Kariba REDD+: downgrade to D, and delist

Contents

Downgrading to D

The downgrade marks the resolution to the decision to put Kariba on 'rating watch' in January 2023, which was reiterated in October 2023 in response to South Pole voluntarily suspending credit sales.

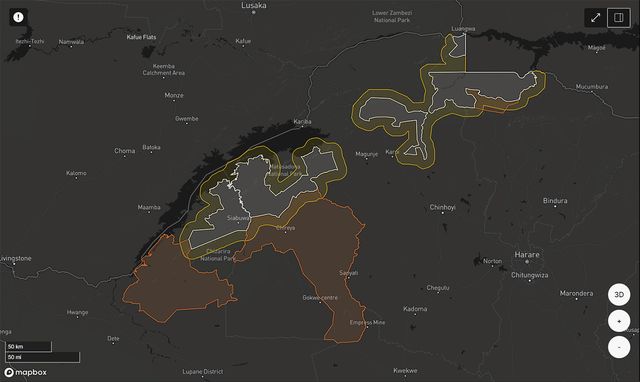

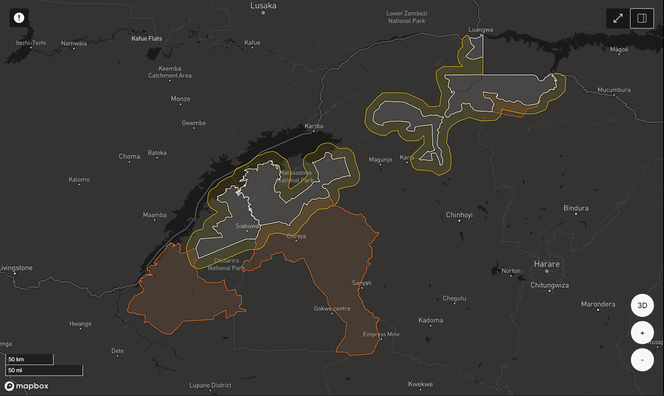

The project area (white), reference region (orange), and leakage belt (yellow) surrounding the Kariba REDD+ Project in northern Zimbabwe. Image as displayed on the BeZero Carbon Markets platform.

The timing of the downgrade reflects the emergence of material new evidence and information regarding the project’s quality:

The decision by Verra, the accrediting standards body, to place the project ‘on hold’ for an undefined period while it investigates allegations of benefit-sharing misconduct, financial malfeasance, and potential unethical or illegal behaviour.

The extremely rare decision by the carbon asset developer to sever ties with the project.

Both announcements represent acute additionality, non-permanence and information risks to the project, in our view. The reported lack of stakeholder engagement also undermines our ability to analyse the effectiveness and longevity of the project’s claimed climate benefits. We believe any decision by Verra to counter reversal risks through its buffer pool mechanism is insufficiently defined at this point, and lacks accommodation for concerns about benefit sharing.

As a result, we find the project’s carbon efficacy is systemically impaired.

Delisting Kariba

The BeZero Carbon Rating for the project Kariba (VCS 902) will officially be delisted with immediate effect. This reflects our view that:

The termination of South Pole’s relationship with the project on 27th October 2023 represents an unprecedented reversal risk to all credits issued by VCS 902 to date.

The emergence of major systemic information gaps puts the project in contravention of our eligibility criteria, namely the provision of sufficient publicly available information. In light of recent events there are now significant information deficits related to the project’s key stakeholders, benefit sharing practices, and carbon accounting.

What next?

The failings of this project are deeply regrettable for the market. However, it must not distract from the many high quality projects, both operational and under development. Nor from the essential role of carbon markets to channel much needed private capital into climate-positive activities.

As a young but critical industry, industry actors must be willing to acknowledge prior mistakes, learn from them, and swiftly embrace new policies and processes to avoid their repeat.

Everyone at BeZero will proudly continue to play our role in leading the professionalisation of the market.