Assessing the quality of Landfill Gas projects

Here are some key takeaways

The carbon efficacy of landfill gas projects—additionality in particular—is heavily impacted by the prevailing policy environment in a given project’s location.

Gas flaring projects, while effective at reducing the global warming potential of landfill gas emissions, are less additional than projects that convert landfill gas to energy.

Leakage and over-crediting risks tend to be low, but can be further reduced with the application of a robust methodology and the use of best practices.

Contents

- Introduction to Landfill Gas

- Types of LFG projects in the VCM

- LFG projects and BeZero Carbon Ratings

- The impacts of regulation

- Risk of Perverse Incentives

- Low Leakage and Over-Crediting Risks

- Lessons for VCM participants

Please note that the content of this insight may contain references to our previous rating scale and associated rating definitions. You can find details of our updated rating scale, effective since March 13th 2023, here.

Introduction to Landfill Gas

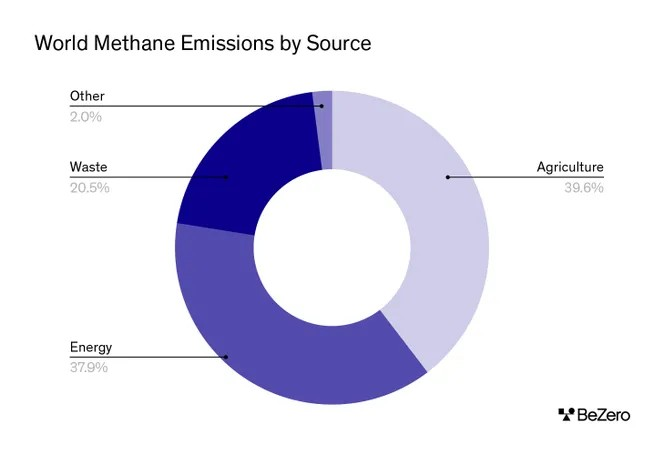

Landfill gas (LFG) refers to gas that is naturally created by decaying landfill waste, and which is roughly 50 percent methane and 50 percent carbon dioxide. Emissions created by decaying landfill waste account for roughly 20 percent of global methane emissions and hundreds of millions of tonnes of CO₂e emissions globally each year (see Chart 1).

Chart 1. World methane emissions from all sources, IEA estimate based on available data. Data from International Energy Agency (2022), Methane Tracker Database, IEA, Paris. License: Creative Commons Attribution CC BY-SA 4.0.

Most landfills collect the gases produced by decaying waste to limit safety and health risks from gas leaks or unabated build-ups. But some of those collection facilities go further, using a combination of techniques and technologies to avoid emissions from the collected gas, and can turn it into a renewable energy source. Some of these projects also use carbon finance to fund their operations. The primary aim of LFG projects such as these is to limit the amount of methane released into the atmosphere by landfills. Methane has a global warming potential 28 times higher than that of carbon dioxide, which makes reducing these waste emissions important to meeting targets set by the Paris Agreement to limit global average temperature increase to 1.5 degrees Celsius.

Types of LFG projects in the VCM

There are several categories of waste-related carbon credits available on the Voluntary Carbon Market (VCM). In addition to LFG credits, projects can measure carbon avoidance as a result of recycling, composting, improved wastewater management, and even the reduction of methane emissions from livestock waste. LFG credits are currently the most abundant of these, and represent hundreds of projects and millions of issued credits.

There are a variety of effective techniques for avoiding emissions from landfill gas. In some cases, landfill operators simply combust the collected methane in a process called flaring, which converts methane into carbon dioxide and water by taking advantage of a chemical reaction that occurs when methane is ignited. Other projects use the collected gas to generate electricity that can either be used on-site or sold back to the grid. The heat given off by generators running on LFG can also be used on-site or sold. Less often, landfill gas is used directly as fuel for certain kinds of engines.

Often, the techniques deployed are required by local or national regulations, which can in some cases render the projects so non-additional that they cannot qualify as carbon credits. But for projects that can pass the additionality tests set out by accreditors, the sale of the credits issued may be vital to the project’s ongoing operations. BeZero applies its ratings analysis techniques to accredited LFG projects available on the VCM to determine the extent to which existing supportive policies, the existence of alternative finance, and the strength of a project’s chosen baseline assumptions pose a risk to that project’s carbon efficacy.

LFG projects and BeZero Carbon Ratings

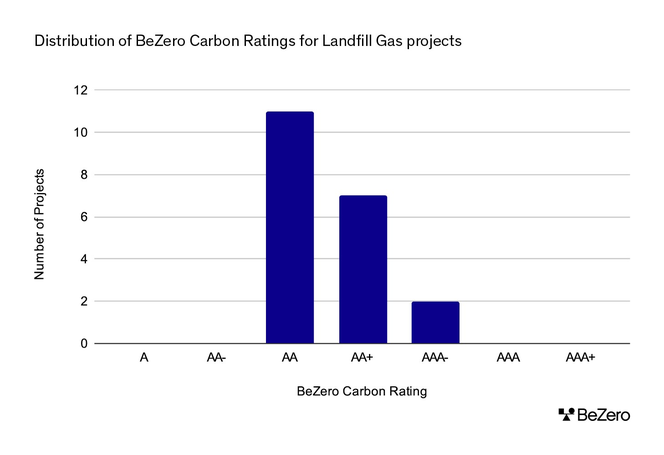

BeZero has rated credits from 20 LFG projects, with ratings varying from AAA- to AA (see Chart 2). The rating range reflects the impact that different regulatory environments and applied technologies have on a project’s carbon efficacy.

For example, where supportive regulatory environments mandate methane capture, or where the energy generation from captured landfill gas is in common practice, projects will tend to have lower additionality. Projects can also benefit from alternative revenues by selling generated electricity to the grid or claiming renewable energy credits, further reducing additionality. Further, emission factors vary by country and projects are often not required by methodologies to use dynamic factors that represent ongoing changes in technology and industry, which may lead to over-crediting risks depending on the emissions factor a project uses.

The varying policy environments between countries and different penetration rates of LFG management techniques lead to a range of carbon credit efficacies within the sector, however, we also find commonalities across the sector. Leakage risks are inherently low for this type of project (all LFG projects assume zero leakage), and we find scope for perverse incentives for all projects.

Chart 2. Distribution of BeZero Carbon ratings for the 20 landfill gas projects listed on the BeZero Carbon Markets Platform, as at 29/07/2022

The impacts of regulation

Serious additionality risks can arise for landfill gas projects where regulations mandate landfill gas capture and use. And because the energy generated from landfill gas can be sold to generate revenue, some projects could operate profitably even without the aid of carbon finance. These dynamics underline the importance of BeZero’s additionality analysis, which assesses that landfill gas projects were not operating independently before the start of the project’s crediting period, and also that the project is not located in a place where local, regional, or national policies require that landfill gas be flared or used to generate electricity.

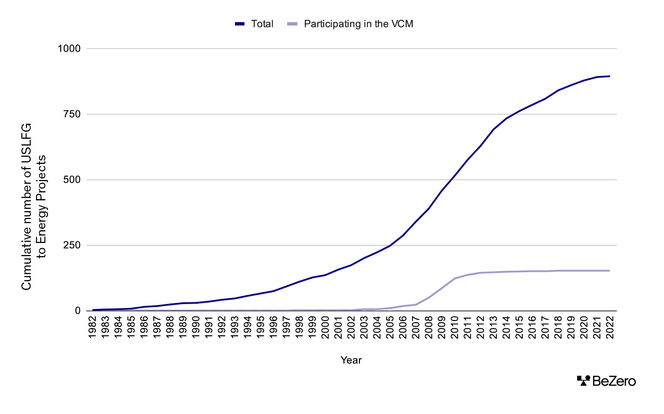

Chart 3. Total number of landfill gas projects in the U.S. against the number participating in the VCM. Source: Environmental Protection Agency.

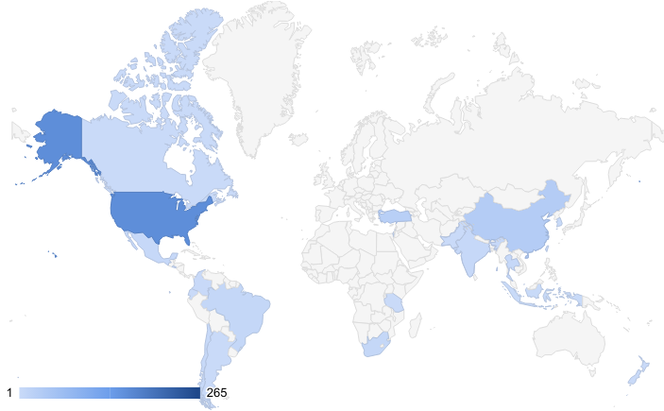

The extent to which regulation impacts LFG projects varies by country. In the United States, for instance, landfills of a certain size are required under the Clean Air Act to operate gas-to-energy projects. There are also strong financial incentives (and plenty of financing incentives) to support smaller landfills in adopting gas-to-energy schemes. LFG projects are common practice in the United States with almost 900 projects in the country, only 17% of which participate in the VCM. This suggests that LFG projects in the U.S. are viable without carbon finance (see Chart 3). Furthermore, the U.S. is by far the largest contributor of LFG projects to the VCM, with 152 projects compared to 41 in China and 28 in Turkey (see Chart 4).

Chart 4. Number of landfill gas projects in the VCM by country. Source: BeZero analysis

Although policy support can increase the number of LFG projects in a given country, a supportive policy environment does not always, on its own, indicate low additionality. Even in certain countries where regulation supports gas-to-energy projects, there may be insufficient public or private funding available to source the equipment needed to start converting landfill gas into energy. For example, some supportive policies exist in South Korea, but BeZero has assessed only some risk, indicating strong additionality, for the LFG projects rated in that country.

Regulation also impacts the profit that proponents can make from the sale of electricity. For instance, where regulation mandates that an electrical grid source a certain share of its energy from renewable sources, electricity generated by landfill gas (classified as a renewable source) may command a premium compared to non-renewable energy. Electricity generation as a source of income means that projects may not be reliant on finance from the sale of carbon credits to fund their work, further contributing to additionality risks.

Risk of Perverse Incentives

Every landfill gas project rated by BeZero so far faces at least some risk from perverse incentives, which is somewhat atypical in the BeZero universe. The possible perverse incentives fall into two broad categories.

First is the risk that project proponents may be inclined to oppose development of legislation or regulation that would require converting landfill gas to energy, because that regulation would reduce additionality and put carbon finance streams at risk. This risk is greater for landfill gas projects than some other types of projects because the project proponents are often municipalities or other government actors, and therefore may have influence over the adoption (or not) of relevant policies.

Second, when the financial rewards for gas-to-energy projects are high, landfill operators may choose to landfill as much waste as possible in the hope of creating more gas to convert to energy and then sell. Some opponents of LFG argue that this dynamic could lead to reduced rates of recycling and composting or a decreased effort by municipalities to encourage citizens to limit the amount of waste they produce.

Low Leakage and Over-Crediting Risks

Landfill gas projects typically have very low leakage risks. Risks may arise related to the emissions created when the equipment used for flaring or electricity generation is transported to facilities. BeZero has found that these emissions are negligible and associated leakage risks minimal.

Some methodologies assign leakage risk to the emissions used in electricity generation that would otherwise not have been consumed, but as many facilities use the energy generated by LFG to power their operations, the BeZero Carbon Rating (BCR) often reflects minimal risk from this source.

Many landfill gas projects rated by BeZero are assessed to have little risk of over-crediting, thanks to the continuous monitoring of electricity use and generation. Some risk of over-crediting can arise when projects use fixed emission factors to quantify the carbon-intensity of the grid-supplied electricity the LFG energy they create is avoiding. In reality, grid emission factors change over time, and as renewable energy becomes more prevalent, the emissions from the electrical grid are decreasing in some places. This means that, over time, the amount of generated LFG energy that’s necessary to avoid 1 tonne of CO₂e emissions from the grid is likely to increase, a trend that projects using fixed emission factors ignore.

Projects where BeZero has assessed higher over-crediting risks tend to use inaccurate or unrealistic baseline settings to calculate emissions reductions, which creates the possibility of assuming more carbon avoidance than is being realised by the project. These risks could arise from a failure to account for the different emissions produced by open vs. enclosed flares, by an inaccurate accounting of the methane emissions created by differing waste storage techniques and underestimation of the amount of CO₂ created by oxidising methane. Learn how BeZero assesses over-crediting risk at a project-level through a curated dataset that goes beyond default values used in emission reduction calculations in our deep dive.

Lessons for VCM participants

Many LFG projects use similar technologies and techniques on the ground. Differentiating their carbon efficacy by assessing variations in project-specific implementation has its limitations.

By contrast, we find material divergences in project carbon efficacy driven by country- and locality-specific factors. These include factors such as the existing regulatory landscape and the availability of non-carbon finance.

BeZero’s ratings show that projects that combust methane are typically less additional than gas-to-energy projects. Key drivers include, but are not limited to, the fact that methane combustion is already in common practice in many parts of the world and is less expensive, and less technically challenging than electricity generation.

The gas-to-energy projects with the highest BCRs are those that operate in unsupportive policy environments, use practices that are not already in common practice in their region, and employ robust methodologies to mitigate risks of leakage or over-crediting. A good example of this contrast is evidenced by comparing U.S.-based projects with those in Southeast Asia.

The simple lesson for those seeking to develop, trade, or retire credits from LFG projects is that their operating conditions can be a deciding factor in understanding their carbon efficacy.