BeZero’s carbon risk factor series: Non-permanence

Here are some key takeaways from the report

Non-permanence is the risk that the carbon avoided or removed by a project does not remain so for the duration committed to. Assessing the degree of such risks promotes comparability across sectors.

BeZero assesses non-permanence by interrogating the appropriateness of employed safeguards and the degree of information risk associated with a carbon project, alongside other risk drivers where relevant.

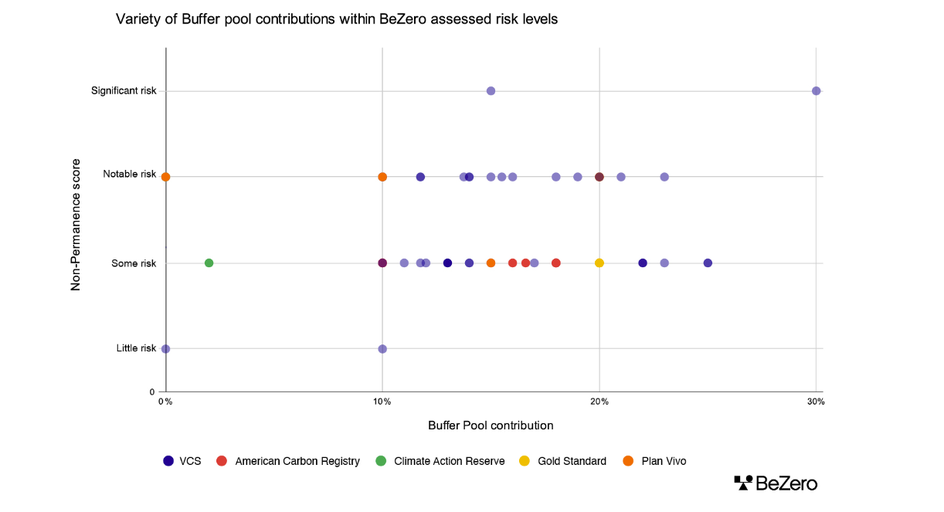

For NBS projects, we find no clear relationship between our assessment of non-permanence risks and the extent of buffer pool contributions. We explore some of the drivers behind this.

Contents

- Introduction

- What is Non-permanence?

- Key factors when assessing risk of non-permanence

- Credit-specific considerations

- Mapping Non-permanence in the BCR universe

- Project-specific bottom-up analyses enable non-permanence assessments

- Further analytical discussions

- Conclusion

- References

Please note that the content of this insight may contain references to our previous rating scale and associated rating definitions. You can find details of our updated rating scale, effective since March 13th 2023, here.

Introduction

Permanence is often discussed in the market as the length of time a given amount of carbon will be stored for, whether through removal or avoidance by a project. In the case of some removals projects, this can theoretically stray into the hundreds, if not thousands, of years.

While much of the commentary on this topic focuses on how permanent a given technology or project type may be in theory, there is less focus in the market on the permanence of the contractual commitment of a given project and its issued credits.

A key role of the BeZero Carbon Rating (BCR) is bridging this gap between theory and reality. This is particularly pertinent to the risk of non-permanence.

A full assessment of these risks requires an understanding of: 1) how long is actually committed to ensuring the carbon avoided or removed remains so, 2) the mechanisms in place to guard against any losses, and 3) the strength and accuracy of the claims made.

The information required to make an assessment of these three factors is not always readily available in the market, as we will go on to show in this article. At BeZero, we are working hard to encourage greater transparency and disclosure of key data points such as the commitment period and the mechanics of any insurance mechanisms in place, whether operated by the project, registry or another entity.

What is Non-permanence?

Non-permanence is “the risk that the carbon avoided or removed by the project will not remain so for the time committed and any associated information risk”. Given that commitment periods vary from sector to sector, evaluating non-permanence is a complex issue which demands both top-down and bottom-up analyses. By making assessments of the likelihood that a project’s carbon benefits will remain for the duration of its commitment period, it is possible to level the playing field and enable comparability across the market for different project types.

Mitigating non-permanence risks is vital in ensuring that the Voluntary Carbon Market (VCM) acts as a truly effective long-term form of climate action. If such risks - whether human or natural - are not addressed, carbon can be re-emitted and undermine a project’s carbon benefits, resulting in reversals.

Market participants have given increasing attention to the risk of non-permanence in recent years, and it is an issue where the risk level varies considerably. The security of carbon removed or avoided by Nature-based Solutions (NBS) projects is particularly at threat, due to a host of natural and man-made risks. This has been highlighted by a number of recent high-profile reversal events, such as wildfires within North American project boundaries. Meanwhile, technology-based avoidance projects face no risk of reversal, at least from a theoretical perspective.

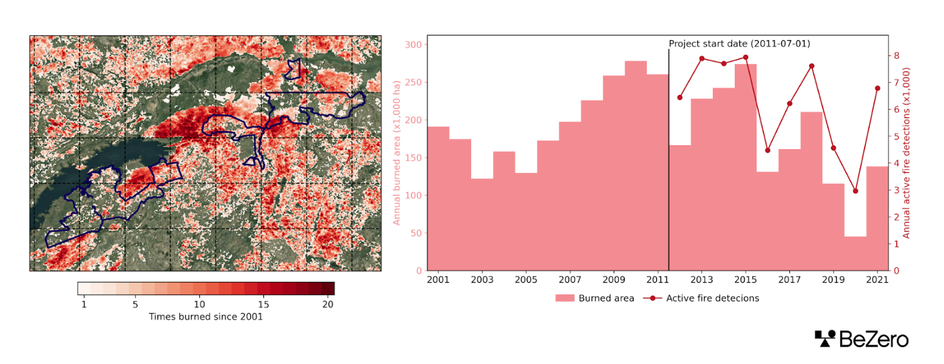

Where fire and drought are pertinent to a project's non-permanence assessment, we use remotely-sensed burned area and fire detection data developed by NASA, alongside satellite-derived climate models, to help assess the risk. Meanwhile, our team is spearheading new ways to track and classify fire events in near real time.

Figure 1: Fire history for an Avoided Deforestation project in Zimbabwe. Our analysis identifies frequent historical burning in the project area (left plot), but with declines in burned area and active fire detections since the project start date in 2011 (right plot). Fires are a natural component of savannah-woodland ecosystems, with tree biomass partly determined by frequency and intensity of burns. The project reports that fire risk is being mitigated through management practices. There remains some risk of non-permanence due to fire, because of fuel build up and increasing climate extremes. Sources: NASA and BeZero Carbon.

Below we explore the key factors which determine non-permanence risks across the VCM, including projects’ commitment periods, their degree of associated information risk and the safeguards put in place to mitigate risks. We go on to look at how these considerations relate to the BeZero Carbon Ratings (BCR) framework, through examples drawn from the 250+ projects rated so far.

Key factors when assessing risk of non-permanence

To break down our assessment of non-permanence, we lay out the primary considerations and how they vary across different sectors and registries: commitment periods, information risks, and employed safeguards.

1. Commitment Periods

In order to make an assessment of a credit’s non-permanence risks, it is first necessary to determine the time period a credit commits to, and then whether the credit faces reversal risks. Commitment periods are the duration over which sequestration or abatement activities have permanence horizons, and differ from crediting periods (the timeframes during which reductions or removals are eligible for issuance as verified carbon credits).

For example, Verra's Verified Carbon Standard (VCS)-registered projects which fall under NBS are required to assess risks at a permanence horizon of up to 100 years. However, across registries there is a lack of standardised terminology relating to how measurement, reporting and verification (MRV) is conducted over multi-decadal timescales, as highlighted in Table 1.

| Registry | Sector | Commitment Period |

|---|---|---|

| Verra | NBS¹ | Maximum 100 years |

| American Carbon Registry | NBS² | Minimum 40 years |

| Climate Action Reserve | NBS³ | 100 years |

| Plan Vivo | NBS⁴ | Maximum 50 years |

Table 1: A list of the registry-required commitment periods within NBS illustrating the variability across the major registries. We focus on NBS projects here because for non-NBS initiatives, accreditors do not provide permanence horizons given they face no technical risk of reversal. Gold Standard is omitted as they have no publicly defined commitment period for NBS projects. This supports our approach to non-permanence of addressing risk level within commitment periods to allow comparability, rather than viewing non-permanence in absolute terms.

2. Risks and safeguards: Sectoral variation

Types of non-permanence risks and countervailing safeguards depend on a project’s sector. Some of the risks which commonly threaten the permanence of both NBS and non-NBS projects are presented in Table 2, along with possible safeguards which act to lower risks.

| Project type | Non-permanence risks | Possible safeguards |

|---|---|---|

| NBS | - Natural hazards (e.g. extreme weather events) - Human hazards (e.g. mismanagement) - Information risks | - Buffer pool contribution - Patrols - Community engagement |

| Non-NBS | - Information risks - Physical leakage | - Comprehensive data provision - Reliable data utilisation - Continuous performance monitoring |

Table 2: Key risks and possible safeguards across NBS and non-NBS activities. This underlines the need for bespoke analysis which incorporates both top-down and bottom-up assessments. Note that this list is not exhaustive.

3. NBS buffer pool requirements

Procedures for assessing and mitigating non-permanence risks also vary across the main market accreditors. Gold Standard (GS) requires all NBS projects to make a fixed contribution of 20% towards a pooled risk buffer. VCS, on the other hand, requires that such projects undertake an independent and bespoke risk assessment to determine the proportion of its credits which must be transferred to a global buffer pool.

The use of a buffer pool can serve to mitigate unforeseen losses in carbon stocks. We consider projects registered under VCS to follow best practice, given the requirements that both internal risks (e.g. project management) and external risks (e.g. natural hazards) are quantified and accounted for. Projects registered under Climate Action Reserve (CAR) also require an independent risk assessment, however this involves many ‘default’ risk factors which can lead to project-specific details not being considered. Meanwhile, the American Carbon Registry (ACR) has a buffer pool, yet also permits the use of a variety of insurance mechanisms. These can include bonds and letters of credit, and are designed to act as proof that a project developer could cover the costs of sufficient credits to offset a reversal event.

For NBS projects, understanding how and why buffer pool contributions are made is vital for making non-permanence assessments, especially since there is strong evidence of risk buffer rules not always being fully implemented. We will address this specific issue in more depth in a future article on buffer pool mechanisms.

4. Information risk: The importance of reliable data

Another key part of assessing risk of non-permanence is gauging a project’s exposure to information risk, i.e. the reliability of the data used to report carbon performance. A project’s commitment and enforceability is significantly linked to the reliability of the information used, and though it is particularly relevant for projects with no technical risks of reversal, it remains a key component of our assessments across every sector.

BeZero’s assessments of information risks are informed by the degree of publicly available data provision, its quality, and its sources. We first determine the degree of information risk from a top-down perspective, with possible sources of such risks deriving from data uncertainties at a national level.

Since many projects employ national datasets for credit issuance calculations and when determining non-permanence risks, it is important to assess the extent to which such data are accurate and reliable. To provide an indication of this, we use public data such as the World Bank Property Rights Index (WBPRI) and the Corruption Perceptions Index (CPI) as proxies for government effectiveness, and help in determining the veracity of national datasets.

The top-down analysis is then corroborated with a project-specific assessment. This involves interrogating project documentation and ascertaining whether the information provided is comprehensive, and thus effective in mitigating information risks.

For example, information risks can be lowered for technology-based avoidance projects if data are made publicly available pertaining to financial assessments, revenues from electricity sales and adopted emission factors, among others. This process enables a full assessment of project-specific information risks, related to sector, methodology or registry, in addition to information risks linked to the broader country effects.

Credit-specific considerations

1. Credit type: Technology-based avoidance

Since there are no inherent risks of reversal for technology-based avoidance credits, such as renewables or enhanced oil recovery, evaluating the non-permanence associated with such projects relies on determining the degree of information risk

This assessment may be top-down, where the information is accessed from external sources such as national data, or bottom-up when the information comes from internal project-specific sources - or a combination of both.

2. Credit type: Removals

For removals, on the other hand, the length of a project’s commitment period and appropriateness of safeguards - such as buffer pool contributions - are crucial for this assessment, alongside information risks.

The primary risks for technology-based removals are physical, i.e. leakage from geologic reservoirs. In contrast, the types of risks typically associated with NBS removals projects range from natural hazards such as wildfires and pests, to political risks and land tenure issues. As noted above, for NBS projects, a portion of credits are deposited into a global buffer pool to mitigate such risks, yet with different requirements from the major registries these contributions vary.

To provide an accurate evaluation of non-permanence risks, it is vital that the suitability of applied risk assessments is interrogated at the project-level. This allows for bespoke analysis which considers the scope and relevance of a project’s risk assessment and corroborates this with peer-reviewed literature and other independent sources (e.g. fire analysis), to determine whether a buffer pool contribution is sufficient.

Mapping Non-permanence in the BCR universe

Across the VCM, the degree of non-permanence risk depends on both external and internal hazards, the safeguards in place and the sources of information risks. We reflect the varying degrees of risk using the following language, from highest risk to lowest risk: ‘significant risk’, ‘notable risk’, ‘some risk’ and ‘little risk’.

A key insight from our universe of rated NBS projects is the weak relationship between a project’s risk buffer contribution and its non-permanence score. Our analysis therefore finds that non-permanence risks are not wholly mitigated by a project’s buffer pool contributions. This highlights the need for a more in depth assessment of the non-permanence risks faced by a project than the headline buffer pool contribution.

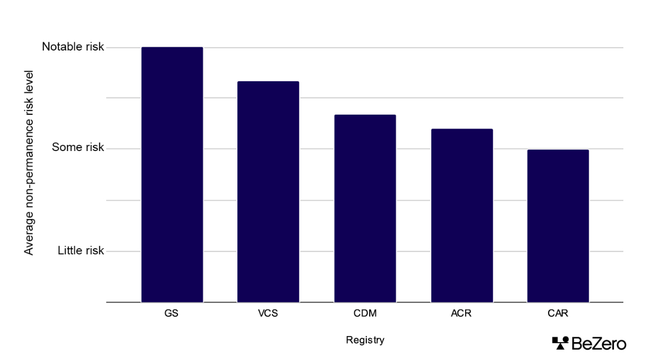

Chart 1: A comparison of the assessed level of non-permanence risk within nature-based projects across the major registries. This highlights the variability across the market and emphasises the value in assessing multiple drivers of non-permanence risks, including information risks.

Our analysis demonstrates that non-permanence risks vary considerably across registries. Within our universe of rated NBS projects, CAR- and ACR-registered projects typically hold the lowest risks, and projects under GS and VCS have the highest.

Given that VCS employ, in our view, more robust measures relative to CAR and ACR, this reveals that even a high or project-specific risk buffer contribution does not always negate non-permanence risks. Therefore, non-permanence risk levels are not entirely determined by such contributions, underlining the need to consider broader factors such as information risks concurrently.

The examples of CAR and ACR help to illustrate some of these other drivers. The low risk level for projects under these North American registries is at odds with recent scrutiny they have faced due to reversal events caused by wildfires. However, the projects highlighted for reversal events are a small subset in high fire risk areas, and are thus not representative of all NBS projects under CAR and ACR. A large number of the projects attached to these accreditors within our BCR universe, on the other hand, are based in areas with lower fire risks.

Projects under these North American registries typically conduct bespoke risk assessments, of which only a small and often default proportion is assigned to fire risk. Therefore, despite the buffer contributions for fire risk buffers in the recently publicised instances being largely depleted, the overall risk buffers may still be effective safeguards.

Moreover, our analysis of non-permanence also takes into consideration factors such as the presence of conservation easements, project management and financial risks and information risks related to data veracity. These factors may support a project’s activities to continue beyond its commitment period and between any change in landowners. For example, projects with conservation easements may permit salvage logging and replanting in the event of a reversal. We also consider how a buffer pool contribution evolves, since projects are required to raise their contribution in the case of a reversal event. These factors further illustrate that it is inappropriate to view buffer pools as the sole proxy for non-permanence risks.

Chart 2: An analysis of buffer pool contributions against non-permanence risk within the nature-based projects in the BCR universe. This demonstrates the lack of a clear relationship and indicates that a high risk buffer contribution does not necessarily equate to low non-permanence risks.

Chart 2 reveals considerable variation in buffer pool contributions along the BeZero Carbon Rating risk levels. The small number of outliers represent projects which are not required to make buffer pool contributions e.g. reducing methane emissions through the use of feed additives, while those with significant buffer pool contributions and high non-permanence risks hold information risks due to data uncertainties.

The lack of a strong relationship alludes to two converse possibilities - where buffer pool contributions do suffice as a risk predictor or that the extent of a buffer pool contribution alone doesn't determine non-permanence risk. We find that both of these factors are in play within our universe of projects rated:

In cases of reversal events, projects increase their risk buffer contributions to prevent under-capitalisation of global pools and this response can be reflected as lower risk.

Our view of non-permanence holistically considers all possible risk drivers, including information risks and other possible safeguards such as easements and management risks, beyond the risk buffer dynamics.

Project-specific bottom-up analyses enable non-permanence assessments

To highlight some of the key factors which determine non-permanence risks at a more granular level, we look at some project-specific examples showcasing both high and low risk cases in the BCR universe.

Case study: Notable risks within non-NBS relating to data uncertainties

We find notable non-permanence risks for a cookstove project in Bangladesh with a commitment period of 21 years. Despite there being no technical risks of reversal, there remains notable information risks on account of uncertainty around the veracity of the information provided by the project.

Internal risks are largely driven by a lack of transparency, with limited disclosure regarding stove sales, how surveys were conducted and how thermal efficiency tests were carried out.

Furthermore, the project relies heavily on national datasets to extrapolate common practices and cooking trends. To corroborate the project-specific analysis, the WBPRI and CPI are used as proxies to indicate the reliability of such data, and both suggest that data uncertainties are high within Bangladesh. Therefore, these notable information risks - from both a top-down and bottom-up perspective - undermine the inherently low non-permanence risks for cookstove projects.

Case study: Notable risks within NBS relating to inaccurate risk assessments

Turning to NBS projects, we find a Paraguayan Afforestation, Reforestation & Restoration (ARR) project with notable risks of non-permanence relative to the sub-sector average. This is despite contributing 20% of its credits into the global buffer pool.

We also find an abundance of evidence suggesting that policy enforcement is weak both nationally and regionally, which indicates that there are considerable risks that the project area will be subject to degradation through logging. Additional man-made risks arise from demand for firewood, with biomass accounting for 46% of national energy demand and evidence suggesting that most of the domestic wood supply is used for firewood.

Neither of these hazards are considered in the project’s non-permanence risk assessment. Altogether, we believe these factors undermine the likelihood of the project delivering its intended carbon benefits for the duration of its commitment period.

At the same time, the assessment regards risks arising from pests and disease as unlikely, estimating that such natural hazards will degrade between 5% and 25% of carbon stocks at most. This is at odds with the project’s own documentation, which notes how 30% of trees in the first instance of the project were infected with a fungus that could lead to a 40% loss of revenue.

With external risks manifesting in both political and natural forms, the project’s buffer pool contribution risks being undercapitalised and considerable risks of reversal are introduced.

Case study: Some risks within NBS relating to data uncertainties

At the other end of the spectrum, we find a Kenya-based ARR project with a 30-year commitment period to have some non-permanence risks. This is despite it only applying a 10% risk buffer.

Our top-down analysis does suggest that there are some observable uncertainties around the provision of data which introduces a degree of information risk. Since Kenya scores poorly among both the WBPRI and the CPI, there are some risks of the data used by the project being inaccurate.

Despite this, a bottom-up assessment largely negates such risks. Although the project’s buffer pool contribution is less than the sector average of 12.2%, the actual risk assessed during accreditation was 2.5% which makes the buffer pool contributions conservative. This is supported by literature which shows that natural risks from drought, pests and fire are mitigated by the spatial configuration of the project, which consists of thousands of individual areas spread across thousands of kilometres.

While this project-specific assessment indicates little likelihood of reversal, the combination with top-down analysis suggests that this project holds some, albeit relatively low risks of non-permanence within its commitment period.

These examples highlight the variety of non-permanence risks and safeguards across the VCM. By bringing the disparities between projects and commitment periods to light, this emphasises the need for bespoke analysis which incorporates both top-down and bottom-up assessments. This enables the non-permanence risks associated with different project types to be evaluated on equal terms and thus promotes comparability.

Further analytical discussions

In this article we have touched upon a couple of issues related to non-permanence risks where greater clarification and information availability would help assess these risks in more detail. We see greater transparency on these factors as a key barrier to scaling the VCM.

1. Project lifetimes

There is no common definition in the market of what constitutes a project's lifetime and what a credit is committing to. This is particularly problematic for nature-based and removals projects where understanding the carbon storage dynamics is key to integrating credits into a broader carbon accounting framework.

We find that while a project's crediting period is the best indication of its expected lifetime, these vary significantly by project and are not readily available as a data point in the market (we will be making this available on the BeZero Carbon Markets platform soon).

Furthermore it is not clear how differences between project crediting periods and registry based permanence periods operate in practice and who the liability for mitigating against reversals at different points in the project’s life cycle sits with.

2. Buffer pool dynamics

There are also disparities between registries in how buffer pool mechanisms are implemented. Not only do the extent of calculated buffer pools differ, as noted above, but registries also diverge in how contributions are managed once a crediting period ends. This topic is explored further in our deep-dive on buffer pools.

These variations combined with limited transparency on project lifetimes make navigating the market very complex. A lack of standardisation across these factors adds difficulty for buyers in knowing which projects to invest in, thereby inhibiting the market’s ability to scale.

Conclusion

The likelihood of a project’s carbon benefits remaining for the duration of its commitment period is an important consideration when determining a credit’s degree of carbon efficacy. It plays a key part of our assessment process when assigning a project a BeZero Carbon Rating.

The issue of non-permanence has received growing attention within the market, although much of the debate remains focused on the theoretical permanence rather than actual commitment period.

Whether a project is NBS or non-NBS largely determines the relative importance of components while assessing non-permanence. Since NBS projects are vulnerable to reversal events through either natural or human phenomena, it is crucial that the composition and appropriateness of applied risk buffer allocations are scrutinised. As highlighted, the processes for doing so vary by registry. Meanwhile, the level of information risk associated with projects across all sectors must be interrogated to ascertain how far employed data can be relied upon.

Given the lack of a strong correlation between NBS projects’ risk buffer contributions and the BCR’s assessed risk level, it is vital that such safeguards are independently assessed, including consideration of information risks and other relevant risk drivers. Involving both top-down analysis via external datasets and bottom-up evaluations of data provision and quality, this approach highlights the need for bespoke assessments of carbon performance.

With non-permanence viewed through such a holistic lens, projects across sectors with different commitment periods can be investigated on a level playing field to promote comparability within the market.

References

¹ Non-NBS

² Non-NBS

³ Tech Solutions - Carbon Capture & Storage - Enhanced Oil Recovery

⁴ NBS