The BeZero Carbon Rating definition and rating scale

The BeZero Carbon Rating (BCR) of voluntary carbon credits represents BeZero’s current opinion on the likelihood that a given credit achieves a tonne of CO₂e avoided or removed.

It is an opinion on the greenhouse gas efficacy of a carbon credit. The BCR is conveyed using an eight-point alphabetical scale ranging from ‘highest’ to ‘lowest’ likelihood.

BeZero is setting carbon market standards because:

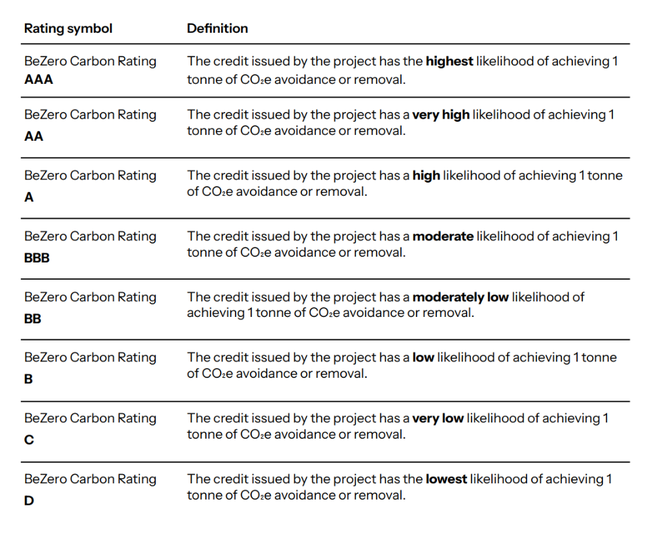

We include specific definitions for each notch on the rating scale, explaining the relative gradations of risk

We are the only rating agency to have clear definitions for each notch of the rating scale, fully aligned with financial market standards

Each of these definitions is outlined in the table below:

BeZero Carbon Rating scale and definitions

The BeZero Carbon Rating is not an assessment of:

The broader risks faced by a carbon project, e.g. fraud, negligence, default risk, political interference, or business interruption, other than the extent to which such risks may inform our assessment of carbon efficacy.

Other specific elements of the credit’s quality other than how they relate to carbon efficacy, such as potential co-benefits from broader ecological and social impacts. These could include biodiversity effects; social, health or economic impacts on local communities; or actual or potential SDG claims. To the extent that such effects may compromise carbon efficacy, they would be taken into consideration, e.g. when considering stakeholder relations and the effect on non-permanence or leakage risk.

Learn more about the BeZero Carbon Rating in our publicly available methodology.