From safeguards to systems: a holistic view of Beyond Carbon

Here are some key takeaways

Minimising risks to communities and ecosystems is essential to high-integrity carbon projects.

Understanding these ‘beyond carbon’ risks requires a holistic approach that goes beyond safeguards and co-benefit claims.

As with carbon efficacy, beyond carbon risks can often be mitigated through project design, creating opportunity to scale investment in carbon projects.

Carbon markets – from the voluntary carbon market (VCM) to compliance markets around the world – are behind when it comes to the socio-economic and environmental aspects of carbon projects. To date, carbon markets have been focused on the atmospheric impact of projects, given early integrity challenges. Whether projects could avoid or remove CO2 at the purported rate was a critical foundation that needed to be established before further progress could be made.

But it isn’t enough. Now that the market has developed the tools to help investors manage the risk of their climate investments, from ratings to insurance, it’s time to earnestly examine the other impacts of financing carbon projects, beyond carbon emissions alone.

At BeZero Carbon, we take a holistic view of the risks beyond carbon – potential harms to communities and ecosystems that, in some cases, have the potential to undermine the integrity of carbon markets. Projects that displace indigenous communities or plant thirsty monocultures in water-scarce regions are visceral examples that have made headlines and dampened demand for carbon credits.

Our approach to assessing beyond carbon risk brings to light and systematically assesses these risks so that buyers, investors, and developers can better understand them. Unlike carbon, social and environmental risk lacks a single metric - risk tolerance and priorities are in the eye of the beholder and as a result, highly variable. But like carbon, many of these risks can be mitigated through careful project design – not only in the early stages but also as an adaptive response once credits have been issued. We’ve seen firsthand the value of increasing transparency around beyond carbon risks, the ultimate outcome being higher integrity projects that secure investors’ confidence and capital.

Addressing reputational risks

If we want to unlock carbon markets at scale, the socio-economic and environmental - beyond carbon - risks are just as important as carbon risks. They need to be brought to the forefront – and soon. Beyond carbon is just as important, not because of the potential for harm or of falling short of delivering promised benefits – as important as these are – but because of the associated reputational risks. It’s these reputational risks that stem from the beyond carbon aspects of carbon projects that are keeping investment on the sidelines, and that we must address.

Dr Clarissa Fontes, Senior Carbon Ratings Scientist and Avoided Deforestation Sector Lead, observes a community member tapping rubber from a tree during a project site visit in Brazil.

Beyond NBS

Carbon projects, whether nature-based solutions (NBS), industrial, or some combination of the two (as with biochar), are like any other physical projects. And physical projects, from conservation to infrastructure, have the potential to impact the natural and human communities with which they intersect. Physical projects also have the potential to be rejected by the communities within which they sit, whether they are likely to cause harm or are merely perceived to do so.

Much attention has been paid to the harm caused by poorly designed nature-based carbon projects, notably those that have resulted in the displacement of indigenous or other marginalised communities. But industrial projects may also carry risk, as evidenced by the recent raft of lawsuits against carbon capture and storage proposals in the United States because of concerns over community and ecosystem impacts.¹ ² ³

Beyond claims

The current frameworks that have been broadly adopted to represent carbon projects’ social and environmental aspects are skeletons of what they could be. Safeguards - mechanisms that a project can implement to minimise harm to people and nature - are a good start, but they aren’t enough. And the United Nations’ Sustainable Development Goals (SDGs), while a lofty framework, were never intended for individual projects. Underpinning both approaches is an overreliance on what project documents claim, which doesn’t reflect the potential risks as a project interacts with surrounding communities and ecosystems.

We must arm buyers - and sellers of carbon credits - with a more robust way to evaluate all of the risks a carbon project may bring, if we’re to have any hope of scaling carbon markets to their potential.

During a cookstove project site visit in Kenya, Vincent, a restaurant chef, explained to our team how using cleaner cooking methods free of harmful smoke helped reduce frequent hospital visits by his staff members, which was affecting his business.

A holistic approach to understanding non-carbon risk

The good news is that we don’t have to start from scratch - there are numerous frameworks out there that we can learn from, and we should adapt them to push carbon markets beyond safeguards and SDGs. For example, environmental impact assessments are used in many parts of the world to evaluate and mitigate the adverse impacts of physical projects. An important aspect of this approach is the focus on what a project intends to do and not what it says - a key limitation of relying upon a carbon project’s inclusion of safeguards and claims about SDGs or ‘co-benefit’ more broadly.

BeZero has developed a more holistic approach to surfacing carbon projects’ socio-economic and environmental risks beyond safeguards and SDGs. Our approach covers the two primary aspects of risk - the downside risk of adverse impacts and community opposition, and, separately, the risk of failing to deliver upon a project’s claimed benefits. These two sources of risk are necessarily distinct, for if combined, there’s the potential for high benefits to mask high risks and vice versa. BeZero has developed separate Beyond Carbon risk and benefit tiers (on a scale of 1-5) that transparently communicate a project’s socio-economic, environmental, and public sentiment risks and its likelihood of delivering benefits.

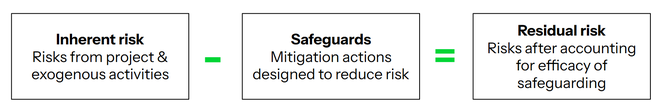

Our Beyond Carbon risk assessment applies the concept of residual risk. Residual risk refers to a project’s remaining risk after accounting for the efficacy of any safeguards designed and/or implemented to mitigate inherent socioeconomic and environmental risks. Inherent risks result from the project activities and exogenous factors (e.g., public policies, cultural norms), before any mitigation actions (safeguards) are undertaken.

Inherent risk can vary widely from one project to another, and dictates the need for safeguards. For example, a project in a country with a strong track record of enforcing labour laws may not need project-level safeguards to minimise the risk of forced labour, as the inherent risk is relatively low. However, a project in a country where there is evidence of forced labour will face higher inherent risk and, as a result, may have higher residual risk if it does not employ strong safeguards around labour practices.

We apply this framework to a comprehensive set of risk drivers, from land and resource rights to ecosystems, biodiversity, and stakeholder engagement. Our approach builds on decades of collective on-the-ground experience across the globe, coupled with the pattern recognition around what risk–and good–looks like that comes from rating over 700 projects.

Our Beyond Carbon risk and benefit tiers employ an approach that mirrors our robust carbon ratings. These tiers also leverage the wealth of knowledge we’ve gained about risks to carbon efficacy, which, in many cases, have a high degree of overlap with Beyond Carbon. For example, a project’s lack of secure land tenure creates permanence risk. Insecure land tenure also creates the risk of conflict and displacement of local communities, which may, in turn, result in negative public sentiment towards the project.

Our Beyond Carbon scores sit alongside our carbon ratings and allow users to clearly see and consider the tradeoffs within a single project. For example, a ‘A’-rated waste project with a high likelihood of delivering 1 tonne of CO2e also has high Beyond Carbon risk (tier 5) due to severe pollution and health impacts, resulting in widespread community opposition and negative media coverage. At the same time, the project offers few benefits, having replaced municipal waste piles with toxic ash, resulting in a low likelihood of benefits (tier 5).

By contrast, a ‘BB’-rated reforestation project with a moderately low likelihood of delivering 1 tonne of CO2e has moderately low Beyond Carbon risk (tier 2), driven by clear land tenure, stakeholder consent and the planting of native species, but some concerns about the structure of the benefit-sharing mechanism. This project also has a high likelihood of benefits (tier 1) due primarily to the creation of well-paying local jobs and the creation of wildlife habitat.

More transparency, more confidence

It’s important to recognise that most carbon projects will likely carry some level of beyond carbon risk. The goal is not so much ‘zero risk’ as ‘transparent risk’, so that buyers, investors, intermediaries and project developers can feel comfortable with the risk they’re taking on when transacting in carbon markets.

We need to create a feedback loop that allows the buy-side, in particular, to send signals about when socio-economic and environmental risks are tolerable and when they’re too much, just as our ratings have done for carbon efficacy. This feedback loop can only happen if we increase transparency around beyond carbon risks and have a means of comparing these risks across projects.

It’s time to move the ‘beyond carbon’ conversation into carbon markets to increase confidence in carbon projects more broadly. If not, we’re likely to find ourselves in a different, and more pernicious, kind of integrity crisis that could threaten to undo the market that many are working so hard to strengthen.

Learn more about BeZero’s approach to Beyond Carbon risk assessment in our methodology. If you’d like to discuss non-carbon risks in a project you’re developing or investing in, get in touch.

²https://northdakotamonitor.com/2025/01/09/landowners-appeal-summit-carbon-storage-decision/