Thinking strategically about carbon credits

Here are some key takeaways from the article

To accelerate the transition to net zero, companies can embrace an expanded Carbon Management Hierarchy (CMH) model to include the use of carbon credits more decisively through Strategic Offsetting.

Strategic Offsetting involves applying carbon credits to specific emission categories or aspects within a company’s value chain to target accelerated decarbonisation.

This can help with targeted decarbonisation efforts across corporate supply chains, especially for hard-to-abate emissions.

Contents

Recent findings from MSCI identifies that only 16% of publicly listed companies align with limiting future warming to 1.5°C.¹ This is despite approximately 40% of total GHG emissions originating from their activities in 2021.²

The Voluntary Carbon Market (VCM) can play a vital role within a net zero strategy. Carbon credits can be used to accelerate decarbonisation across supply chains, especially for hard-to-abate emission categories that are often complex and may lack sufficient technological solutions at present.

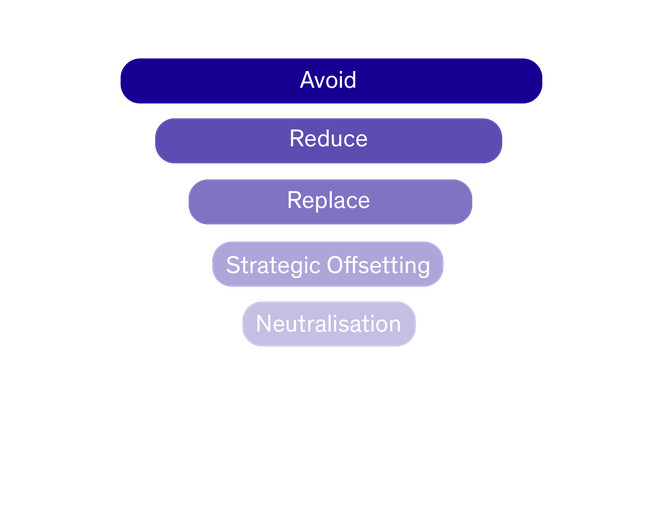

Growing awareness of the VCM’s potential requires companies to consider how carbon credits can be best placed in an overall strategy. A common approach to using carbon credits is the Carbon Management Hierarchy (CMH), in which a company offsets their emissions once they have made all efforts to avoid and reduce emissions. However, credits used in this manner target emissions at the end of a net zero journey, mitigating those that cannot be abated. Doing so limits the ability for credits to be used for carbon management, helping to target hard to abate emissions directly.

What is Strategic Offsetting?

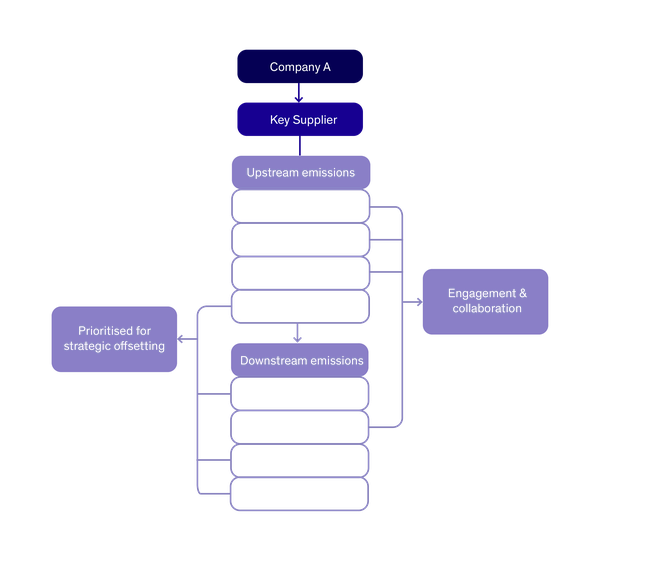

Building on the core foundations of the CMH model, the concept of strategic offsetting expands the structure to incorporate carbon credits more decisively.³ Strategic offsetting involves linking carbon credits to specific parts of a company’s footprint. This could include aspects like different emissions scopes and categories, or within the supply chain to engage with suppliers and service providers.

While decarbonisation within a company’s own value chain is still prioritised, this framework demonstrates that carbon credits can be used to:

Put a price on carbon to encourage the integration of carbon into purchasing decisions.

Invest in technologies and activities that may help to decarbonise elements of a company’s value chain either directly or indirectly.

As a last resort, compensate for those emissions that cannot be abated.

An expanded CMH structure.

A strategic offsetting framework can be easily incorporated within a company’s carbon accounting and supply chain engagement process, identifying hotspots for closer attention and prioritising emissions categories that may not have an effective solution currently. In this way, greater value can be derived from credits as they can be used with greater purpose as a targeting tool to decarbonise, rather than neutralisation at the end of the process. An example can be found below:

Using strategic offsetting for supply chains.

The potential impact of Strategic Offsetting

Carbon credits can be powerful tools for accelerating decarbonisation. Building net zero strategies which consider them will be integral for developing robustness and resilience. A substantial shift in approaches to net zero is required to meet global ambitions, and it has been accepted that climate finance will be essential for meeting climate goals as stated in IPCC’s AR6 report.⁴

Strategic offsetting encourages deeper and more critical consideration of how carbon credits can be framed. They are not a single function tool, there is significance in their application to build on strengths across a supply chain, as well as help mitigate risk in lagging areas.

For example, credits can be used to target hard-to-abate emissions, such as carbon intensive categories of Scope 3. These categories may require future development of technology to truly reach net zero, beyond our capabilities right now. Therefore strategic offsetting can be used to bridge the gap between short term actions and longer term low carbon investment, and also help channel funding to innovative new solutions.

Additionally, strategic offsetting presents the opportunity to engage with higher quality credits which can be tailored to specific standards or applications, helping to improve credibility. Understanding what feeds into the efficacy of a carbon credit is fundamental for this. Carbon Ratings will therefore play a central role in helping companies to make informed decisions on the credits that they purchase. An assessment of quality is particularly important for strategic offset as this involves a more focused budgeting for credits, as they are applied to specific emission categories rather than for blanket offsetting at the end of a year. In future, tailored approaches could include selecting credits in similar geographies to supply chain components, or aligning credits to additional factors that have significance such as biodiversity claims and SDGs.

¹https://www.msci.com/documents/1296102/26195050/MSCI-Net-ZeroTracker-October.pdf

²https://www.generationim.com/our-thinking/insights/listed-company-emissions/

³Piper K and Longhurst J. Exploring corporate engagement with carbon management techniques [version 1; peer review: 2 approved with reservations]. Emerald Open Res 2021, 3:9 - https://doi.org/10.35241/emeraldopenres.14024.1

⁴https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_Chapter15.pdf