Vintage Based Ratings - Mind the Gap

We observe that these gaps can occur at any point across a project’s lifetime and are a significant risk to a project’s eligibility for a rating. Further, vintage gaps can also result in lower carbon ratings since the lack of transparency and disclosure is viewed as an information risk¹ , which can impact all parameters of credit quality or be reflected as double counting risk within over-crediting².

Here are some key takeaways

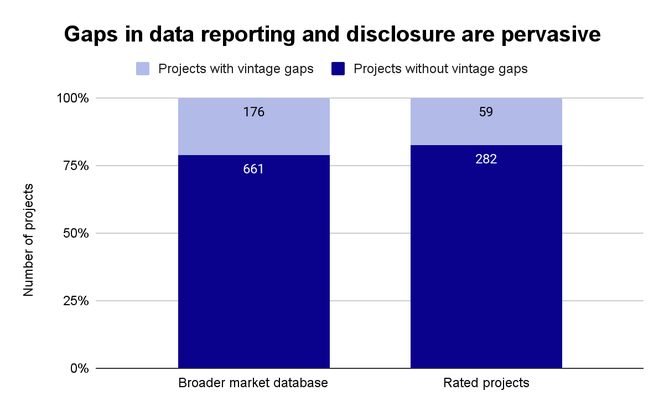

Vintage-based gaps in credit reporting are extensive in the voluntary carbon market (VCM). We find that 17% of the 341 BeZero-rated projects and 21% of the 837 projects on a broader market database have gaps in documentation and data disclosure.

In certain instances, these gaps in vintages create scope for double counting risk. BeZero’s data governance process identifies this risk in its vintage-based ratings approach.

These gaps extend into market-based credit labels such as CORSIA. For example, we note that 6% of BeZero-rated CORSIA-labelled projects present vintage gaps. Improved transparency and disclosure from projects and accreditation entities in the market are critical in eliminating vintage and data gaps.

Contents

- Vintage gaps within the BeZero Ratings

- Key drivers of vintage gaps

- Vintage gaps by sector

- Decline of vintage gaps

- Conclusions:

Vintage gaps within the BeZero Ratings

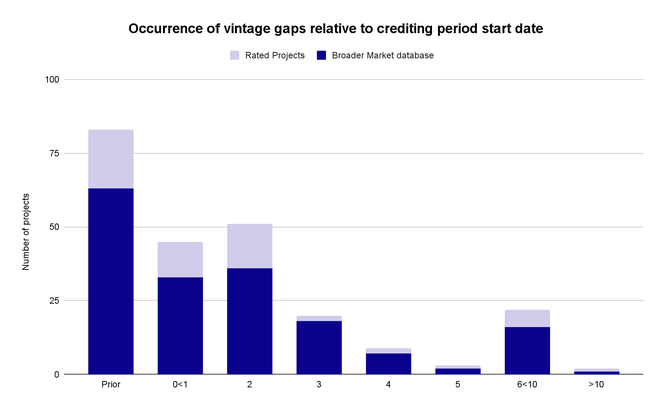

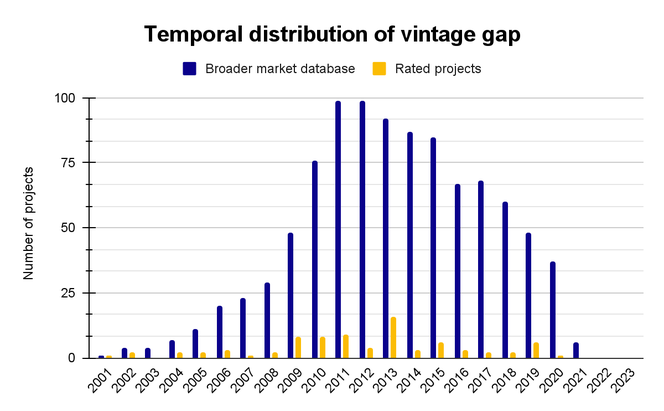

Of the 341 BeZero-rated projects, we note that 59 projects (17%) have vintage gaps, with many projects exhibiting gaps across multiple vintages. The pervasiveness of these data gaps increases to 21% in a broader market database of circa 837 projects for which BeZero has systematically standardised carbon accountancy parameters (Chart 1).

Chart 1. Vintage-based gaps in data reporting and disclosure are pervasive in the voluntary carbon market with up to 21% of projects indicating gaps.

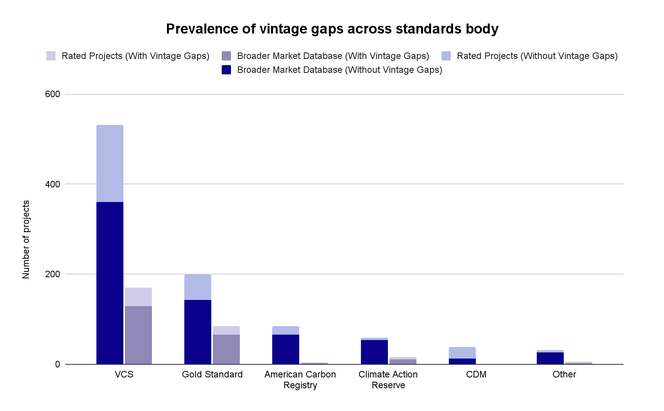

Across standards bodies, vintage gaps are most frequently observed within Verra and Gold Standard projects, comprising circa 58% and 27% of rated projects with vintage gaps respectively. This observation extends to our broader markets dataset, where of the projects with vintage gaps, circa 61% and 31% are registered with Verra and Gold Standard respectively (Chart 2). These data may also reflect the broader trend of higher project numbers and issuance for these two standards bodies. Further, the notable lack of vintage gaps within American Carbon Registry (ACR) and Climate Action Reserve (CAR) may be reflective of a more general lack of disclosure that impinges on all vintages and the eligibility for a rating.

Chart 2. Presence of vintage gaps by standards body as of 17/08/2023.

Key drivers of vintage gaps

There are four key underlying drivers that cause vintage gaps to issued ratings which include:

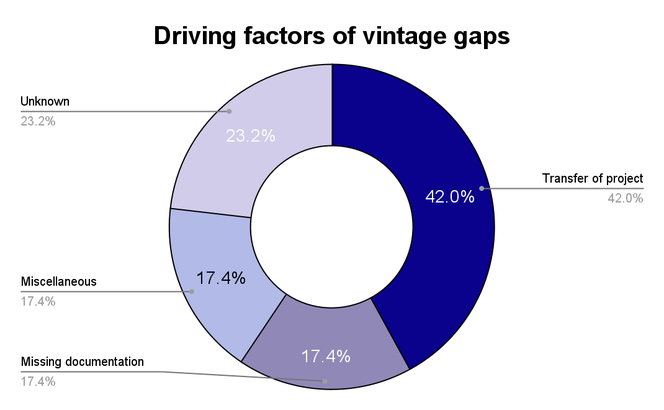

Chart 3. Four factors drive vintage gaps and of these, the most prevalent is project transfer across standards bodies. Data as of 17/08/2023.

1. Transfer of projects across standards bodies:

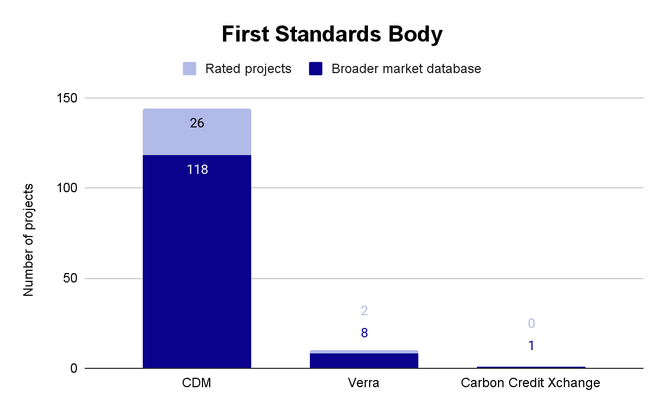

The most prevalent driving factor of vintage gaps (42%) is related to the transfer of projects between standards bodies. For example, in many cases, projects transfer from the Clean Development Mechanism (CDM) to standards bodies such as Verra and Gold Standard. In fact, in 93% of the 155 projects where transfer across standards bodies is observed as a factor, projects have been transferred from or to the CDM (Chart 4). This is because a lack of standardised credit reporting and fragmented reporting of credit cancellation during project transfers presents vintage gaps and also information and double counting risk.

Chart 4. Projects often transfer across standards bodies, with the most common first standards body being the CDM.

Projects may transfer from the CDM to other standards bodies to extend their crediting period and this may cause vintage gaps. Projects that transfer to other standards bodies may be eligible for retroactive crediting for up to two years before the CDM project start date. Consistent with this, we find that most instances of vintage gaps are within the first two years of a project (Chart 5). In most instances, the CDM is the first standards body to which projects are registered (Chart 4).

Chart 5. Vintage-based gaps in credit issuance and reporting are most prevalent in the early years of a project.

2. Missing documentation

Another driver for vintage gaps is the absence of credit reporting documents such as monitoring and verification reports. Sufficient public information and disclosure on underlying credit issuance is one of the primary eligibility criteria for a BeZero Carbon Rating. Here, we find that although projects can be eligible for a rating, gaps can persist for certain monitoring periods if documentation is amiss. This factor accounts for 17% of the vintage gaps in BeZero rated projects.

3. Miscellaneous

We also find several less pervasive factors that create vintage gaps and together account for 18% of all vintage gaps in the broader market database and BCM combined. These may be sub-sector specific. For example, vintage gaps in Renewable Energy projects can be explained by projects issuing RECs/I-RECs, which disqualify them from converting the same avoided emissions into carbon credits to avoid double counting. This is the case for 14% of all rated Energy projects with vintage gaps. Another cause of gaps within this category can be the inability to find auditors for specific monitoring periods.

4. Unknown

Unknown vintage gaps are, in the simplest terms, vintage gaps without any underlying publicly available explanation. These gaps account for 23% of all the vintage gaps observed within BeZero rated projects and present significant information risk.

Vintage gaps by sector

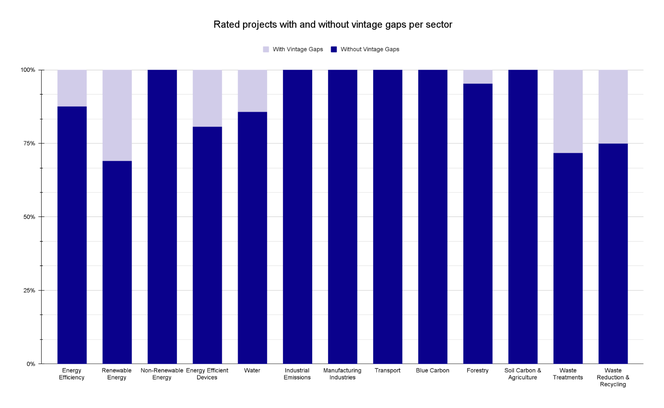

Whilst vintage gaps occur across multiple sectors of the VCM, our analysis finds that the Energy sector is particularly host to vintage gaps (Chart 6). The Renewable Energy sector dominates projects with vintage gaps, making up 58% of all BeZero rated projects with vintage gaps. Interestingly, vintage gaps are also prominent in other non-nature based sectors such as Energy Efficient Devices and Waste Treatments projects, which host 10% and 19% of projects with vintage gaps, respectively. In these sectors, the presence of vintage gaps can also be linked to double counting risk if cancellations during project transfer across standards bodies are incomplete.

In contrast, only 8% of all vintage gaps are observed in the Forestry sector despite the sector making up 31% of rated projects. This is likely because Verra dominates projects and issuance within the Forestry sector and there are fewer projects being transferred from Verra to other standards bodies, a process which creates scope for vintage gap risk.

Chart 6. Vintage gaps in BeZero Carbon-rated projects’ sub-sectors as of 17/08/2023.

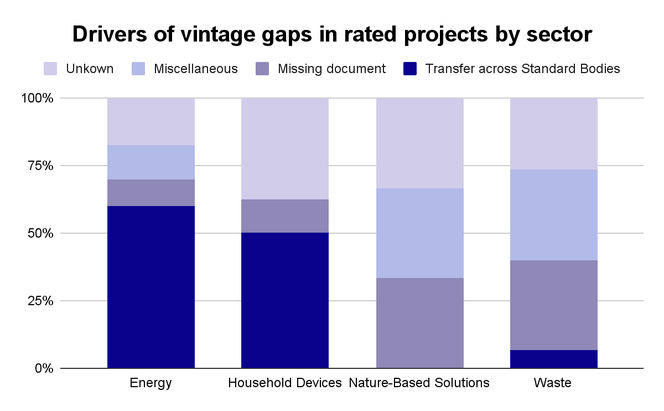

Below, we see the key drivers for vintage gaps across sector groups. For the Energy sector, where vintage gaps are particularly prevalent, they are mainly driven by the transfer of projects across standards bodies (Chart 7). However, for other sector groups, vintage gaps are mainly driven by missing documentation or other miscellaneous reasons.

Chart 7. Transfer of projects across standards bodies is the main driver of vintage gaps in the Energy and Household Devices sector. In comparison, missing documents or other miscellaneous reasons drive vintage gaps in the Waste and Forestry sectors. Data as of 17/08/2023.

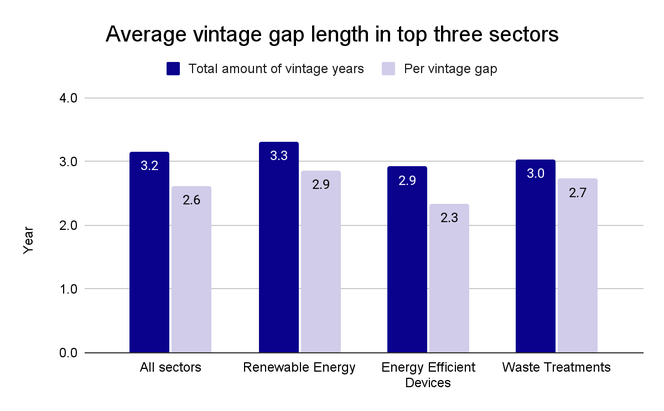

Across the different sectors, there are no notable differences in the average length of years vintage gaps are observed per instance. For example, for the three main sub-sectors with vintage gaps, there is no notable difference in the total number of years with vintage gaps (Chart 8).

Chart 8. Length of vintage gaps across the three sub-sectors where vintage gaps are most prevalent.

Decline of vintage gaps

For credit issuances taking place since 2012, we note that the prevalence of vintage gaps has been continually declining (Chart 9). In fact, we find that vintage gaps are most prevalent for credits issued between 2011 and 2013. This overlaps with the restricted use of CERs in the EU emissions trading system implemented at the end of the Kyoto commitment period in 2012 and a slump of CER prices. Given that vintage gaps are often observed in cases where projects transfer from the CDM to other standards bodies (see Chart 4), both of these factors may explain why this period features extensive vintage gaps. After the EU Commission restricted the use of CERs, projects likely moved from the CDM to other standards bodies to enable credit eligibility through other schemes. When projects are transferred, standard body guidelines typically retain the same crediting period dates as before . In these instances, the years 2011-2013 would be flagged as years with vintage gaps as the issuance period under the CDM would be ineligible for a rating.

Further restrictions on the use of international credits such as those from the CDM at the end of the EU ETS phase 3 (in 2020) may also enable the decline of vintage gaps. For CDM credits to partake in the EU ETS, credits would have to be transferred to national registries - a process associated with non-standardised documentation which creates scope for vintage gaps.

Of note, the decline in prevalence of vintage gaps is likely unrelated to the sectoral changes in issuance, given that in sector groups such as Energy where gaps are most pervasive, issuance has increased since 2018.

Chart 9. Vintage gaps continually decrease over time since 2012.

Conclusions:

Vintages are a key data label for every credit in the VCM with implications for quality, regulatory standards, and double counting. As part of our data governance and ratings process, projects are assigned vintage-based ratings which in certain instances can exhibit vintage gaps.

These gaps are driven by non-systematic or insufficient credit reporting and can reflect significant risk to a project's rating.

To eliminate these gaps, market entities need to move towards standardised carbon accountancy templates, and credit issuance and cancellation reporting. Further, projects and their underlying credits require data labels to identify transferred projects, projects that issue to national registries, or credits through alternative schemes such as RECs.