A guide to rating forestry projects in the Voluntary Carbon Market

BeZero has assigned ratings to over 100 forestry projects, both avoidance and removals, accounting for nearly one third of all rated projects. You can download our sector-specific methodologies on Avoided Deforestation¹ and Afforestation, Reforestation & Restoration² to learn how these support our universal ratings methodology.

The brief guide below highlights some of the research and thinking behind our approach to rating forestry projects.

Contents

- What is a forest?

- What are the main types of forestry projects?

- What is the current market context for Forestry credits?

- Where do Forestry ratings sit on the BeZero Carbon rating scale?

- How do we assess carbon quality in Avoided Deforestation projects?

- How do we assess carbon quality in Afforestation, Reforestation & Restoration projects?

- What drives non-permanence risk in Forestry projects?

- How can non-permanence risk in Forestry be mitigated?

- Dig deeper on our platform

What is a forest?

A simple question on the surface, yet an oddly difficult one to give a definitive answer to. At the crux of the problem is the fact that different countries define forests in different ways. Factors such as tree height, canopy cover and even politically motivated land use classifications influence forest definitions.

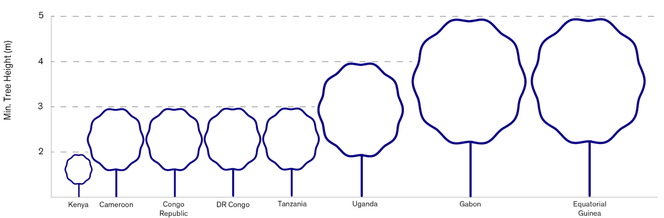

Tree height (m) for a selection of countries as per their national forest definitions. Source: Forest definitions risk carbon confusion.

A 3 metre tree with 10% canopy cover ticks the forest box in Papua New Guinea, but doesn’t make the cut in neighbouring Indonesia (5 metre and 30%, respectively). These discrepancies create greenhouse gas accounting challenges in the context of Nationally Determined Contributions, and may potentially influence carbon credit trading under Article 6 mechanisms.

Fundamentally, the lack of a globally agreed definition of forest and associated monitoring tools creates the potential for varying estimates of forest carbon, with deep implications for over-crediting risk.

What are the main types of forestry projects?

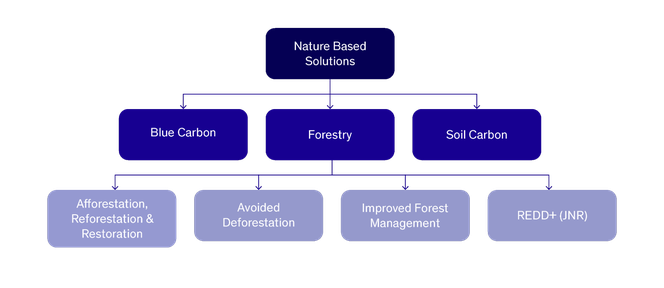

Forestry projects involve forest conservation or expansion, increasing sequestration potential and associated carbon stocks.

In the BeZero Sector Classification System, there are four sub-sectors within the forestry category. These are Afforestation, Reforestation & Restoration; Avoided Deforestation; Improved Forestry Management; and REDD+ (JNR).

What is the current market context for Forestry credits?

As of end June 2023, Forestry is the largest sector of the overall Nature Based Solutions (NBS) sector group, with 661 million credits or 88% of NBS total issuance to date. While the first half of the year saw a slowdown in Forestry credit issuance, the longer term trend looks more bullish: compared to H1 2018, issuance grew by 164% over the H1 2023 period.

Demand for Forestry credits later in the year could be catalysed on the back of changes to a key REDD methodology by the market’s largest accreditor, Verra. Questions about the carbon efficacy of reduced emissions from deforestation and degradation (REDD) credits have been a major topic this year. This has shaped wider market opinion about forestry projects and even the integrity of the wider VCM.

Verra will be updating its existing VCS Avoiding Unplanned Deforestation and Degradation (AUDD) project methodology to a more consolidated approach. Expected changes include revising deforestation projection techniques, standardising the duration of historical reference periods, and revising methods for producing conservatively estimated baselines. The new methodology - set to be released in Q3 2023 - could mark a notable shift in the perception of credit quality within Forestry projects.

Where do Forestry ratings sit on the BeZero Carbon rating scale?

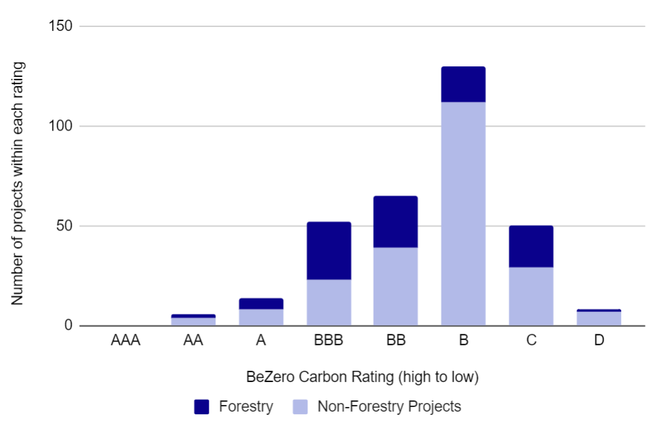

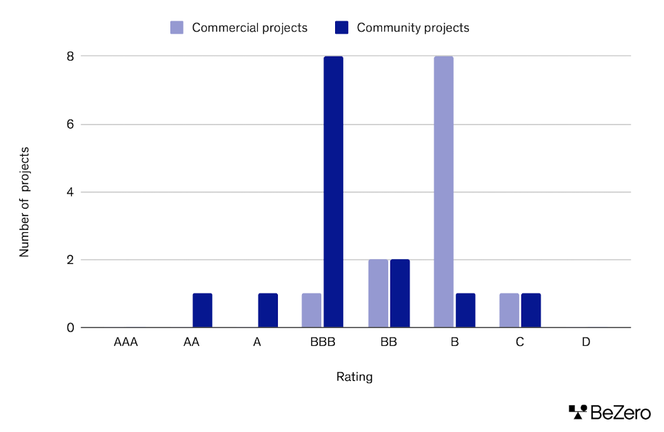

Most projects from the Forestry sector that have been assigned a BeZero Carbon Rating are rated BBB, representing a moderate likelihood of achieving 1 tonne of CO2e avoided or removed. However, ratings do vary between AA - a very high likelihood - to D - a very low likelihood (as of 10 July 2023).

Ratings distribution of BeZero Carbon Ratings for Forestry projects and non-Forestry projects, as of 10/07/2023.

How do we assess carbon quality in Avoided Deforestation projects?

To date, Avoided Deforestation is the largest sub-sector in the VCM, making up 353 million credits, or 47% of total credit issuance within the Nature Based Solutions sector group. It has also been the fastest growing sub-sector over the last five years (H1 2018 vs H1 2023), growing by 616% in terms of half year issuance (from 11 million to 37 million credits).

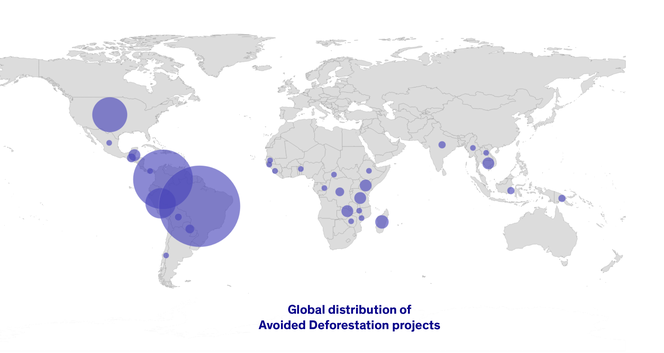

There are 135 Avoided Deforestation projects across the BeZero sector classified database, distributed across 32 countries, with projects primarily located in Brazil, Colombia, and the USA.

The global distribution of Avoided Deforestation projects within our sector-classified database. Circle size indicates the relative number of projects in each country.

To supplement our universal methodology for rating all carbon project types, BeZero has published a sub-sector specific Avoided Deforestation methodology which represents our analytical approach to assessing specific risks in the largest sub-sector of all NBS projects in the VCM. Over 50 ratings analysts, climate scientists, geospatial experts and data scientists contribute to the analysis and design of models behind every single BeZero Carbon Rating.

How do we assess carbon quality in Afforestation, Reforestation & Restoration projects?

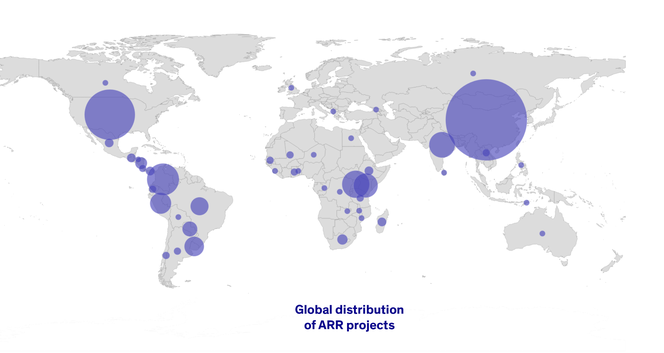

With 58 million credits issued to date, Afforestation, Reforestation & Restoration (ARR) represents 8% of issuance within the Nature Based Solutions sector group, and 3% of total VCM issuance. It was the second fastest growing sub-sector over the last 5 years (H1 2018 vs H1 2023), growing by 180% in terms of half year issuance.

The global distribution of ARR projects within our sector-classified database. Circle sizes indicate the relative number of projects in each country.

The purest form of carbon removal within the forestry sector, the ARR projects we've assessed tend to rate higher than average compared to the wider universe of BeZero rated projects. ARR projects are highly diverse in their methods, operations and incentives. An instructive way to distinguish ARR project types is splitting them out into two categories: commercial plantations versus community-based tree planting.

Our ratings analysts and geospatial scientists recently used this distinction to provide case studies for two risk factors - additionality and non-permanence - which vary the most in BeZero Carbon Ratings across ARR projects. They explain why community-based ARR projects often have higher ratings than commercial ones.

Ratings breakdown of commercial versus community projects rated by BeZero within the ARR sub-sector (as of 09/05/2023).

Supporting our master ratings methodology which allows for a universal and fungible assessment of carbon projects across sectors and locations, BeZero has published a sub-sector specific ARR methodology. This detailed document contains examples of applied research in action as well as the analytical toolkit required for assessing project-specific and sub-sector specific risks in ARR projects.

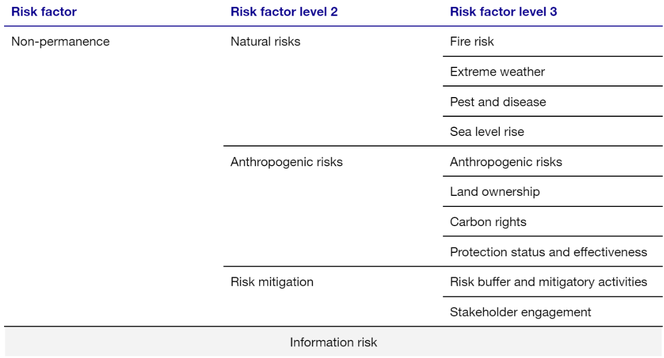

What drives non-permanence risk in Forestry projects?

Sub-components of our assessment of non-permanence risk in the Forestry sector are summarised in the table below.

We also take into account the impact of forest degradation on carbon emissions. A recent study published in Science Magazine and co-authored by BeZero scientist Dr Camila Silva reveals that the extent of forest degradation in the Amazon may exceed that of deforestation, bringing about as much biodiversity and carbon loss as deforestation itself.

Only a small minority of projects adequately address the second ‘D’ in REDD. For example, among 17 Amazonian REDD+ projects with a BeZero Carbon Rating, only four account for carbon emissions from forest degradation in their credit issuance.

At BeZero, we consider each of these disturbance mechanisms in our approach to carbon ratings, as well as the underlying drivers: demand for land and resources, governance, demography, and climate change.

We are controlling for edge effects in our statistically-matched dynamic baselines and monitoring fire and drought across all nature-based carbon projects. We are also working through international partnerships to advance scientific understanding of how carbon and biodiversity are impacted by disturbance.

How can non-permanence risk in Forestry be mitigated?

Risk buffers are designed to mitigate the risk of reversals in carbon projects. However, in our view, they fall short of providing adequate system-wide insurance of the risks posed. In our deep-dive on buffer pools, we highlight three key factors where more work is required to provide broader insurance products to help scale the market:

Project-specific risk assessments vary considerably across registries, meaning buffer pool contributions may not always match the risk profile of the project.

How the risk buffer is practically used in the case of reversals varies across registries and is not always clear from public disclosures.

Market participants need more sophisticated tools that better model risks and match the payouts to the losses in case of any reversal events

To bring credits to the VCM, projects must regularly demonstrate their emission reductions or removals through monitoring, reporting,and verification (MRV) events. As part of this process, across the four largest Standards Bodies in the VCM, third-party auditors and project developers work together to ensure projects are adequately adhering to Standards Bodies’ methodologies.

MRV provides an integral mechanism for independent checks and balances, which increases the likelihood of credit quality. Standards Bodies have various MRV governance mechanisms and in certain cases, nature-based projects deviating from minimum MRV requirements have a portion of their buffer pool credits placed ‘on hold’.

At present, Verra is the only Standards Body that ‘holds’ buffer pool credits as a form of enforcement for MRV for NBS projects. We find that 28 projects currently have circa 1.2 million buffer credits on hold. We identify at least 33 nature-based projects in the broader voluntary carbon market (VCM) which deviate from the minimum MRV frequencies, specifically under Verra (24 projects). However, we observe that several projects have not yet placed buffer credits on hold, with up to 28,917 credits with high potential to be placed on hold.

Hold status of buffer credits is one of the most transparent and direct forms of MRV enforcement in the VCM. This mechanism offers a quantitative signal to the market on buffer credit risk and plays an important role in ensuring credit quality and reducing non-permanence risk associated with NBS projects on the market.

Dig deeper on our platform

As a platform user, you can find everything you need to know about Forestry projects, all in one place. In just a few clicks, you can find projects filtered according to your needs (e.g. by location, sub-sector, rating, methodology…etc) and compare them between one another.

Ratings distribution charts can provide a snapshot of carbon quality within specific sub-sectors such as Avoided Deforestation and ARR, and users can even make comparisons at individual risk factor level. For instance, you can easily compare over-crediting risk across Amazonian REDD+ projects, or gauge additionality within ARR projects in West Africa.

The BeZero Carbon Markets platform hosts detailed risk assessments behind >100 Forestry project ratings, including interactive charts supporting the analysis. You also benefit from regular research, insights and exclusive webinars, as well as powerful analytics to help benchmark your carbon portfolios against other project groups.

You can access to interactive geospatial maps and tools which leverage the most reliable reference set of audited project boundaries in the VCM, manually checked or reconstructed by BeZero. You can explore project boundaries for all our rated NBS projects, including leakage belts, reference regions and key biodiversity areas.

They can also monitor forest cover and loss with our new Global Forest Change tool which leverages a well known, globally consistent dataset that provides coverage across all regions. It is one of a number of forest change datasets used judiciously in our ratings, to understand trends in forest cover and resulting carbon risks for nature-based projects.

Forest loss mapped for the Tumring REDD+ project in Cambodia (VCS 1689). Since the project started in 2015 through to 2022, half of the initial forest extent has been cleared. Our in-house models (to 2023) confirm this trend of accelerating forest loss. Project accounting area reconstructed in-house by BeZero. BeZero Carbon Rating correct as of 11/07/2023.

References:

Source for credit issuance data: American Carbon Registry, Climate Action Reserve, Gold Standard, and Verra (the four largest Standards Bodies in the VCM), reflecting a sample of 5,989 projects for which BeZero has individually assessed sector classification. These circa 6,000 projects reflect 97% of total VCM issuance. Data as of July 2023.