Sector Snapshot: Renewable Energy

Contents

- What are Renewable Energy projects?

- Key Figures

- How we rate Renewables projects

- Dig deeper on the BeZero Carbon Markets platform

Learn about our ratings and research on Renewable Energy projects, and how you can use our platform to dig deeper into the sector.

What are Renewable Energy projects?

Renewable projects tap into natural, self-replenishing resources such as sunlight, wind and water to generate electricity and displace carbon intensive fuels.

Renewables projects issue carbon avoidance credits.

Key Figures

The Renewables sector represents approximately 35% of the Voluntary Carbon Market by credits outstanding.

There are currently more than 2,000 Renewables projects listed on the major registries (VCS, Gold Standard, Climate Action Reserve, American Carbon Registry and CDM).

Led by India (38%), and followed by Turkey (19%) and China (19%), Renewable projects can be found in over 75 countries around the world.

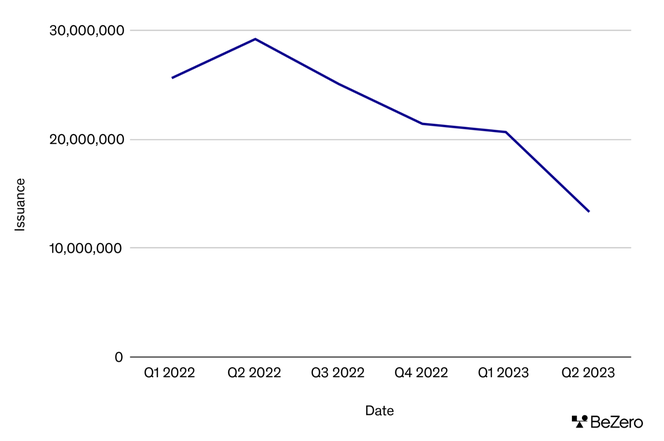

Q1 of 2023 saw a 19% decrease in credit issuance within the Renewables sector compared to Q1 of 2022.

Quarterly issuance of carbon credits within the Renewables sub-sector

How we rate Renewables projects

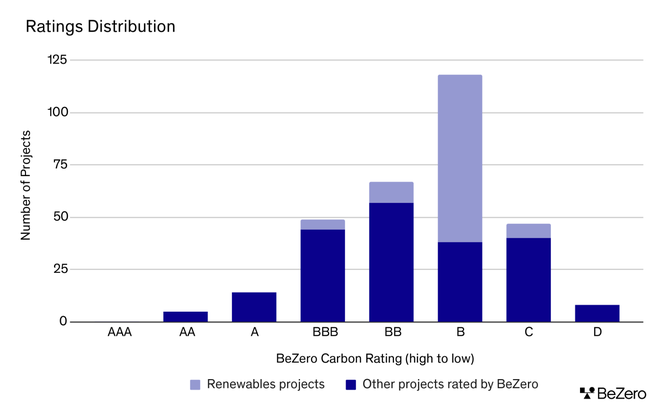

You can find BeZero Carbon ratings for more than 100 renewable projects in over 20 different countries on the BeZero Carbon Markets platform, as of October 2023.

We find that most have a low likelihood of reaching their carbon avoidance promises, with 81 having a BeZero Carbon rating of a single B.

However, project ratings within the Renewable Energy sector range from BBB (moderate likelihood) to C (very low likelihood).

Distribution of BeZero Carbon Ratings for Renewable Energy projects compared to the wider universe of BeZero rated projects, as of June 2023.

In our view, the biggest risk facing renewable projects is their additionality. This is because:

Grid expansion and the renewable energy transition are often government priorities.

As technologies have matured, costs have fallen to become competitive with traditional, emission intensive, forms of energy generation.

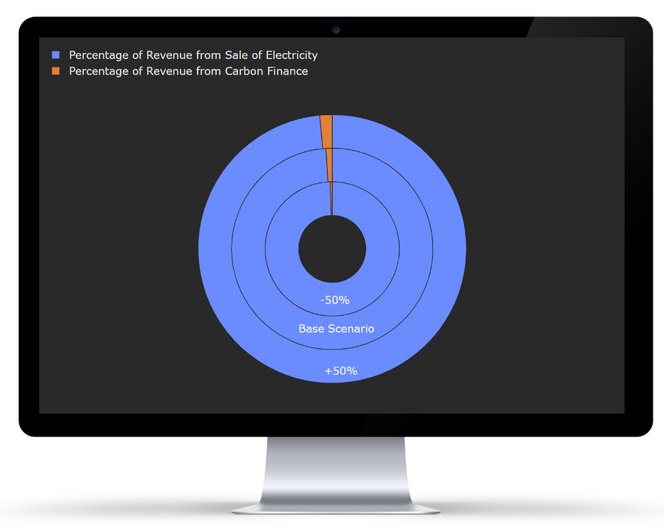

We find the implementation of a renewable energy project is more likely to be governed by the price of electricity as opposed to the sale of carbon credits.

Learn how we build bespoke datasets to rate Renewable Energy projects. You can also download our Renewable Energy methodology for a detailed outline of how we assess carbon risk in the sector.

Approximated revenue breakdown for a Renewable Energy project rated by BeZero. Detailed analysis available on BeZero Carbon Markets platform.

Dig deeper on the BeZero Carbon Markets platform

Get an instant snapshot of carbon quality and risk for renewables in any location, any methodology, and for any accreditor.

View detailed rating breakdowns for each project, and discover why additionality risk tends to be high in the Renewable Energy sector.

Explore interactive charts supporting our analysis of carbon risk in renewables projects.

Chinese wind capacity coverage on the CDM. EOY grid connected wind capacity available from IRENA. Detailed analysis available on BeZero Carbon Markets platform.

Further exclusive insights on Renewable Energy projects, and projects across all major sector groups in the voluntary carbon market, are available for users of the BeZero Carbon Markets platform. If you’d like to learn more, email commercial@bezerocarbon.com and our team will be happy to set up a demo.