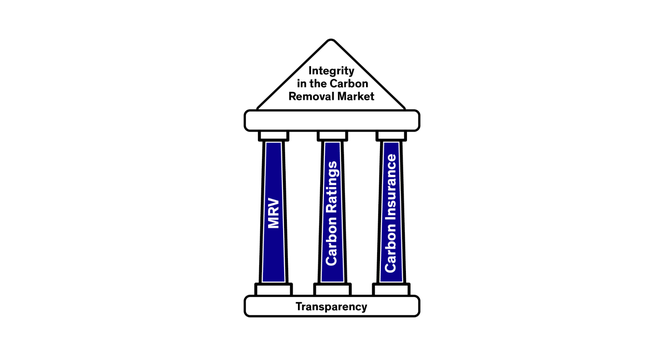

The three pillars of integrity in the carbon removal market

*As of the time of writing, Kita is a client of BeZero Carbon.

Here are some key takeaways from the report

The carbon removal industry needs to grow by 1,300-fold in three decades to meet climate targets.

Currently the market is stifled by a lack of transparency and needs to develop more trusted risk frameworks (ratings) and products (insurance).

Market stakeholders need to boost data transparency and improve understanding of Monitoring, Reporting and Verification (MRV), insurance and carbon ratings to unlock the growth necessary.

01 The challenge in the carbon removal market

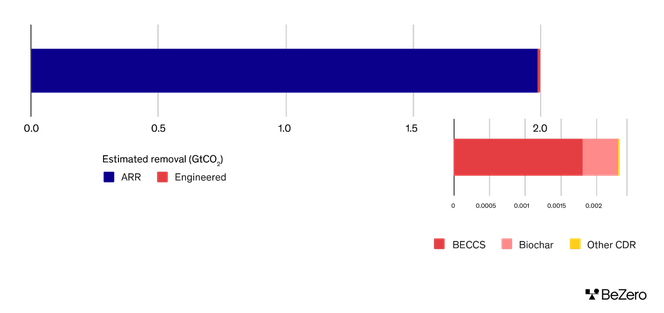

The carbon removal market is building solutions that recognise the pressing climate need to remove billions of tonnes of carbon dioxide (CO2) from the atmosphere. To make this a reality, carbon removal technologies need to grow by a factor of 1,300 on average by 2050.¹ The numbers indicate the challenge at hand – 2 million tonnes of carbon removal today against a projected 165 billion tonnes of cumulative removal by 2050, with around 47 billion tonnes projected to come from engineered removal.²

Figure 1: Estimated annual carbon removal in billion tonnes (GtCO2). The majority of carbon removal is currently met through afforestation, reforestation and restoration (ARR) (blue) with only 0.12% met by engineered carbon removal methods (red).

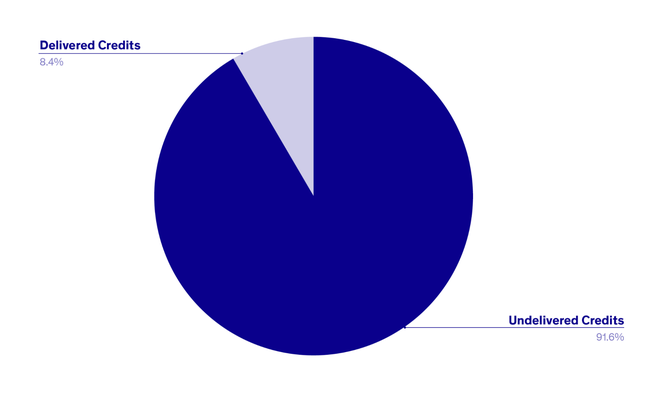

Of the c.800,000 carbon removal credits sold to date, less than 10% have been delivered as ex-post credits, meaning that buyers are inherently taking a delivery risk by investing today in carbon removal credits projected to be delivered in the future. The clear uncertainty on this is evident when looking at levels of private sector investment, currently reported by cdr.fyi at $780,000. While exact numbers might be higher due to non-public investments, we are far from the trillions needed for billion tonne scale.

Figure 2: Engineered carbon removal credit deliveries as of March 2023³

The key challenge is how we scale from a nascent market today to that of a consistent billion tonne scale by 2050. Three core hurdles need to be overcome to unlock this growth:

Transparency: publicly available data and information

Confidence: trusted forecasts and risk analysis tools

Safeguards: protections for investments when outcomes are not as expected

Three emerging aspects of the carbon removal market – Monitoring, Reporting and Verification (MRV), ratings and insurance – have the potential to make significant improvements across these key problems. Together MRV, ratings and insurance are essential underpinnings of the market and can act as a stamp of confidence to greenlight institutional level investment.

Case study: MRV, ratings and insurance in the fixed income market

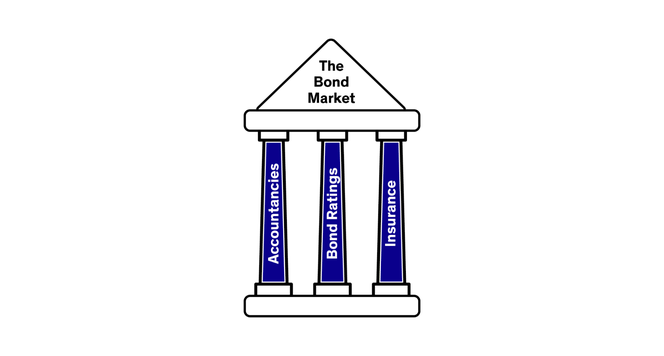

The fixed income market, otherwise known as the bond market, has been able to scale and gain trust over the last two centuries due to the efficient transfer of information and price. The more information able to circulate in a market in a structured way, from credible sources, the better all market participants can assess risks associated with the trading assets.

Accountancies, ratings agencies and insurance companies have helped perform this vital function. They have facilitated and accelerated the growth of the global fixed income market to ~$123 trillion of outstanding securities in 2021.⁴

The first pillar is accounting and auditing. Accounting is the practice of showing the position, profitability and performance of an organisation. Auditing is the practice of verifying the accuracy of data presented in financial accounts. This first pillar of integrity is vital because without the accurate and verified data, no further assessment can be made on ratings and insurance.

The second pillar is credit ratings. Rating agencies use the financial statements developed by the accountants and auditors. With this information, alongside other information sources, they carry out the assessment using a ratings methodology and then assign a rating to the bond. This rating will assess the probability of the issuer defaulting on its debt. In other words, a rating is an assessment of the issuer’s creditworthiness, i.e. its ability to make dividend and principal payments on time.

The third pillar is insurance. In the bond market, the insurer underwrites the risk that a bond will not return its payment on time. The higher the risk, the higher the insurance premium paid by the investor is going to be. Insurance companies will use credit ratings from agencies such as Moody’s or S&P as a key factor - but by no means the only factor - in establishing the risk of that bond. Insurance companies will also undertake independent analysis when underwriting this risk.

The market for products insuring fixed income instruments has become so advanced that there are traded insurance products in the form of credit default swaps. This not only provides the buyer with a certain level of protection against the default of a given instrument, but it also provides a live market price for that protection which can be used as a risk premium benchmark.

Figure 3: Three pillars of the bond market

To scale the carbon removal market even to a fraction of the size of the fixed income market, these three aspects - MRV, ratings and insurance - will all be essential. Together, they have the ability to boost transparency, increase trust and garner market demand for carbon removal credits.

The following chapters will unpick how each of these pillars operate in the carbon removal market and set out what needs to be done to help deliver all three.

02 Three pillars of integrity in the carbon removal market

A. MRV

What is MRV and how does it work?

MRV - monitoring, reporting and verification - is to the carbon removal industry what accountancy and auditing is to the fixed income market. In practice, this acronym encompasses a broad spectrum of practices and technologies, including accounting for all of the emissions, energy use, environmental and public health impacts, and other factors associated with a carbon removal project to determine its net climate impact. The process tells us if the removal activity was done safely, effectively and provides documented evidence and ongoing monitoring.

Whereas the accounting process in financial markets is undertaken by accountancy firms, the MRV process in the carbon removal market is undertaken by a combination of the project operator or its contractors, along with third-parties who can verify the claims made. The content and frequency of the MRV is often dictated by the methodology and is sometimes supplemented by interested stakeholders. The independence of the third-party is vital to ensure a robust and reliable process.

| Monitoring | Reporting | Verification |

|---|---|---|

| - Using best available science, revise and update measurements and protocols. - Identify an appropriate protocol for quantifying the carbon removal. - Conduct measurements, both in field and through models, to quantify the carbon. | - All processes developers put in place for gathering, saving and delivering the data on their projects. - This is delivered via in house or external registries. | - Carried out by a third party, this includes: -- The auditing at the start of a project, known as validation. -- The ongoing monitoring of carbon removal, known as verification. |

Table 1: MRV explained

Why is MRV necessary?

MRV is necessary to ensure climate outcomes. The Voluntary Carbon Market’s (VCM) core function is to catalyse private sector capital for reducing and removing carbon from the atmosphere. Robust MRV ensures those climate outcomes are validated and accounted for. Without MRV, there will be no trusted data and no functioning market for carbon.

MRV is also necessary to build investor confidence. Trillions of dollars of capital will need to be deployed to reach the IPCC target of 10 billion tonnes of carbon removal a year by 2050. Investors need to be able to trust that these projects are delivering on real removals with validated accounting and auditing. If this can be achieved, it is the first step to building investor confidence in the carbon removal market.

How do projects enable MRV?

1. Find or create the methodology

This could be created in house or with an external provider. Alternatively, a developer could use an approved methodology which exists within an established registry.

2. Create the project design document (PDD)

A PDD describes how a project will implement the aforementioned methodology. Not all projects are the same and this document looks at those specific differences such as the type of monitoring equipment used for the project.

3. Employ third party verifiers to validate the numbers at execution and throughout the life of the project.

Auditors are known as validation/verification bodies (VVBs), and act as independent third-parties to assess carbon projects against the rules set out by the relevant registry. Despite the common underlying principle that carbon projects must be verified to demonstrate measurable additionality and permanence, there are differences in auditing protocols across various accreditors and methodologies within the VCM.

Increased automation will improve the MRV process by providing more frequent updates at a more granular level that can be made available to a broader set of stakeholders in a timely manner. This will bring greater levels of transparency and accountability to the carbon removal industry.

B. Carbon ratings

What are ratings and how do they work?

The BeZero Carbon Rating of voluntary carbon credits represents BeZero Carbon’s current opinion on the likelihood that a given credit achieves a tonne of CO2e avoided or removed. The rating provides users with a risk based assessment for understanding and interrogating carbon credit performance of any type, in any sector and country. Non-public information is not considered.

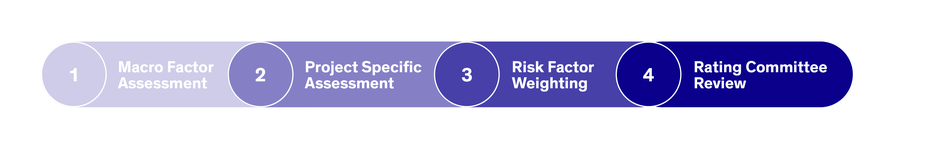

Once these criteria have been met, the assessment under the BeZero Carbon Rating Methodology will commence. This is a four-step process as set out below:

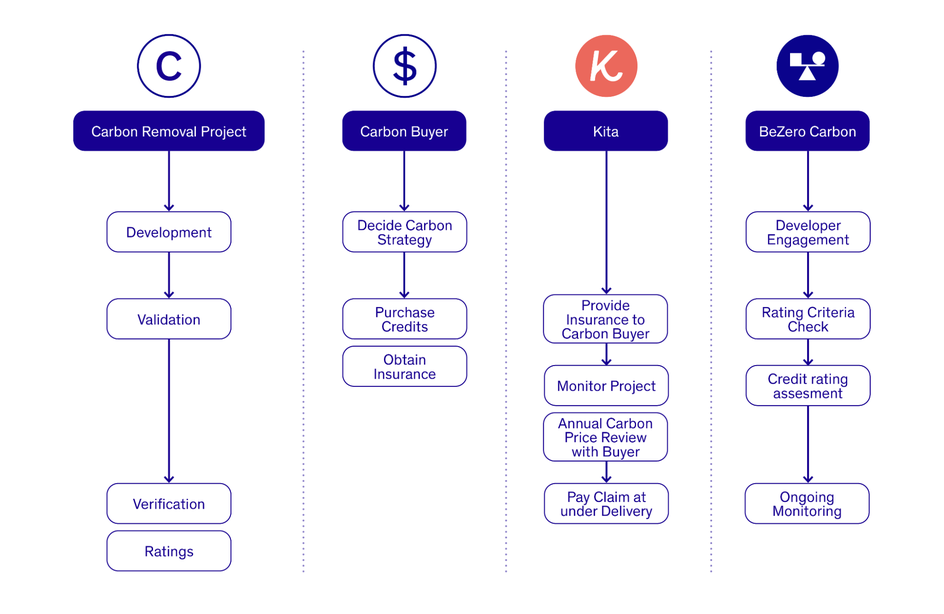

Figure 4: BeZero Carbon Rating process

Macro factor assessment

This is a top-down assessment of the country, sector and methodology.

Project specific assessment.

This is a bottom-up assessment of a series of publicly available information about the project, including but not limited to: accreditation documents, peer reviewed research papers, social and economic data and earth observation geospatial analysis.Risk factor weighting.

Project ratings are to a large extent driven by risk factors, but assigning a project rating is a deeply analytical process, not a mere algorithm based on individual factor assessments. The sole objective is to assign a rating reflective of the credit’s likelihood of avoiding or removing carbon. In some circumstances, if a specific risk factor is judged to have an overbearing impact on the overall project rating, the rating can be driven by or constrained by the said factor. The weightings are based on the team’s assessment of a risk’s relative importance to the overall rating.Rating Committee review.

BeZero’s Rating Committee, made up of ratings analysts and chaired by a senior member of the ratings team, formally reviews the analysts’ findings and rating recommendations. Unanimous approval by the Rating Committee is required for a final BeZero Carbon Rating to be assigned.

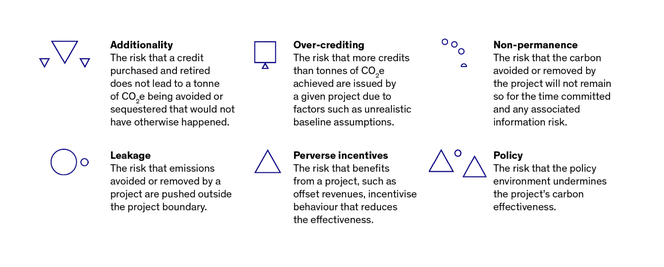

The BeZero Carbon Rating follows a robust analytical framework involving a detailed assessment of six critical risk factors affecting the quality of credits issued by the project. Strong performance on our assessment of most of these following risk factors - additionality in particular - will likely result in a high BeZero Carbon Rating.

Figure 5: The six critical risk factors in the BeZero Carbon Rating

Why are ratings necessary and how do they help the market?

Until recently, the VCM - which includes the carbon removal market - has operated through a binary lens. Before ratings, buyers were given two clear choices: an accredited credit or a non-accredited credit. Beyond that choice, for years buyers were left unable to efficiently price risk in the market and understand the differences in carbon quality between credits.

This created a market failure: a lack of correlation between price and quality in the market. No functioning market works when price and risk are misaligned. The emergence of carbon rating agencies in recent years aims to address this discrepancy. The goal of ratings data is to arm market participants with risk information, giving them a new and valuable input into price discovery and helping to make the market more efficient.

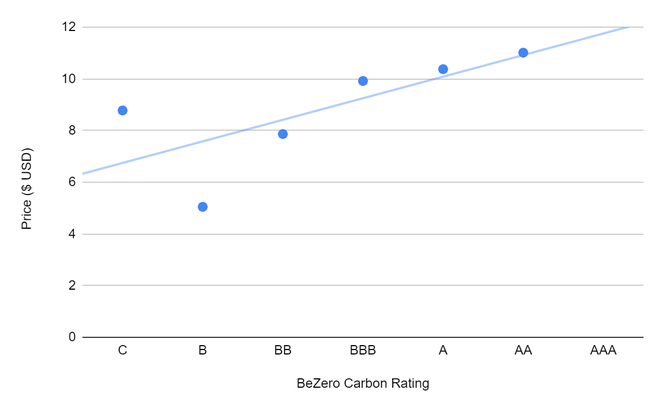

Preliminary analysis of the price-ratings relationship shows the impact ratings are starting to have in the market. While it is early days, we find some signs of an emerging relationship. Using transaction data provided by Xpansiv, from its CBL market, BeZero Carbon analysis incorporated live trading prices from data representing over 10 million tonnes worth of transactions since April 2022. This analysis suggests that higher BeZero Carbon Ratings may be associated with higher prices overall.

Figure 6: Price and rating relationship (April - December 2022)

Similar to fixed income markets, carbon ratings can help develop other market instruments:

Ratings help to drive more risk-driven pricing, which in turn leads to more reliable and consistent traded prices. A market without ratings has poor mechanisms for price and risk discovery.

The development of price benchmarks and indices can incorporate ratings as price-quality correlations increase.

They can help encourage transparency. One in four VCM projects are not eligible for a BeZero Carbon Rating due to lack of disclosure. As ratings become a key trust indicator in the market, this barrier to entry will encourage developers to improve their data disclosure.

Facilitating the growth of market instruments. Future products could migrate over from financial markets such as traded contracts, Exchange Traded Funds, and derivative instruments, and these could all be underpinned by ratings.

How do projects receive a rating?

The BeZero Carbon Rating is for ex-post credits only. This means that a project needs to be in operation and issuing retirable credits for it to be considered for a rating. For ex-post credits, there are three eligibility criteria for a carbon credit to be eligible for a BeZero Carbon Rating:

The project must have applied an additionality test or provide sufficient information on how it is deemed additional.

The project must be audited by a recognised third party auditor in order to ensure the robustness of the data and information published.

Sufficient information on the design and ongoing monitoring of the project must be available in the public domain at all times. Non-public information will not be considered. BeZero Carbon has published a Carbon Accounting Template as guidance.

C. Carbon insurance

What is insurance and how does it work?

Insurance is a third-party risk management mechanism which is common to most standardised markets. It reduces risk by transferring it to a specialised third party (a (re)insurance company), where it can be distributed amongst a larger pool. Insurance for the carbon markets is not a new concept and has existed in small pockets since the advent of the Clean Development Mechanism. However, factors such as the size of the market; lack of historical data; shifting prices; long-term risks; and a rapidly evolving landscape, have made the carbon markets, and VCM in particular, a space that suffers from an insurance protection gap.

In spite of these challenges, insurers have innovated to release products catered towards the carbon markets. For example, products protecting parties against carbon credit invalidation; fraud and negligence; and natural disasters, such as fires. Kita's Carbon Purchase Protection Cover protects buyers of forward purchased carbon credits against the risk that the carbon forecasted is not delivered, whether due to unavoidable losses such as natural catastrophe; avoidable losses such as fraud, negligence, or insolvency of the underlying carbon removal developer; or shifts to carbon methodologies and baseline assessments.

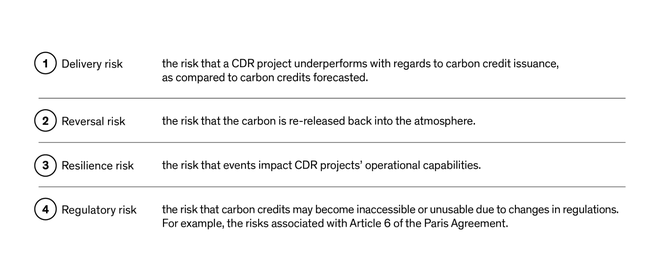

Insurers may be deemed a novel player within the carbon market. However, the risks they address are not unprecedented. Four key risks in the carbon removal market are: delivery, reversal, resilience, and regulatory. These risks are reflected, and covered by insurance, in other standardised markets. For example, oil companies have insurance for their operations and a purchaser of oil can be insured for delivery risk. This suggests that insurance could become a standardised, rather than novel, element of the carbon removal market.

Four key carbon market risks

Why is insurance necessary and how does it help the market?

The carbon removal market is relatively new and rapidly developing. With new companies entering the space; evolving supervisory standards; advancing MRV techniques; and new carbon removal technologies, risks are inevitable. Yet, few established risk management frameworks are in place.

Currently, both carbon removal developers and credit buyers are using forms of "self-insurance” to protect themselves against risk. Examples include, implementing buffers to tackle non-permanence risk, or contractual agreements and financial structuring, to manage delivery risk. Whilst these risk mitigation measures are logical, as a sole risk mitigation mechanism, they are inefficient. The risk is passed between market participants, creating barriers to entry for parties with limited balance sheets, low credit worthiness, or those that are generally more risk averse. Market participants need a creditworthy third party, to whom they can transfer risk, to enable scaling of the carbon removal market at the speed required to meet climate targets.

Figure 7: Insurance and its role in the market

1. A balance between traditional risk management and innovation

Specialised carbon insurance products can provide a map to navigate the unique risk landscape of the carbon removal market. For example, by outlining to project developers the data requirements needed to assess and monitor risk or outlining to buyers optimal contractual frameworks that enable insurance to play an effective risk transfer role. Introducing a creditworthy counterparty to the carbon removal market can increase trust and progress the market towards a commercially attractive, standardised structure. For example, Kita is a Lloyd's of London Coverholder, thus combining the development of innovative carbon insurance products with the safety of the A+ rated paper of Lloyd’s underwriters.

2. Stamp of confidence

Currently, there is a lack of trust in the carbon removal market. The insurance industry will bring confidence to the market, thanks to its depth of risk management and regulatory expertise, honed over decades and multiple sectors. Buyers may look to insurance, alongside other mechanisms, such as ratings, to indicate high quality projects to invest in. This is partly due to the extra level of due diligence and ongoing MRV which insurance provides, as well as the further security that if an insurance company assesses the risk incorrectly, they will stand behind that assessment in the form of a claim.

3. Detailed assessment of risk

Insurance underwriting involves an in-depth analysis of the risks associated with carbon projects. This process highlights areas of high risk across project types, sending a wider message to the market with regards to improvement of broader risk management.

4. Encourage market participants to take necessary risks

Insurers take responsibility when things go wrong, in the form of paying a claim. This provides market participants with the freedom to take defined risks that might not otherwise fit into the governance structures of their organisations. For example, Kita’s Carbon Purchase Protection Cover provides security that buyers will be compensated if an under-delivery occurs. This removes barriers to action, by giving buyers the confidence to invest in forward purchases of carbon removal credits. Without this protection, these forward transactions may be deemed too risky for many companies, thus limiting the significant upfront financing required to scale carbon removal.

How insurance can narrow the gap between carbon removal demand and supply

According to Mckinsey Sustainability, 'the current pipeline of carbon removal capacity...falls 80% short of the requirement suggested by IPCC’. This is exacerbated by the high costs associated with project development. Pre-purchase credits and pre-purchase agreements have been introduced, to stimulate upfront financing for projects. However, there is a risk that the carbon promised will not be delivered. This risk can disincentivise market participants and therefore limit the finances available to projects at their development stage.

Insurance products, like Kita’s Carbon Purchase Protection Cover, can address delivery risk by paying a claim if the purchaser’s carbon is not delivered. By reducing the financial risk associated with upfront investment, insurance makes purchasers feel more comfortable to invest greater capital in projects at an early stage, mobilising the necessary finances for project development and the scaling of supply within the market. Thus, insurance provides a solution to the problem of limited carbon removal supply.

How can a project enable insurance?

There are steps which projects can take, to facilitate insurance.

1. Providing transparent and consistent data

Detailed data, at a project level, allows insurance companies to carry out accurate risk assessments and therefore produce robust policies. Similarly, detailed project data feeds into more accurate ratings. Ratings can be used by insurers, as a useful indication of the quality and risk level of a project. Therefore, more accurate ratings also help the insurance underwriting process.

Consistent data across project types also makes comparisons easier; processing more efficient; lowers costs; and reduces errors. Insurance companies rely on past data patterns, to determine the probability of a future event and thus the associated level of risk. With little historical data on carbon removal, insurance companies are having to find innovative ways to gather data and assess risk. For example, via looking at data proxies that exist in related markets. Therefore, providing consistent data, as carbon removal evolves, will be beneficial for the future development of insurance products within the market.

Alongside detailed and consistent data, being able to evidence good risk management practices and a strong track record of project execution will help to obtain insurance on better terms and pricing. Good examples would be mitigations to prevent or reduce the impact of physical/environmental risks, or contractual provisions to restrict the insured’s liability or strengthen their ability to obtain recourse.

2. Robust MRV methods

Accurate MRV, such as the methods being explored by Verra and Pachama, allows insurance companies to assess risk continuously over the policy term, creating more bespoke policies and premiums which accurately reflect the level of risk of the project across its lifespan. Continuous monitoring can also indicate early to the insurer when there is a loss event and thus whether a claim is likely to be made.

3. Using standards, certified third-party auditors and ratings agencies

Standards, third-party auditors and ratings agencies are necessary, to provide a neutral commentary and assessment of the project. This helps insurers to avoid conflicts of interest, when determining whether a claim can be made.

How ratings and insurance could interplay in the future

Insurance could boost ratings. In the fixed income market, credit enhancement can be enabled through bond insurance. As a result of the insurance, the risk profile of the credit is reduced and therefore the rating can be improved. Once ratings become proliferated throughout the VCM, the same could happen in this market.

Ratings support facilitating insurance. In the fixed income market, bond insurers tend to only insure securities which have underlying ratings in what is known as “the investment-grade category” - usually between ratings BBB to AAA. The ratings analysis from the established credit ratings such as S&P and Moody’s has become a central tool for risk analysis for the insurance companies. This precedent is likely to be followed in the future VCM as the market scales.

Figure 8: The roadmap to integrity for the carbon removal market

03 What needs to be done

MRV, ratings, and insurance are pillars for integrity in this emergent market. To unlock its full potential for growth, all three will be necessary. But, two steps need to be taken to facilitate this: improving understanding, and boosting transparency.

1. There needs to be increased understanding of MRV, ratings and insurance in the carbon removal market.

To ensure that these nascent methods and their carbon credits are delivering what they claim, robust monitoring, reporting, and verification is needed. This means that the accounting and auditing systems need to be developed and given credibility. To scale, MRV must be backed up with observable data relying on proven methodologies.

There is still a long way to go to improve MRV readiness amongst carbon removal solutions. As BeZero Carbon’s Scalability Assessment for Carbon Removal uncovered, all methods assessed - Bio-energy with Carbon Capture & Storage (BECCS), Biochar, Direct Air Capture (DAC), Enhanced Weathering, and Ocean Alkalinity Enhancement - have barriers when looking at MRV readiness.

Some carbon removal methods have particular barriers. Ocean Alkalinity Enhancement is a method with acute issues, due to its low technology readiness level and reliance on computational modelling for MRV. Even some of the more mature technologies in the engineered carbon removal space, such as BECCS and DAC, have some barriers to scaling, exemplified by the fact that no established methodologies exist on the key VCM registries.

The role of carbon credit ratings also remains insufficiently understood in the carbon removal market. To date, just 11% of BeZero Carbon Ratings are for removal projects. Of these, none are engineered removal projects. This is due to the inability for projects to fit the eligibility criteria for the BeZero Carbon Rating. Given the high price-point of carbon removal projects, the ability to demonstrate their quality through a rating should be attractive.

The same can be said for insurance. Carbon-specific insurance is still deemed novel to many market participants. If carbon removal market participants are aware of the insurance products available to them, and how to enable insurance, this risk management mechanism could become a standardised procedure within the market. This would allow the growing carbon removal market to manage risks more effectively, saving costs and reducing risk transfer between parties.

Developers and intermediaries alike need to be educated on the process and benefit of these three pillars of integrity in the market - MRV, ratings and insurance. Without these basic market mechanisms being developed, the market is in danger of losing credibility.

2. Transparency from developers needs to improve.

Transparency is the cornerstone of any well functioning market. In order to build confidence in the carbon removal market, people need the information and tools to make informed decisions.

The carbon removal market is currently too opaque. The vast majority of engineered carbon removal projects in the market are currently in the BeZero Carbon Rating and uninsurable due to their insufficient levels of public data. If projects are to be accredited, rated and insured - three crucial tenets for scaling this market - they will need to publish data points such as: issuances, retirements, crediting period, risk buffer etc.

MRV systems are integral to creating and maintaining the data that will need to be used for accreditation, rating and insurance. Without the work to develop methodologies and monitoring systems, by organisations such as DNV, the data will never exist in the first place to allow market stakeholders to understand what these credits mean.

One solution to this is BeZero Carbon’s public Carbon Accounting Template, which is applicable for the whole VCM. Currently, public reporting lacks consistency in format and structure across standard bodies and project types. This template is a simple tool for all project developers to make disclosure faster, and easier to assess.

Without this kind of transparency, efficient risk allocation and price discovery will be unable to happen in this market, stifling the chance for ratings and insurance to take hold. In turn, the perception of a carbon market lacking in credibility, a narrative that has prevented capital flowing to carbon removal solutions at scale, will continue to be perpetuated.

Conclusion

The carbon removal market is nascent, with few tools currently available to give policymakers and investors certainty. To unlock the growth necessary for billion tonne scale carbon removal by the mid-century, the market needs to enable three core pillars of integrity: MRV, carbon ratings and carbon insurance.

Figure 9: Pillars of integrity in the carbon removal market

Some of the views expressed in this article are those of Kita and do not necessarily represent the opinion of BeZero Carbon.

References

¹State of Carbon Dioxide Removal, 2023