The essential pillars of a carbon rating

In order to build a rating that fulfils these requirements we have done the following:

1. Built a ratings model applicable across all project types. This requires building a universal ratings methodology supported by sub-sector specific frameworks capable of capturing all of the nuance of the project and activity behind a carbon credit.

Examples include our approach to rating Afforestation, Reforestation & Restoration projects (full methodology here).

Visit bezerocarbon.com/ratings/resources to read our sector frameworks spanning both nature-based and technical solutions.

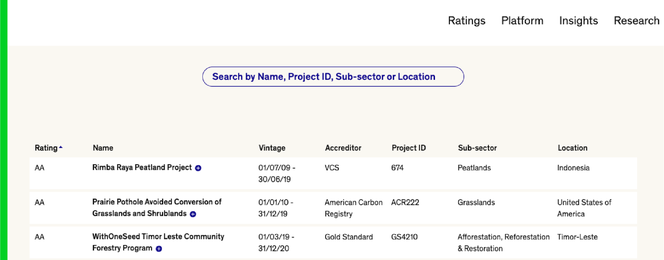

2. Always being transparent. Our headline ratings have always been made public, are shown the same everywhere, and there’s no privileged access to them (everyone finds out the rating at the same time). Today, more than 4,000 organisations subscribe to the headline letter rating on our website, and thousands of companies access the ratings via our partnerships with more than twenty marketplaces and exchanges in +10 countries. It is now the most frequently cited risk metric in the market for referencing or benchmarking carbon quality.

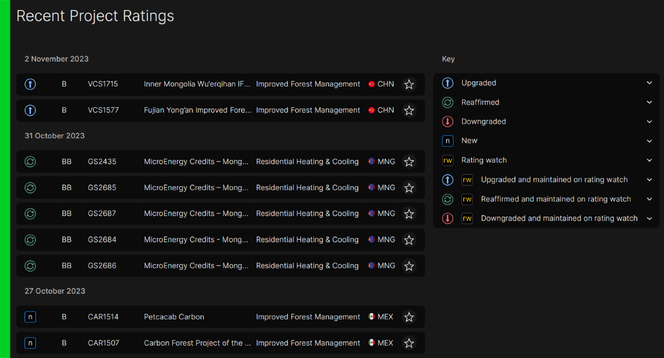

3. Built a watch mechanism for the rating. In order for the rating to be live and up to date, we need a way to tell our users when there is new information that may impact a carbon credit’s rating. Without this, a rating risks becoming out of date or stale fast.

Why BeZero Carbon Ratings change

Carbon projects are dynamic, often living, things. Their performance and context can change on a weekly, monthly, annual basis; and the market and our understanding of them and the evidence used to assess is deepening continuously.

BeZero reviews all our ratings at least once a year, and has formally reviewed more than 275 ratings since launching on 4 April 2022. As of the start of November 2023, we have placed 146 projects on Ratings Watch once, 19 on watch twice, 1 on watch three times, resulting in 113 downgrades, 28 reaffirmations, 29 upgrades, and 1 delisting.

During that time, we have seen a number of methodology updates, tens of projects issue new monitoring reports, hundreds of relevant academic studies have been released and projects have been exposed to volatile El Niño conditions, not to mention the media scandals and suite of new innovations and tools BeZero has brought to market.

To be useful to our customers, if the facts change, so too must the rating be live and up to date. “Getting it right” is not a static concept. They are not a once and done analysis.

Project event: we continuously track all pertinent information related to the 365+ carbon projects we have rated to date. This involved monitoring the project, registries, media, academia, third party systems and in-house models to assess natural hazard risks to see if information materially changes our view of the project. In cases where we observe changes to the project, the watch mechanism is a way to inform our users while we analyse the impact.

Registry issue: we track publicly available information for all projects in our ratings database, including those available on the registry. In cases where a new document is issued or the registry makes an announcement, the watch function enables us to communicate this promptly with clients while we assess its relevance to the rating.

Project developer feedback: we only use publicly available information for our ex post rating. We want to be able to validate the analytical assessment underlying the rating with information available to our users. In order to ensure the rating reflects all relevant information, our team has engaged with almost all the developers behind the 365+ projects we have rated. This gives them the opportunity to publish more information in order that the market may benefit, and it may be reflected in the rating.

Innovation: we are constantly looking to improve and refine our ratings approach. As the science behind many of the project activities making up the market continues to evolve, our rating should reflect that. Whether it’s new industry research or new datasets giving our team insights, the rating should reflect the latest scientific and technological knowledge available.

Case study - Brazilian Avoided Deforestation (VCS 1329)

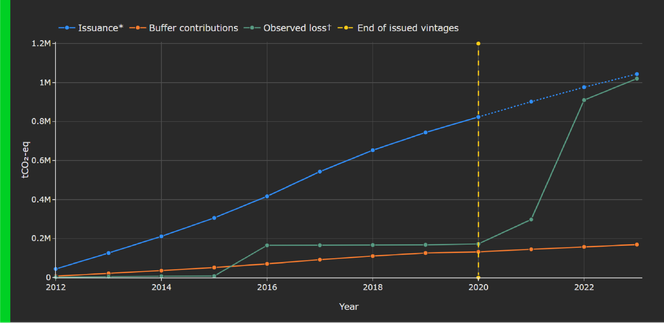

VCS 1329 is a useful illustration of how ongoing monitoring of a project can lead to a ratings change.

Between 2020 and April 2023 our analysts observed approximately 2,200 hectares of forest loss (7.5% of the initial forest area) within the project area. The scale of this deforestation was not available from public documentation, although the Standards Body had put all of the project’s buffer pool credits on hold.

To that point, the project had made buffer pool contributions equivalent to approximately 370 hectares worth of forest loss. In our view, the project’s buffer pool contributions were insufficient to compensate for the large amount of deforestation we observe in recent years, posing significant non-permanence risk. The project was placed on Ratings Watch in December 2022, and downgraded to a C from B in January 2023 (and remains on Ratings Watch).

Figure 1. Cumulative carbon issuance (blue) and buffer pool contributions (orange) versus BeZero Carbon analysis of observed carbon stocks loss (green).