Update: why we placed Kariba REDD+ on rating watch

In light of Verra’s announcement that the Kariba REDD+ Project is being placed on hold, we are re-sharing our comment article from January 31st 2023 discussing the placing of the rating on 'rating watch'.

We placed Kariba on watch on the 31st of January 2023 in response to South Pole voluntarily suspending the sale of credits. Since then, the project has remained on watch while we await new information from either the project developer or Verra.

Verra has today (October 17th 2023) placed Kariba on hold. The original rating watch decision is consistent with this. At present, no new material information has been published by either Verra or the project developer. If this remains the case for 12 months after the original watch publication (January 31st 2023) we reserve the right to withdraw the rating.

Please note the article below was first published on January 31st 2023. Since then, the BeZero rating scale changed - please see here for more information.

Context

Recent reporting of the Kariba REDD+ project in Zimbabwe (VCS 902) implies the project may be markedly overestimating its baseline, and the carbon revenues it generates may not be reaching the project’s communities.

South Pole, who were involved in the development and is the main seller of credits from the project, responded by announcing it is suspending sales of unsold credits from current vintages (2019-2021), the combined sold and unsold issuance of which account for ~24% of the project's total credit issuance to date. This is an extremely rare event.

Today, we are placing VCS 902 on Rating Watch triggered by two events:

The exceptional decision by South Pole to voluntarily suspend the sale of credits.

The news that the project consultant, auditor and/or Standards Body may be aware of material non-public information regarding the project’s baseline and carbon stock data and the expectation that this may be released in coming weeks or months.

BeZero had a rating of AA+ for this project applied for vintages between 2011 and 2021.

In this note, we discuss the recent developments, and revisit why we assessed credits issued by the project as having a moderate likelihood of delivering a tonne of avoided carbon dioxide equivalent.

Please note, to date, BeZero has rated 12 projects developed by South Pole but VCS 902 is the only one affected by the announcement that South Pole is reviewing its REDD+ portfolio.

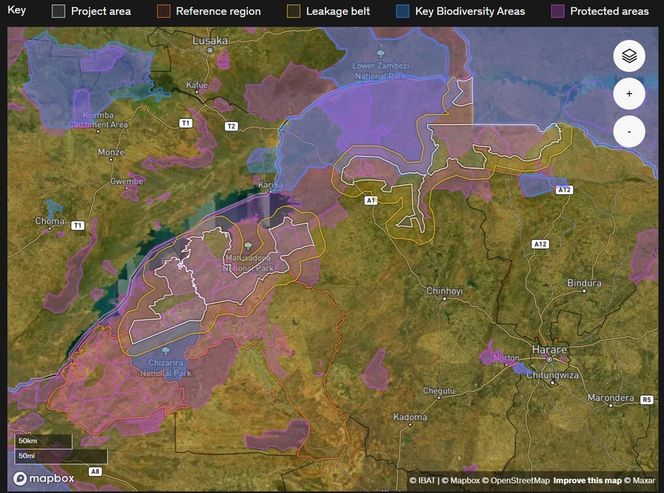

Chart 1. Situation of the Kariba REDD+ project in northern Zimbabwe. Map shows the project area, reference region, and leakage belt surrounding the project, as well as overlapping protected areas. © Mapbox.

Debate 1: Did Kariba set an appropriate baseline?

Data sources are not disclosed, but some of the evidence being cited in the media appears to rely on data from Global Forest Watch / University of Maryland, a commonly used global forest change dataset developed by Hansen et al (2013).

These data suggest that deforestation rates in the project’s reference region, an area used by the project to inform its baseline calculations, are much lower than the constructed baseline would imply, and have further decreased since the project started.

Whilst this information may be readily available, BeZero is of the view that Hansen data are ill-suited for monitoring avoided deforestation projects in African drylands (where VCS 902 is situated).

For example, for other REDD+ projects in African drylands (e.g. VCS 562 and VCS 612), the Hansen dataset misses the presence of forest almost entirely. In the case of VCS 902, forest is detected, but the reliability of change detection is limited.

Chart 2. African dryland forests within the project boundaries of VCS 902 in Zimbabwe (upper) and VCS 562 in Kenya (lower). In both landscapes, globally available forest change data have low accuracy. For VCS 902, the Hansen dataset likely overestimates forest cover and underestimates tree cover loss. Conversely, for VCS 562, the same dataset identifies no forest at all. In both cases, open canopies and high seasonality mean that reliable change detection requires extensive ground truth or manual delineation of individual tree crowns, coupled with high resolution seasonal time-series of satellite imagery. © Mapbox.

Our view was that the project had some risks of over-crediting.

This is because the project had so far reported zero forest loss in the entire project area. We considered this highly unlikely given the large size of the area and the fact that it is under threat from a variety of deforestation agents. This oversight likely results from the project relying solely on (potentially conspicuous) permanent sample plots to monitor change, due to the difficulties with satellite imagery in this region.

We also noted issues with the applied baseline, namely that it predicts almost complete forest loss in the project area within the crediting period of thirty years. This is common for the cumulative deforestation model applied under the VM0009 methodology, and is included in our top-down assessment across other projects that use the same approach.

However, when the project started, national deforestation rates in Zimbabwe had been increasing, and were close to the project’s baseline rate (2% per year versus 3% per year) at the time of the project’s inception.

Deforestation was particularly high in communal lands, such as the project area and reference region. Given subsequent deforestation trends, over-crediting risks are therefore likely higher for later vintages, which could potentially be countered in the renewed baseline (if applied retrospectively - see below).

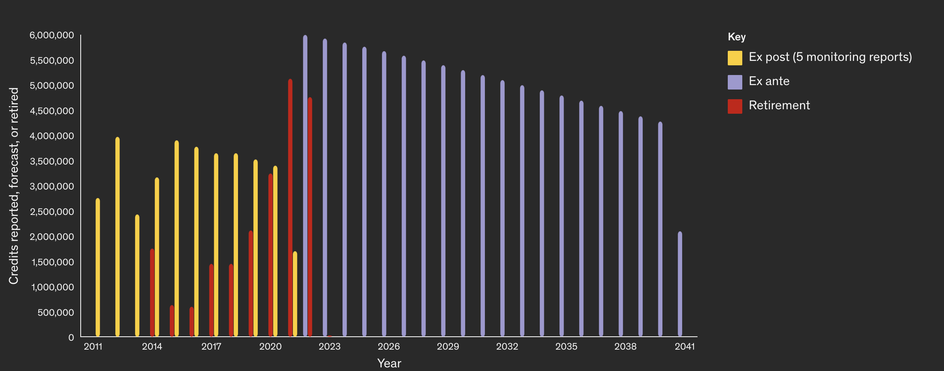

Lastly, we note that the project has to-date issued ~27 million fewer credits than was predicted ex ante. This is as a result of baseline emissions being reduced in ex-post estimations, which is likely a consequence of revised (lower) carbon stock estimates measured in the project area.

Debate 2: Does carbon finance reach the project’s communities?

The second issue discussed in recent public commentary relates to the distribution of carbon finance, and whether those involved in the project development and credit sales are withholding more of the revenue than has been publicly disclosed.

Project development documents state that 70% of generated carbon revenue is directed to project activities and participating communities, in order to ensure a fair allocation of benefits and maintain compliance with project goals. The remaining 30% is reported to be necessary to cover marketing and technical costs, including auditor and certification fees.

Interestingly, more generally, South Pole claims that it keeps 25% of the project’s revenue as commission and that the remainder flows back to the proponent, Carbon Green Investment (CGI), the project operating costs and the local people.

A key argument we found for the project’s additionality is the lack of significant alternative sources of income to offset the cost of project activities without carbon finance, or to overcome local opportunity costs associated with reduced reliance on forest land and resources. See our deep dive into Additionality.

Furthermore, public documentation (e.g. from the World Bank) suggests that South Pole was prepared to make up the difference from their own pocket in years when carbon credit sales were below what was needed to support project activities. This is somewhat supported by the chart below, which shows that the majority of credits have been retired in recent years.

We also find evidence that South Pole has been trying to act in good faith:

It could be argued that the decision to pause the sale of outstanding credits from recent vintages suggests the project is not seeking to continue to make revenues, despite no calls for suspension from the Standards Body.

In accordance with the methodology, if there were more credits issued prior to this baseline re-evaluation than what is predicted in the new model, no new credits will be generated until the later baseline reaches the same level of deforestation as previously predicted. This acts as a safeguard to prevent over-crediting across the project lifetime and can counter any potential over-estimations from recent vintages.

Chart 3. Carbon credits reported and forecast by the project (note this may differ from issuance reported on the registry) and retirements reported on the registry. Data are as of 30/01/2023 and support reports that credit sales were initially low. In these years, carbon revenues are claimed to have been directed entirely to project activities as these would not have been possible without financial support, bolstering additionality.

Our analysis did however identify some risks to additionality due to the fact that a number of project activities were still in development and that the identified drivers of deforestation may not have posed as much of a threat as believed. This would suggest that any avoided deforestation in the project area is not entirely a result of VCS 902.

Of course, if it’s true that the auditor, Standards Body and project developer/ consultant are potentially aware of misreported or outdated evidence to support their assessments, and this comes to light, we will revise our view on additionality and the overall rating accordingly.

What else do we consider in the rating?

Our full rating analysis is available for platform users, but we highlight a few key considerations below to add colour to our prior position:

One of the key drivers of our moderate view on Kariba REDD+ was the policy backdrop in which it was created. Back in 2011, Zimbabwe lacked a clear regulatory and policy framework for REDD+ and was characterised by ineffective coordination, unclear land tenure regimes and a lack of carbon ownership systems.

Deforestation rates were rising (reaching ca. 2% per year nationally by 2010) with the highest rates recorded in communal and resettlement areas, which this project takes place in.

We also found the project to have used a reasonable reference region and ground surveys to inform its baseline, given the challenges of remote sensing approaches at the time.

Our rating acknowledged that there is evidence that the rate of deforestation in Zimbabwe has stabilised or declined since the project’s inception.

What next?

The purpose of carbon ratings is to establish what a carbon project is claiming to deliver and then provide an independent assessment of the carbon efficacy of such claims.

Rating carbon projects relies on interrogating counterfactual (i.e. non-observable) scenarios, often for complex socio-ecological systems.

In the absence of new definitive data either way we will keep the project on Rating Watch until sufficient project disclosure, Standards Body intervention, or other credible third party datasets allow us to more definitively take a view.

At the same time, BeZero is currently investing heavily in developing targeted monitoring capabilities across different ecosystem types, both proprietarily and via research partnerships.

Our Geospatial and Earth Observation team have significant on-the-ground experience in African drylands, and are developing methods to accurately monitor forest dynamics in these complex landscapes.

Why Rating Watch is useful for the VCM

The use of Rating Watch is one of the many innovations BeZero has brought to the VCM borrowed from more mature financial markets. Our priority is to improve transparency and disclosure in the VCM to drive quality, standards and investment higher.

Our analysis is not a one-time assessment, it is dynamic and will continue to reflect the latest publicly available information and scientific advances. It’s therefore best practice to have an instrument to articulate that evolving reality.

Finally, we welcome that this approach is starting to be used by others operating in the market.