How Emirates NBD built a leading carbon trading and advisory desk using third-party ratings

What they said

Accelerated setup of a one-stop shop for all things carbon, including project finance, spot trading and bespoke advisory solutions

Boosted customer trust by integrating independent, science-based risk assessments of carbon projects

Fulfilled growing demand from corporations to manage their carbon offsetting and align with the UAE’s Net Zero by 2050 initiative

Vijay Bains, Chief Sustainability Officer and Group Head of ESG Emirates NBDAt Emirates NBD, we are committed to support our customers' environment journey through our sustainable financial practices and always look to improve our capabilities to support our clients. Our partnership with BeZero has enabled us to offer more transparency into the products and investments. BeZero’s reputation as an independent ratings agency also boosted customer confidence to operate safely in carbon markets.

Challenge

Amid increased scrutiny of organisations’ climate claims, incorporating high-quality carbon credits as part of a credible decarbonisation strategy is essential. Nowhere is this more pertinent than the MENAT (Middle East, North Africa, and Türkiye) region, traditionally known for its abundant hydrocarbon resources and energy-intensive industries, contributing around 5% of the world’s carbon emissions annually. While small in absolute terms, the region’s emissions intensity and growth rates are among the highest in the world. Emirates NBD, a leading banking group in the MENAT region, and a regional leader in carbon credit trading and advisory, is addressing the growing demand from corporates to manage their carbon footprint with confidence. To help their customers address their residual emissions and align with the UAE’s Net Zero by 2050 strategic initiative, Emirates NBD sought a way to reliably identify and procure high-quality credits globally.

BeZero platform

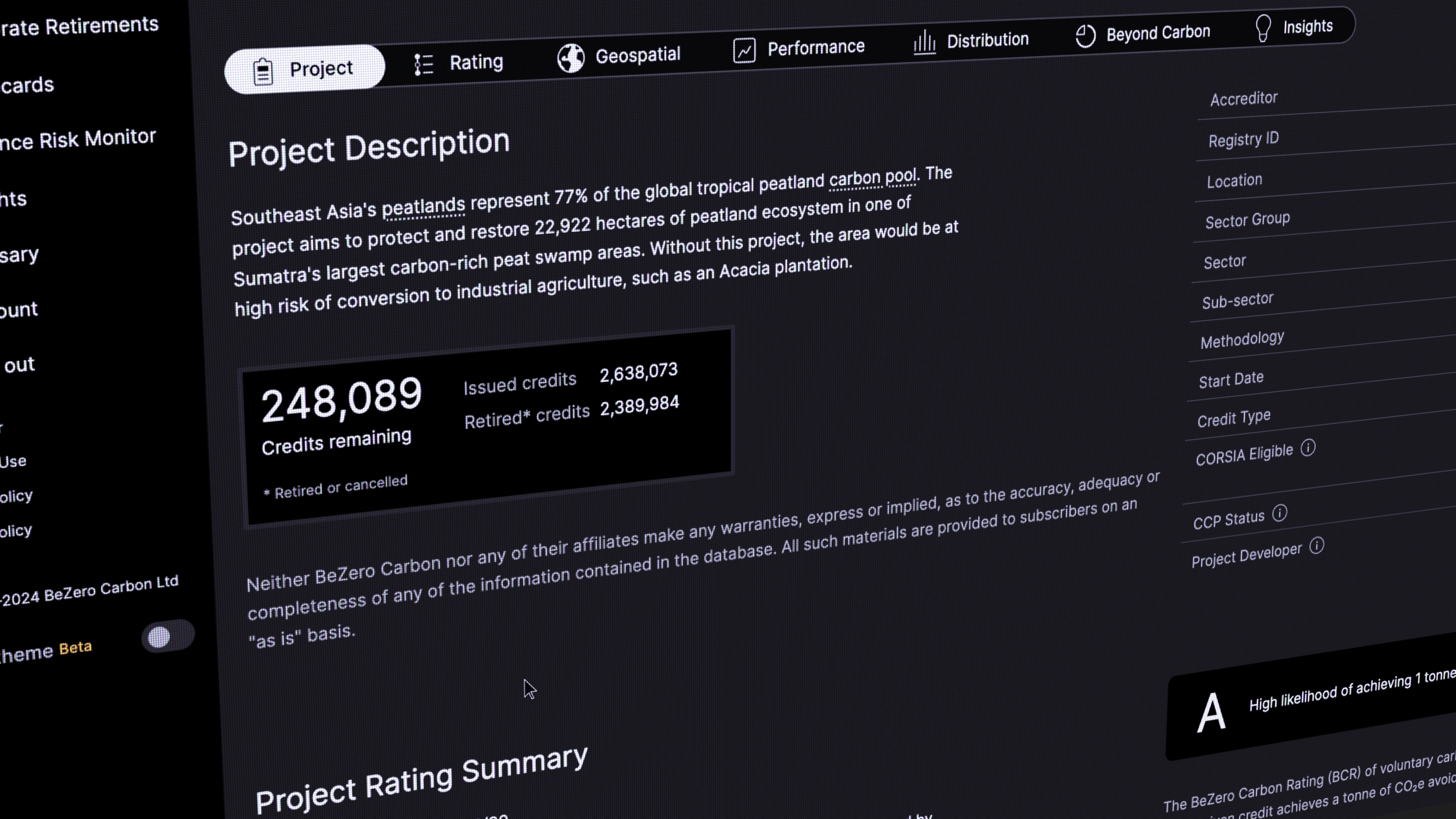

Emirates NBD became the first bank in the UAE to partner with an independent carbon ratings agency. To accelerate the setup of their new carbon trading desk, the bank leverages BeZero’s ratings platform which hosts essential data and risk analytics for thousands of carbon projects. This includes detailed analysis behind 480+ project ratings, screening, risk assessment and portfolio management tools, and hundreds of insights on all things carbon. The team also has direct access to BeZero’s analysts for deep dives on specific projects, sectors, or carbon market topics.

Impact

Using BeZero’s platform significantly enhanced Emirates NBD’s carbon credit trading and advisory capabilities. They report that time spent on credit due diligence fell considerably, freeing up resources to focus on sophisticated, bespoke solutions for their customers, from spot trading to project finance, to carbon hedging and more. BeZero’s reputation as a truly independent ratings agency also boosted customer confidence to operate safely in carbon markets. Knowing their investments have been rigorously vetted by an expert third party means their clients can take pride in their climate strategies, and credibly support the UAE’s Net Zero 2050 action plan. Furthermore, to select and retire high-quality credits to address the bank’s own emissions, Emirates NBD referred to BeZero’s science-backed ratings.

Carbon explored

Read about the latest insights, analysis and trends in global carbon markets.

Explore InsightsCarbon Markets in the Middle East and North Africa: cost or opportunity?

Examining the role of carbon markets in the MENA region, exploring the current state of the market, existing initiatives, and emerging opportunities

Why companies use ratings for carbon credit due diligence

Showcasing how climate leaders around the world make use of ratings as part of their carbon credit procurement