How our platform helps companies deliver credible claims

We are delighted to introduce a risk-adjusted portfolio tool to our platform, enabling our customers to construct credible carbon credit strategies that align with their net zero priorities.

Using our risk-adjustment framework, the portfolio tool allows customers to analyse their carbon credit portfolios and calculate how many credits of a given quality they would need to purchase or retire to make a credible carbon claim.

This cements BeZero as the only full-service agency to provide an end-to-end toolkit to allow customers to assess risk at any stage in a project’s life cycle, and across any sector: from pre-issuance tools such as our newly released Checklist, Issuance Risk Monitor and ex ante ratings framework, to ex post ratings, and portfolio building and monitoring features.

Applying discount rates to the BeZero Carbon Rating

At present, when a buyer retires a credit and makes a claim against it, each credit is assumed to equal a tonne of CO2e. However, as our ratings show, not all credits are created equal, exposing end-buyers to greater risks when making tonne-based carbon claims.

To overcome this, BeZero published a first-of-its-kind discounting methodology, setting out how risk-adjusting can be used to make credible net zero claims when buying and retiring credits. You can read our blog for an explainer on risk-adjusted tonnes.

BeZero also consulted with industry stakeholders across the voluntary carbon market to address critical questions on our discounting framework, which will continue to reflect new data and research when it becomes available. This practical application of our framework specifically helps bridge the gap between the credits on offer in the market and the tonne-based claims buyers are seeking to make.

Calculate risk-adjusted carbon credits - a step-by-step guide

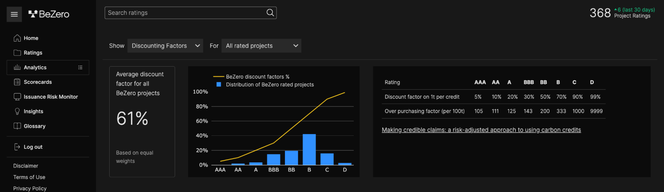

The risk-adjusted portfolio is available on our platform and can be accessed through the Analytics page. This tool allows you to view the over-purchasing factors based on your portfolio’s holdings and build a risk-adjusted version using those figures.

When you first access the page, you can benchmark the average discount factor for your portfolios and all BeZero rated projects.

Download a spreadsheet to see your projects, input your target offsetting amount and holdings, and it will show you your credit shortfall.

From this, you can check each project’s risk-adjusted tonnes, and work out the number of credits to over-purchase in order to reach your target goal and make quantitative carbon claims.

Understand the macro factors that affect a project's carbon performance

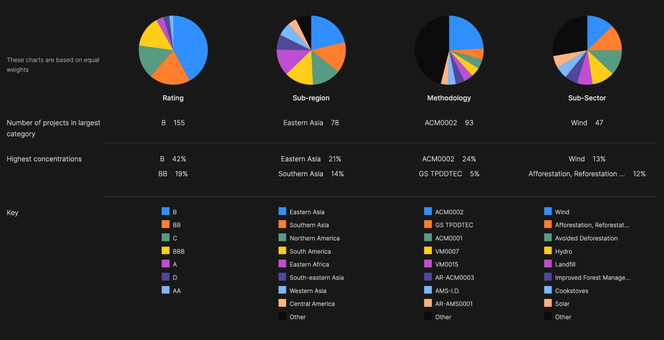

You can also assess the diversification of your holdings across various categories and minimise risk by seeing where your portfolio is most exposed.

Our dashboard looks under your credit portfolio’s hood, helping you understand where your credits hold the most risk.

To ensure a given claim is not overly exposed to changes in a single credit’s risk profile, the best practice is to build a portfolio that is diversified across these different categories.

Our suite of portfolio tools provides customers with greater confidence in the use of carbon credits, helping them build credible carbon credit strategies that align with their net zero priorities.

Further material on risk-adjusted portfolios

Our white paper outlines the current framework for building risk-adjusted portfolios

Our explainer on risk-adjusted tonnes

Our blog outlining a hypothetical, net zero aligned carbon portfolio

A replay of our webinar on risk-adjusting, featuring a guest speaker from Vertree

A recap of key debates from industry stakeholders on our discounting framework

Get in touch with our team at commercial@bezerocarbon.com for any questions or demo requests.

N.b. The risk-adjusted tool is for information purposes and for your internal use only. It does not constitute a solicitation, recommendation or endorsement by BeZero Carbon or any third party to invest, buy, hold or sell a carbon credit and/or to invest in a specific project and doesn’t warrant any project performance in the future. Under no circumstances, including but not limited to negligence, shall BeZero Carbon or its affiliates be liable for any direct, indirect, incidental, special or consequential damages arising out of or connected to the use of the risk-adjusted tools by you, even if BeZero Carbon has been advised of the possibility of such damages.