How the VCM can turn the tide for blue carbon

Here are some key takeaways

Blue carbon projects account for only a small percentage of the credits in the voluntary carbon market (VCM), the majority of which are mangrove projects, but the sector has untapped potential to scale.

There are numerous barriers to entry for blue carbon projects, such as high implementation costs and technical barriers. These will need to be addressed for the supply of blue carbon credits to increase.

Carbon finance can overcome some of these barriers by covering project implementation costs, funding mechanisms for benefit sharing, and aiding investment into robust data collection and monitoring systems.

Contents

- Introduction

- Blue carbon in the VCM

- Barriers to blue carbon implementation

- Utilising carbon finance to overcome barriers

- Conclusion

Introduction

The oceans are sometimes referred to as the real ‘lungs of the planet’, generating 50% of the oxygen we need to breathe.¹ They play a vital role in regulating Earth’s climate system, acting as a net sink. The oceans have absorbed an estimated 20 - 30% of all anthropogenic carbon dioxide emissions in the last two decades, regulate land temperature by taking up over 90% of the planet’s excess heat, all while generating the oxygen we need to breathe. ²

Oceans provide benefits beyond climate regulation including: providing animal protein for 15% of the world, jobs for nearly 50% of the global population, and providing recreational activities and wellness. Their survival and health is integral to life on Earth.

The importance of ocean conservation has been highlighted through the enactment of recent global policies. At the Convention on Biological Diversity in 2022, over 190 nations adopted the 30 x 30 agenda, agreeing to protect 30% of the land and 30% of the ocean by 2030, with particular emphasis on areas with important biodiversity and ecosystem functions and services.

Other initiatives, such as the High Seas Treaty, have introduced additional protections for marine ecosystems. The High Seas Treaty is a landmark decision to help protect and establish Marine Protected Areas (MPAs) in national regions outside a country’s exclusive economic zone.

For these policies to succeed, funding at an unprecedented scale is required.

However, oceans are underrepresented in funding mechanisms. MPAs currently receive USD 980 million annually, a mere 4% of the USD 23 billion that terrestrial protected areas receive annually. The oceans provide important climate mitigation and ecosystem services, but the funding they receive is not appropriately representative of this role.³

To achieve the goals of the 30 x 30 agreement by 2030, an increase in funding to USD 9-12 billion is required, or an 80-85% increase compared to current levels.⁴ The funding gap is even greater in the global south where finance for MPAs, including coastal ecosystems, is disproportionately underfunded.⁵

Funding for ocean conservation is largely from private mechanisms such as conservation trust funds and blue bonds, as well as government-led initiatives to either direct funding into conservation of marine and coastal ecosystems, or towards aiding financing streams into developing countries.⁶

Markets are another pathway to increasing global funding for ocean conservation. The VCM, sovereign carbon trading via the Paris Agreement’s Article 6 mechanisms, and nascent biodiversity markets provide possible routes for financing coastal and marine ecosystem restoration and protection. The VCM is currently the most established market to transact credits aiding ocean conservation through the issuance of blue carbon (BC) credits.

Blue carbon refers to coastal and marine habitats that sequester and store carbon, including mangroves, salt marshes, seagrass meadows, kelp forests, and other fauna/flora. Collectively, BC stores more than 30 gigatons of carbon at a global scale, a significant amount of which is stored in waterlogged soils.⁷

BC credits are currently underrepresented in the VCM. This report aims to provide an overview of blue carbon projects in the VCM, explore the barriers associated with project implementation, and evaluate how carbon finance can be utilised to overcome these barriers.

Blue carbon in the VCM

Blue carbon represents a small fraction of issuance in the VCM

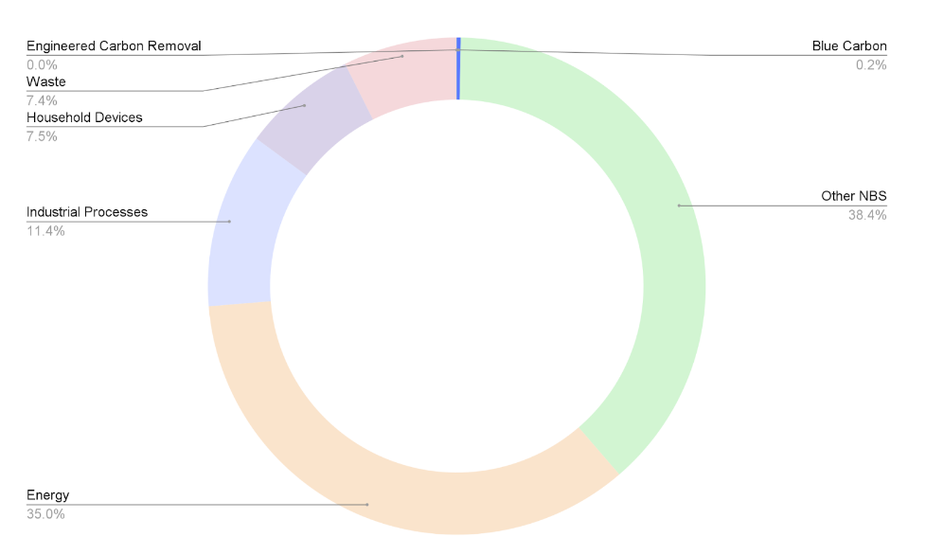

Blue carbon projects currently play a very small role in the VCM accounting for only 0.2% of the total issuance, or just over 5 million credits as of January 2024 (Figure 1).⁸ In 2014 the Mikoko Pamoja project, based in Kenya, issued the first blue carbon credits through Plan Vivo; since then, at least a further twelve projects have issued blue carbon credits. Relative to other sectors in the VCM, blue carbon is relatively nascent.

Figure 1. Issuance of credits in the voluntary carbon market by sector.

VCM blue carbon projects are predominantly mangrove projects. Mangrove projects are responsible for 99% of BC credit issuance, with 32% of these (1.6 million) retired to date. The remaining 1% of BC credit issuance is from wetland restoration, and were issued by one project.⁹

Historically, blue carbon projects have been relatively small in scale, issuing an average of 172,000 credits a year per project between 2014 and 2021. However, in 2022, the supply of blue carbon credits increased by 90% to over 3 million credits. The source of the issuance is from one project, Delta Blue Carbon, a large-scale mangrove project in Pakistan with vintages spanning back to 2015.

The supply and demand of BC credits has increased.¹⁰ The recent surge of retirements in the VCM may be owed to the publicity around the Delta Blue Carbon project and its recent sale of 250,000 credits.¹¹

Blue carbon credits appear to have price premiums

Existing blue carbon credits appear to command price premiums, suggesting that the potential of BC to raise finance could be substantial. The average price traded for BC credits is between USD 13 - USD 35, with some credits as high as USD 40 a tonne.¹²

Our analysis of carbon pricing using data from Xpansiv CBL markets finds a weighted average price of USD 11.50 for forestry credits transacted in 2022.¹³ This is consistent with other industry findings on the topic.¹⁴ Owing to the small sample size of BC projects, we could not draw conclusions from the blue carbon credit price data in our own analysis.

The large-scale Delta Blue Carbon project recently issued credits for their mangrove reforestation project in Pakistan, and generated USD 27.80 per tonne for 250,000 2021 vintage credits.¹⁵ This was 40% above spot prices for credits with a similar vintage in the VCM in December 2022.¹⁶ Although it is not clear what drives the higher price of BC credits, the lack of supply in relation to demand is likely to be a contributing factor. Furthermore, the community and biodiversity benefits that blue carbon projects provide may also contribute to price premiums.¹⁷

BC projects are also likely to be more costly to implement and maintain than terrestrial nature-based solutions projects.¹⁸ Higher project costs would thus need to be reflected in the credit price for the project to remain viable: the fact that buyers are prepared to pay these higher prices arguably indicates the positive way that BC projects are perceived.

Blue carbon projects account for 1 in 5 of every ‘AA’-rated projects

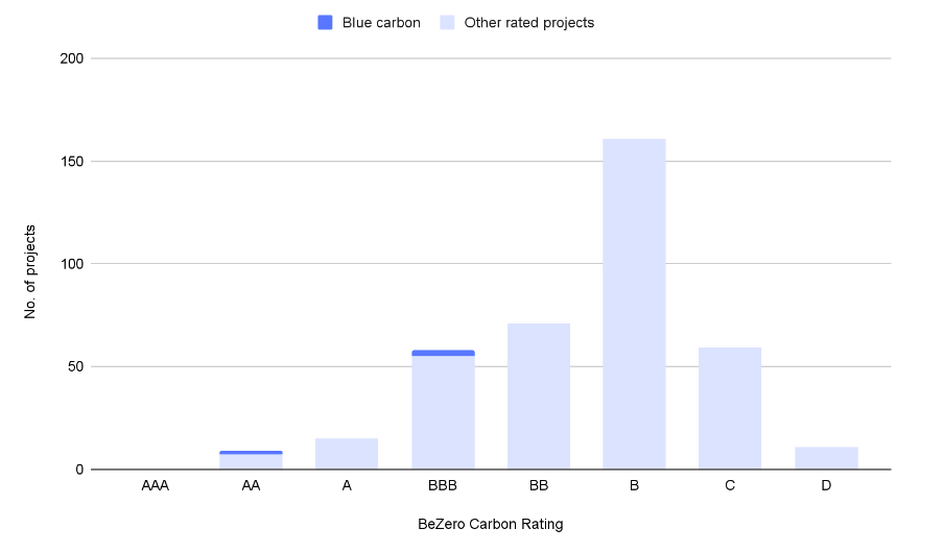

BeZero Carbon has rated five blue carbon projects representing 5 out of the 379 BeZero Carbon-rated projects as of 09/1/2024. Coverage of the rated credits represent 68% of blue carbon issuance in the VCM, all of which are mangrove projects, reflecting the current market trend.

These credits are rated ‘AA’ - a very high likelihood of achieving a tonne of CO₂e removed or avoided - and ‘BBB’ - a moderate likelihood of achieving a tonne of CO₂e removed or avoided (Figure 2). Blue carbon projects account for 22% of ‘AA’ rated projects and 5% of ‘BBB’ rated projects.

Figure 2. Rating distribution of blue carbon projects compared to other sectors on the BeZero Carbon Rating framework.

Barriers to blue carbon implementation

There is substantial potential to scale blue carbon within the VCM, however for this to be successful, multiple barriers must be overcome.

High project implementation costs

High implementation costs are likely the major driver behind the low share of blue carbon credits on the VCM, driving their potential reliance on carbon finance. From establishment to development and maintenance of project activities, BC projects can bear higher costs than terrestrial forestry projects. This is largely due to the complexity of understanding the hydrology of the landscape, which contributes to labour-intensive costs related to measuring, monitoring, and verification within the coastal zone.¹⁹ Therefore, blue carbon projects often face a funding gap to cover costs.

Technical barriers

Knowledge gaps can hinder the implementation of blue carbon projects. One of the major barriers concerning knowledge is the lack of science underpinning the climate impact of project activities. For instance, as of January 2024, there are no methodologies for sequestration of carbon by seaweeds in terms of conservation. There is, however, a ‘Methodology for Creation of Seaweed or Kelp Farms’ which is under development by Verra.

While mangrove science is more developed, there are still improvements that could be made to blue carbon methodologies to incorporate technical advances. For example, VM0033 ('Methodology for Tidal Wetlands and Seagrass Restoration’) has had multiple revisions to incorporate the most up-to-date science and technology, such as by incorporating a non-permanence risk tool to assess the risk of erosion and sea level rise on the carbon stocks.²⁰ VM0033 is currently under revision to incorporate protecting at-risk wetlands, improving water management on drained wetlands, maintaining or improving water quality for seagrass meadows, and other related activities.²¹

BC ecosystems often struggle with the availability and quality of data relating to a specific project. For instance, projects may lack sufficient baseline data, making it challenging to monitor the changes in carbon stocks over time. Projects may also be inhibited by project location, which may be in remote areas, making it challenging to collect data. Furthermore, uncertainty around the spatial extent and condition of BC impacts their known contribution to the global carbon cycle, particularly regarding seagrass where areas are yet to be mapped.²² These factors can lead to over-crediting risks for VCM carbon projects.

Insecure land tenure and carbon rights

BC ecosystems frequently occupy contested land or overlapping jurisdictions and legislatures, leading to uncertainties surrounding land tenure rights, and subsequently rights to the carbon. For instance, mangroves often sit on communal lands. This can result in disputes over who owns the right to the carbon, and who therefore has the right to transact carbon credits. Disputes may occur between public and private parties, and may be exacerbated where project areas extend beyond national boundaries and even beyond exclusive economic zones. This may be the case for BC ecosystems such as seagrass and seaweed, depending on project activities. Securing land tenure and carbon rights will be important for scaling blue carbon projects.

Community engagement

Blue carbon projects are often expensive to set up and maintain and, like other sectors, require local collaboration. It is therefore important that the local community is involved in project design and implementation, and receives a just portion of carbon credit sales. Indeed, examples of successful blue carbon projects typically have the commitment and support from the local community.²³ Communities may also benefit from the project activity through building of local infrastructure, such as schools or community centres, and employment or training programmes such as sustainable fishing practices.

Non-permanence risk

Like other NBS projects, BC can be impacted by natural hazards increasing the likelihood of reversal risk during a project’s crediting period. BC ecosystems can be destroyed or damaged by extreme weather, increased salinisation, and sea level rise. Habitats can also be damaged by anthropogenic activities such as coastal development, conversion of land to aquaculture/agriculture, and pollution. Subsequent mortality of mangrove propagules can result in loss of income for project stakeholders and investors, as well as reducing the co-benefits provided by mangrove projects, such as coastal resilience. These risks can threaten the permanence of a project, resulting in the release of sequestered carbon, potentially resulting in reversals.

Spatial constraints

Relative to terrestrial ecosystems, which occupy 30% of global land cover, BC ecosystems are spatially constrained to coastal regions and occupy around 0.4% of the global land space.²⁴ This means there is more forest area available for conservation, as well as terrestrial forest afforestation and reforestation activities. In addition, there are often intense human socio-economic pressures on BC driven by high population densities driven by their coastal location, which may be less common in terrestrial forests occurring in remote locations.

Blue carbon projects are also impacted by their size. For instance, smaller mangrove areas/BC ecosystems could result in areas that are too small to generate profit from carbon finance. More research and understanding surrounding minimum project size is needed, and should be embedded in project methodologies to understand more widely the return-on-investment for BC projects.

Utilising carbon finance to overcome barriers

Carbon finance has the potential to overcome these barriers and provide a means of funding to scale blue carbon project implementation in the VCM. Carbon finance can be utilised through benefit sharing mechanisms to provide finance to local communities, investment in robust data collection models, access to training and equipment for monitoring, and demarcation of land tenure, among many more benefits. Furthermore, scaling project development globally can attempt to fill the knowledge gap surrounding the return-on-investment for BC projects.

Conclusion

In summary, blue carbon projects face significant barriers to scaling activities. Carbon finance has the potential to mitigate these barriers by providing projects with income from the sale of carbon credits. This may be used to aid in project development, invest in robust data collection and monitoring systems, or funding mechanisms for benefit sharing. Furthermore, BC credits often command price premiums compared to terrestrial forestry credits, suggesting the potential for BC projects to gain finance is substantial.

Overcoming these barriers may increase the number and size of blue carbon projects in the VCM, help scale activities, and allow for the conservation and restoration of BC and subsequent climate benefits. BC, and wider ocean conservation, are a vital part of the global response to the climate challenge, which needs to be reflected through both policy and market mechanisms.

References:

⁶ Blue Marine Foundation, 2023

⁸ This figure is likely lower than the market as the credit issuance dataset uses Gold Standard, Verra, ACR, and CAR and no credit issuance for Plan Vivo.

⁹ Coastal wetland projects restore the wetland’s characteristics to its natural function.

¹⁰ International Finance Corporation, 2023

¹² Jennifer, L., 2023; Abatable, 2022

¹³ The weighted average price takes into account each individual transaction from the data.

¹⁶ The spot price is the price that buyers and sellers value the carbon credit; DGB Group, 2023

²⁰ Verra, 2023

²¹ Verra, 2023