Corporate retirements: see the volume & quality of retired carbon credits

Contents

- Cleaned and standardised retirements data at your fingertips

- How to use Corporate retirements

- What you need to know

Of the 8,000+ businesses taking climate action through science-based targets and net-zero commitments1, about a third use carbon credits as part of their climate strategy.2

But what are these companies actually buying? Data on credit retirements is often fragmented, incomplete, and/or unstructured. Details about the volume, type and quality of credits companies are retiring is not readily accessible, all in one place.

BeZero’s latest platform feature, Corporate retirements, brings all this information together. Covering more than 3,000 companies, the tool allows you to not only understand what businesses are retiring every year, but where applicable, the quality of those retired credits, as measured by the BeZero Carbon Rating.

From developers identifying popular credits, to intermediaries uncovering demand trends, to sustainability leaders looking to benchmark themselves against their peers, our product empowers everyone in the carbon value chain with the largest and most dependable dataset on retirements, alongside the market’s leading risk metric.

Here’s how it works.

Cleaned and standardised retirements data at your fingertips

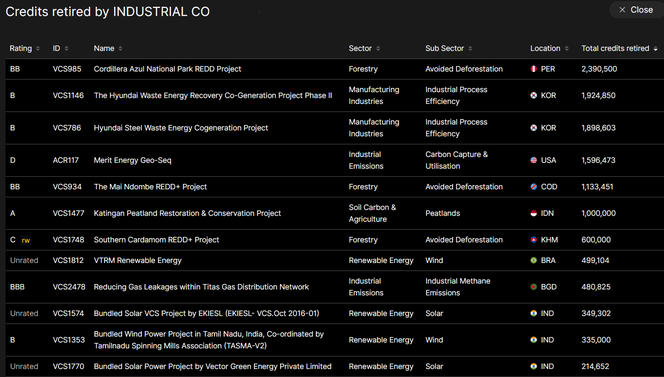

Corporate retirements allows users to view, alongside the corporate who retired them:

Credit type, including project identifiers and BeZero’s proprietary sector classification.

Volume of credits retired for a given year or multiyear period.

Quality of credits retired as measured by the BeZero Carbon Rating (where applicable).

Corporate retirements extract from BeZero Carbon Markets platform (illustrative data).

With coverage of more than 3,000 companies, retirements are mapped using Legal Entity Identifiers (LEIs). As a widely adopted reference used in financial markets,3 LEIs allow for maximum standardisation and quality of corporate retirements data.

We collect details of credit retirements such as volume and retirement date from six major standards bodies registries: Verified Carbon Standard (Verra), Gold Standard, Climate Action Reserve, ACR, Cercarbono, and Puro.earth.

This data is often unstructured and unstandardised. To ensure the displayed information is reliable, BeZero’s expert team of data scientists have built a clean and robust dataset, relying both on automation (including Natural Language Processing) and analyst validation.

How to use Corporate retirements

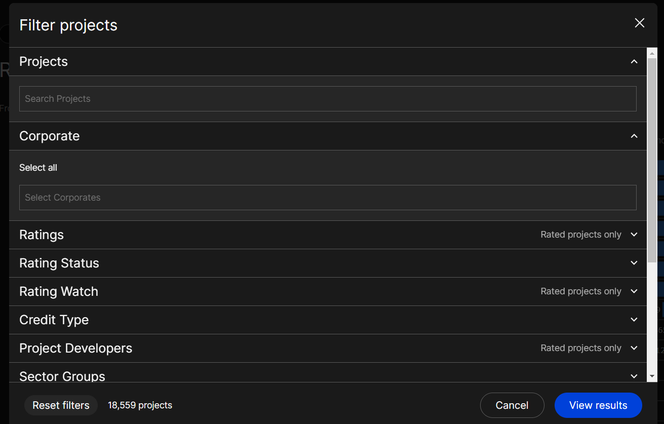

Accessed via the platform’s main menu, Corporate retirements allows users to view which companies have retired carbon credits since 2014. Retirements can be filtered for a given year, or a multiyear period.

The feature can give market stakeholders a macro view of overall corporate retirements of credits matching specific criteria (e.g. filtered by credit type, sector, location, rating status, rating etc), as well as a micro view, i.e. which carbon credits a given corporate has retired.

BeZero’s tool uniquely allows users to not only view credit volumes and types, but also the quality of those retirements, where applicable.

Corporate retirements offer valuable insights for all types of carbon credit users. For example:

A cookstove developer in East Africa can see which companies are retiring similar credits in the region, and identify opportunities to market their projects to them.

An investor in Engineered Carbon Removal projects can scope out quality and corporate demand for similar credits before committing to their investment.

A trader at a bank’s carbon trading desk can refine their sales strategy for a given client by investigating what kind of credits they’ve been retiring.

A marketplace can monitor demand trends to optimise their project sourcing and available inventory.

A sustainability leader in charge of credit procurement can benchmark the quality of their company’s carbon portfolio against its peers.

An sustainability consultant can gain deeper insights into retirement trends to better advise prospects and clients on risks and opportunities.

An asset manager performing environmental due diligence on their fund holdings can check if credits retired by companies they’re exposed to are rated.

What you need to know

The ability to assess the volume, type and rating status of retired carbon credits in an integrated way yields unique market insights you can’t find elsewhere.

This matters because BeZero Carbon Ratings are driving buyer behaviour, with an increasing amount of companies drawn to highly rated credits. In the first quarter after we launched our public ratings (Q3 2022), 17% of retired BeZero rated credits sat at the upper end of our rating scale, with ‘AA’ or ‘A’ ratings. As of the most recent quarter (Q2 2024), that figure has grown to 27%.

Covering more than 3,000 companies uniquely mapped via Legal Entity Identifiers, users of BeZero’s Corporate retirements tool benefits from clean and standardised data for a dependable view of retirements data.

Rigorous data collection and curation, using data science techniques such as Natural Language Processing combined with analyst judgement, further enhance the reliability of this dataset.

By enriching retirements data with BeZero’s proprietary data such as carbon ratings and over 45 sub-sector classifications, users benefit from a deeper understanding of the quality of corporate credit retirements, as measured by the carbon market’s #1 risk metric.

Get in touch at commercial@bezerocarbon.com to request a demo of Corporate retirements. Retirements data is also available via an API solution, with seamless integration into platforms using Legal Entity Identifiers.

If you haven’t already, sign up for BeZero’s public platform to preview the full suite of features, including carbon project listings, ratings analysis, risk assessment tools, and portfolio analytics.

References:

Allied Offsets, November 2023: 2023 VCM Forecast Report

Established by the Financial Stability Board in June 2014, the Global Legal Entity Identifier Foundation (GLEIF) is tasked to support the implementation and use of the Legal Entity Identifier (LEI).

Caveat on data limitations:

We automatically collect and map data from six registries: Verified Carbon Standard (Verra), Gold Standard, Climate Action Reserve, ACR, Cercarbono, and Puro.earth. As of July 2024, 32.1% of all retired credits from these six registries can be associated with a Legal Entity Identifier, and are available in this platform feature. The remaining retirements either don’t have necessary information in the retirement note, or could not be associated with a LEI (i.e. not listed on the GLEIF registry), or are companies with less than 10,000 total credits retired. As a result, the completeness of retirements data is dependent on the level and quality of disclosure in the market. Just over 3,000 corporates have been identified using our methodology. Neither BeZero Carbon nor any of their affiliates make any warranties, express or implied, as to the accuracy, adequacy or completeness of any of the information contained in the database. All such materials are provided to BeZero Carbon Markets subscribers on an "as is" basis.