How Climeworks enhanced project due diligence and won new business using BeZero’s platform

What they said

Accelerated early-stage project evaluations by complementing in-house due diligence with BeZero’s independent ratings analysis.

Significantly lowered RFP response times with instant access to information on project quality.

Refined commercial outreach efforts by identifying trends in credit retirements and targeting relevant opportunities.

Adrian Siegrist Chief Commercial Officer, ClimeworksClimeworks and BeZero first engaged in 2024, when their analytical team assigned the first ever ‘AAA’ rating to our flagship DAC project. BeZero’s independent ratings analysis now plays a critical role in helping us evaluate potential suppliers and strengthen the portfolios we deliver to our customers. Their insights help us respond faster, stay transparent, and support customers with robust, science-based decisions.

Challenge

To help companies achieve their net zero goals, Climeworks is striving to build the world’s lowest-cost Direct Air Capture technology, and deliver high-quality portfolios spanning both engineered and nature-based carbon removals.

With a commitment to trust, impact, and risk, Climeworks only partners with high-quality players (details of their quality framework here). Accordingly, their in-house Science Team is tasked with assessing third-party projects, and ensuring only high-integrity credits earn a place in their portfolio offering. The team maintains regular engagement with CDR developers they have offtake agreements with, to ensure timely delivery remains feasible.

To stay on top of a vast and highly fragmented market, with projects spread across multiple locations, registries, methodologies, and quality bands, Climeworks needed a way to get a quick yet reliable understanding of this dynamic landscape to inform future portfolio decisions. This included identifying promising removal projects across sectors, screening them for quality, and reviewing CDR credit retirements by buyers active in the market.

BeZero’s solution

Climeworks turned to BeZero’s ratings and analytics platform to speed up their workflows. BeZero’s standardised datasets, project fundamentals, and in-depth ratings analysis complemented the Science Team’s in-house market scoping and project screening, allowing them to rapidly build an initial perspective on average credit quality for both engineered and nature-based removals.

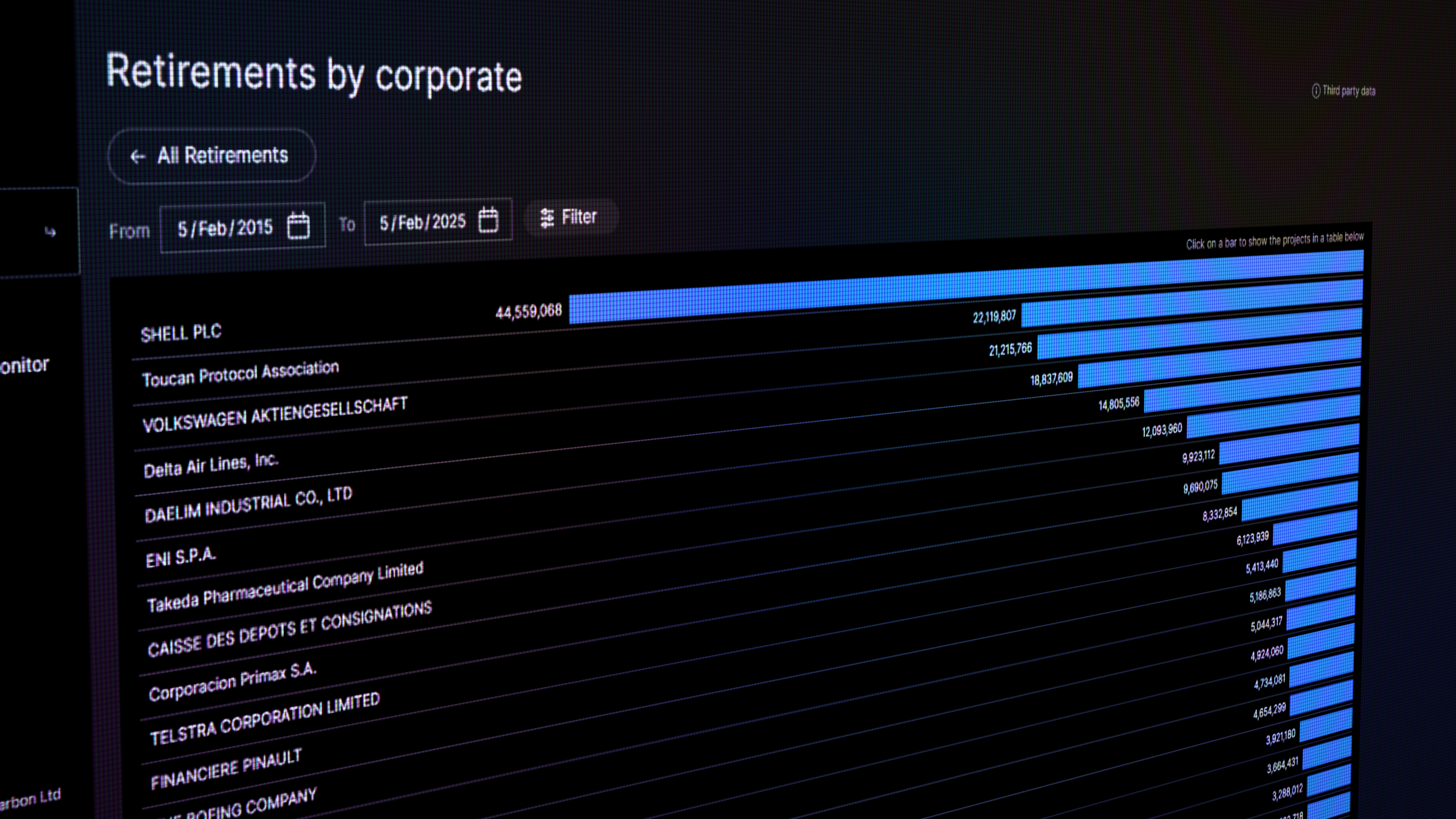

Additionally, BeZero’s corporate retirements tool helped the team map out credit issuance and retirement activity across multiple registries, and gain a detailed, normalised perspective on company-level demand for different carbon removal project types.

Impact

By using BeZero’s platform alongside their own due diligence, Climeworks reported they were able to rapidly assess project quality at scale, vastly accelerating early-stage evaluations. They highlighted how the platform made it easy to scan highly-rated CDR projects across tech- and nature-based solutions, which in turn significantly lowered RFP response times. Paired with the Science Team’s first-hand insights from developers, this combined approach ensured robust, transparent, and science-based decision making, as well as resilient carbon portfolios.

Climeworks also noted how the platform’s corporate retirements tool helped their commercial team refine their go-to-market strategy by focusing outreach efforts on relevant organisations, with a known history of purchasing removal credits. This targeted approach resulted in stronger engagement with prospects, and a higher closed deal conversion rate.

Finally, the team called out the CDR-themed research and webinars hosted on the platform which allows them to stay on top of market developments from the perspective of both BeZero’s analytical team, and external thought leaders.

Carbon explored

Read about the latest insights, analysis and trends in global carbon markets.

Explore InsightsWebinar - Carbon markets: 2025 insights, 2026 outlook

Insights from our 2025 carbon credit market review, plus expert perspectives on emerging trends, policy developments and the year ahead.

Webinar - From Innovation to Investment: Evaluating Durable Carbon Removal

Demystifying durable carbon removal - exploring innovation, MRV, and due diligence in a rapidly scaling market.