How Imperative unlocked carbon finance for a South African forest restoration project with a pre-issuance rating

What they said

Discernibly increased interest in Imperative Projects

Increased number of discussions with project funders

Increased willingness from both investors and buyers to view credits from the project as premium-quality, therefore supporting a higher price curve, based on BeZero’s rating

Scobie Mackay CEO at ImperativeSince the rating was assigned, we received considerably more interest in the project from institutional investors and high-profile buyers. The rating from BeZero Carbon not only affirms the quality of our projects, but also provides our stakeholders, investors, and customers with the assurance that they are contributing to genuinely impactful and credible climate solutions.

Challenge

Businesses are increasingly recognising the need to deploy investments into new projects as well existing ones to reach net zero, marking a shift towards the pre-issuance carbon market. To protect their reputation, many look to early-stage projects with strong potential to avoid or remove carbon. Investing in pre-issuance credits can help hedge against rising costs, and secure high-quality offtake for the years ahead. But while buyers play an essential role in scaling the market, they need reassurance that they are channelling finance towards effective climate action. Forestry projects represent the largest sector in the voluntary carbon market. Growth in credit issuance within the Afforestation, Reforestation and Revegetation carbon removals method makes it the fastest growing sub-sector amongst nature-based solutions. Developers such as Imperative, who operate carbon projects at a global scale and who wish to differentiate their projects on the basis of quality, are faced with the challenge of demonstrating to the market that the risks inherent in projects are well understood, mitigated and managed. Detailed third-party assessment of the design, risks and mitigants of a project, in the form of an external rating, assists in providing an independent assessment of quality, thereby helping to secure funding, offtake and quality-differentiated pricing.

Rating

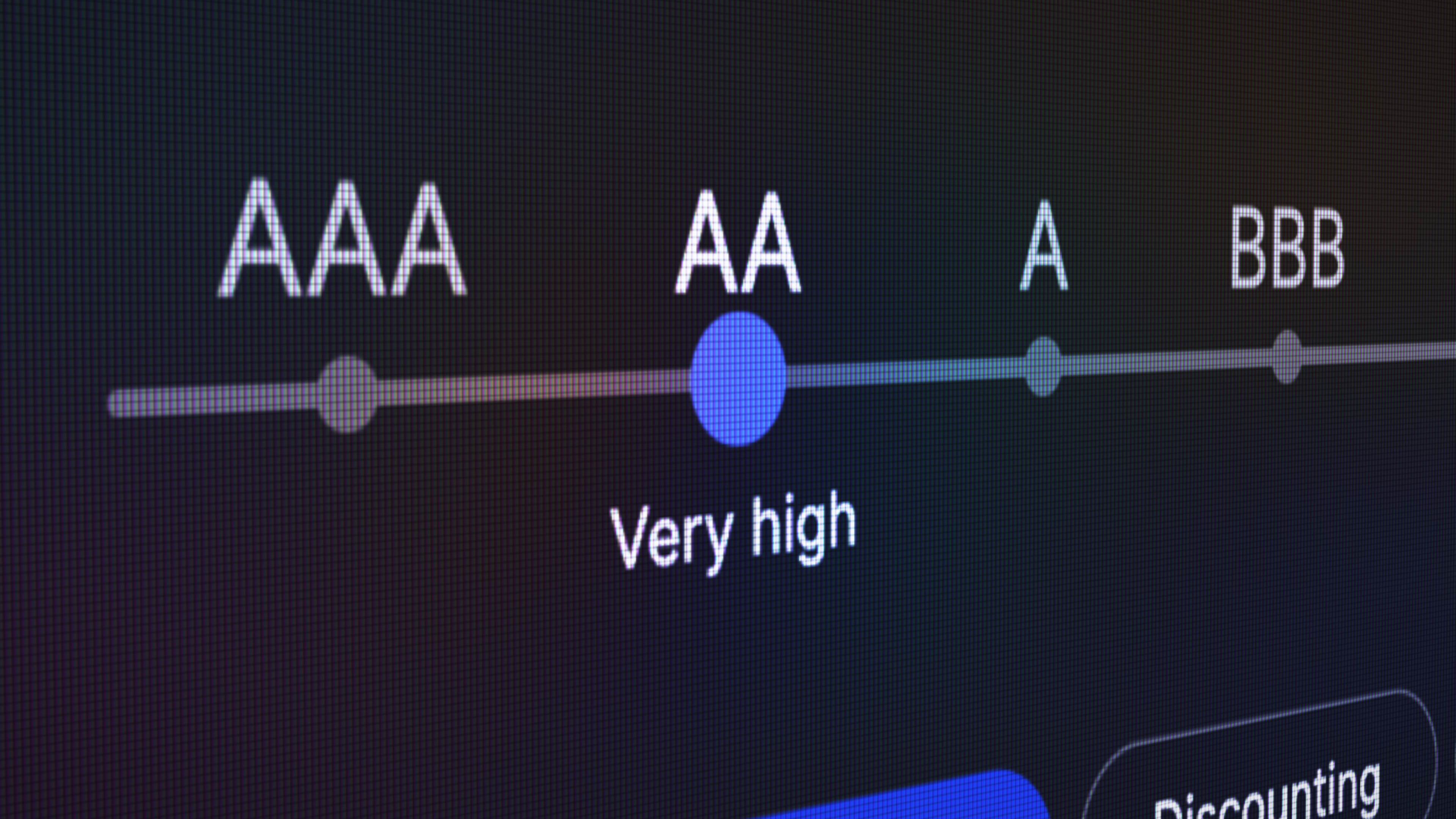

In June 2024, BeZero Carbon assigned Imperative’s South African restoration project an ‘Ae’ ex ante rating for credits yet to be issued and a standalone carbon rating of ´aa´. The ex ante rating, which takes into account both carbon risk factors, and project execution risk, represents BeZero Carbon’s current opinion of a high likelihood of credits issued by the project to remove one tonne of CO2e. BeZero’s rating approach was evidence-based, supported by developer engagement, independent geospatial analysis, and a thorough risk assessment by experts in soil sciences, forestry and project finance. Our assessment distilled the project’s quality into a single, easy-to-understand metric, providing the market with an independent third-party opinion. The project’s ex ante report is also available on BeZero’s platform, giving the project visibility to a wider audience of carbon market participants.

Impact

Imperative has reported increased investor interest in this project and other projects in its portfolio, increased overall buyer engagement and an increased willingness from both investors and buyers to view credits from the project as premium-quality, therefore supporting a higher price curve, based on BeZero’s rating. As well as unlocking finance and generating more demand for credits from this project, the ex ante rating put Imperative’s forest project amongst BeZero’s highest rated Afforestation, Reforestation and Restoration projects. Feedback from Imperative was that BeZero’s credentials and deep expertise helped inform their own understanding of project risks. As execution progresses on the project, Imperative aims to further increase the project’s rating to raise the bar for high-quality projects in the pre-issuance market.

Carbon explored

Read about the latest insights, analysis and trends in global carbon markets.

Explore InsightsWebinar - Rooting out risk in forestry projects

Exploring how our standardised datasets uncover risk in forestry projects, and enhance due diligence.

The BeZero Carbon ex ante Rating methodology

The BeZero Carbon ex ante Rating methodology