First concrete-based carbon rating

Contents

- Concrete in the VCM

- The first BeZero carbon capture in concrete rating is a ‘A’.

- Key considerations

- What comes next?

BeZero Carbon has published an industry-first ex post carbon capture in concrete rating. This rating reflects the development of carbon capture and utilisation (CCUS) in the construction materials sector, and is a new project type for BeZero Carbon Ratings, enabled by the adequate public disclosure of project information and the issuance of ex post credits.

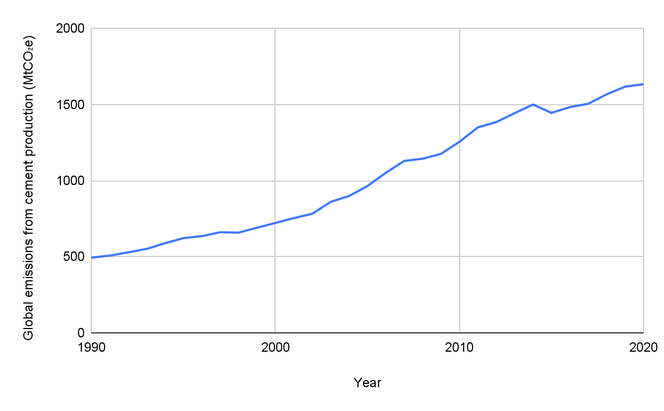

In recent years, emissions from cement production alone have constituted approximately 5 to 8% of global anthropogenic greenhouse gases 1,2, and have been increasing continually since the 1990s (Figure 1).

Figure 1. Global CO2 emissions from industrial processes 3, referring specifically to emissions from cement manufacture, indicate a continual increase in emissions from this hard-to-abate sector.

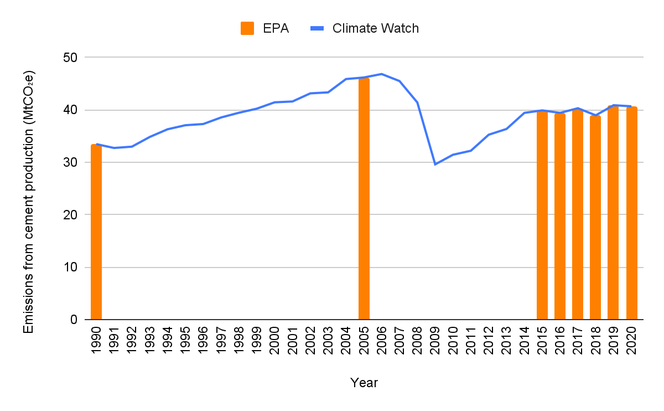

The US Environmental Protection Agency (EPA) 4 reports that emissions from the cement sector increased 23% from 1990-2021. While emissions fell from 2006-2009 due to the economic recession, since 2010 they have risen by 31% (Figure 2). CCUS is the process of capturing CO2 from anthropogenic sources for either utilisation or storage, creating a closed loop cycle, and is a key technology for meeting global climate targets 5. It presents an opportunity to reduce emissions significantly in hard-to-abate sectors such as cement production and, by extension, concrete.5 One of the current climate solutions utilising CCUS technologies is injection into ready-mix concrete, which is the focus of this rating. Captured CO2 can be used in the production process of ready-mix concrete and is injected into the concrete at the curing stage to increase the speed and efficacy of carbonation. This is not only considered permanent storage of CO2 but it in turn is reported to increase the durability and compressive strength of the concrete7, resulting in a lower volume of cement required in the mix design 8.

Figure 2. Data from the EPA 4,6 and Climate Watch3 indicating CO2 emissions from cement production in the USA.

Concrete in the VCM

Across the voluntary carbon market, only four projects validated under an established registry are currently issuing for the mineralisation of carbon in concrete (as of 12/12/2023), with a further four projects under development. The projects under development include a number of methods, including accelerated carbonation in concrete, carbonation of concrete aggregates, and supplementary cementitious materials.

The first BeZero carbon capture in concrete rating is a ‘A’.

BeZero Carbon has assigned credits issued by this project a ‘A’ BeZero Carbon Rating. This is based on the opinions and reasons expressed in our analysis of publicly available information. Of the 370+ carbon projects rated on the BeZero Carbon platform, only 21 are rated ‘A’ or higher (as of 12/12/23). Carbon credits rated ‘A’ provide a high likelihood of achieving 1 tonne of CO₂e avoidance or removal. This rating assesses the project against our risk factors, as set out below.

Additionality

Our assessment of additionality focuses on three main drivers: common practice, technical barriers and financial additionality. As a new and developing technology in a slow-to-change sector, additional revenues from carbon finance may help to mitigate risk associated with investment in the project technology, in addition to helping to overcome technical barriers. We find that this project has a lower risk to additionality as carbon finance appears to be required to facilitate investment in project activities. Project activities may receive revenues from the sale of the ready-mix concrete produced, in addition to cost savings from the reduction in the amount of cement required, which may present some financial risk.

Over-crediting

In our assessment of carbon accounting practices, we review methods of calculation laid out in the methodology, in addition to its application on a project-to-project basis. A major consideration in assessing the risk of over-crediting is the project’s quantification of emissions avoided in cement savings. Furthermore, the risk of double counting is limited by validating the source of injected CO2, ensuring that any sources considered in crediting calculations would have otherwise been released if not stored by the project activity.

Leakage

Our assessment of leakage incorporates consideration of where emissions may be pushed outside the project boundaries, in addition to factors that may have an impact on market dynamics. For example the potential for an increase in production volume as a result of reduced requirements for the volume of cement represents a potential risk of leakage, although we find this risk to be minor. We also assess instances of positive leakage, whereby the project may cause further emission reductions outside of its stated project boundaries, such as improved quality of materials in the subsequent lifetime of the product.

Non-permanence

In our assessment of non-permanence, once emissions are avoided, they cannot be unavoided. However, in the case of concrete mineralisation, we find some risk of reversal exists for the portion of credits issued for the carbon stored in the concrete. As a result, our assessment also takes into account processes that may reverse this reaction, such as acid rain. As discussed in our durability assessment 9, we find that for concrete mineralisation, there is a low risk of reversal, creating a highly durable solution that the wider scientific community generally concurs is permanent.

The project’s full rating is accessible to our clients on our platform. To learn more about our platform, request a demo or email commercial@bezerocarbon.com. You can also access our headline letter ratings for free on our public website.

Key considerations

Carbon projects in the concrete industry are developing and there are more in the issuance pipeline. As the sector matures, there are some keys considerations that would help to encourage high quality projects:

Additionality assessments, such as positive lists and regulatory surplus, benefit from holistic assessments of financial additionality. For example, the role of carbon finance in the facilitation of the project activity needs to be demonstrated. As more projects are developed and begin issuance, a lack of common practice becomes less pertinent in additionality assessments, resulting in an increased focus on the specific technical and financial barriers to implementation that a project faces.

The uptake of sustainable technologies may be impeded by a number of factors 10, perhaps the most restrictive being a slow-to-change industry; prescriptive construction standards limit the wide-spread application of new technologies. Uses of new types of concrete that aren't specified in current standards may include non-structural applications such as flooring and roads 11. However, a shift from prescriptive standards to performance-based approaches 12 is more likely to facilitate faster uptake of new materials, as these are more likely to consider enhanced qualities in new materials – such as the improved compressive strength reported in carbon-cured cement.

More transparency in documentation is key in the assessment of quality. As a nascent technology, projects seeking carbon finance for a newly developed method of carbonation in concrete or aggregates may find disclosure difficult when trying to protect their intellectual property and safeguard competitive information. As these methods establish more of a presence in the voluntary carbon market, a higher level of transparency will enable a better understanding of their role in the market and could help to develop a higher level of trust in their quality. Published project documents, monitoring reports, and reported issuance and retirements are necessary first steps on this journey towards transparency.

What comes next?

For hard-to-abate sectors such as construction, this industry-first carbon rating indicates progression in maturing technologies that offers a potential roadmap for more innovative techniques to decarbonise the sector. This may also lead to shifts in market demand to more nascent spaces, where the scalability of carbon storage is higher and can be more flexible in practice.

In these areas, ratings provide an opportunity to invest in the highest quality reductions in order to decarbonise heavy industries.

References:

9 BeZero Carbon: Durability assessment

11 IEA (2019)