Why insurance and ratings matter in the pre-issuance market

The fundamentals of the voluntary carbon market (VCM) are changing. As pre-issuance purchases increase, investors and buyers need to bolster their portfolios with ex ante credit ratings and carbon insurance products.

Over the last year, demand in the market has decidedly shifted away from issued credits and towards purchasing pre-issuance credits (credits which are yet to be delivered) and investment. For every $1 spent in the ex-post market, roughly $4 is being invested in the ex-ante market.1

This shift is driven in part by recent media criticism of the secondary market, which has made buyers wary of existing credits. To protect their reputations, many are now looking to future projects which promise to deliver high quality credits. In addition, more buyers are looking towards carbon removal credits, which are increasingly sold on the pre-issuance market. Many buyers look at pre-issuance as a way of ensuring offtake for the years ahead.

But the shift towards investing in pre-issuance projects also presents new risks. As these projects are yet to become operational, there is the added risk that the credits will not be delivered on time, at capacity, or at all. It can take years for a project to go through the various stages of development to reach the point at which it becomes operational and begins to issue credits. Projects can face delays or fail for any number of reasons during this period.

Investors need to know how to price the cost of capital. As credit buyers and investors start to look at these future carbon projects, they need to be able to understand the added risks these projects face, including the team involved and various operational, legal, technological and financial risks. Only with a deep understanding of these risks can they appropriately price their cost of capital, whether it be through equity investment or debt financing.

Developers need to show market stakeholders that their product risk is transparent and can be priced. Developers of all shapes and sizes are trying to move away from equity financing towards debt and carbon credit financing. To unlock this next iteration of the project lifecycle, investors need to be able to understand their method and price risk. It is all but impossible to do this without risk products like ratings and insurance.

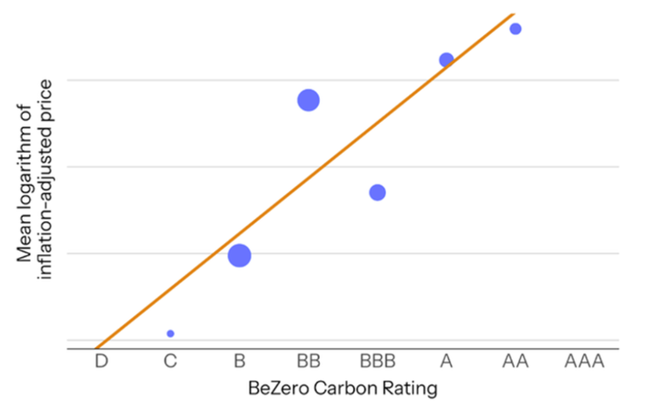

Carbon ratings are integral to improving this risk evaluation for developers, investors and end-buyers alike. Ratings have helped the fixed income market scale to a $123 trillion over the last century. This is a model to follow as we seek to de-risk the VCM and increase demand for credits in the year to come. As BeZero’s recent report shows, ratings are increasingly an important factor driving the pricing of credits in the VCM, showing the early signs of it helping to scale the market.

Average price-rating relationship

Figure 1. Average price and rating relationship April 2022 - December 2023. The number of transactions for credits of each BeZero Carbon Rating in the period analysed is indicated by the size of the data point. Analysis uses transacted price data from Xpansiv CBL market.

Carbon insurance and carbon ratings can be considered two sides of the same coin. Where BeZero reviews project data to understand if the project achieves a certain degree of quality, Kita reviews similar data to understand if the project (and associated supporting entities) will perform as it says it will based on key risks. Carbon insurance is another risk management tool that should be in every company’s toolbox. The types of risks inherent to the carbon markets where insurance may help include:

Non-Delivery - The risk that the credits expected/promised from a project are not delivered in part or in full (or on time).

Reversal – The risk that carbon captured by a project may be re-released into the atmosphere. This risk is most significant for forestry and land-use projects, for example if a forest burns down. Engineered solutions could suffer a reversal, for example if carbon stored underground leaked.

Counterparty – The risk that parties within the transaction may default on the contract and not fulfil their obligations. This can be a particular concern within the VCM, as it is an unregulated market with many small companies in a wide range of jurisdictions. A lack of standardised contracts can exacerbate this risk.

Invalidation – The risk that the carbon credits or an entire project are invalidated, for example due to a fraudulent or negligent act, a significant reversal of carbon dioxide back into the atmosphere, or a significant shift in methodology.

Political - The risk that a host country may alter its regulations, impacting the carbon project, transaction or sale of credits. This is an emerging risk in particular for Article 6 markets. Specific to pre-issuance credits, the top 3 risks where companies face the most exposure are non-delivery, counterparty and political.

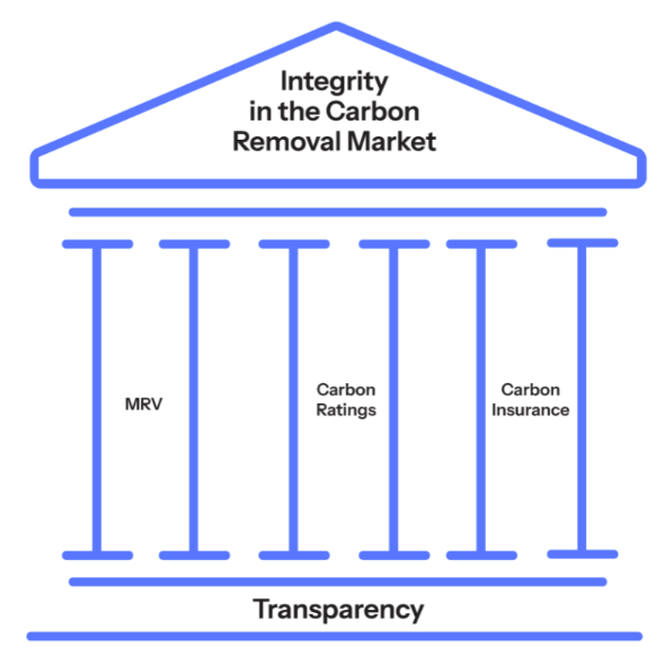

As we showed in our report Three Pillars, insurance and ratings are key foundations of the VCM. Standardising robust MRV, ratings, and insurance across the market will provide the adequate trust and risk management layers to help drive investment and scale this market.

Figure 2. Pillars of integrity in the carbon removal market

As the market moves towards pre-issuance credits, it is important that these fundamentals are transferred over. Project execution risk needs to be priced and evaluated alongside carbon risk. This will allow investors and buyers to properly be able to evaluate the risk of a project delivering as promised.

Kita Earth and Oxbow Partners will be co-hosting a webinar on Wednesday 7th February to explore the vital role that insurance plays in supporting carbon markets. BeZero’s Lead Analytical Officer Ronan Carr will share his thoughts on how carbon ratings can help insurers manage risk. He will also be joined by speakers from London Stock Exchange Group and CUR8. Register today to learn why carbon credits may be the next billion-dollar insurance market.

References:

¹ MSCI, Ecosystem Marketplace, BeZero analysis