Assessing carbon delivery risk

Here are some key takeaways

Carbon projects face multiple dimensions of risk including the accuracy of issuance forecasts. The BeZero Issuance Risk Monitor (IRM) helps users model the likelihood a forecast credit will be issued.

The IRM leverages our database of projects to compare forecast versus realised issuance. When aggregated, this allows our users to see the distribution.

This is a crucial tool for the market to enable users to risk-adjust on a forward looking basis, complementing the BeZero Carbon Rating (BCR) which looks at the likelihood that an issued credit achieves a tonne of CO₂e

Contents

Why measure carbon delivery risk?

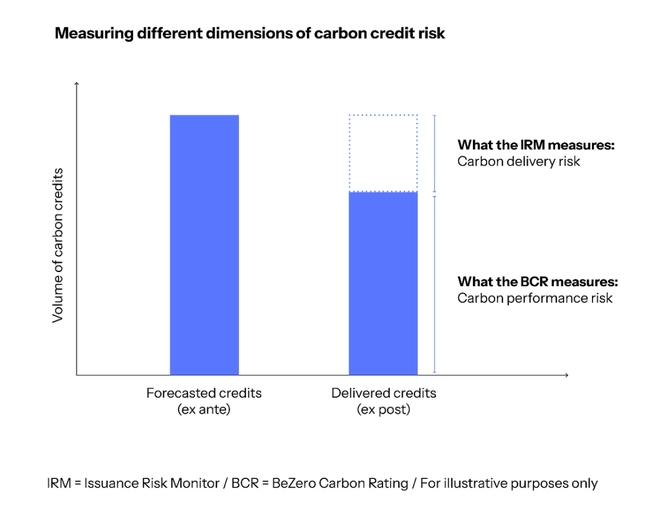

The BeZero Carbon Rating (BCR) is our view on the likelihood that an issued credit achieves a tonne of CO₂e avoided or removed. It is a tool that enables market participants to make a risk adjusted assessment of ex post credits available in the market today.

What the BCR does not do is assess forward looking issuance risk. While our database of rated credits can be used to see what drives variations in carbon performance and risk across project types, countries etc., it does not provide a view on the likelihood that a project will actually deliver a given number of credits.

This data already today is a critical component across key decision making processes with a number of stakeholders in the voluntary carbon market (VCM) value chain: from project investors carrying out due diligence on a project, to project developers looking to understand the drivers of variations in issuance, to insurance companies calculating premiums and pricing risk.

Figure 1: In this illustrative example, the vintage of this project has under-delivered credits (ex post) against its initial forecast (ex ante). The Issuance Risk Monitor (IRM) is designed to help monitor this carbon delivery risk, while the BeZero Carbon Rating (BCR) measures the carbon efficacy of issued, ex post credits.

The IRM helps address this need for a carbon delivery risk tool. It enables users to leverage our database of projects to see the distribution of historical performance of issued credits versus forecast. This can be used to risk-adjust forecasted credit issuance by a given project, with the users able to filter the sample by a number of factors such as sector, country, accreditor and others.

Database & use cases

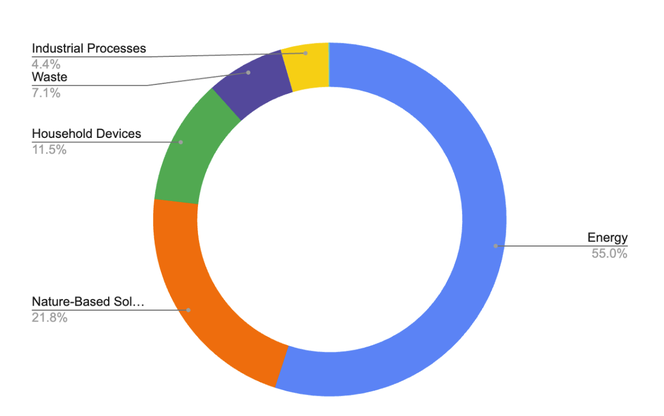

As of March 2024, the IRM leverages data from just over 755 rated and unrated projects. Chart 1 shows the distribution of these projects by sector group.

Chart 1: Distribution of 755 BeZero rated and unrated projects by sector group.

We collect observations of the number of ex post credits issued in each vintage by a project and compare this to the number of credits the project forecast it would issue ex ante when it first started (collected from the registry’s Project Design Document).

Comparing the two, we create a percentage metric of credits issued versus forecast. This ratio represents the project’s issuance rate: a figure of less than 100% indicates the project has under-delivered, while a figure above 100% means the project has over-delivered. The figure is then aggregated across all projects in the sample and displayed to IRM users.

While deviations in individual projects’ issuance from what was forecast may be driven purely by idiosyncratic factors, the tool gives users the context of what has happened historically for projects in the market to input into models and assessments as they see fit.

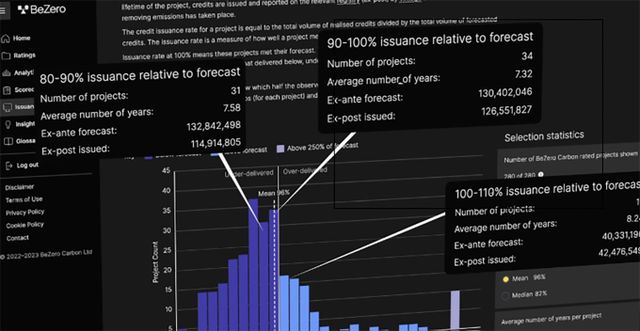

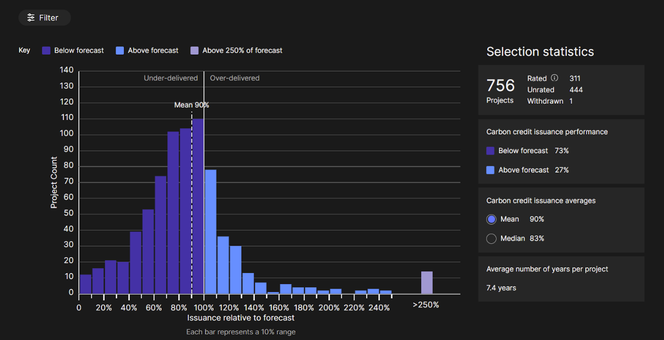

Interestingly, while the average project issued the same number of credits as forecast at the project start date (mean = 90%, median = 83%), we find this distribution to have a considerable range. The projects in our sample have delivered credits between 0% to over 250% of what was forecast at the start of the project (Figure 2).

Figure 2: screenshot of the Issuance Risk Monitor from within the BeZero Carbon Markets platform

Having access to this distribution enables our users to leverage the historical performance of projects in the VCM when risk-adjusting forecast issuance. The displayed sample can be filtered by any of the data labels on the platform; sector, country, accreditor etc, allowing for additional layers of granularity. However there is a tradeoff between greater specificity on the sample being used and the sample size. As a statistical exercise, the bigger the sample size the better.

The IRM also allows users to see where specific projects sit within the distribution. This empowers them with a more in depth look at individual projects, linking the issuance performance with the broader ratings analysis available on the platform to assess the risk profile and characteristics.

Feedback on the IRM amongst our early users of the tool has been positive. One user from a major energy company stated: "It’s very relevant to us in terms of how we think about this risk, and how we price it into our portfolio.”

If you’re interested in learning more about the IRM and our ratings platform, reach out to commercial@bezerocarbon.com