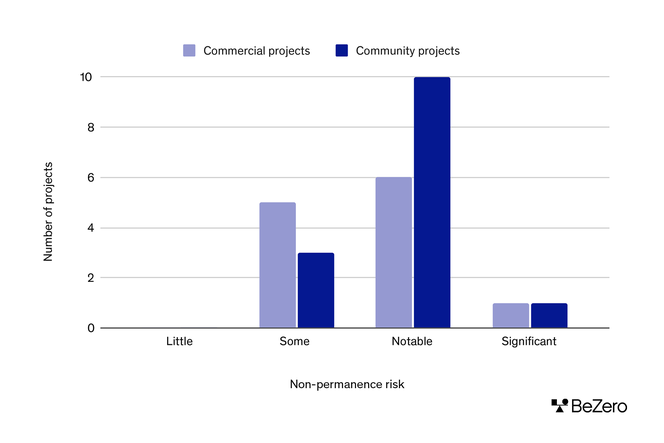

Here, we use this distinction to provide case studies for two risk factors - additionality² and non-permanence³ - which vary the most in BeZero Carbon Ratings across ARR projects.

Afforestation, Reforestation and Restoration

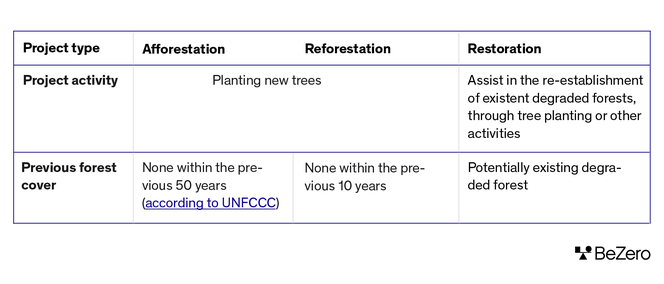

ARR projects are the original carbon removals method within the VCM. Emissions removals are achieved by increasing sequestration of carbon by biomass and soil carbon pools above that of a baseline scenario. Key differences between ‘afforestation’, ‘reforestation’, and ‘restoration’ are highlighted in the table below.

Currently, the majority of projects in the ARR sub-sector conduct afforestation or reforestation activities, with relatively few focused primarily on restoration. For this reason, this insight piece focuses on projects that conduct afforestation and reforestation activities. There are also projects within other sectors, such as soil carbon and blue carbon, that conduct some ARR activities, but are classified differently due to their ecosystems and the proportion of credits coming from each project activity.

Table 1. Key differences between afforestation, reforestation and restoration projects.

Most afforestation and reforestation projects fall into one of two categories:

Commercial plantations. These projects mostly focus on large-scale planting of a monoculture of non-native, commercial tree species. These species may be harvested for timber, or produce commercial non-timber forest products such as fruits and nuts. The project proponent receives the benefits of the project’s revenue from the sale of forest products and carbon finance.

Community-based tree planting. These projects facilitate the planting of trees on private lands owned by small-scale landowners. They provide financial, technical, or educational support for landowners to help overcome barriers to planting such as planting costs, lack of expertise or equipment, or lack of knowledge of the benefits of tree planting.

The key differences between these categories are highlighted in the table below. These differences contribute to some of the variance in the BeZero Carbon Rating across ARR projects.

Table 2. Typical traits of commercial versus community ARR projects

We find that community projects generally achieve a higher overall BeZero Carbon Rating than commercial projects. Or in performance terms, we find community projects to be more likely to achieve the claimed emission removals - see figure below. This is largely driven by our findings of lower additionality risk for community projects.

Ratings breakdown of commercial versus community projects rated by BeZero within the ARR sub-sector (as of 09/05/2023).

Additionality

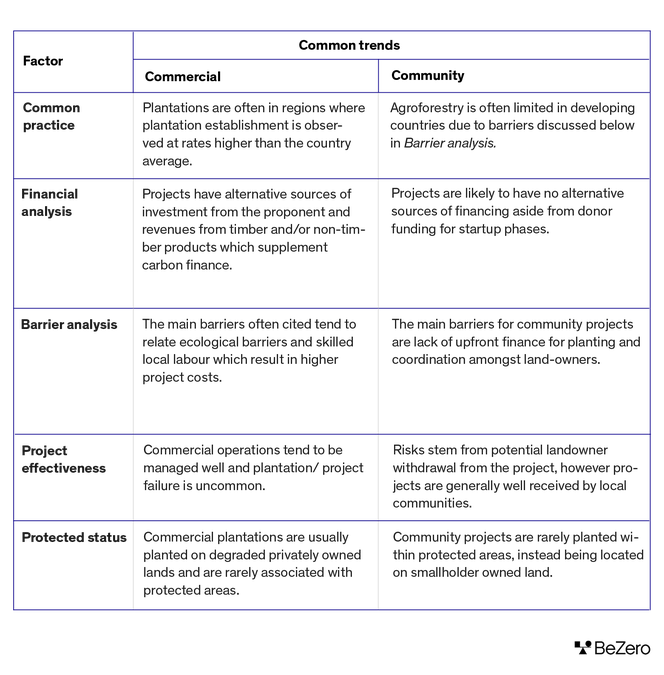

Our view on a project's additionality can fundamentally limit the rating we assign to credits issued by that project. In the table below, we highlight some of the factors that inform our view, and key trends we have observed depending on the activity type.

Table 3. Typical additionality trends of commercial versus community ARR projects

Common practice assessment

Common practice is a major driver of our additionality analysis for ARR projects. It explores the extent, setting and trend of similar activities at landscape, regional and national levels.

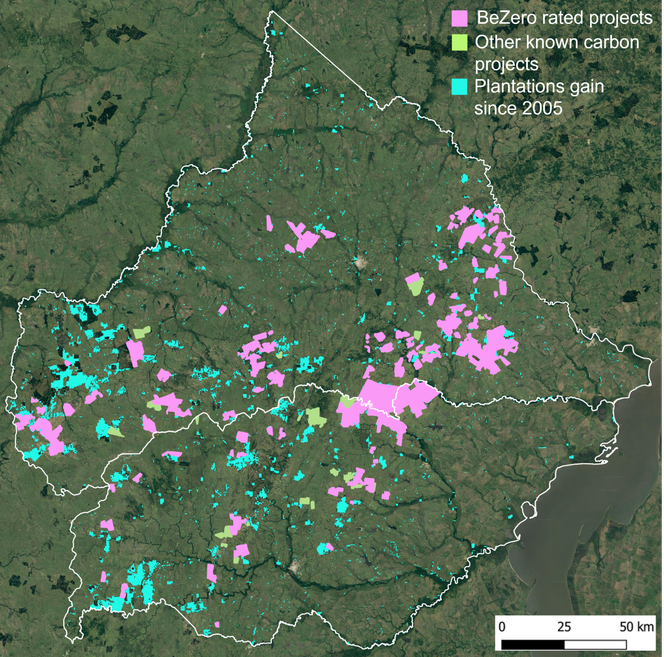

For example, we use the Spatial Database of Planted Trees and related estimates of planting years, combined with in-house analysis of satellite imagery from Landsat, Sentinel and commercial providers, and spaceborne LiDAR, to understand where and what has been planted in the wider landscape, patterns of rotation, and how this has changed over time. Especially for community based projects, where planting is often at lower density and spatially dispersed, we inspect high resolution imagery, inside and outside the registered land parcels.

One example is shown in the figure below: the expansion of commercial plantations in Cerro Largo and Trienta y tres Divisions of Uruguay, since a relevant national policy change in 2005. In this case we found that similar plantations to those of rated projects were commonplace in the region, without the necessity for carbon finance. For more information on our common practice analysis and how it is used in our risk factor assessment, see our webinar where we offer insight into three ARR projects in Uruguay.

Expansion of commercial plantations in Cerro Largo and Trienta y tres Divisions of Uruguay, since a relevant national policy change in 2005. There are currently nine ARR carbon projects in these two divisions. Four have a BeZero Carbon Rating (mapped in pink), while the other five have yet to issue credits (in green). Our analysis finds that 60% of the new planting was established outside these project boundaries, and thus independently of carbon finance (mapped in blue).

As shown above, our assessment of common practice also leverages our extensive in-house database of all other carbon projects operating in the region (we digitise these manually where not provided on the registry). We further consider how the observed planting patterns could be limited by governance constraints, and the suitability of soils, topography and climatic conditions (integrating climate reanalysis data from ECMWF with soils data from ISRIC, and topographic data from NASA).

Our overall view on common practice contextualises these geospatial findings with data on national and regional trends (e.g. from the FAO and government datasets), industry and academic literature on typical species type, rotation length, policy and market trends.

We find that the outcomes often differ for commercial and community projects, due to the stakeholders involved, and the different types of planting in terms of scale, density and species, as highlighted in table 3.

Financial analysis

For commercial projects, we determine financial additionality according to our assessment of the viability of the commercial venture in the absence of carbon finance. In some cases, we find through a combination of common practice assessment and financial analysis that commercial projects are sufficiently financially viable in the absence of carbon finance.

For instance, finding a project’s Internal Rate of Return without carbon finance is competitive with similar existing non-carbon backed plantations in the region can lead to significant risks to additionality that can overwhelm a project’s overall rating. In extreme cases, a lack of evidence to support additionality claims may preclude BeZero from rating the project altogether.

In contrast, community projects focus primarily on the financing of the project and its proponent instead of the financial analysis of the enrolled community land owners. This is because we find that these kinds of projects focus on overcoming non-financial barriers that land-owners face, which may include educational barriers or technological barriers such as access to equipment and saplings, or the human resource to undertake forest planting. In these scenarios, we often find that the project helps to overcome these barriers, and is often reliant on solely carbon finance to cover the ongoing costs of project activities.

Non-permanence

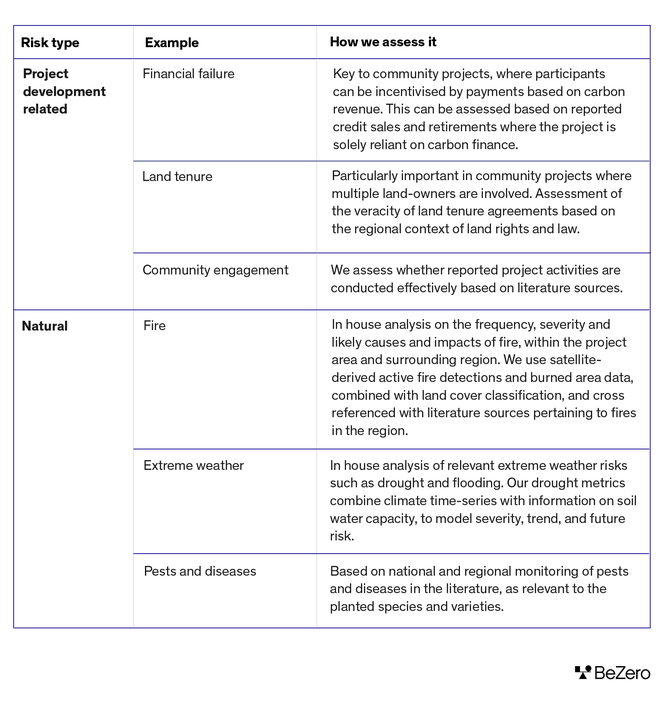

Non-permanence is another risk factor that varies highly based on our bottom-up assessment of ARR projects, and has nuances based on the project's construction as commercially driven versus community based.

Nature-based projects often address reversal risks through a buffer pool. Buffer contributions are a percentage of overall issuance, sometimes determined through project-specific assessments of non-permanence risks. We assess the appropriateness of the project’s allocation, for each risk, relative to our view of the magnitude of that risk, and any mitigation techniques that the project employs. The table below highlights some of the key factors and how we assess them.

Table 4. Key non-permanence risks and how we assess them, in the context of ARR. Note that this table is not exhaustive.

Generally, commercial projects consist of monoculture plantations or trees planted in species-specific stands. This increases the risk faced from pests and diseases, as the lack of genetic diversity may allow for easier transmission and wider spread. Whereas, community-based projects tend to pose a lower natural non-permanence risk, as they are often distributed over a larger area and consist of tens to thousands of small land parcels, such that fire, pests and disease are less likely to spread, or may be more easily controlled.

Nevertheless, we consider the steps that the project takes to reduce the likelihood and impact of these reversal risks. Commercial projects often have greater financial capability and incentive than community projects to protect their carbon stocks from natural hazards, and are likely to have a greater level of management knowledge.

One of the most common non-permanence risks faced by forestry projects is from fire. We routinely monitor active fire detections and burned areas for all nature based projects, using data from NASA (MODIS MCD64A1 and VIIRS VNP14IMGML), which we interpret in the context of the vegetation type and associated fire risk.

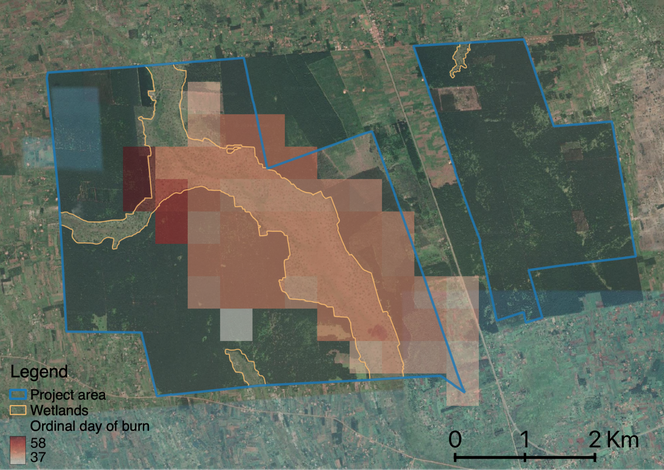

Fire is a natural part of many ecosystems and therefore assessing risk should be nuanced. For example, our analysis of burned area data for CDM4653, a Uganda-based commercial reforestation project, indicates there were years during the project's lifetime where up to 38% of the project area burned. However, other satellite imagery, together with the project’s planting compartment plan, indicates the affected areas were unplanted at the time. We attribute the fires mainly to grassland burns (natural or anthropogenic in origin) during the dry season. The commercial proponent’s fire prevention methods, such as buffer regions and fire breaks, have helped to prevent subsequent fires spreading into planted areas. As a result, we deem the project’s fire related risk to be low.

Observed burned area, for CDM4653 for the year 2011 where there was the greatest extent of fire detection in the project area. However, this fire occurred before plantations were established in these areas, and did not result in significant carbon stock losses. The background image is a high resolution true colour image of a more recent year, during which fire activity was low.

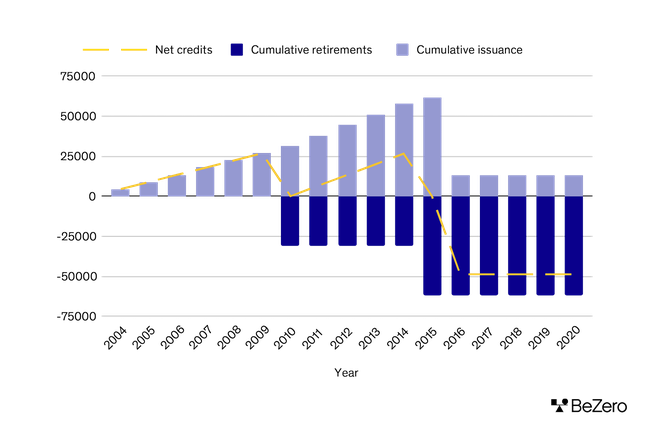

One non-permanence risk that is particular to community projects is the risk of individual land-owners withdrawing from the carbon project. This differs from land tenure risks as land ownership is not transferred. An example of this risk in action is VCS 594, a Uganda-based community project where owners of ~56% of the project area (and 86% of the project’s planted trees) chose to remove their land from the project, in order to harvest planted Eucalyptus, during its third monitoring period. Since the project had already retired all of its previously issued credits, these reversals put the project in net negative issuance (i.e., the project has now retired more credits than tonnes of CO₂e sequestered and stored). The project is relying on future issuances to recoup its emission reductions within the project lifetime.

VCS 594’s cumulative issuance and retirements, highlighting that retirements now outnumber issuance due to a loss event caused by farmers withdrawing their land from the project after 2015.

Conclusions

One useful shorthand to interrogate ARR projects is whether they are commercial plantations or community-based tree planting. In aggregate, we find community projects have lower additionality risks and tend to provide a higher likelihood of achieving one tonne of CO₂e removal. Nevertheless, no two projects are the same and generalisations, such as screening at the level of Standards Body or methodology, are insufficient on a standalone basis.

The BeZero Carbon Ratings provides a detailed, project- and vintage-level analysis, interrogating risks and mitigating factors case by case. Our approach of coupling sector specific considerations expressed via fungible risk factors allows for a more granular approach to assessing carbon efficacy uncovering the nuance of carbon projects alongside key top-down trends.

References

1Based on our analysis of the big four Standards Bodies (Verra, Gold Standard, American Carbon Registry, and Carbon Action Reserve.

2BeZero’s carbon risk factor series: Additionality

3BeZero’s carbon risk factor series: Non-permanence