Credit hold ups: Missteps in MRV frequency and buffer pools

Key takeaways

BeZero’s continuous monitoring provides a mechanism to continuously capture the monitoring, reporting, and verification (MRV) risk profiles of projects even before these are detected or reported by the standards bodies.

Standards bodies have various MRV governance mechanisms and in certain cases, nature-based projects deviating from minimum MRV requirements have a portion of their buffer pool credits placed ‘on hold’.

We find that 28 projects currently have circa 1.2 million buffer credits on hold. We identify at least 33 nature-based projects in the broader voluntary carbon market (VCM) which deviate from the minimum MRV frequencies, specifically under Verra (24 projects). However, we observe that several projects have not yet placed buffer credits on hold, with up to 28,917 credits with high potential to be placed on hold.

Contents

Please note that the content of this insight may contain references to our previous sector classification system. You can find details of our updated system, effective since July 19th 2023, here.

Introduction

To bring credits to the VCM, projects must regularly demonstrate their emission reductions or removals through monitoring, reporting,and verification (MRV) events. As part of this process, across the four largest standards bodies in the VCM (Verra, Climate Action Reserve (CAR), Gold Standard, and American Carbon Registry (ACR)), third-party auditors and project developers work together to ensure projects are adequately adhering to standards bodies’ methodologies. MRV provides an integral mechanism for independent checks and balances, which increases the likelihood of credit quality.

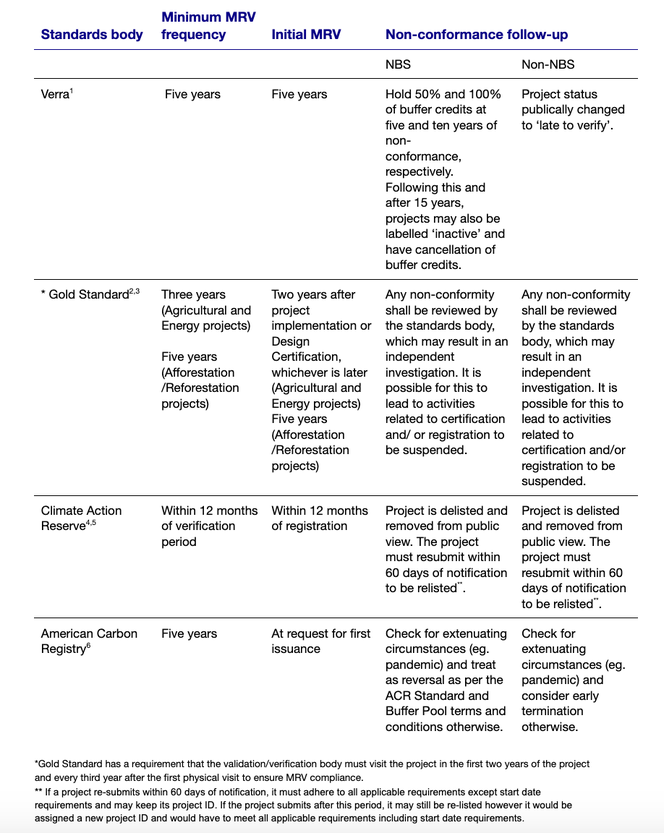

We find that the guidelines for frequency of MRV are similar across all four standards bodies, with MRV required at a minimum of every five years (Table 1), with issuance of new credits suspended until an MRV event occurs. However, some nuances exist regarding initial MRV events and how non-conformance to MRV guidelines are actioned. For example, non-conformance with MRV guidelines can result in buffer credits being put on hold, project statuses changed to ‘late to verify’, or complete delisting of projects.

Table 1. A summary of guidelines for MRV frequency across the major standards bodies.

Standards bodies have established various governance mechanisms to oversee MRV frequencies (See Table 1). For example, for nature-based (NBS) projects under Verra, non-conformance with MRV guidelines results in a minimum of 50% (and up to 100%) of the buffer credits being placed ‘on hold’. Further delays to MRV can also result in the complete cancellation of buffer pool credits (and other credits as required) and the projects being labeled as inactive. For non nature-based projects, since buffer pool credits cannot come into play, standards bodies proactively seek to determine if projects are still active. Project proponents are required to evidence activity implementation within a year and this is publicly posted to VCS with project statuses being changed to ‘late to verify’.

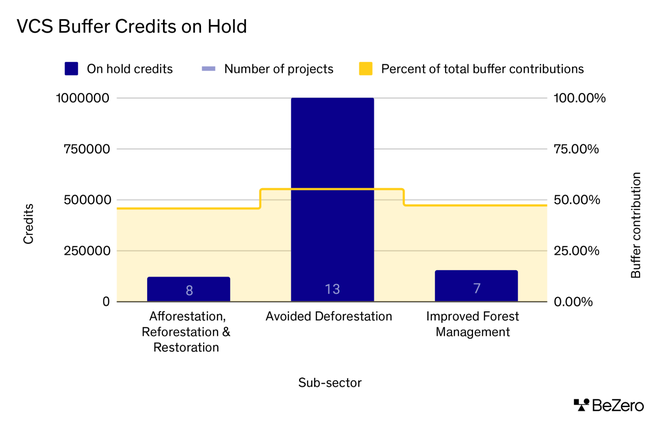

At present, Verra is the only standards body that ‘holds’ buffer pool credits as a form of enforcement for MRV for NBS projects. Currently, there are 28 projects that cumulatively have around 1.2 million buffer credits on hold due to MRV non-compliance. These projects span across all forestry sub-sectors within the wider NBS sector group (Chart 1) and represent 13% of the 209 projects that have issued credits towards the VCS buffer pool. Interestingly, we note that projects within the Blue and Soil Carbon sectors that are typically associated with higher BeZero Carbon ratings are also typically MRV compliant. However, these data may also reflect the broader trend of fewer projects in these two sectors.

Chart 1. VCS projects from all forestry sub-sectors are observed to have buffer credits placed on hold. The number of buffer credits on hold from the Avoided Deforestation sub-sector is 6.5 fold higher than other sub-sectors, indicating higher risk.

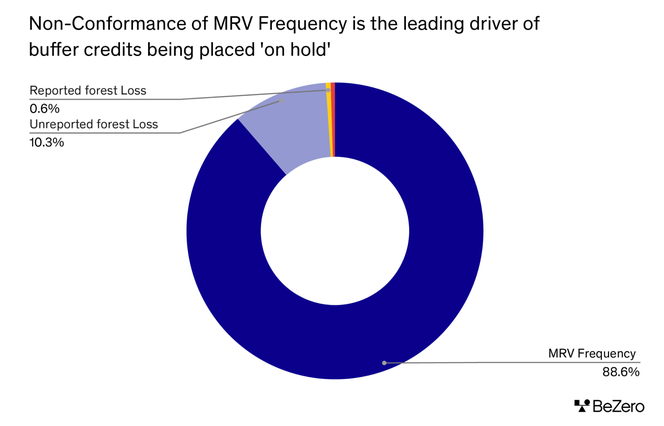

In fact, the leading driver for credits being placed on hold is due to non-conformance with standards body guidelines for MRV frequency (88.6%, Chart 2). In comparison, the status of buffer pool credits due to reverals from loss events has a smaller driving effect (around 11%). There is also one case (0.5% of projects) in which the underlying reasons driving credit hold status remain undisclosed.

Chart 2. Non-conformance in MRV frequency is the leading driver of VCS projects having buffer credits being placed ‘on hold’. Other factors include loss events (which can lead to reversals or issuance deductions) or unreported reasons. Here, unreported forest loss refers to forest loss undocumented by the standards body and observed by BeZero Carbon.

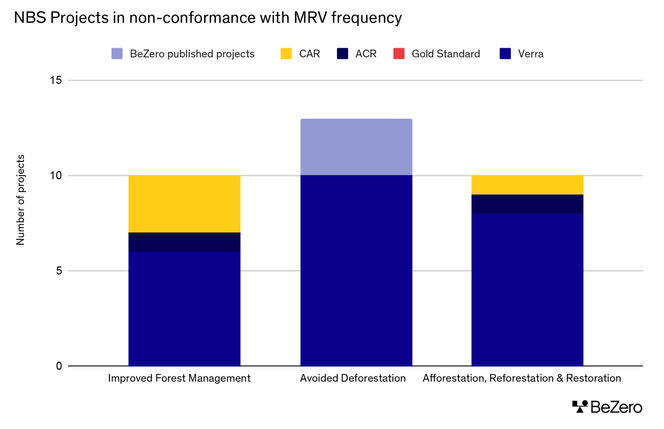

Across the four major standards bodies, our analysis identifies that there may be 33 nature-based projects which do not meet the MRV frequency guidelines set by standards bodies (Chart 3).

Hold status of buffer credits is one of the most transparent and direct forms of MRV enforcement in the VCM and is applied for NBS projects by Verra. This mechanism offers a quantitative signal to the market on buffer credit risk and plays an important role in ensuring credit quality and reducing non-permanence risk associated with NBS projects on the market.

Chart 3. Thirty-three nature-based projects may not be in compliance with minimum MRV frequencies set by standards bodies. Of these, BeZero Carbon has rated three Verra Avoided Deforestation projects.

Ratings & MRV conformance

BeZero carbon ratings incorporate assessments of risk associated with MRV non-compliance. This is reflected in our rating of non-permanence, through both our analysis of the availability of buffer pool contribution and information risk associated with a lack of verified project monitoring (NBS and non-NBS).

In the case where buffer pool credits are put on hold, risk of non-permanence is likely to increase as insufficient credits are available to counter reversals. Non-permanence risk due to insufficient buffer pool credits is particularly relevant where reversal risks have increased in the project region since the last monitoring period i.e. due to increased natural risks such as fire or anthropogenic risks such as forest clearance. Further, infrequent MRV creates scope for smaller scale landscape changes, such as forest degradation, being insufficiently accounted for during carbon accounting.

Where buffer credits are not placed on hold, the non-permanence risk is reflected through information risk. Information risk is incurred as the lack of MRV for prolonged periods prevents the independent checks and balances on project implementation from being up-held, and as such increases the risk associated with credit quality. Therefore, any risk associated with MRV events are continually incorporated in our rating.

As part of our continuous monitoring process, there are a number of events which can trigger a review of the assigned rating. Such events include continuous remote detection of loss events, changes in buffer credit status to ‘on hold’, and MRV non-conformance, in addition to the release of new information.

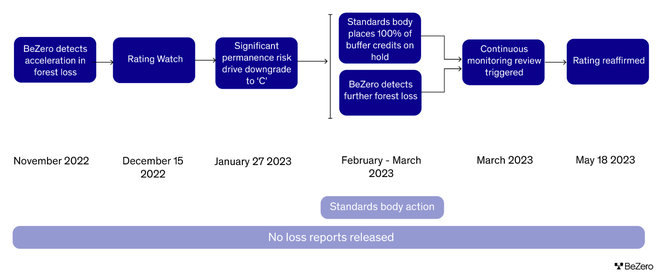

To demonstrate this approach in action, we take our continuous monitoring of VCS 1329. For this project, our geospatial analysis detected forest loss through large-scale clearing events in late 2022 which triggered a ‘Ratings Watch’. The significant non-permanence risk faced by the project due to forest loss and the insufficiency of its own buffer credits to cover this loss resulted in a ratings downgrade to ‘C’ prior to the project or standards body reporting any changes to the project.

Subsequently, in February 2023, through our continuous monitoring approach, we noted that 100% of the project’s buffer credits were placed on hold, while our geospatial analysis observed ongoing forest clearance. Similarly, following substantial and ongoing forest clearance in another Avoided deforestation project, based in Cambodia, we believe that all of the project's buffer pool credits (72,305 credits) are at risk of being placed on hold and subsequently cancelled.

Through such continuous monitoring processes, BeZero can forecast circumstances in which credits might be at risk of hold or cancellation prior to MRV events or standards body reporting and in real time. Furthermore, BeZero has identified 33 projects with MRV non-conformance risks currently unreported by standards bodies and 28,917 credits which could potentially be placed on hold.

Conclusions

Regular MRV of project activities is an important mechanism to ensure projects are adhering to methodological best practice, which in turn allows for minimum quality standards to be maintained across the VCM. Amongst the four major standard bodies, various mechanisms are in place to enforce compliance with minimum MRV requirements. The most stringent enforcement mechanism is in place for NBS projects under Verra, whereby up to 100% of buffer pool credits can be placed on hold when minimum MRV standards are not adhered to. Consequently, circa 1.2 million credits are currently on hold, 88% of which are as a result of MRV non-compliance. This is regarded by BeZero as a key mechanism protecting against project non-permanence in the NBS sector.

Under BeZero’s continuous monitoring process, a further 28,917 credits have been identified as being at risk of being placed on hold due to MRV non-compliance. Our monitoring process is therefore an important tool for early identification of non-permanence risk associated with MRV non-compliance, as well as early detection of project loss events. As a result, we are able to provide a more accurate and nuanced assessment of project non-permanence and the associated project risks.

Sources

1Verra, Registration & Issuance

2Gold Standard, Principles and Requirements

3Gold Standard, Land use & forests activities

4Climate Action Reserve, Verification Program Manual

5Climate Action Reserve, Reserve Offset Program Manual March 12, 2021

6American Carbon Registry, personal communication.