How Cloverly drove customer demand by signalling quality with ratings

What they said

BeZero Carbon’s Ratings have moved the needle for demand for high-rated projects

Project ratings have become a prerequisite for most RFPs received at Cloverly

Greater customer confidence in purchasing impactful carbon credits as this third party validation helps reduce perceived risk for buyers

Accelerated due diligence to help identify high-quality projects matching customer needs

Jason Rubottom, CEO CloverlyBeZero’s independent ratings provide a snapshot of a carbon offset project’s risk and quality that helps Cloverly identify the best projects for our customers. Their breadth of coverage, easily digestible ratings scales, and technology-first platform provide us with the data that supports our exemplary in-house approach to project quality.

Challenge

Cloverly is a leading US-based carbon market platform. It empowers both the businesses that buy and the businesses that supply carbon removals by providing the necessary trust, ease, and access to optimise their results.

Cloverly is committed to building transparent and useful information infrastructure to help carbon markets prosper. Knowing that project quality is an essential consideration for companies transacting on their platform, Cloverly was looking for a way to not only identify high-quality projects for their portfolio, but also signal that quality on their platform to help their users price and manage risk.

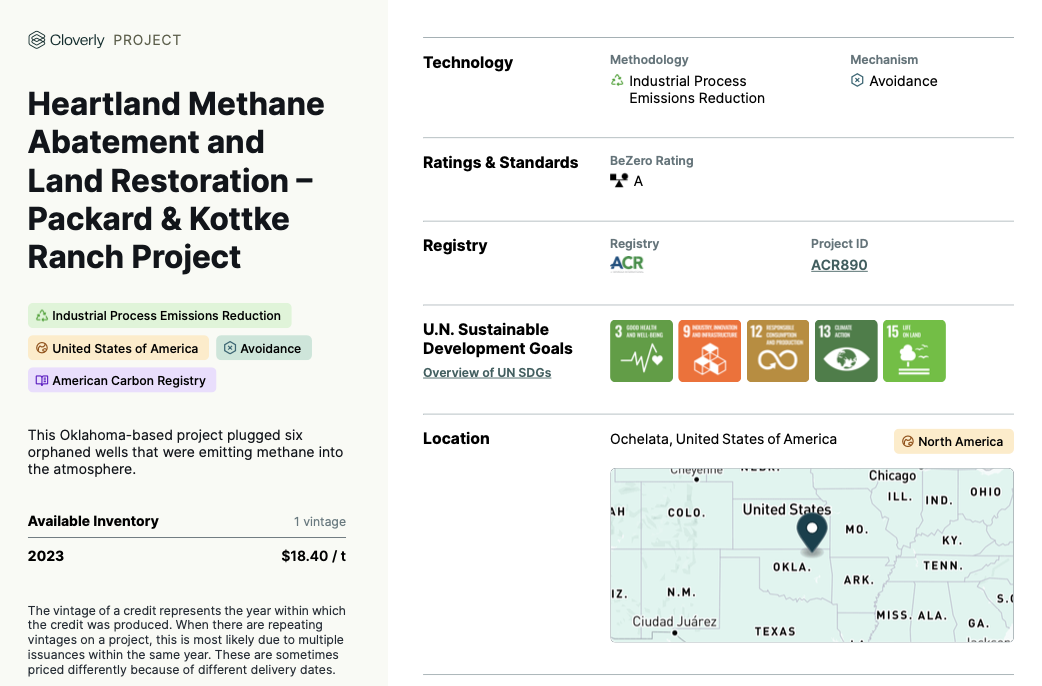

Ratings

To help their customers make more informed decisions, Cloverly decided to display BeZero’s risk-based carbon credit ratings on their platform. By providing a snapshot of risk and quality, the BeZero Carbon Rating provides Cloverly’s customers with the most important aspects of a carbon offset project’s performance in an easily digestible and comparable manner, giving them greater confidence to transact.

Image: BeZero's ratings are live and dynamic, this rating is accurate as of 14/01/2024. See here for more.

Impact

After BeZero’s ratings were made available on their marketplace, Cloverly said that this moved the needle for demand for high-rated projects. Their customers have reported greater confidence in the impact of their carbon credit purchases, highlighting how deeper insights into the additionality, carbon accounting and non-permanence across a wide variety of project types are informing their decisions.

BeZero’s ratings are frequently requested by name and have also helped refine and accelerate Cloverly’s own carbon credit procurement, helping to optimise their inventory to better match their customers’ needs. Leaning on BeZero’s robust carbon market expertise and in-house geospatial capabilities has saved Cloverly countless hours in due-diligence.

Cloverly’s customers are thinking more deeply about carbon risks than ever before. As a result of easier access to project insights via ratings, Cloverly’s customers are having more regular conversations with the team to better understand credit quality, and build impactful carbon portfolios with confidence.

Carbon explored

Read about the latest insights, analysis and trends in global carbon markets.

Explore Insights2024: Carbon credit markets in review

A review of carbon markets in 2024, including an overview of major policy developments followed by analysis of key market statistics

Towards efficiency: Carbon credit pricing and risk part II

Exploring the price-rating correlation for nature-based carbon credits