How to build a diversified portfolio to make credible net zero claims

The price of credits is not considered here. Instead, the focus is solely the sample portfolio’s risk-based dynamics.

Please note, this is an illustrative example and is purely for reference only. It does not represent a recommendation or advice in any way.

Contents

Stage 1 - net zero alignment

Using guidance from the Oxford Offsetting Principles, a net zero aligned claim of 1,000 tCO2e in 2023 could be supported by a portfolio composed of the following:

450 tCO2e (45%) avoidance, for example Cookstoves or Industrial Methane Emissions,

450 tCO2e (45%) carbon removal with short lived storage, for example Mangroves or Afforestation, Reforestation & Restoration,

100 tCO2e (10%) emissions reduction or carbon removal with long lived storage, for example Carbon Capture and Storage, Direct Air Capture with Carbon Storage or Bioenergy with Carbon Capture and Storage.

Stage 2 - calibrating credits to tonne-based claims

The first step for Corporate A is to decide which credits it wants to purchase and retire.

Having reviewed the market, its internal procurement policy is to only consider credits with a BeZero Carbon Rating of ‘BBB’ or above.

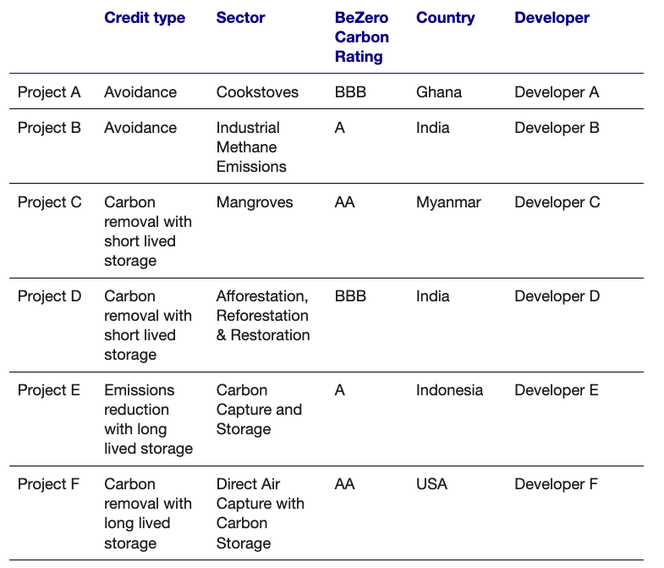

The table below sets out the projects they have identified as qualifying for procurement, and includes information about example macro risk factors, such as the sector and country of the project.

Table 1: A sample list of projects that meet Corporate A’s procurement requirements

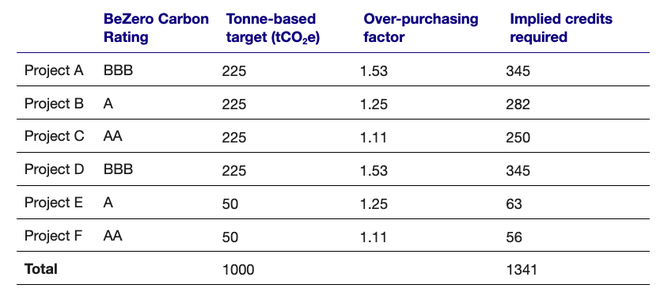

The next step is to calculate how many credits Corporate A would need to purchase if it were to construct an equal weighted portfolio aligned with making a net zero aligned claim of 1,000 tCO2e (the composition derived in Stage 1).

Table 2: A sample equal-weighted portfolio

The combined over-purchasing for an equal-weighted portfolio implies Corporate A should purchase 1341 credits to make a net zero claim of 1,000 tCO2e.

However, before buying this portfolio, Corporate A needs to understand the exposure of this equally weighted portfolio to the different risk categories, such as country risk.

At present, the portfolio has a high exposure to India at a country risk level:

Project B and Project D are both based in India, no other country appears twice.

The over-purchasing factor implies total retirements for Indian-based projects would account for 46.7% of the portfolio, or 637 credits.

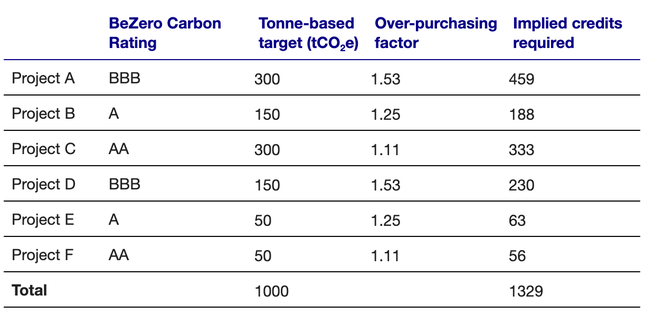

To mitigate this risk, Corporate A should think about rebalancing away from the two India-based projects. By doing this while maintaining a credit-type composition required for net zero alignment, Corporate A can ensure a diversified approach (shown in Table 3).

Table 3: A sample portfolio diversifying against country level risk

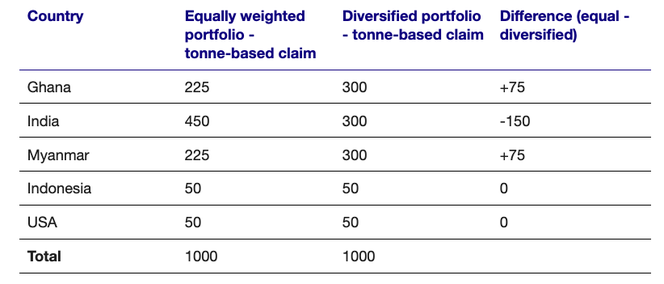

Finally, it is useful to compare the implied country level exposure of the equally weighted portfolio versus the diversified portfolio, as shown in Table 4.

Table 4: The sample equal-weighted vs. one-factor diversified portfolio

Please note that this case study uses a simple scenario here for illustrative purposes only.

In practice, we would expect portfolios to be more diversified in absolute terms (i.e. credits come from a higher number of projects) and rebalancing analysis to be carried out across a number of risk factors such as project type, methodology, developer etc.

For more details on our approach to discounting, email commercial@bezerocarbon.com or watch our webinar replay where our Chief Innovation Officer & Co-Founder Sebastien Cross and guest speaker David Stead from Vertree explained why this new discounting tool is essential for building credible, net zero aligned portfolios.