Introducing the BeZero Carbon Portfolio Rating

BeZero Carbon has introduced a first of its kind methodology for rating carbon credit portfolios.

Portfolio ratings give buyers greater confidence to make credible, risk-adjusted claims using a composition of credits.

All portfolio ratings have strict guardrails to ensure higher standards of risk management.

Sign up for our webinar to hear from experts across the market about the opportunities and challenges a portfolio approach can bring.

Carbon credits - a crisis of claims

Carbon credits have been going through an identity crisis. Historically they have all been labelled as achieving exactly one tonne of CO2e. Yet no credit can prove it achieves exactly this because every carbon credit has risks. Labelling them as achieving exactly one tonne of CO2e fails to reflect those risks. This issue manifests itself with end buyers who use carbon credits to make tonne-based claims, with the precision of such claims also failing to reflect the risks.

Risk-adjusted tonnes - enabling more credible claims

Ratings are the tool that reflect the varying levels of risk credits face in achieving a tonne of CO2e. The BeZero Carbon Rating is both publicly available and live, reflecting risk in close to real-time. Ratings are an analytical risk assessment, with the ratings scale ranging from the highest to lowest likelihood of a credit achieving a tonne of CO2e.

With a practical application of that risk assessment, credits can be transformed into tonnes of CO2e, and their risks can be reflected in how claims are made. In our whitepaper - making credible claims - we estimated a discount schedule for the ratings scale. This tool gave users a way to make tonne-based claims that take account of risk - a concept we introduced as risk-adjusted tonnes.

Introducing the BeZero Carbon Portfolio Rating

Today we are launching the BeZero Carbon Portfolio Rating, a market first application of ratings to carbon credit portfolios. This new rating type brings together portfolio theory with the discounting approach introduced in our whitepaper. Our methodology enables clients to compose portfolios of credits and use them to make tonne-based claims with greater confidence.

Supporting high integrity through strict guardrails

In order to ensure the BeZero Carbon Portfolio Rating is used to drive higher standards of risk management in the carbon market, we have introduced strong guardrails to the methodology. These include:

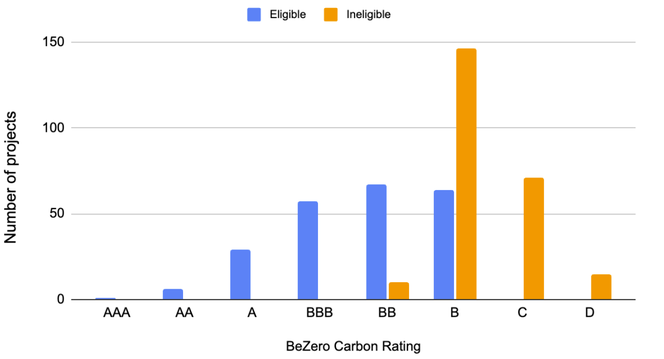

All credits used must have a BeZero Carbon Rating of ‘B’ or higher (credits with C, D, withdrawn or on ratings watch are ineligible).

Credits with significant additionality risks cannot be included.

A portfolio cannot achieve a rating higher than the highest rated individual credit, which must constitute at least 25% of the portfolio in order to count as the highest rated.

Discounting can only be applied to increase the rating of individual projects by two notches.

These criteria rule out over half of the rated universe at present (see Figure 1) but provide a tool for those eligible credits to be brought together in robust portfolios that can be composed to give buyers greater confidence when using them to make claims.

Projects eligible for a BeZero Carbon Portfolio Rating

Figure 1: Projects with credits eligible for a BeZero Carbon Portfolio Rating, as of all BeZero Carbon Ratings Monday 21st October 2024

An important innovation to scale the market

We believe that using portfolios is one of the key innovations required to scale the market. Doing so fosters a more sustainable approach to risk by encouraging market participants to seek diversification. Furthermore it enables a broader participation of end buyers in the market who can make carbon-based claims using portfolio credits with greater confidence. This is achieved through intermediaries having the tools to understand and actively manage risk, and applies common and best practice from other financial markets.