Why does engineered carbon removal need ratings?

Contents

Introduction

The deployment of engineered carbon dioxide removal (CDR) at a gigatonne scale per annum is ‘unavoidable’ in every scenario in which the world achieves net zero, with around 10 billion tCO2 of removals likely to be required each year by 2050.¹

This critical sector is nascent but has begun to show early signs of maturing. Ever-growing numbers of projects are becoming operational and starting to issue credits, and in September BeZero published an industry-first CDR rating for a biochar project - the first for any ex post CDR project. BeZero has also built two first-of-a-kind assessment frameworks for evaluating carbon removals with the Scalability and Durability assessments. Investment is also continuing to pile into ex ante credit purchases from projects which are still in the developmental stage, with more than 4 million such credits sold in the past year. ²

Although the sector is growing, an enormous scale-up is still required. Estimates anticipate that demand for CDR will grow to 40-200 Mt/CO2e per year by the end of this decade.³ At present, engineered CDR removes just 61,000 tonnes of CO2 per year. Therefore meeting the projected demand will require annual deliveries to increase by 655-3,300 times by 2030.⁴

Ratings will be vital to helping the sector meet this challenge. Over the coming years, they will be a catalyst for the growth of the sector by driving demand for CDR credits, helping to unlock finance for new or early-stage projects, and improving confidence and trust in the voluntary carbon market.

Ratings for CDR and CDR credits

Carbon ratings are independent assessments of the quality of a given carbon credit. For example, the BeZero Carbon Rating (BCR) represents BeZero’s view on the likelihood of the credit actually achieving what it claims it will do: removing or avoiding one tonne of carbon for a given period of time.

What is an ex ante rating?

A private ratings report using both private and publicly available information to feed into the assessment.

Projects can receive an ex ante rating at any stage of the project origination lifecycle (design, implementation, and pre-issuance).

The scientific due diligence for ratings reports are carried out by BeZero's 80+ strong science team.

What are the use cases for engineered CDR?

Developers: fundraising for equity investment, selling offtake/pre-purchases, marketing benefit.

Investors: Due diligence for investment, Pricing risk & cost of capital for project finance/ debt allocation.

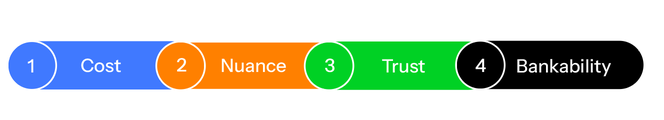

Carbon ratings such as the BCR have an essential role in helping the CDR sector to scale at the rate required. There are four key areas in which ratings will add value:

1. Cost

The inconvenient truth is that, at present, all engineered CDR methods are expensive. As a result, the sector is not currently cost-competitive with other carbon credits, such as those from nature-based removals or avoided emissions. For example, direct air capture credits are priced between $320 to $2,050 per tonne and biochar credits are priced between $100 and $590 per tonne. These credits are typically many times more expensive than those from nature-based removals, which generally cost between $3 and $50 per tonne. This price differential is likely to limit demand for CDR and could be a key barrier to scaling.

Ratings can help to overcome this problem. Buyers are increasingly seeking to purchase high-quality credits in order to reduce risks to their reputation and fiduciary obligations. By independently assessing the quality of different carbon credits, ratings are helping buyers to make informed decisions on which credits to purchase. This is now driving an emerging alignment between the price and quality of carbon credits available on the market.

CDR projects frequently claim that they will produce high-quality carbon credits, because of a high degree of additionality, measurability, and low non-permanence risk. If CDR projects do indeed produce high quality credits, then ratings will be integral to these projects justifying their high price point. Buyers will understand that the higher prices for CDR credits are reflective of their quality relative to other credits available on the market, and are likely to be more willing to pay these higher prices in return for the reduced risks associated with them.

2. Nuance

Within the carbon credit market, there is a wide variety of different project types across the removals and emissions reductions and avoidance sectors. There are fundamental differences between project types, and even between projects of the same type, which can make it difficult for buyers to compare credits and to understand their fungibility. However, ratings allow buyers to compare projects across the entire carbon credit market. This will be essential to helping buyers better understand CDR credits and how they differ to others available on the wider market.

As the CDR sector continues to grow, buyers will have an increasing number of projects to choose from. It will therefore become increasingly important for buyers to understand the nuances between individual CDR projects and methods, in order to make informed decisions on which are best suited for them to invest in. Key areas in which ratings can assist buyers in this process include:

Additionality. CDR is generally considered to be highly additional due to the high costs involved, but this may not always be the case. The founding principle of a carbon credit is that the removal activity would not occur in the absence of carbon finance. However, some CDR projects may have alternative revenue streams accessible to them, such as the sale of the energy generated through BECCS or the utilisation of CO₂ captured from a direct air capture facility. Rather than taking it as a guarantee, the ratings process instead requires CDR projects to demonstrate additionality through their financial analysis. This enables buyers to better understand how the additionality risk compares between different projects.

Non-permanence risk. Some projects will store carbon more durably than others, with a lower risk of reversal and stronger contractual measures in place to reduce risk. BeZero’s ratings evaluate the likelihood of a credit achieving a tonne of carbon removed over the duration of its commitment period, a risk evaluation closely linked to the physical durability of the carbon storage (see our Durability Assessment for more detail).

Carbon accounting. A growing number of methodologies are being published detailing how registries certify and issue credits for different CDR methods. For some CDR methods there are multiple methodologies available. For example, methodologies for biochar have been published by Verified Carbon Standard, Puro.Earth, and the European Biochar Certification C-Sink. The carbon accounting frameworks under these methodologies vary, and often the robustness of the carbon accounting comes down to how the project developer has applied a methodology than the methodology itself. The quality of credits is therefore not uniform across all projects covered by a methodology. Ratings are therefore needed to unpack the nuances in carbon accounting for individual projects.

In addition, these methodologies are binary. The assumption is that a credit issued under a methodology represents exactly one tonne of carbon removed. This is not always the case. Instead, ratings help buyers to comprehend these accounting frameworks and to better understand how robust the carbon accounting is for each project. By evaluating how the project developer applies the methodology from the bottom up, ratings make it possible to understand whether this application presents a risk of over-crediting or leakage.

Execution risk for ex ante projects. Most CDR methods are relatively novel and some are still in the very early stages of development. The majority of projects are therefore still in development with very few operational and issuing ex post credits.

Every ex ante project will face a different level of project execution risk: the risk that a project fails to go ahead as planned. This risk is influenced by a wide range of factors, including the technical and financial risks facing a project, the experience and expertise of the project developers, and any relevant political or regulatory risks. The different technologies, supply chains, and teams behind each ex ante project mean that each will face a different level of execution risk. By evaluating the execution risk, ratings will be indispensable in helping prospective buyers evaluate the relative risk that different ex ante projects might fail before reaching issuance, and therefore not deliver on their purchases.

3. Trust

Trust and confidence in the Voluntary Carbon Market (VCM) is lacking at present. A wide spectrum of quality exists and media investigations have resulted in some projects receiving significant criticism for failing to deliver on their claims. Buyers are therefore increasingly wary of the reputational risk that investing in poor-quality credits can pose to them and, as a result, the growth of the VCM has halted in recent years.

For CDR, the issues faced by the wider VCM are compounded by the fact that CDR remains a nascent sector - one which is not yet well understood by buyers. As a result, most CDR credits are still purchased bilaterally, through agreements negotiated directly between suppliers and consumers. If the sector is to scale, it is likely that the VCM will need to become the dominant source for CDR transactions.

It is therefore essential that trust is restored to the VCM. BeZero’s ratings can help to achieve this in two ways:

Ratings develop trust in the market by enabling buyers to better understand the quality of credits available on the market and to avoid investing in those which are unlikely to deliver on their claims.

Ratings increase transparency across the market. For ex post credits, our headline letter ratings and ratings summaries are made publicly-available, free of charge, and we require projects to meet strict qualifying criteria before they become eligible for a rating.

4. Bankability

CDR is still a nascent industry populated by many start-ups and utilising a range of novel and emerging methods. As a result, the sector relies almost entirely on venture capital for small-scale pilot projects. If the industry is to scale at the pace required, there is a need for developers to raise the necessary finance for larger projects as soon as is feasible.

However, only a limited number of lenders are willing or able to fund such projects at present. This is because the appropriate mechanisms for these lenders to price and manage risk, and therefore the cost of capital, do not yet exist. The early-stage nature of most CDR projects means it is also difficult for developers to demonstrate their “bankability” and to attract the investment they require.

Ratings for CDR projects will help to address this issue by providing a crucial tool for these lenders to better understand the risks associated with a given project, and thus better price the cost of capital. It also follows the precedent set by financial ratings agencies, who undertake project finance ratings. In addition, it reduces the need for investors to undertake as much due diligence in house, which both incurs additional costs and requires relevant expertise.

Venture capital is vital in kickstarting the development of new technologies and approaches, but it is project finance that will really help to accelerate CDR along its developmental S-curve. Ratings can help unlock this next stage of financing. In turn, this will stimulate further demand and further accelerate CDR’s scale-up.

Further information

BeZero Carbon is the leading ratings agency for the engineered carbon removal sector. We are the only ratings agency to have published ex post CDR ratings, which are publicly available on our website (find out more about our industry-first Biochar rating here). Our ratings are not specific to particular methods and our team is able to rate any kind of CDR project, at any stage of development.

Interested in commissioning a rating for a CDR project? Please contact commercial@bezerocarbon.com.

References:

¹ IPCC, 2022, Mitigation of Climate Change. Summary for Policymakers, pg. 36.

² Cdr.fyi data

³ Boston Consulting Group, 2023, Climate Needs and Market Demand Drive Future for Durable CDR

⁴ Cdr.fyi data