How companies can successfully navigate the voluntary carbon market

The 2020s are commonly known as ‘the decade of change’, with a rapidly growing number of companies aspiring to contribute to the fight against the climate crisis. However, companies entering the voluntary carbon market (VCM) at this time of transition - with inbound guidance, regulation, and new players in the market - need to consider various factors linked to the nature of this emerging market.

Contents

- Identifying barriers

- Rising to challenges and integrating credits effectively

- Tools can help inform intelligent decisions

Identifying barriers

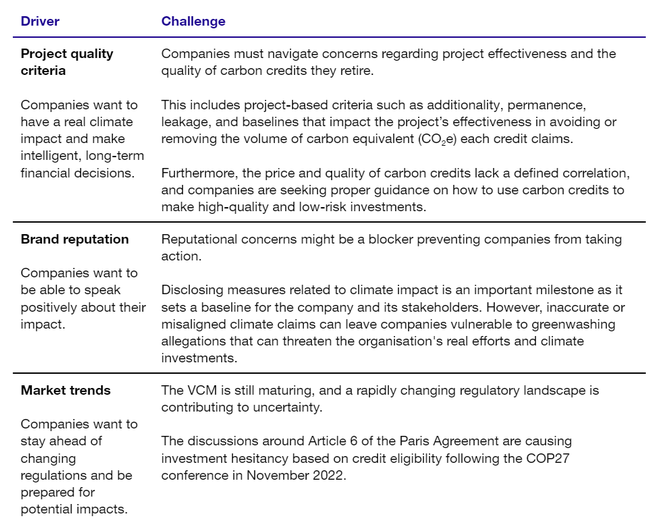

In this time of transition, a variety of challenges can hinder progress, discouraging businesses from taking ambitious action or investing in innovative solutions like carbon credits. Some of the main drivers and challenges limiting climate action are summarised below.

With these challenges, diving into the world of carbon credits can be daunting for many companies. The past 24 months has seen a host of enhancements and new participants enter the VCM. Yet, the market remains opaque, complex, and fragmented for many buyers. It can be difficult for sustainability managers to find trustworthy partners and quality carbon credits, while also mitigating the challenges related to greenwashing and climate reporting.

However, acknowledging challenges can empower companies to successfully navigate them and find opportunities to demonstrate clear climate leadership.

So how can this be done?

Rising to challenges and integrating credits effectively

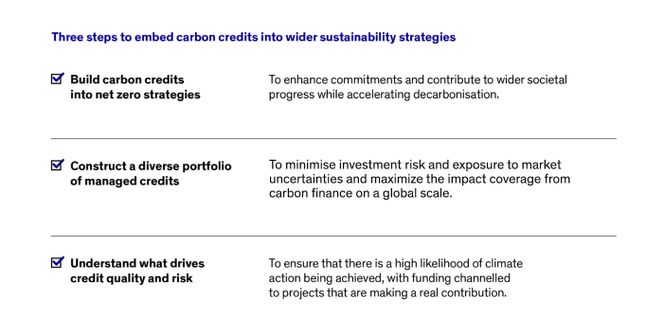

When addressing the challenges posed by leveraging carbon credits, companies can take three main steps to embed carbon credits into their wider sustainability strategies. These are:

Build carbon credits into an ambitious and credible net zero strategy

Managing emissions requires a robust decarbonisation strategy and ambitious net zero targets; not just across the company’s own operations, but reaching beyond their front door and associated supply chains to contribute to societal goals as well.

Many companies have set targets aligned with frameworks like the Science Based Targets initiative (SBTi), the leading framework for net zero strategy. Globally, over 2,000 companies have now set targets in line with an aim of limiting global warming to at least 2oC.

Decarbonising 90%+ emissions directly should be the first priority. But carbon credits offer a viable path to contribute towards residual emissions reductions as part of a net zero strategy, while providing additional value toward global climate goals.

Carbon credits are not the sole solution for reaching net zero but can be a valuable component, complementing efforts to avoid or sequester carbon alongside a company's own reduction pathway. They are not a standalone tool, but they play a crucial role in leveraging current strengths in decarbonisation pathways across a company's supply chain, while supporting areas that require improvement.

Therefore, thinking strategically about using carbon credits encourages critical consideration of how they can be framed and communicated to improve effectiveness. With this in mind, some important applications include:

Scope 3 supply chains and residual emissions: Targeting hard-to-abate emissions in carbon-intensive Scope 3 categories as well as residual emissions associated with Scope 1 and 2 (such as infrastructure) can help bridge the gap between immediate action and future advancements that require time to scale. These emissions pose a challenge currently beyond our capabilities as they require future technology for actual net zero results.

Future-proofing: Investing in future-proof projects is vital for reducing hard-to-abate emissions, alongside expanding technologies that can have wider reaching benefits. This includes advancements in renewable energy, innovative carbon removal technologies, sustainable fuels, and efficient supply chain logistics. Traditional funding may not support these projects, but carbon credits provide new revenue streams to accelerate progress.

Driving innovation and business value: Furthermore, investment in carbon credits and related sustainability initiatives may help companies become more efficient and innovative as they decarbonise their operations. This can lead to reduced costs and new products and services, unlocking competitive advantage and future revenue. In this way, near-term strategic decisions could have wider and longer lasting benefits for companies that need to adapt to a changing world.

Staying ahead of regulatory changes: Many countries are introducing legislation to address corporate responsibility for GHG emissions. New climate disclosure regulations such as the EU Corporate Sustainability Reporting Directive (CSRD) will help to hold companies accountable for reporting their emissions, how they plan to reduce them, and how they will mitigate any remaining emissions. Certain regulations also focus on Scope 3 emissions, which can be particularly challenging for businesses to address. By including carbon credits in their climate transition plans, companies can proactively demonstrate their ongoing efforts to reduce emissions, both within and outside their supply chain.

Co-benefits: Carbon credits go beyond immediate value chains, providing support for environmental and social benefits. They include co-benefits such as biodiversity preservation and promoting Sustainable Development Goals (SDGs) through projects that protect habitats and create employment opportunities for communities.

To assist companies looking to build out carbon credits within net zero frameworks, there are several new initiatives seeking to provide clarity and guidance. On June 28, the Voluntary Carbon Markets Integrity Initiative (VCMI) unveiled its Claims Code of Practice, followed by the release of the Integrity Council for the Voluntary Carbon Market (ICVCM)’s Core Carbon Principles Assessment on July 27. Both organisations have joined forces to create market leading practice standards and are expected to release joint guidance later this year. The SBTi guidance on Beyond Value Chain Mitigation (BVCM) will also be released later in 2023 and is expected to clarify the role carbon credits have to play in the context of broader societal net zero. This guidance provides insight into how best to make use of carbon credits within a corporate sustainability strategy.

Build a diverse portfolio of managed credits

Diversification is another crucial aspect to consider when it comes to carbon credits. Similar to how financial investments work, building a diversified portfolio can help mitigate market risk as well as create a solution tailored to a company’s specific goals. Developing carbon credit portfolios that exhibit integrity and flexibility is vital for effectively navigating the uncertainties inherent in the VCM.

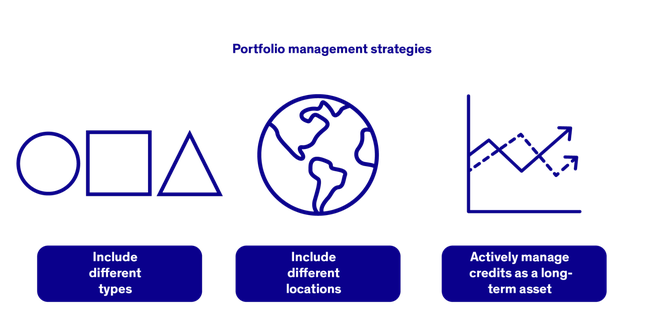

Minimising exposure to credit-specific risks (such as sector and location) can also help to mitigate uncertainty. Recognising that no carbon credit is perfect presents opportunities to invest in a range of innovative solutions to balance uncertainty and maximise opportunities. Here are some portfolio management strategies to keep in mind:

Include different types:

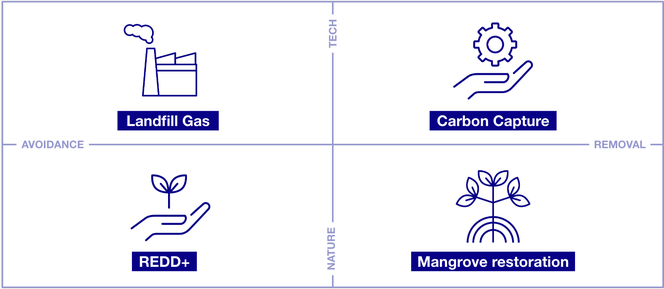

One key to diversification is including different types of investments in your portfolio. For example, carbon avoidance and carbon removal credits both play crucial roles in addressing various aspects of carbon emissions but with different approaches. Avoidance credits support solutions that steer away from fossil fuel norms and prevent ecosystem degradation, while removal credits fund technology and nature-based solutions that remove carbon from the atmosphere.

Diversifying ensures a balanced approach while also fostering global sustainable growth, resilience in changing market conditions, and development in emerging market segments.

Examples of projects, by credit type and project activity

Include different locations:

Investing in credits from all over the globe, not just locally, is also an important diversification strategy to consider. Climate change may impact regions where previous credits were easily sourced, so limiting credits to a single location may increase unwanted exposure to certain supply risks. Widening the scope of credit purchases to projects in different regions is a simple way to negate this.

Furthermore, global investment in projects located in developing regions provides a critical source of funding and directly impacts the ecosystems and communities that rely on them.

Actively manage credits as a long-term asset:

Carbon credits are versatile assets and portfolios should be adapted over time to align with a company’s evolving emissions requirements.

It’s also essential to stay up to date with the latest science and net zero strategies, including protocols for credits. Methodologies, quality measures, and the availability of different types of credits continue to evolve in a dynamic and expanding market. As a result, navigating risk intelligently requires assessing and managing these changes on an ongoing basis.

Understand what drives credit quality and risk

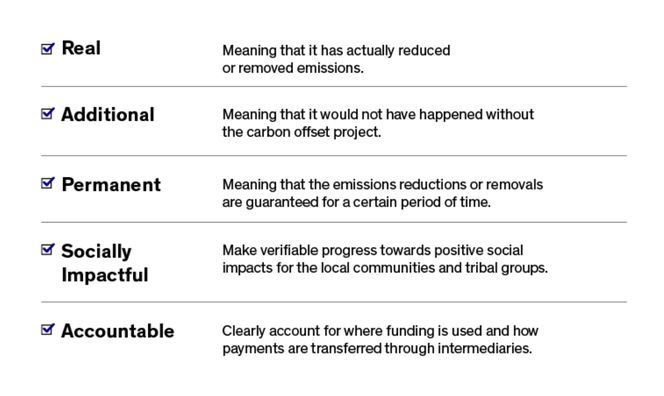

Carbon credit quality refers to the degree to which a carbon credit meets certain standards of environmental, social, and financial integrity. These standards can be enforced by monitoring and verifying whether a project is real, additional, permanent, socially impactful, and accountable:

Carbon credit risk, on the other hand, refers to the potential that a carbon credit may not deliver the environmental benefits that it is supposed to. This could be due to a project not being implemented as planned, not being able to deliver the promised emissions reductions or removals, or even having adverse environmental impacts.

High-quality carbon credits are those that have a low risk of not delivering their promised benefits. They are typically more expensive than low-quality carbon credits, but they offer the peace of mind that the money is being used to support projects that are actually making a difference.

Tools can help inform intelligent decisions

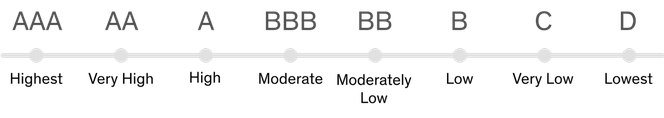

To help companies make more informed decisions, there are a variety of market tools available. For carbon quality assessment, we can turn to independent rating agencies, such as BeZero Carbon. Carbon ratings help companies to gain a deeper understanding of carbon credit projects through detailed risk analysis, project comparisons and benchmarking, and continuous monitoring of carbon efficacy over time. By referring to a rating for carbon credit projects, a buyer can easily uncover and assess the risk associated with a particular project, both before a decision takes place and on an ongoing basis, through portfolio monitoring tools.

BeZero’s rating scale. The BeZero Carbon Rating represents BeZero’s current opinion on the likelihood that a given credit achieves a tonne of CO₂e avoided or removed. The rating is expressed on an eight-point scale, ranging from ‘highest likelihood’ (‘AAA’) to ‘lowest likelihood’ (‘D’).

Carbon marketplaces can also be a helpful decision-making tool as they allow companies to easily build a diversified portfolio of credits. In addition to providing a vetted selection of credits that have already undergone due diligence, these marketplaces allow companies to view and compare quality markers of each project, including independent ratings.

Example of a carbon marketplace that includes independent ratings, giving buyers and sellers an additional risk reference point.

Carbon credits provide a practical way for organisations to address residual emissions that cannot otherwise be reduced on their journey to net zero in the short term. By carefully assessing the risk involved in buying carbon credits and considering their quality, companies can credibly contribute to a sustainable future while achieving their targets. This will enable them to position themselves for long-term success in a rapidly changing world.

References:

¹ Additional benefits.

With built-in transparency, ease of purchase, and reporting capabilities, carbon marketplaces such as Cloverly can be helpful for a company seeking to build a robust portfolio of credits. Using the BeZero Carbon Rating Scale, businesses can gain an independent assessment of a project’s carbon efficacy to inform purchases for effective and impactful carbon credit portfolios.

Authors

BeZero Carbon - Tommy Ricketts is the CEO and co-founder of BeZero Carbon, a global ratings agency for the VCM. Founded in 2020, its global team combines expertise within climate and Earth science, financial research, geostatistical modelling, data science, and public policy. Prior to founding BeZero Carbon, Tommy was a VP in Global Research at Bank of America and worked as a political strategist in London and Brussels.

Cloverly - Shawn Gagné is the Director of Sustainability at Cloverly, where he develops and deploys market risk management strategies aimed at enhancing transparency within the VCM. He has over 20 years of experience in environmental science and climate risk management, as well as extensive expertise across all transaction stages of the VCM. In prior roles, he served as a Climate Consultant and founded several impact-oriented companies. One of his companies, *Urban Offset<s>, developed and implemented a first-of-its-kind carbon bundling product that combined high-quality carbon offsets from global projects with local, community forest programmes. He has a Master of Science in Environmental Science from Wilfrid Laurier University.